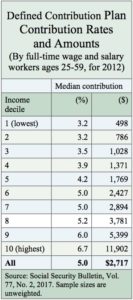

Partial 'Rothification' of the 401(k) system might be on the Republican tax reform agenda this fall. If passed, it could lead to lower contribution levels, analysts at the global...

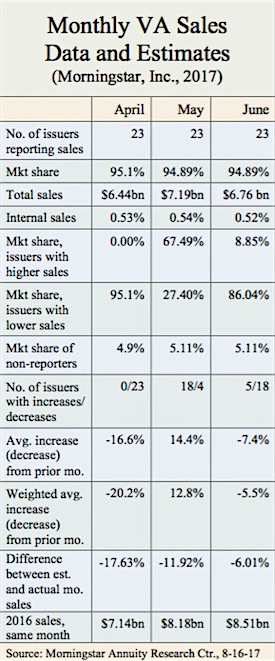

First-half annuity sales drop to 16-year low: LIMRA SRI

'Qualified VA sales have experienced a more significant decline than non-qualified VAs,' said Todd Giesing, director, Annuity Research, LIMRA Secure Retirement Institute.

Lower expenses and lower taxes put life/annuity industry in the black

Total income dropped 7% to $348.9 billion, as large reinsurance agreements undertaken in 2016 and 2017 drove the results, a spokesman for A.M. Best said.

Two retirement journalists accept new posts

Tamiko Toland, an annuity product analyst, has moved to CANNEX from Strategic Insight. Bob Powell, a retirement writer for USA Today and former MarketWatch columnist, will begin writing a...

RIJ Takes a Two-Week Holiday

Everybody needs an occasional break from the daily grind. RIJ will be taking the second half of August off, returning with the September 7 issue. See you after Labor...

Fed leaves rates unchanged at 1% to 1.25%

The Open Market Committee said it will keep reinvesting principal payments from holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and rolling over maturing Treasury...

ERISA lawyers explain latest DOL moves

'The most interesting change is that... the adviser can avoid calling itself a fiduciary during the transition period, even if it is providing fiduciary advice,' said the Client Alert...

Annuity issuers need to innovate: A.M. Best

Many post-election signs in the U.S. appear favorable for life insurers, but it may be 'a little too early to lock in this enthusiasm,' said the ratings agency in...

Brighthouse offers fee-based indexed variable annuity

Brighthouse Financial reported $570 million in sales of its Shield portfolio in the second quarter of 2017, up 28% year-over-year. The products were previously sold under the MetLife brand.

Fiduciary rule delayed until July 1, 2019: DOL

'The delay is really more about giving the DOL time to rework the rule rather than companies really needing more time to prepare,' said Jamie Hopkins, co-director of the...

Some DC plan sponsors would switch to state-run plans: LIMRA SRI

Sponsors of DC plans with over $50 million in assets were more inclined than sponsors of plans with under $10 million in assets to say they would replace their...

As Boomers retire, economy will slow: BerkeleyAGE

Demographic “tailwinds” accounted for 48% of annual economic growth from 1990-2015, the report by the Berkeley Forum on Aging and the Global Economy said.

Moshe Milevsky wins award for book on tontines

Milevsky said he is about to publish a “prequel” titled The Day the King Defaulted: Lessons from the Stop of the Exchequer in 1672.

Honorable Mention

Brief or late-breaking items from Great American Life, Brookstone Capital, MetLife, Brighthouse Financial, and the SEC.

Advisors could lose autonomy as a result of regulation: Cerulli

Asking CFP, CIMA or CFA advisors to outsource portfolio construction and management to a third party is tantamount to questioning their purpose in life,' said new research from Cerulli...

An Obama-era retirement savings initiative gets the ax

The program aimed to work in support of private industry, not against it. When MyRA account balances reached $15,000, Treasury bond assets would be liquidated and rolled into private-sector...

Three 401(k) providers take aim at Vanguard and Fidelity

American Funds, Empower Retirement and Voya are now joining Fidelity and Vanguard on plan sponsors’ short-lists of potential recordkeepers, according to Cogent Reports.