Over the last decade, life insurers increased the share of risky, illiquid assets on their balance sheets, according to the Federal Reserve's annual Financial Stability Report.

In the UK, private equity finds a NEST-ing ground

NEST has been at the forefront of UK’s auto-enrolled master trusts expansion into illiquid assets, but some doubted a private equity manager would work for a low expense ratio.

USAA inked a pair of reinsurance deals in 2021

USAA, a reciprocal insurer, completed reinsurance transactions with Commonwealth Annuity and Life and Fortitude Re, according to its 2021 annual statements.

Annuity sales on pace for another $250bn year

'Both fixed indexed annuities and fixed-rate deferred products benefited from the significant interest rate increases in the first quarter,” said Todd Giesing, assistant vice president, SRI Annuity Research (in...

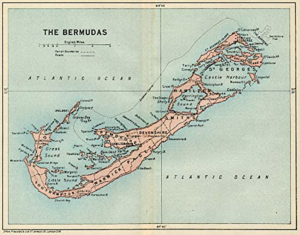

‘Bermuda Triangle’ news

FNF 'dividends' 15% of F&G Annuities & Life stock to shareholders; Ares Management announces $40 billion in lending commitments; Athene gets ‘Excellent’ strength rating from AM Best; KKR closes...

Finke report touts benefits of ‘contingent deferred annuities’

A CDA 'unbundles' the two main parts of a variable annuity with a living benefit: the investments and the income guarantee. It gives advisors more investment flexibility than VA...

Holy satoshi! Fidelity blesses bitcoin for 401(k)s

But "plan sponsors are overwhelmingly not considering, and will not consider, cryptocurrency a prudent investment option in a retirement plan," a Plan Sponsor Council of America survey shows.

Investors play wait-and-see: Morningstar

High-yield bond funds saw a $27.8 billion exodus in March. Large-blend funds, including S&P 500 Index funds, took in $26.5 billion to lead all Morningstar Categories.

Breaking news

‘Bermuda Triangle’ on LIMRA conference agenda; AIG issues new five-year FIA for New York; Falling sales prompt Pacific Life to discontinue LTC products; DeSanto takes CEO reins at New...

Who snagged the best investment results in 2021? Dalbar knows

Dalbar founder Lou Harvey's latest Quantitative Analysis of Investor Behavior shows how much more equity investors might have earned in 2021 if they had stuck to the fundamentals. But...

Breaking News

MetLife launches 'private equity fund' platform; Inflation, war affect asset allocations at pension funds: bfinance; Eagle Life enhances index annuities; Elizabeth Heffernan joins Micruity.

Net income of stock life/annuity firms tripled in 2021: AM Best

'The persistent drag from low interest rates continues to impact margins, but ongoing growth in general account invested assets has pushed investment income higher,' said Best's analysts.

Prudential divests $31 billion block of in-force VAs

Prudential executive vice president and head of US Businesses Andy Sullivan said his company will focus on selling more of its “protected outcome solutions, like FlexGuard and FlexGuard Income.”

Breaking news

US among countries with lowest fund fees: Morningstar; Old-age poverty scarier than death for the unretired: Allianz Life; American Funds and Morningstar partner for ‘Target Date Plus’; Prudential’s PRIAC...

Advice is still a luxury item

Either because they avoid advisers or advisers avoid them, about 80% of investors with less than $100,000 saved do not have a financial adviser, according to Cerulli. Fees are...

Breaking News

Annexus and State Street partner on TDF with income rider; SEC seeks more SPAC disclosure; RetireOne hires McNeela and Cusack; SEC aims to regulate securities dealers, market makers; ‘Thematic...

Goldman Sachs acquires NextCapital

NextCapital, based in Chicago, is an open-architecture digital retirement advice provider that partners with US financial institutions. Terms of the acquisition were not disclosed.

‘SECURE 2.0’ Passes House, Moves to Senate

Retirement industry stakeholders and their representatives praised the passage of the bill, HR 2954, which loosens the rules on RMDs and QLACs and clears the way for ETFs in...

Breaking News

Equitable to buy CarVal, a $14.3bn alt-assets manager; Life/annuity industry capital and surplus at year-end 2021: $444.5 bn; HealthView Services reports on rising medical costs; PBCG licenses insurer data...

Target-date fund assets grow to $3.27T: Morningstar

Five providers control 79% of the target-date market: Vanguard, Fidelity, BlackRock, State Street, and American Funds, according to Morningstar's 2022 Target-Date Strategy Landscape report.