The answer depends on whether your clients want income to start now or in five years or 10 years. Indexed annuities offer the highest minimum income guarantees, if you...

‘RIAs, You’ve Got to Try This’: Macchia

'A recent article said that high valuations make this the worst possible time to retire. I say, This is the perfect time to retire if your advisor has provided...

Will Fee-Only Advisors Warm to Annuities?

At the National Association of Personal Financial Planners' meeting in Philadelphia this week, Wade Pfau of The American College and David Lau of DPL Financial Planners urged fee-only advisors...

Ohio National Hits the Trail

Advisors who sold rich Ohio National variable annuities with guaranteed minimum income benefits are fuming at the insurer's announcement that it would no longer pay "trail" commissions to certain...

Meet the Dare-Devils Who Own Annuities

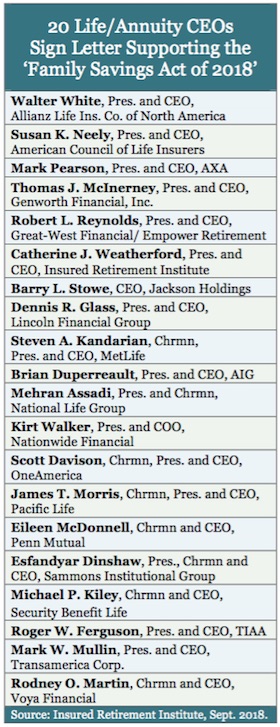

In an elaborate media event to launch the Alliance for Lifetime Income, a jet-car driver, a shark wrangler, and four C-level life insurance company executives gathered in and around...

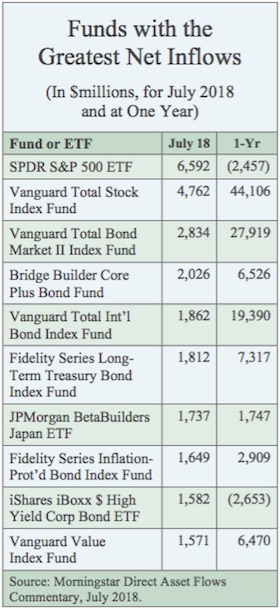

Red Bulls and Blue Bears

After the 2016 election, Republicans shifted toward equities and Democrats shifted toward bonds. MIT researchers found that out of step with the classic image of the ‘rational investor’ and...

Guess What: America Is Rich

Warning: Ingestion of the contents of this column may cause symptoms of apoplexy and dyspepsia among disciples of classical macroeconomics, neo-liberalism, or 'deficit hawks' in the US Congress. ...

On the Case: Plan for A Couple with $750K

RIJ asked advisor/actuary Jerry Golden, founder of Golden Retirement, Go2Income.com, and the Income Power method, to develop a retirement income plan for the 'M.T. Knestors,' a couple with about...

Enjoy Today’s Income Plan

RIJ is committed to regularly publishing examples of retirement income plans that advisors and firms--call them decumulation pioneers--have developed for real (but anonymous) clients.

How to Make Your Widow Merrier

The generosity of the Social Security spousal benefit is something every primary earner should understand. Yet many spouses--and even some professionals--aren't sure exactly how it works.

Research Roundup

Recent research suggests that factor investing may beat passive; air pollution promotes dementia; investors buy active funds because they believe hard work pays off; Fed 'surprises' cause wider ripples...

Making Annuities Easier for RIAs

It's no longer a minority report. We talk to executives at Envestnet, DPL Financial, RetireOne, Allianz Life and United Capital about new platforms for helping registered investment advisors integrate...

Allianz Life adds living benefit to structured index annuity

The new Allianz product offers four index options, two death benefit options, five combinations of performance caps and downside buffers and a living benefit rider with deferral bonuses and...

Meet the First ‘Structured Outcome’ ETF

Innovator Capital Management and Milliman have built the first structured outcome product on an exchange-traded fund (ETF) chassis, challenging the annuity monopoly in this category.

The Science (Not Sci-Fi) of Social Security

The overlap of Social Security policy and behavioral finance was the subject of several papers aired at the Retirement Research Consortium’s 20th annual meeting last week. Economists are trying...

The Big Turnaround in Retirement Policy

Since November 2016, the direction of retirement policy in the U.S. has reversed. Legislators, not bureaucrats, are in the lead. The SEC, not DOL is in charge of ethics....

‘PEP’ Talk

In this sixth installment of our series on "pooled employer plans" or PEPs

(also known as "open multiple employer plans" or MEPs), we asked 401(k) experts if this new...

A Brave New Deregulated 401(k) World

'There are three factors that we think are converging and are likely to help move the needle” in terms of expanding plan adoption by small employers, said Ben Norquist,...