Does automatic enrollment lead to higher consumer debt? Should employers stop sponsoring retirement plans? These are other ideas were floated at the Defined Contribution Institutional Investors Association Academic Forum...

Which Annuity Is Better? This New Tool Tells You

Cannex, the Toronto-based annuity product data, just announced a new tool, based on research by annuity guru Moshe Milvesky, that enables advisors to do side-by-side comparisons of annuity contracts....

Anecdotal Evidence: Trump and the DOL Rule

'Would the financial services industry want to return to square one after spending millions of dollars to reconfigure their compliance systems and products' for the DOL conflict of interest...

Trump and the Trajectory of Interest Rates

'There could be pressure for rates to go higher as investors digest the deficit spending pushed by Mr. Trump,' said Andrew McCormick, head of T. Rowe Price’s U.S. taxable...

The View from the (DOL) Trenches

'“Many of the broker-dealers are still searching for a light switch in a dark room,” said James Lumberg of Envestnet, who, with Jeff Schwantz of Morningstar and Arjun Saxena...

Anecdotal Evidence: How to Charm a Client

When dealing with your HNW clients and prospects, success depends less on performance or fees than on solving clients’ problems and simplifying their complex lives.

A Word to the Wise Advisor

At the Money Management Institute Fall Solutions conference in Boston this week, one of the presentations focused on the right and wrong words to use when explaining the impact...

Anecdotal Evidence: Football and Financial Ads

Watching football games lets me see TV ads for financial services companies. Last weekend, I saw funny ads from E*Trade and GEICO, and a serious ad from Northwestern Mutua....

The Annuity That Pays for Itself

The deferred income annuity, aka longevity insurance, is favored by academics and is mandatory in Germany and Singapore. Here's a compelling new way to explain its value to clients,...

Retiring (Temporarily) to Paradise

An old friend who retired early to a hacienda by the sea in Nicaragua sent me an e-mail recently, responding to my question about his life there. His answer...

We Believe What We Like to Believe

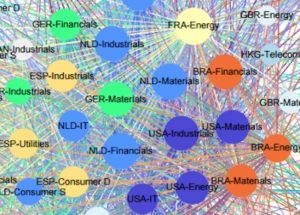

In another of our occasional Research Roundups, we survey papers that explore how we like to fool ourselves, how debt keeps women working, why it's better to grow up...

Two Definitions of ‘Best Interest’

The gap between what advisors can deliver and what clients feel that the DOL rule promises them is exactly where the plaintiff’s attorneys may focus their litigation efforts.

One Step Ahead of a Rolling Boulder

In Colorado Springs this week, members of the Insured Retirement Institute met to discuss the impact of the DOL fiduciary rule. 'It's not all doom and gloom,' said one...

President ‘Id’ or President ‘Super-Ego’?

About Monday's presidential debate: It’s irresponsible for a candidate to stoke anxieties, to inflate them like toy balloons and leave them hanging in the air, without demonstrating a grasp...

Anecdotal Evidence

In this week's opinion piece: The possibility that the DOL rule will extend to taxable accounts; Vanguard's formula for calculating a safe withdrawal rate; thoughts on recent news coverage...