By using the managed-volatility funds, VA contract owners can get a lifetime withdrawal benefit rider without having to put at least 30% of their assets in fixed income investments.

Time, money, age and advice: They’re all connected

At any given life stage, a new research paper says, people tend to manage their investments in one of three ways: by doing nothing (“inertia”), by doing it themselves...

Czechmate: New government will end auto-enrolled DC plan

The Czech experiment with a voluntary, auto-enrolled national defined contribution plan (a "second pillar" plan to supplement the primary pay-as-you-go plan) will end. Balances will be rolled into the...

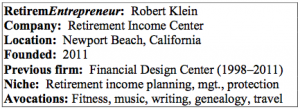

RetiremEntrepreneur: Robert Klein

West Coast CFP, CPA and RICP Robert Klein has jumped on the retirement bandwagon, recasting his business as the Retirement Income Center, becoming a MarketWatch RetireMentor and putting fixed...

What Fools These Mortals Be

E*Trade, TD Ameritrade and Merrill Edge all dangle a $600 signing bonus to people who open new brokerage accounts with cash--lots and lots of cash, it turns out.

Is There a Retirement Crisis or Not?

Two recent reports from different organizations paint very different portraits of retirement readiness in the U.S.

Everybody wants to be a wealth manager

"Advisers are more likely to set an asset minimum (43%) than to have a definition of their ideal client," according to results of a survey by the Financial Planning...

Great-West Financial launches low-cost VA with income rider

The contract has two sleeves, one for investment and the other for income. Only money designated for the income sleeve is subject to the lifetime income benefit rider, a...

So far, fee disclosure hasn’t moved the fee-awareness dial

Fee disclosure regulations that were established in 2012 brought greater transparency to the retirement industry. But LIMRA finds they’ve had little effect.

“Empathy for Geeks”

Annuity product manager and actuary Lance Poole of Protective Life gives a "TED talk" in which he explains how even actuaries can learn empathy with customers and demonstrates that...

Deconstructing Warren

In new research, three quants from AQR Capital Management have tried to explain exactly why Warren Buffett has been so successful. They neglect to mention that he made the...

Nationwide Ties New VA Income Rider to Managed-Vol Funds

For its deferral bonus, the "Income Capture" GLWB offers a simple interest rate credit of 3% plus the nominal rate of the monthly 10-year Treasury constant maturity (currently 2.86%).

The Ghost of VA Contracts Past

Insurers and asset managers love managed-vol funds and VA portfolios, whose sales are climbing. But in a low-vol bull market, advisors wonder about their value.

Unions balk at proposal to cut Illinois pension benefits

Chicago's glittering downtown may be stunning, but the Illinois state pension system is underfunded by an estimated $100 billion and the state has the worst credit rating in the...

Colorado “trader” charged with duping retirees in $4 million Ponzi scheme

Gary Snisky is charged with telling elderly investors that he would invest their money in government-backed agency bonds. Instead, he used $2.8 million of investor funds to pay his...

Managed-vol funds added to JeffNat’s Monument Advisor VA

The new managed-vol funds include three from American Funds that use the Milliman risk management technique, along with the Federated Managed Tail Risk Fund II and the Goldman Sachs...

Aegon reduces longevity risk exposure in Netherlands

The risk is assumed by third-party investors and reinsurers, including SCOR, a €32.6 billion reinsurer operating in 31 countries.

Five fat years may be followed by five lean ones: T. Rowe Price

“The U.S. bull market is aging,” said Bill Stromberg, T. Rowe Price’s head of equity. “International investments, especially in emerging markets, represent the best long-term value from here in...

PacLife launches fixed annuity with GLWB and roll-up

The product, which may be unprecedented, merges the most popular annuity options with the most basic annuity chassis. It’s a little like opting for heated leather seats, turbo and...

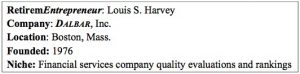

RetiremEntrepreneur: Lou Harvey

Louis S. Harvey is president and CEO of Dalbar, Inc., a Boston-based research firm that performs a variety of evaluations and quality ratings of financial services practices and communications.