Recent surveys of plan participants and IRA owners from Cerulli Associates and the Investment Company Institute shed light on a pivotal question: Which type of account will most Boomers...

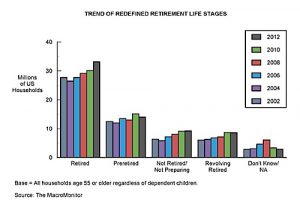

First you’re retired, then you’re not

"As retirement evolves into a more flexible yet complicated life stage, financial services providers could benefit from understanding the multiple stages of retirement better," says SRI Consulting-Business Intelligence.

When unemployment goes up, so does number of ‘partially-retired’

High inflation also "discourages full-time work and encourages partial and full retirement,” according to a trio of researchers from UC-Berkeley, the University of Michigan and the Social Security Administration.

Harbinger details annuity sales results for fiscal 2013

On Nov. 1, Harbinger unit Fidelity & Guaranty Life announced it would leave Maryland and relocate to Iowa for that state’s “deep insurance talent pool, sophisticated regulatory approach to...

Does threat of layoffs make workers work harder?

A new study by economists at Stanford and the University of Utah suggests that less-productive workers start working harder when local unemployment rates go up.

The Bucket

Brief or late-breaking items from New York Life, MassMutual, Towers Watson, Jackson National, Fidelity Investments and Guardian Life.

Quote of the Week

"The most common qualification of the economic forecaster is not in knowing, but in not knowing that he does not know. His greatest advantage is that all predictions, right...

Asia’s appetite for alternatives on the rise: Cerulli

"Managers that start engaging institutions early, even when the latter are not ready to allocate to alternatives, will stand a better chance of winning mandates when an institution is...

Indexed annuity sales soar in 3Q 2013

Allianz Life prevailed as the leading issuer of indexed annuities with a 12.91% market share, while Security Benefit Life and American Equity maintained their positions as the second and...

Allianz Life launches Signature 7 FIA, a companion to Core Income 7

The Signature 7 offers a monthly sum crediting strategy and a spread of 1.7% on the Barclays U.S. Dynamic Balance Index. Any return above 1.7% will be credited to...

A model for investing Social Security funds in stocks

An act of Congress in 2001 allowed the Railroad Retirement fund to start investing in equities, and the fund has encountered and overcome some significant risks associated with equity...

Net VA flow ebbs to $1.5 billion in 3Q 2013: Morningstar

“Shifts in market share this year have been massive,” writes Morningstar VA analyst Frank O’Connor in his third quarter and year-to-date sales report, issued yesterday.

A Fool for a Client?

MassMutual is the latest target of the St. Louis plaintiff's attorney Jerry Schlichter, who has won eight-figure judgments and settlements in a series of "excessive fee" cases against high-profile...

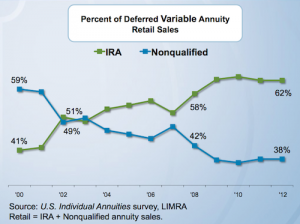

The Hangover

Publicly held annuity issuers could be handicapped in the future by lingering liabilities, and should have foreseen the impact of IRA money flowing into VAs starting in 2002, says...

Sign of the times: Fidelity adds short duration bond funds

The funds are: Fidelity Limited Term Bond Fund, Fidelity Conservative Income Municipal Bond Fund and Fidelity Short Duration High Income Fund (Advisor and retail share classes.)

Vanguard tops mutual fund flow charts in October

Vanguard gathered just over $6 billion in the quarter ($60 billion YTD) to lead all fund companies. American Funds, PIMCO, Columbia and Janus all saw outflows of more than...

Hedge fund managers’ eyes are bigger than customers’ budgets: E&Y

The growth ambitions of managers may not be matched by sustained investor appetite," said Art Tully, EY’s Global Hedge Fund Services co-leader said in a release.

More DB sponsors intend to off-load risk

“Pension plan sponsors remain under tremendous pressure to reduce the financial liabilities of their DB plans,” said Michael Archer, leader of the client solutions group for retirement, North America...

The ‘haves’ have retirement plans; the ‘have-nots,’ not so much

White, male, well-educated, healthy and married full-time workers are more likely to have access than non-whites, women, single people, the less educated and the less healthy.

FINRA Talks a Good Game

FINRA's recent report on conflicts of interest at brokerages laid bare some dingy practices. Some say it's a move to burnish FINRA's credentials as a candidate for regulator of...