Public-option retirement plans

The authors of this article, Angela M. Antonelli, director of the Georgetown University Center for Retirement Initiatives (pictured), J. Mark Iwry, a Brookings Institution fellow, and David C. John, an AARP policy advisor, recommend that individual US states with public-option workplace retirement plans should work in concert rather than alone.

By Editorial Staff

The acquisition will double the size of Principal’s U.S. retirement business in terms of total recordkeeping assets. More than two-thirds of Wells Fargo’s institutional retirement assets are in plans ranging in size from $10 million to $1 billion.

By Editorial Staff

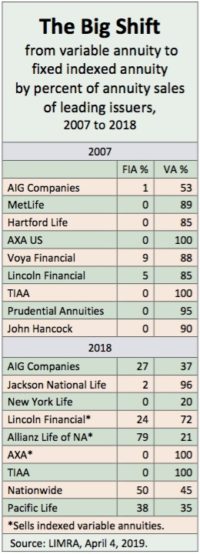

IRI issues 4Q 2018 annuity sales report; iPipeline favors “best interest” rule in New York; Vestwell, a retirement plan fintech, raises $30 million; Vanguard brings new active commodities fund to market; Giovanni and Coutts rise at Lincoln Financial; Global Bankers to divest its US life companies.