By Kerry Pechter

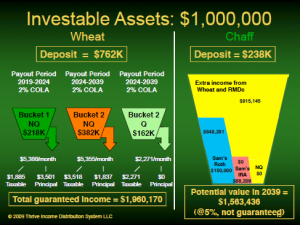

Iowa insurance man Curtis Cloke thinks he has solved the "annuity puzzle" by building ladders of deferred income annuities for his clients. Now he and his partners are scaling up his "Thrive" system and taking it national.

By Kerry Pechter

The variable annuity "arms race" is over, a victim of the equity crash, low interest rates, and the destructive effects of competition for market share - mainly among publicly held life insurers. Here's a three-part look at what has happened, why it happened, and what could happen next in the "living benefit" space.

By Kerry Pechter

Faced with capital shortages and ratings downgrades, the ranks of major publicly-held life insurers appears to be headed for consolidation. Historically low stock prices alone have made merger talk inevitable.