CANNEX, the annuity data provider, has partnered with Luma Financial Technologies, a fintech firm, to launch the CANNEX Annuity Marketplace. The new platform is designed to help financial professionals at small and mid-sized firms research, compare, and select annuities for clients.

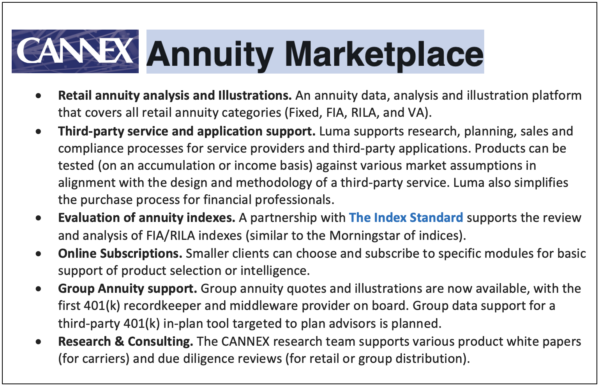

Advisers, agents and retirement plan sponsors can use the platform, accessible through a portal on Luma’s website, to analyze the performance of hundreds of fixed, fixed indexed-linked, variable, and income annuities based on CANNEX’s annuity data, research, and illustration resources.

The Annuity Marketplace will provide income, rate, yield, and product information on annuities from more than 60 issuers, a CANNEX release said. Advisers can illustrate the outcomes of market scenarios and investment choices across products, asset allocations, riders, and annuity categories.

The proliferation of new annuity products, the expansion of annuity sales, and the passage of regulations that require advisers and agents to find products “consistent with best interest requirements and client goals” has increased “the importance of being able to understand and evaluate annuities on a standardized basis” said Gary Baker, president, CANNEX USA, in a release.

The proliferation of new annuity products, the expansion of annuity sales, and the passage of regulations that require advisers and agents to find products “consistent with best interest requirements and client goals” has increased “the importance of being able to understand and evaluate annuities on a standardized basis” said Gary Baker, president, CANNEX USA, in a release.

“The marketplace provides an important resource for financial professionals looking to help clients incorporate annuities into their financial plans,” added Jay Charles, director of Annuity Products, Luma Financial Technologies.

CANNEX is an independent financial data and research services company with operations in Canada and the U.S. Since 1984, it has provided data, analytics, illustrations and research services to insurance companies, banks, brokers, service providers and independent advisers.

Fintech software developed by Luma Financial Technologies is used by broker/dealer firms, RIA offices, and private banks worldwide. Founded in Cincinnati in 2018, Luma also has offices in New York, Zurich and Miami.

© 2024 RIJ Publishing LLC. All rights reserved.