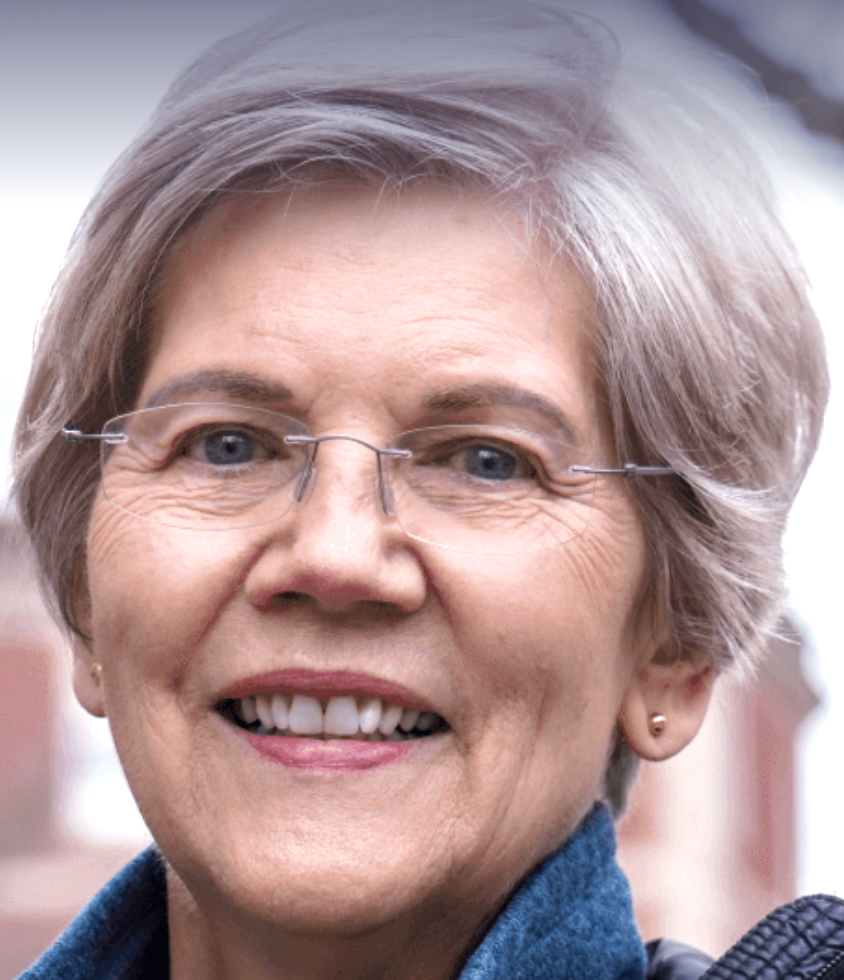

U.S. Senator Elizabeth Warren (D-MA) has just attacked the life/annuity industry at the most sensitive spot in its organizational anatomy—its reliance on flashy sales incentives for the marketing organizations and insurance agents who distribute and sell its bread-and-butter products.

Warren, a long-time, persistent scourge of the financial services industry recently published a white paper, “Cancun, Cruises and Cash: How the Department of Labor’s New Retirement Security Rule Would End Insurance Industry Kickbacks that Cost Savers Billions.”

While criticism of gifts, high commissions and hard sales tactics in certain parts of the annuity industry is old news, the whitepaper has a fresh peg. Warren timed it to appear on the date—September 23, 2024—when the Biden Department of Labor hoped that the latest iteration of its “best interest rule” would go into effect. A judge blocked its progress last July.

The “best interest rule” required that insurance agents, instead of trying to persuade clients to buy annuities (especially fixed indexed annuities) with rollover IRA money, adopt a more selfless “fiduciary” ethical standard and only recommend products to IRA owners that would be in their best interest.

Introduced at the end of the Obama administration, the first version of the fiduciary rule ran into a wall in 2018 when, in a 2-1 decision, the Fifth Circuit Court of Appeals reversed a lower court decision (overruling the dissent of its own chief judge) and vacated the rule on the grounds that the DOL had no authority to put special hurdles between insurance agents—whose activities are regulated by state insurance commissions, not the DOL—and the savings in IRA accounts.

(The DOL regulates the investments in 401(k) plans, but its jurisdiction has never been explicitly extended to include the rollover IRAs into which so many plan participants transfer their 401(k) savings when they change jobs. The Fifth Circuit judges ruled that only Congress could do that, and it hasn’t.)

The initial lawsuit against the rule was brought not by injured citizens—the rule appeared to be popular—but by the American Council of Life Insurers, whose members could lose sales as a result of it, with support from the U.S. Chamber of Commerce. The lead attorney, Eugene Scalia (son of the late Supreme Court Justice Antonin Scalia) had represented the industry before. The following year, President Donald Trump appointed Scalia to be U.S. Secretary of Labor.

When the Biden administration succeeded Trump, the DOL started work on a new and more challenge-proof version of the fiduciary rule.

Much of Warren’s white paper is devoted to documenting the many kinds of sales incentives that annuity issuers advertise to annuity wholesalers and insurance agents. Warren’s argument is that these incentives, rather than the clients’ best interests, drive the agents’ recommendations to older Americans.

Her white paper concludes, “The annuity industry’s efforts to obscure its pervasive use of kickbacks and perks reveal why the DOL’s Retirement Security Rule is needed—and how it will protect consumers. The industry’s secret kickbacks hurt consumers by incentivizing agents to sell certain products because they will earn a bigger cash bonus or fancier vacation, not because they are in their client’s best interest.”

© 2024 RIJ Publishing LLC. All rights reserved.