The National Association of Insurance Commissioners (NAIC) likes to remind Uncle Sam that states regulate the business of insurance, per the McCarran-Ferguson Act of 1945. When a federal agency questions an annuity industry policy, the commissioners often tell it, in effect, to “stay in its lane.”

On March 21, Federal Reserve economists warned, as they have periodically since 2013, that the growth in risky lending and offshore reinsurance by major private equity-led annuity issuers may undermine the stability of the financial system.

The economists, in a research note entitled, “Life Insurers’ Role in the Intermediation Chain of Public and Private Credit to Risky Firms,” provide, through text and charts, new insights into the way insurers and affiliated asset managers exploit “loopholes” in state, U.S., and Bermuda regulations to reduce capital requirements and maximize profits.

In a letter also dated March 21, the NAIC called on Congressional leaders to abolish the Federal Insurance Office, which monitors the U.S. industry from within the Treasury Department. The FIO was established after the 2008 financial crisis, when some life insurers needed federal bailout assistance. The NAIC made a similar request last fall.

NAIC’s letter to the Senate and House leadership said:

“After more than a decade of experience interacting with the Treasury’s Federal Insurance Office, we have reached the conclusion that the Federal Insurance Office stands in direct conflict with the states’ role as primary regulators, complicates the state’s engagement with fellow insurance regulators globally, duplicates confidential data collection from our industry, and blurs the lines that separate Treasury from the financial regulators. Therefore, we urge Congress to respect states’ primary role in regulating the insurance market by abolishing the Federal Insurance Office.”

The NAIC, which is not a regulator and has no enforcement authority or power, has made abolishing the FIO one of its top priorities for 2025.

What worries Fed economists

The economists warn that “since the 2007-09 financial crisis, the share of life insurers’ general account assets exposed to below-investment-grade (‘risky’) corporate debt… now exceeds the industry’s exposure to subprime residential mortgage-backed securities in late 2007.”

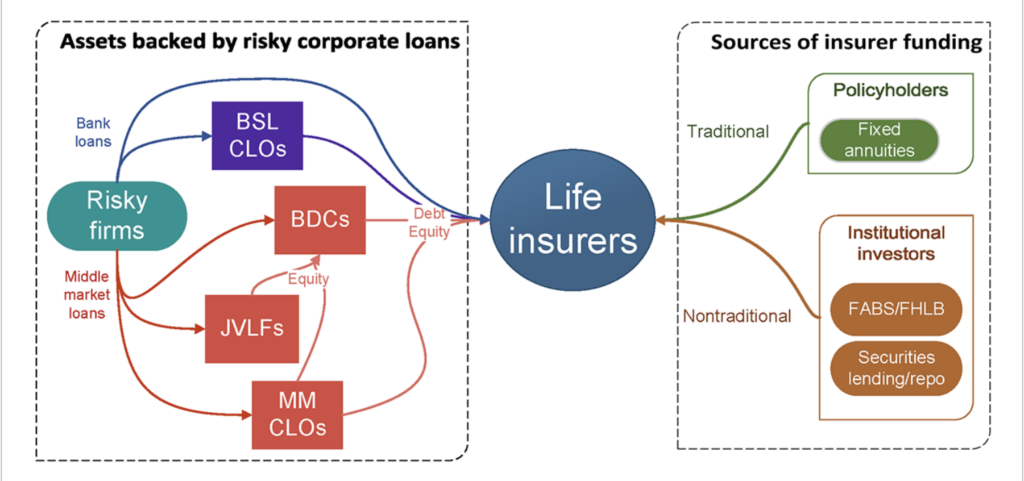

Life insurers’ position in intermediation chain of credit to risky firms. Source: Federal Reserve, March 21, 2025.

Over the past decade, the Federal Reserve, Federal Insurance Office, the Treasury Department’s Financial Stability Oversight Council, the International Monetary Fund and others have issued warnings about the hard-to-measure risk created by offshore reinsurance and risky assets on life insurers’ balance sheets.

Their research note says in part:

Life insurers invest directly in risky firms through high-yield corporate bonds and leveraged loans, while also gaining exposure indirectly via broadly syndicated loans (BSL), collateralized loan obligations (CLOs), middle market (MM) CLOs, business development companies (BDCs), and joint venture loan funds (JVLFs).

Life insurers’ affiliated asset managers have become major corporate loan originators and managers of BSL and MM CLOs, BDCs, and JVLFs. Partnerships between life insurers and asset managers have created complex and arguably opaque structures to increase investment returns.

Insurers’ involvement in CLOs is not just yield-seeking behavior, but also reflects pre-existing relationships with asset managers, making investment decisions more complex than simply a search for yield.

These arrangements seek to shift portfolio allocations towards risky corporate debt while exploiting loopholes stemming from rating agency methodologies and accounting standards.

Through innovative financing structures, life insurers have sought to further develop their role in the intermediation chain of public and private credit to risky firms.

At the same time, the industry’s level of wholesale funding is near its 2007 level, shortly after which life insurers experienced runs on their nontraditional funding structures, such as FABS and securities lending.

U.S.- and Bermuda-based insurers can significantly reduce their risk-based capital requirements without changing their underlying asset exposure by swapping corporate loan holdings for CLO investments. This loophole arises because capital charges in these jurisdictions are primarily determined by credit ratings.

Insurers holding a portfolio of B-rated loans can cut their risk-based capital charges by two-thirds if they package those loans into a CLO and purchase the entire CLO capital stack. The impact is even more pronounced for middle-market loans, as their lower ratings lead to exponentially higher capital charges. An insurer in the U.S. or Bermuda that packages its MM loan holdings into a CLO and invests in the entire CLO capital stack could reduce its capital charge by a factor of 10.

NAIC committees have been studying these matters and have written drafts of proposals to address concerns about the use of offshore reinsurance and ownership of high-risk assets, especially by life insurers controlled by or affiliated with private equity companies.

The NAIC is a private group supported in part by service fees from insurance companies. It gathers and distributes insurance industry data, drafts model regulations that states may choose to use or not, and promotes nationwide consistency among the regulations that state insurance commissioners use.

© 2025 RIJ Publishing LLC.