Bond analysts see pros and cons of alternatives in 401(k)s

In an August 29 new research brief, “Private Credit: Making the Most of 401(k) Democratization,” bond analysts at KBRA analyzed the potential impact of President Trump’s August 7 executive order “to potentially ease regulatory barriers that have limited defined contribution (DC) retirement plans’ access to alternative investments,” including private credit.

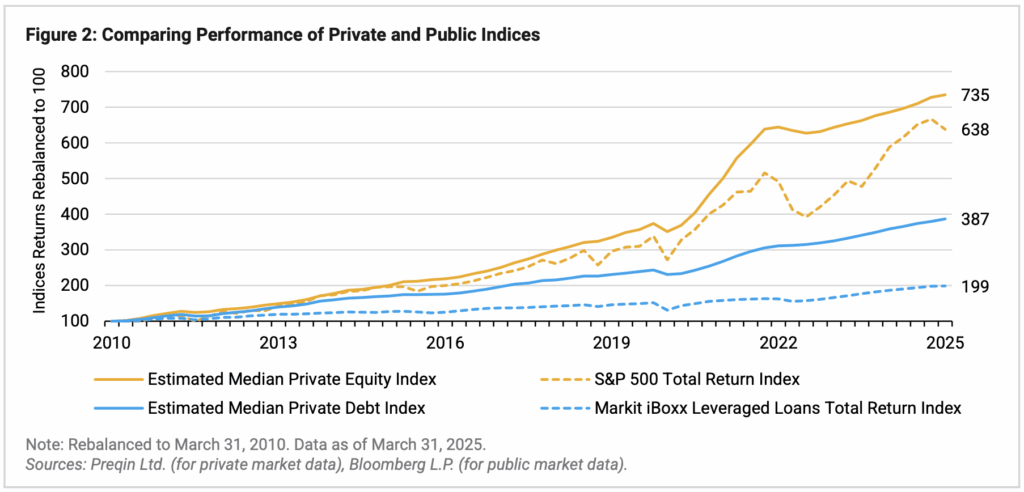

“Access to alternatives is already a common and growing feature in the retirement accounts of defined benefit (DB) plan savers (typically government employees and legacy corporate pension beneficiaries),” the analysts wrote. “This democratization seems profoundly fair, given that alternative investments have historically outperformed comparable public market options, on average.”

But they saw potential dangers in democratization.

“Regulatory Scrutiny: The Department of Labor and the Securities and Exchange Commission (SEC), will likely spend significant time monitoring how alternative investments are being democratized. …Over time, the probability of additional regulation is high.

Missteps: The first AAM that falls short of performance expectations—or the inevitable bad actor—may face litigation, which could engender pushback against the entire industry. This will create additional regulatory scrutiny, headline risk, or a negative perception of alternatives.

Buyer Beware: Fund-level liquidity [of alternatives] is often limited to match asset-level liquidity by some form of gating or redemption deferral mechanism. This differs from most public market funds. …Additionally, fees for alternative investment vehicles are higher in most cases.”

Via KBRA.

Private credit funds attract revenue at record pace

The Financial Times reported on September 2 that “Affluent individual investors in the US have pumped $48bn into private credit funds in the first half of this year,” and could surpass “the highwater mark of $83.4bn set last year, according to investment bank RA Stanger.”

“The inflows underscore the growing importance major private investment groups are now placing on individuals, with analysts at rating agency Moody’s calling it ‘one of the biggest new growth frontiers in the industry,’” the Times said.

Private asset groups “lobbied heavily to open the broader US retirement market up to private equity and credit, which culminated with US President Donald Trump’s executive order last month paving the way for their broader inclusion in 401(k) plans.”

The private asset industry apparently needs more revenue. “Fundraising in traditional drawdown private credit funds has slowed alongside a broader downturn for the leveraged buyout industry, which has struggled to return capital to investors in the years since the Covid-19 pandemic and has, in turn, suffered weaker inflows,” the article said.

Offshore reinsurance increases life insurer leverage: AM Best

“Asset-intensive transactions flow involving life insurers for capital efficiency has continued to tremendously increase and has intensified utilization for offshore reinsurance connected to mostly private equity interests, especially in the islands of Bermuda and Cayman,” AM Best reported August 28.

“Private equity-backed insurers and investment managers, along with some prominent insurers, have leveraged their premium flows with offshore reinsurance structures, including the increase in sidecars activity lately for capital efficiency,” wrote analysts in a report, “Global Life/Annuity Reinsurers’ Capital Management Strategies Evolve to Achieve Target Returns and Meet the Needs of Cedents.”

Best analysts expressed some concern about rising leverage, which reinsurance can promote by reducing—by design—the capital backing liabilities. “Concentration in certain reinsurers and incremental reinsurance leverage can somewhat diminish a company’s capital quality and place pressure on the group’s overall balance sheet strength assessment.”

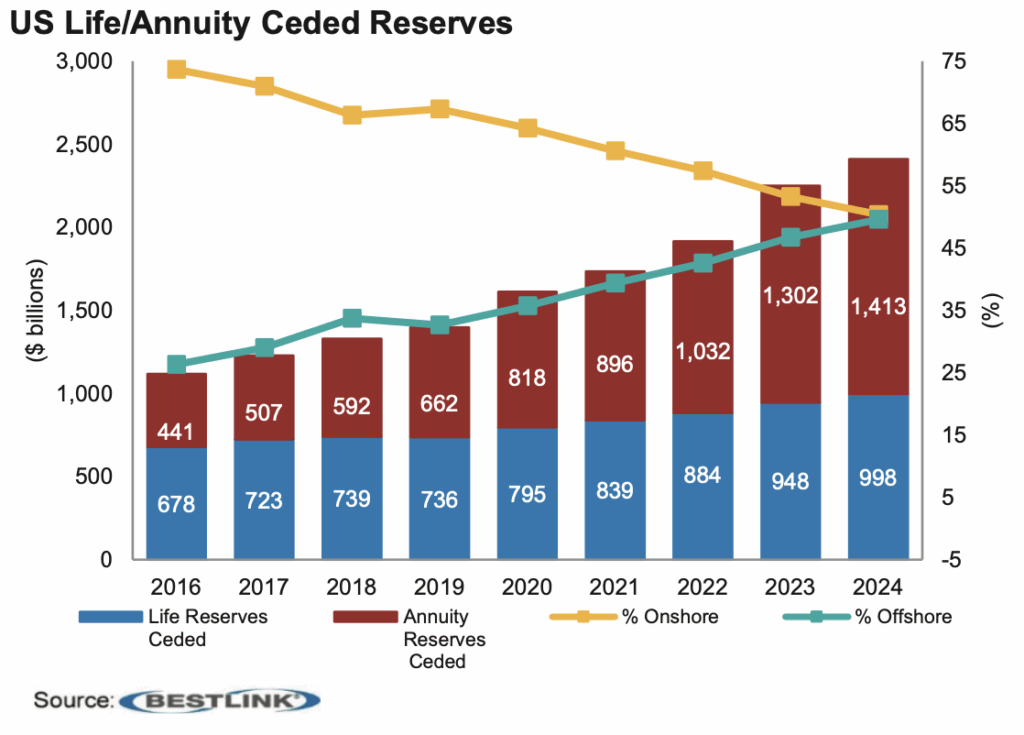

“The amount of annuity reserves has expanded over 10% in each of the last four years, and ceded reserves have doubled from 2016 to 2024. The notable annuity growth is likely to continue, and more companies may look to reinsurers to manage growth and capital levels,” the report said.

“Offshore reinsurers can [often] choose the accounting system for their regulatory reporting (e.g., adjusted or modified US risk-based capital (RBC), US GAAP, IFRS 17, local statutory, or, in some cases, BCAR), which can lead to reserve credits taken by cedents not being equal to or mirroring the reserves assumed by the reinsurers.”

Rising supply depresses Treasuries’ advantage

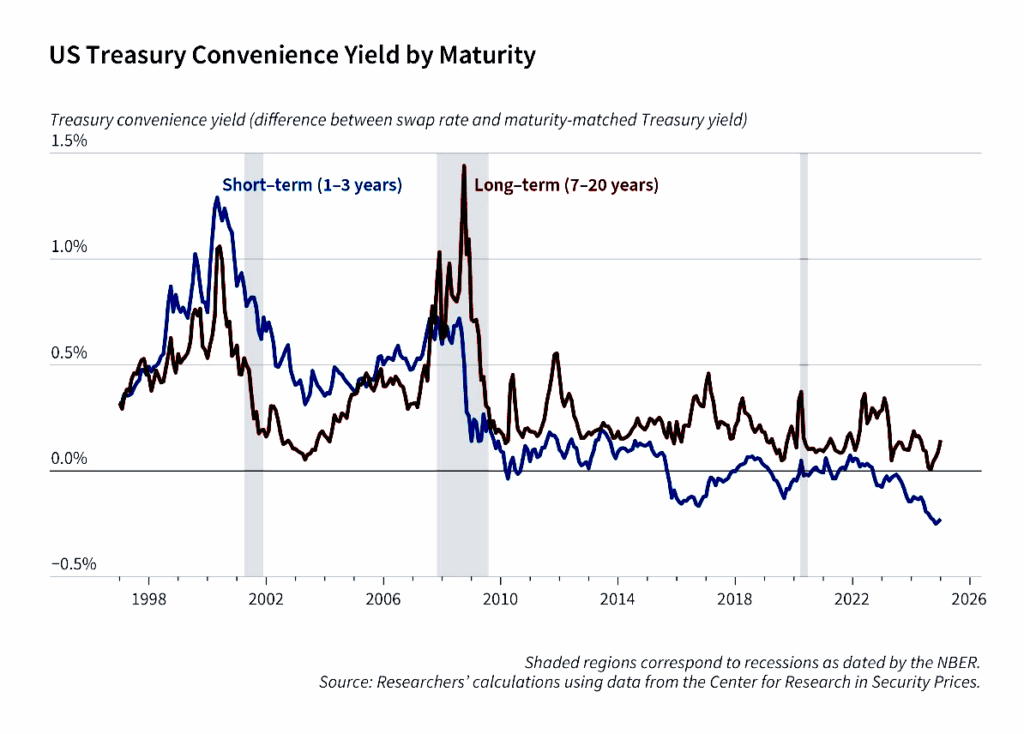

The rise in U.S. public debt in the last 25 years has raised questions about the long-term sustainability of the “convenience yield,” a factor that has encouraged the world’s investors to buy Treasuries at low interest rates, according to a new working paper from the National Bureau of Economic Research.

In Convenience Lost (NBER Working Paper 33940), Zhengyang Jiang of Northwestern’s Kellogg School, Robert J. Richmond of New York University, and Tony Zhang of Arizona State suggest “that the US government’s seigniorage revenue has declined by around 5% to 10% of the annual federal interest expense over the past 20 years.

“This long-run decline in seigniorage revenue is largely explained by the rising supply of medium- and long-term Treasury bonds.”

The trio found that “a 5 percentage point increase in the debt-to-GDP ratio causes the Treasury basis for long-term Treasuries to decline by 0.74 percentage points while that for medium-term Treasuries declines by 0.35 percentage points. Once again, there is no statistically significant decline for short-term Treasuries.

from “Convenience Lost.”

© 2025 RIJ Publishing LLC.