401(k)/IRA

The MetLife solution enables participants at all savings levels to purchase an immediate income annuity through an insurer selected by their employer and annuitize any portion of their savings,...

Meet the Newest Platform in the 401(k) Annuity Space

'We’re a product design firm,' ALEXIncome co-founder E. Graham Clark told RIJ. 'We feel we’ve built the best process for integrating annuities into retirement accounts.'

This Year’s Legal Battles

The life/annuity industry faces three big legal issues this year. All stem from, or are complicated by, the patchwork regulation of financial products in the US, our out-of-date pension...

Fidelity’s Plan Sponsors Can Now Offer Annuities

Income products issued by MetLife, Pacific Life, Prudential Financial and Western & Southern Financial Group are available on the Fidelity platform, with additional insurers to be added in the future, Fidelity said in its...

‘Sticking to the Plan’ While Taking Income

Pension Plus is a recent entry in the race to sell decumulation tools to 401(k) plan sponsors. Shlomo Benartzi, the behavioral finance expert, conceived it. Retirement industry veteran Mike...

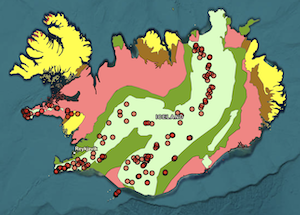

Iceland’s Tiny But Great Collective DC Plan

I visited Iceland in mid-2022 to interview pension experts in Reykjavik, the capital city and to fish for brown trout in the rivers near Akureyri, a harbor town on...

Of Athene, Pension Risk Transfers, and Fiduciaries

The ERISA Advisory Council recently heard comments on changing the criteria that fiduciaries use when vetting annuity providers in pension risk transfer deals. Athene's vice chairman defended his company's...

Pension experts assess ‘OregonSaves’

Workers in industries and firms with low wages, volatile wages, and high turnover have trouble saving, even in state-sponsored, auto-enrolled Roth IRAs, research shows.

How do 401(k) participants save? Vanguard knows.

Vanguard released its 2022 edition of 'How America Saves,' a compendium of data on millions of Vanguard-administered 401(k) plan accounts. Of participants ages 65+, half had balances under $88k....

Church-affiliated retirement plan adopts Pacific Life longevity annuity

'We are honored to be selected as the provider for the QLAC portion of the LifeStage Retirement Income program,' said Ruth Schau, senior director of Pension Solutions for Pacific...

Envestnet and Kestra co-launch platform for plan advisers

Envestnet's cloud-based platform supports more than 108,000 advisors and 6,000 companies. Kestra Financial, based in Austin, Texas, is part of Kestra Holdings.

In the UK, private equity finds a NEST-ing ground

NEST has been at the forefront of UK’s auto-enrolled master trusts expansion into illiquid assets, but some doubted a private equity manager would work for a low expense ratio.

The ‘Retirement Income Consortium’ is Born

Eight financial giants formed the Retirement Income Consortium to promote income solutions in 401(k) plans and 'develop a vetted due diligence framework' for 'selection and monitoring' of those solutions.

Holy satoshi! Fidelity blesses bitcoin for 401(k)s

But "plan sponsors are overwhelmingly not considering, and will not consider, cryptocurrency a prudent investment option in a retirement plan," a Plan Sponsor Council of America survey shows.

Bloomberg’s Ideas for Overhauling 401(k)s

Bloomberg editors call the existing 401(k) program 'dysfunctional' and a 'morass.' Their critique is valid, but their suggestions are not quite new.

Goldman Sachs acquires NextCapital

NextCapital, based in Chicago, is an open-architecture digital retirement advice provider that partners with US financial institutions. Terms of the acquisition were not disclosed.

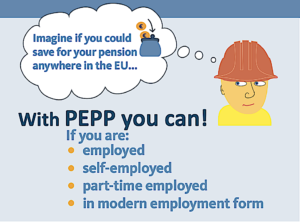

Europe’s Borderless New DC Plans

After 10 years of preparation, the European Union has created Pan European Personal Pension plans (PEPPs). These will be available to any EU-country citizen working in any EU country....

401(k)s Are a ‘Fraud,’ and Other New Research

Here are five fresh, timely pieces of academic research on retirement-related topics, including the alleged unfairness of the employer-sponsored defined contribution plan savings system.

Our retirement system needs work: Morningstar

The content and tone of Morningstar's new Retirement Plan Landscape Report, from a new Morningstar retirement research group, reflects the crisp, business-like approach that Morningstar's broad audience needs and...

A Policy Dynamo Touts ‘Dynamic Pensions’

Bonnie-Jeanne MacDonald, an actuary and retirement policy expert at Canada's National Institute on Aging, claims that a non-guaranteed lifetime income tool could generate more income than any annuities. Tontines,...