401(k)/IRA

'A reliable way to avoid potential litigation is to... develop processes for determining which digital designs and elements are most relevant for participant success,' said Shlomo Benartzi. The UCLA...

New York proposes public-option IRA by 2021

Fewer than half of working New Yorkers have access to a retirement savings plan at work and 40% of New Yorkers ages 50 to 64 have saved less than...

New Jersey to establish auto-enrolled IRA for workers without plans

The Garden States joins two other 'blue states,' California and Oregon, in sponsoring a portable workplace savings plan for workers without access to a plan. The IRAs will offer...

The Links between Golf and RMDs

RMDs produce zero change in a client’s wealth. They just create a 'balance sheet' adjustment, where money moves from a pre-tax to an after-tax account, current taxes get paid,...

Employer Match vs. Auto-Enrollment; The Winner Is…

'Most of the estimates from the literature substantially understate the effect of matching,' write analysts Nadia Karamcheva and Justin Falk of the Congressional Budget Office's Microeconomic Studies Division. (Image...

OregonSaves, a state-sponsored workplace IRA, welcomes ‘gig’ workers

Since the first wave of the program launched in November 2017, tens of thousands of workers have saved more than $9 million towards retirement, according to an OregonSaves release...

‘Auto-Portability’ Gets Closer to Reality

After five years of pitching their idea for automatically moving assets from one 401(k) plan to the next when a worker changes jobs, Retirement Clearinghouse this week received the...

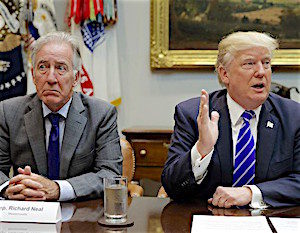

New Bedfellows: Richard Neal and the 401(k) Industry

As the next Ways & Means chairman, the liberal Massachusetts congressman won't just be the gatekeeper of retirement legislation. He’s also the only legislator who can ask for President...

‘Roll-in’ specialist exceeds $4 billion in account consolidations

Retirement Clearinghouse works with plan sponsors, record-keepers, and participants to complete assisted rollovers, automatic rollovers, and both assisted and automatic roll-ins.

Two firms position themselves for the ‘open MEP’ market

TAG Resources, LLC, headquartered in Knoxville, TN, is a pioneer in the area of Multiple Employer Plans (MEPs), including creating and trademarking 'The Open MEP.'

Individual Tontine Accounts – Yes, Seriously!

Tontines offer investors a way to pool mortality and longevity risks directly among themselves, without intervention by any insurance company, write our guest columnists. (Pictured: Lorenzo di Tonti, creator...

Master trusts face tighter regulation in the UK

Britain's experience with 'master trusts' could help inform US policymakers who are on the brink of allowing plan providers to set up similar types of plans in this country....

Ten most popular ‘former’ 401(k) providers

Nearly half (46%) of former plan participants did not take any action with regard to rollover options in 2017 and 43% intend to leave their assets in-plan this year,...

Securian to offer “unitized model portfolios” to 401k plans

The unitized portfolios are positioned as more customizable than target date funds as qualified default investment alternatives in 401(k) plans.

Ascensus’ TPA empire continues to grow

'This addition to Ascensus TPA Solutions goes a long way toward helping us build a national TPA,' said Jerry Bramlett, head of TPA Solutions at Ascensus.

Inside new target date funds, Lincoln offers risk-adjustment options

Morningstar Investment Management LLC will provide the glide path, portfolio construction and ongoing management for each of the portfolio strategies.

US sends ‘myRA’ accounts to Retirement Clearinghouse

The Treasury Department will transfer the remaining unclaimed IRA assets in the canceled Obama-era workplace savings program from Comerica Bank, the original custodian.

A new concept for defined contribution plans: The Retiree MEP

'Within an open multiple employer plan would exist a guidance platform--the Retiree MEP--where participants could receive objective information about retirement saving and distribution,' said Ted Goldman, Senior Pension Fellow...

Ascensus acquires two TPA firms

Continental Benefits Group, Inc., and 401kPlus will be folded into Ascensus' TPA Solutions division, Ascensus announced this week.

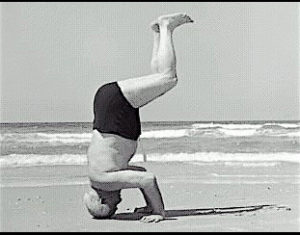

Turning the 401(k) on Its Head

Executives at State Street Global Advisors, Transamerica, Securian, and Prudential discuss their strategies for developing multiple employer 401(k) plans for small companies and helping to close the 401(k) ‘coverage...