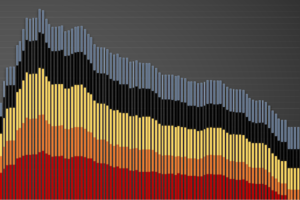

Bonds

A new Cerulli report also explores sales of annuities to fee-only advisors; '84% of independent registered investment advisors (RIAs) sold no annuities in the last 12 months… despite significant work in...

Why bonds fit awkwardly in the separate account space

'The bond market is structured around the trading habits of large institutions,' said a Cerulli director. 'With rare exceptions, fixed-income separately managed accounts are likely to continue to be...

For Higher Yield, Consider Emerging Market Debt

investors will find that a blend of EM dollar bonds from dozens of countries can help diversify their portfolios and improve their outcomes, writes our guest columnist, head of...

A Closer Look at CLOs

New research into collateralized loan obligations (CLOs), which are helping reshape the investment policies of the life/annuity industry, explores whether they have the same vulnerabilities as the 'CDOs' in...

A Closer Look at CLOs (and Other U.S. Credit)

Bond mavens, check this out. A new SEC report describes how most of the $54-trillion dollar U.S. credit market survived last spring's financial crisis. It covers securitized 'leveraged loans,'...

The Short and the Long of the Fed Buying Corporate Bonds

'The Fed’s aggressive actions have benefited the markets in the short term. Longer term, however, we think there will be downgrades, defaults, and bankruptcies, particularly among companies that came...

‘Performance-enhanced’ bond funds? Evidently.

Many actively managed bond funds are riskier than advertised, and often provide higher returns than their stated portfolio holdings would suggest, according to research by business school professors at...