Featured

In the final week or two of its RFI on in-plan annuities, the Labor Department began receiving comments from the industry that has a big stake in the way...

Part II: Tracing the Distortion

In print, on radio and on TV, Rush Limbaugh and Newt Gingrich helped fuel the rumor that 401(k) plans were under attack.

Using Psychology to Sell Annuities

Some behavioral finance experts believe that principles of psychology could be used to boost annuity sales.

From GAO, a Primer on Retirement Income

Last week, the Government Accountability Office sent a snapshot of America’s retirement income status to Sen. Herb Kohl, who will hold hearings on the topic in June.

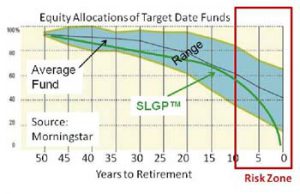

The Hidden Risk in Target Date Funds

Glide paths of TDFs differ markedly as the investor comes within ten years of retirement, and this divergence can lead to unpleasant surprises.

Great-West Enters the In-Plan Income Space

"SecureFoundation" wraps a lifetime income rider around a set of proprietary target date funds for an all-in annual fee of 160 basis points.

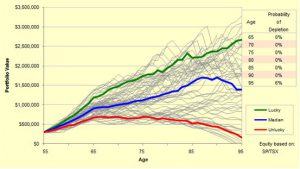

The Future of DC Plans, Via PIMCO

A PIMCO executive’s new book is an ode to custom target date funds—and offers a glimpse of the Allianz unit’s retirement business strategy going forward.

Off-Track Bettors

"It should be noncontroversial that we can’t afford any more innovation on Wall Street," says the author of several books on the financial system.

One Man’s Response to Uncle Sam’s RFI

Joe Bellersen, president of Qualified Annuity Services, Inc., explains how employer plans lost their guaranteed income mojo over the past 30 years, and offers advice on how they might...

How Big Is the Gap in Public Pensions?

Depending on the rate one uses to discount future obligations, state and local government pension plans face a funding shortfall in the wide range from $1 trillion to $3...

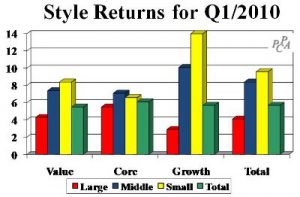

1Q 2010 Equity Performance: An Unconventional Evaluation

Surz, the president of San Clemente, CA-based Target Date Solutions, uses proprietary tools to dissect the first quarter's equity returns.

Two Trends in One: CTFs and TDFs

Collective trust funds and target date funds are ‘made for each other,’ one analyst said. But will CTF-TDF hybrids create the same false sense of security among 401(k) participants...

My Life as a ‘Dangerous Woman’

The New School economist and 401(k) critic reveals that her notoriety is, in part, the result of a misunderstanding that went viral--with help from Rush Limbaugh.

Insult to Injury: Disability’s Impact on a Retirement Plan

Even good retirement plans can backfire if you do not carefully consider the effect of disability and lost earning power on retirement savings.

ING Offers a Simpler, Cheaper Variable Annuity

The contract costs 2.25% a year, including 100 bps for the income rider, 75 bps for the M&E risk fee, and 50 bps for fund management, says Bill Lowe,...

Floor It!

In the Arizona desert, Mike Zwecher had a vision that led to his new book on building outcome-oriented retirement portfolios.

Milliman Offers Hedging Strategies to Distributors

With three trading platforms around the globe, the Chicago-based actuarial consultant has come a long way from merely advising insurers.

If You’re Human, You Have Capital

Ibbotson president Peng Chen asks, “Are you a stock or a bond?”

The Joy of Illiquidity

The legendary Roger Ibbotson told money managers that there’s hidden gold in low-turnover stocks.

So Few Words, So Many Implications

The Department of Labor proposes a subtle change in 401(k) advice regulations that may have huge repercussions for fund companies.