Regulations/Legal

'The settlements are part of an ongoing, industry-wide investigation into immediate annuity replacement practices in the state,' regulators said.

Subscription-based planners sue SEC over Reg BI

Like eight state attorney generals, the subscription-based XY Planning Network has filed a federal lawsuit against the SEC in New York. XYPN was co-founded by celebrity adviser Michael Kitces...

Why Eight States Are Suing Over ‘Reg BI’

'Dually registered' advisers can switch hats between the broker/commission model and the adviser/AUM model as needed, to the confusion and expense of investors. Eight state attorneys general say the...

House MEP bill could fuel pension risk transfer deals

According to a CBO estimate, HR397 calls for loans and grants to insolvent or troubled multiemployer pensions totaling almost $49 billion between 2019 and 2024 and almost $68 billion...

SEC Sides with the Brokers

Although there will be no higher standard of conduct for advice on tax-deferred retirement accounts—the essence of the Obama DOL fiduciary rule—the new 'Regulation Best Interest' will apply to...

Do Fiduciary Rules Work, or Do They Backfire?

'We found that broker-dealer representatives in states with common law fiduciary duties sold cheaper and better products and sell fewer variable annuities overall,' said Manisha Padi, one of the...

Flash: House passes major retirement bill

The Secure Act (H.R. 1994), which provides for "open multiple employer plans" and reduced liability for employers who want to add annuities to their retirement plans, passed by a...

Deregulating Retirement

Retirement bills close to passage in the House and Senate remove barriers to commerce in the 401(k) business but could also weaken safeguards that have been in place for...

The Case for Collaboration among State-Sponsored Savings Plans

The authors of this article, Angela M. Antonelli, director of the Georgetown University Center for Retirement Initiatives (pictured), J. Mark Iwry, a Brookings Institution fellow, and David C. John,...

JPMorgan Chase to pay $135 to settle SEC charges

'With these charges against JPMorgan, the SEC has now held all four depositary banks accountable for their fraudulent issuances of ADRs into an unsuspecting market,' said Sanjay Wadhwa, Senior...

New Jersey to establish auto-enrolled IRA for workers without plans

The Garden States joins two other 'blue states,' California and Oregon, in sponsoring a portable workplace savings plan for workers without access to a plan. The IRAs will offer...

‘Auto-Portability’ Gets Closer to Reality

After five years of pitching their idea for automatically moving assets from one 401(k) plan to the next when a worker changes jobs, Retirement Clearinghouse this week received the...

Ohio National Sued for Compensation Breach

So far in November, three variable annuity sellers, including Commonwealth Financial, have filed federal class action lawsuits against Ohio National Life, which this fall left the annuity business and...

SEC fines Citibank $38m for mishandling ADRs

Citibank improperly pre-released ADRs to brokers in thousands of transactions, the SEC found, when neither the broker nor its customers had enough foreign shares. This led to inappropriate short selling...

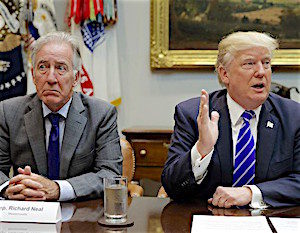

New Bedfellows: Richard Neal and the 401(k) Industry

As the next Ways & Means chairman, the liberal Massachusetts congressman won't just be the gatekeeper of retirement legislation. He’s also the only legislator who can ask for President...

SEC proposes the use of shorter prospectuses for variable annuities

The Commission has requested public comment until February 15, 2019, on the proposed rule changes, as well as on hypothetical summary prospectus samples that it has published.

House Passes Family Savings Act of 2018

This bill could open a path to great changes in retirement plans. The Senate may take action on it during the lame-duck session, a new bulletin from Wagner Law...

DOL issues regulations regarding multiple employer pension plans

The proposal doesn't address 'open MEPs' that would allow retirement plan providers to sponsor plans. It establishes seven requirements for groups or associations that want to co-sponsor a plan...

Regulation, Kavanaugh, Trump & the Indexing of Capital Gains

'Presidents and political parties favor regulation mainly when it when it advances their own agenda, regardless of the number of pages it adds to the Federal Register,' writes our...

Public Reactions to SEC ‘Best Interest’ Proposal

A survey sponsored by AARP, the Consumer Federation of America, and the Financial Planning Coalition shows that most people are at best confused by the language of the SEC's...