RIJ and ChatGPT Discuss ‘Funding Short’

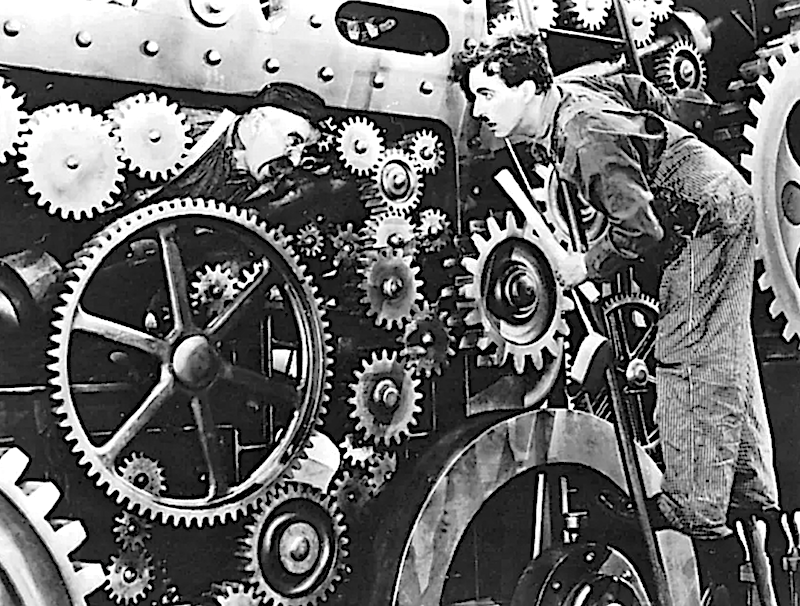

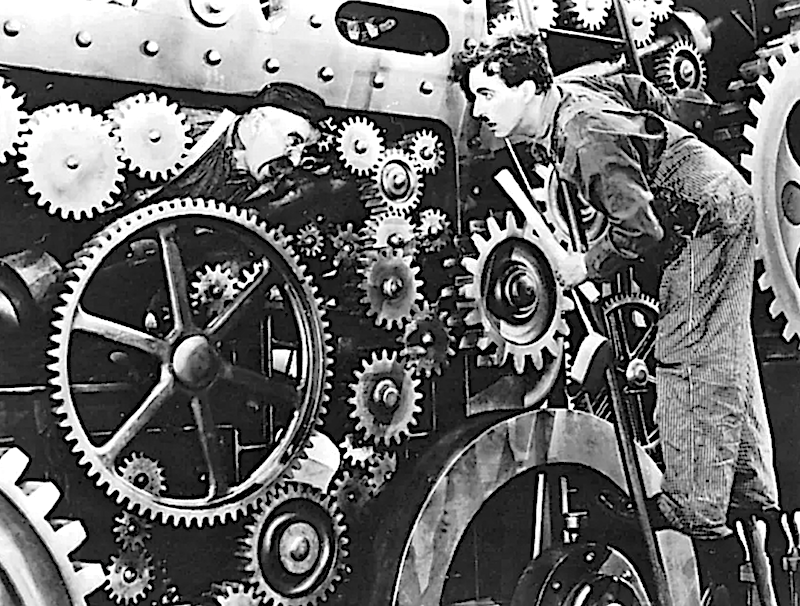

Life insurers used to be known as champions of 'asset-liability matching,' or ALM. Today, many of them are doing the opposite by 'funding short.' Here's a transcript of RIJ's recent conversation with ChatGPT about the risks and rewards of funding short, and its role in today's annuity business.