PacLife acquires Genworth’s term life new business platform

Pacific Life Insurance Company has acquired Genworth Financial’s term life new business platform, saying that the transaction will allow it to “extend its ability to fulfill the financial protection needs of a broader consumer market without disruption to Pacific Life’s current business platforms and sales channels.”

The new term life business will offer a separate product suite of low-cost life insurance protection products for the mass market. No financial details of the transaction were disclosed. The business will be located in Lynchburg, Va., and will begin operations in the fourth quarter of this year.

The acquisition “will allow us to accelerate our growth into the protection business without sacrificing our focus and responsibility to our core markets of highly affluent individuals and businesses,” said Rick Schindler, Executive Vice President of Pacific Life’s Life Insurance Division, in a release.

As part of the transaction, Pacific Life hired certain Genworth staff, as agreed upon by the parties. Dawn Trautman, senior vice president of Product and Strategy Management for Pacific Life’s Life Insurance Division said her company expects to create at least 300 jobs in Lynchburg in the next three years.

Indiana Public Retirement System taps MetLife for annuities

The Indiana Public Retirement System (INPRS) selected MetLife as its future provider of member annuities. The change is expected to be effective April 1, 2017, with a contract finalized by next Jan. 31.

The decision by INPRS’ board of trustees, at its June 24 meeting, follows four years of public discussion regarding the financial risk of INPRS providing annuities internally. In 2014, the Indiana General Assembly passed House Bill 1075 which set a glide path toward market-rate annuities and allowed the INPRS board to move to a third party provider in January 2017.

“MetLife will provide our members a similar benefit while protecting employers and taxpayers from the risks of managing this program internally,” said INPRS’ Executive Director Steve Russo. “They manage a more diversified line-up of businesses that uniquely positions them to accept more risk and potential reward than INPRS can.”

MetLife serves over 3,000 public sector organizations across the country. Over one-third of state governments across the U.S. offer MetLife group insurance or annuity benefits.

Use of an outside annuity provider has no impact on the pension benefits of current or future retirees. It affects only retiring members who choose to annuitize the money they’ve saved in INPRS annuity savings accounts (ASAs).

Members of the Teachers’ Retirement Fund (TRF) and Public Employees’ Retirement Fund (PERF) participate in a “hybrid” pension plan that includes both a pension plan and a separate ASA.

While TRF and PERF pensions provide a specified lifetime monthly benefit, members may choose what to do with their ASA funds. Some opt to take the money in a lump sum, while others leave it invested with INPRS. About 40% convert their ASA funds to a monthly benefit payment called an annuity.

With approximately $29.9 billion in assets under management at fiscal year-end 2015, the Indiana Public Retirement System (INPRS) is one of the largest 100 pension funds in the U.S., serving about 450,000 members and retirees and representing more than 1,100 public universities, school corporations, municipalities and state agencies.

LPL advisors gain access to BlackRock’s iRetire platform

BlackRock’s iRetire retirement investment framework, iRetire, is now available to LPL Financial 14,000 independent advisors The platform uses on CoRI, BlackRock’s series of retirement income indexes, and the risk analytics of Aladdin.

According to a BlackRock release, iRetire “enables advisors to initiate an income-focused discussion and then move clients to take action to help manage their income situation… [It] lets advisors show clients how much income their current savings could provide annually in retirement and how changes in behavior (e.g., working longer, saving more, changing their investment strategy) could help close the income gap.

Advisors can also use iRetire insights to build various portfolio scenarios for clients to consider, based on their retirement income goals.

BlackRock launched iRetire in November 2015 to help reframe the retirement planning problem and provide new solutions using BlackRock’s proprietary technology and support. Currently, the iRetire offering is available to 18,000 advisors on the wealth management platform powered by Envestnet, Inc., a provider of unified wealth management technology and services to investment advisors.

Prudential surveys financial concerns of LGBT community

In its first survey of LGBT Americans since the U.S. Supreme Court legalized same-sex marriages, Prudential Financial, Inc., found the LGBT community more worried about the threats that market volatility or low interest rates pose to their financial security than about gay rights issues.

LGBT Americans, in other words, share the same concerns about saving for retirement as the general population. That finding departs from Prudential’s 2012 survey, when basic rights issues were top of mind.

The 2016/2017 LGBT Financial Experience, explores changes following the U.S. Supreme Court’s year-ago landmark Obergefell decision and is the result of interviews with LGBT Americans in all 50 states during April and May.

“Having the fundamental right to marry has begun to simplify financial lives within the LGBT community,” said Kent Sluyter, CEO of Individual Life Insurance and Prudential Advisors. “Unfortunately, wage inequality, workplace insecurity and pension survivor benefits issues still cast a shadow on the ability to attain true financial security.”

Those surveyed say the right to marry has given them the ability to file joint tax returns, pay for health benefits with pre-tax earnings, list same-sex partners on health insurance, and ensure that a loved one’s interests are protected in the event of death.

But only a third say the Obergefell decision affected future financial plans. Among key findings:

- The LGBT marriage rate has more than tripled since 2012, to 30% from just 8% in 2012’s survey. Most of the newly wedded said they married a longtime partner.

- Half surveyed said being in a legally recognized same-sex partnership has simplified their finances, up from 13% four years ago.

- Lesbian women reported an average annual salary of $45,606 vs. $51,461 for hetersexual women. Gay men reported average earnings of $56,936, compared with $83,469 for heterosexual men.

- Concerns over legal and institutional barriers to achieving financial goals are strongest among same-sex partners.

- Financial needs for the LGBT community are the same as for the general population, said 46% of those survey, but 45% said they need to follow a different path to meet their needs.

For more information about The 2016/2017 LGBT Financial Experience, please visit:http://www.prudential.com/lgbt.

FidelityConnect, a portal for plan sponsor advisors, to roll out in early 2017

FidelityConnect, a new website for the more than 5,000 retirement advisors and consultants who manage workplace plans with Fidelity, is being piloted with a number of Fidelity advisor clients and is expected to be fully available during the first quarter of 2017, Fidelity said in a release this week.

Fidelity’s User Experience Design (UXD) team has met with more than 150 retirement advisors to find out how much time they spend researching investments, compiling reports and navigating the existing site. Retirement advisors and consultants said they wanted a single view into their entire book of business with Fidelity.

In response, Fidelity designed a personalized executive summary with three tabs: plans, investments and compensation. This view offers advisors instant, high-level analysis of all their plans with Fidelity, with the ability to drill down for details.

Behind the homepage, plan-level information helps advisors view and evaluate individual plan statistics and design, investments held, compensation, and contact information for sponsor clients.

These pages leverage Fidelity’s Executive Insights to offer advisors the same intelligence and benchmarking that sponsors receive. An advisor can easily see all the plans and participants invested in a single fund across their book of business, plus their performance and assets.

New regulations from the Department of Labor’s (DOL) Fiduciary Investment Advice Rule could put even more pressure on an advisor’s time with retirement plan clients. FidelityConnect is intended to give them greater access and control over a client’s plan design and investments.

DC plan participants crave lifetime income guarantee options: Prudential

Partly because many plan sponsors assume that participants aren’t interested in guaranteed lifetime income options with their plans, only about 4% (35,500) of defined contribution plans offer guaranteed lifetime income solutions.

But Prudential Retirement, which offers an optional guaranteed lifetime withdrawal benefit on target date fund portfolios in its plans, believes that most participants are in fact interested in so-called in-plan annuities. Prudential’s findings, based on a 2015 survey of 1,000 employees, are outlined in a report called The Ease of Automation and Guaranteed Lifetime Income.

The report, the fourth in a series of reports examining how plan sponsors can help American workers save for retirement, shows that employees have a keen interest in auto-enrollment, auto-escalation and guaranteed lifetime income options as part of DC plans such as 401(k) or 403(b) plans.

Of plan participants who said they were familiar with guaranteed lifetime income options, 78% believe it’s “very important” to include them in workplace savings plans and 77% said they would choose such an option, Prudential found. Among other findings:

- 54% of participants say they believe guaranteed lifetime options offered as a default investment option would provide better-than-average retirement outcomes.

- 80% of plan participants plan to rely on their workplace plans as a source of lifetime income more than any other source—including Social Security.

- 71% say auto-enrollment is an importance feature of DC plans.

- 45% worry they won’t meet their retirement goals through their current plans.

- Millennials are more enthusiastic about automatic plan features and guaranteed income solutions than any other age group.

Software maker sees opportunity in DOL ruling

Anticipating rising demand among advisors for more holistic financial plans and better documentation systems under the DOL fiduciary rule, Advicent, a software-as-a-service (SaaS) provider to financial institutions, has launched two new tools, called Narrator Clients and Narrator Advisor.

“Financial planning software was often regarded as ‘nice to have,’ but the DOL is now driving it to be a ‘need to have,’” said an Advicent release. “If advisors want to remain relevant in the digital world and remain compliant to new legislation, they need to re-think the way they work.”

According to Advicent’s website, Narrator Clients is an interactive client portal that “offers advisors and their clients insight into their personal financial plan anytime, anywhere with transparency and security… with 24/7 accessibility and actionable analytics.” Narrator Advisor gives advisors a dashboard where they can see and analyze their clients’ holdings.

“Holistic financial planning will play a key role when creating compliance strategies for the impending DOL fiduciary rule for many financial services professionals,” said an Advicent release. “Advisors will need to deliver proof that they are providing credible advice that is in the best interest of their clients. Planning software and other FinTech tools will make this easier to accomplish and keep these records if they are needed in the future.”

Advicent provides SaaS technology solutions for the financial services industry. Its products include the NaviPlan, Figlo, and Profiles financial planning applications (which power the Narrator Advisor and Narrator Clients portals); the Advisor Briefcase marketing communications tool; and the Narrator Connect application builder, which drives Advicent APIs.

© 2016 RIJ Publishing LLC. All rights reserved.

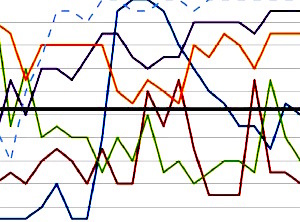

Now that Ruark has established its predictive model and settled on the four most important factors to run through it, the actuarial firm hopes to apply the analytic tool to creating benchmarks. Going forward, the benchmarks will reveal the accuracy of each company’s forecasts and show each issuer whether its experience falls within industry norms or not.

Now that Ruark has established its predictive model and settled on the four most important factors to run through it, the actuarial firm hopes to apply the analytic tool to creating benchmarks. Going forward, the benchmarks will reveal the accuracy of each company’s forecasts and show each issuer whether its experience falls within industry norms or not.