Archives: Articles

IssueM Articles

BlackRock’s Non-Insured Path to Predictable Income

Last year BlackRock launched a free new “razor” called the CoRI Retirement Index. Last week it introduced the “blades” for that razor: the CoRI Funds, a series of five actively managed target-dated mutual funds that invest primarily in investment-grade bonds.

The new funds, which are intended to attract the tax-deferred assets of Boomers ages 55 to 64, are managed (with the CoRI Index as a guide) to grow to a specific value in a specific number of years. The target value is the cost of an inflation-adjusted income annuity that (at age 65) delivers the level of income predicted at time of purchase. BlackRock has been talking about the CoRI Funds for months, and now they’re available.

This non-insured product appears to deliver some of the same benefits as deferred income annuities or deferred annuities with lifetime withdrawal benefits. But, while the future income stream of a DIA is guaranteed and the contract owner must annuitize at the end of the deferral period, CoRI Funds are not guaranteed to hit their target value, nor must the client annuitize.

The CoRI Funds could also serve as an alternative to bond index funds, offering a haven from interest rate risk for near-retirees who currently have a lot of money in bond funds but fret that those funds will fall in value as rates rise. In that scenario, the CoRI Funds could help protect them from sequence-of-returns risk while they pass through the so-called Retirement Red Zone.

Calculating your CoRI Index

What’s the CoRI Retirement Index? It’s a benchmark that tracks the current price of a dollar of future inflation-adjusted income. Using an online calculator, prospects can, by inputting their current age, discover their personal Index value, which is the cost today of a dollar of lifetime income at age 65. By dividing their investable assets by the Index value, they can find out about how much income their savings will deliver—assuming that they invest in an age-appropriate CoRI Fund now and convert the assets to an inflation-adjusted single premium immediate annuity at 65.

Here’s an example. You go to the CoRI website and input the datum that you’re 57 years old. The calculator will tell you that your CoRI Index is $14.53. Then you input the datum that you have $800,000 in savings. The calculator will tell you that, based on your CoRI Index of $14.53, your savings could buy an immediate inflation-adjusted annuity that will pay $55,058 a year starting when you reach age 65.

Since time is money, the older you are (up to age 64), the higher your CoRI Index will be and the more your future income will cost. A 60-year-old’s Index today would be $16.58 and he or she would have to invest $913,000 to get a $55,058 income at 65, not the $800,000 that a 57-year-old would pay.

The five initial CoRI Funds, which were filed with the SEC last July 30, are limited-term mutual funds. They’re designed for Boomers who will reach retirement age in 2015, 2017, 2019, 2021, and 2023. They’re actively managed to track the CoRI Index for each of those years. The managers will generally invest 80% of the assets in investment grade bonds and the rest in riskier assets, including derivatives.

Each fund has a current expense ratio of 0.83% (1.17% if and when fee waivers expire) and 0.34% for institutional class (0.58% if waivers expire). There’s a front-end load that starts at 4% for initial investments below $25,000 but gradually declines to zero for investments of $1 million or more.

CoRI Funds aren’t designed to be held indefinitely. It’s up to the individual to decide if or when to sell the funds and whether to buy an annuity or tap the bonds for systematic withdrawals. But in the year the investor turns age 75, “the fund will be liquidated and your remaining investment returned to you,” according to BlackRock.

While there’s no guarantee that investments in a CoRI Fund will deliver the projected income on the projected date, BlackRock evidently will apply a lot of active, quantitative management toward meeting that goal. Instead of watching the NAV of their traditional bond funds fluctuate between now and retirement, 55-year-olds, for example, could rely on the presumed predictability of their CoRI 2023 Fund.

“Understanding what a lump sum savings provides in estimated retirement income is difficult,” said Chip Castille, managing director and head of BlackRock’s U.S. Retirement Group, in a release last week. “The CoRI Indexes enable pre-retirees to quickly estimate the annual lifetime income their current savings may generate once they turn 65.”

In essence, these are target date funds whose managers try to track a benchmark that’s based on the age of the investor, the prevailing interest rates, the anticipated future prices of income annuities and other variables. By all accounts, that’s not an easy task.

As someone familiar with CoRI Funds explained at the Morningstar Ibbotson Conference in Phoenix today, it’s one thing to create an inflation-adjusted annuity price index; It’s quite another thing to successfully track that index, given all the variables involved. Others have noted the complexity of the CoRI concept. The mere fact that the CoRI Index and the client’s future annual income are inversely related (the lower the Index, the more income per dollar invested) may be confusing to some investors.

“My sense is that the CoRI Index is a sophisticated process that may go over the head of the average investor,” said one annuity industry participant. “It may be more for advisory use.”

Alternative to an annuity

As noted above, investors could probably accomplish the same goal with a deferred income annuity (which would require annuitization) or with a fixed-rate deferred annuity (which permits but doesn’t require annuitization). But investors who are averse to annuities might prefer BlackRock’s non-insurance approach. Owners of tax-deferred accounts, who don’t need another layer of tax-deferral over their investments, may also find the CoRI mutual fund approach less redundant than an annuity.

Indeed, the funds are intended for, but not limited to, tax-deferred accounts, according to the prospectus. It’s not hard to see how the CoRI Funds might appeal to 401(k) plan sponsors or IRA advisers who want to encourage participants or clients to adjust their mindsets from accumulation to decumulation without necessarily bringing the complexities of annuities into the picture.

The CoRI concept, not unlike Financial Engines’ Income Plus and Dimensional Fund Advisors’ Managed DC, seems able to help guide a participant’s portfolio toward the fulfillment of an income goal while remaining agnostic on the purchase of an annuity. This is one direction in which the retirement industry seems to be moving.

Plan sponsors today arguably feel more pressure to reduce fees than to provide income solutions, however, and CoRI Funds cost much more than bond index funds. If the contract’s temporary fee waivers ever expire—they’re good at least until March 1, 2015, according to BlackRock—and the expense ratios jump to 1.17% (for individual accounts) and to 0.58% (for institutional accounts), plan sponsor advisers may have a harder time justifying the higher cost.

But individual investors and their advisers might like the CoRI Funds’ combination of semi-certainty and full liquidity. An investor can always decide to sell his or her CoRI Fund and put the money somewhere else. That scenario wouldn’t necessarily be bad for BlackRock. The CoRI concept might still have served as a hook for attracting, at least temporarily, many millions of dollars in 401(k) and IRA money from near-retirees.

© 2014 RIJ Publishing LLC. All rights reserved.

MetLife exits U.K. bulk annuity market

MetLife Assurance, a U.K. subsidiary of the U.S. insurance giant, has sold its bulk annuity book to Rothesay Life Ltd., a British-based pensions insurance provider, IPE.com reported. The sale marks MetLife Assurance’s exit from the U.K. and Irish markets.

Rothesay Life was founded by Goldman Sachs in 2007. Last fall, Goldman Sachs sold 64% of the firm to Blackstone (28.5%), GIC (28.5%) and MassMutual (7%), according to Artemis.bm.

The MetLife-Rothesay deal, still subject to regulatory approval, will move around £3bn (€3.7bn and $5.1 billion) in assets between the insurers. In the U.K. bulk annuity market, insurers buy the annuity contracts of members in defined benefit (DB) plans in return for assets and premiums.

That market opened up in the middle of the 2000s. MetLife entered the market around 2007 and soon gathered vast assets. But conditions changed, and hedging replaced risk-transfer as a de-risking measure. Other insurers, such as Aviva and Lucida, downsized or abandoned their involvement in the bulk annuity business.

The purchase by Rothesay Life boosts its position in the market, as it steps up competition with market leader Pension Insurance Corporation (PIC). Addy Loudiadis, chief executive at Rothesay Life, said the acquisition of MetLife Assurance would turn Rothesay into the largest dedicated provider of bulk annuity assets, in terms of assets under management. With the transfer of MetLife’s 20,000 policies from the U.K. and Ireland, and £3bn in assets, Rothesay now has more than £10bn in AUM.

© 2014 RIJ Publishing LLC. All rights reserved.

In the U.K., “collective DC” beats “pure DC”: Aon Hewitt

U.K. employers who find the costs of their defined benefit (DB) plans unmanageable should move toward collective defined contribution (CDC) instead of pure defined contribution plans, according to Aon Hewitt, IPE.com has reported.

A shift to DC plans would only drive up DB sponsor costs because the DC plan sponsors can’t “contract out” of participation in the so-called S2P—the supplemental state pension. They would have to start contributing to S2P, which would raise costs by about 3% a year, according Aon Hewitt.

“We urge them to start considering CDC now,” said Matthew Arends, a partner at Aon Hewitt. “It can be a desirable alternative to implementing a DC arrangement in 2016.” Aon Hewitt also called on the government to provide more certainty on the timetable for legislative changes required before CDC can be implemented.

In any event, the S2P will be gone entirely by 2016, when the U.K. moves to a simpler, single-tier pension like our Social Security program. And CDC—a hybrid of DB and DC with centrally managed assets and a variable income stream—may be the next big thing in the U.K. anyway.

The U.K. pensions minister, Steve Webb, has been a promoter of U.K.-style CDC, which he calls “Defined Ambition.” He was inspired by the Dutch and Danish retirement systems, where collective defined contribution, in which participants and employers share risks, is often the model. In a speech last October, Webb said it was one of the core options he envisaged for the future of U.K. pensions.

CDC has received support from several sections of the U.K. pensions industry and across the political spectrum. Even the opposition Labor Party’s representative for pensions, Gregg McClymont, has backed the exploration of CDC, reversing the sentiments of a 2009 Labor government white paper.

One big question is whether the government will be able to pass legislation supporting Defined Ambition/CDC by 2016, when the single-tier pension will be instituted. If a CDC option isn’t available, DB plan sponsors may choose pure DC instead.

Aon Hewitt said it also expected CDC to be enshrined into legislation by 2015, taking effect as contracting-out comes to an end. Arends called on the government to provide certainty on the timetable for implementing CDC, in a bid to avoid employers having no alternative to pure DC.

© 2014 RIJ Publishing LLC. All rights reserved.

What Boomers want, and when they want it: Hearts & Wallets

“Responsiveness,” “certifications or credentials,” and being “proactive” are all attributes that consumers who are on a “Retirement Learning Curve” look for in advisers, according to a report on new research by Boston-area consulting firm, Hearts & Wallets, LLC.

The Retirement Learning Curve, as defined by H&W principals Chris Brown and Laura Varas, is much bigger than the so-called retirement “red zone.” It starts seven to 10 years before full-time work ends and lasts for 11 or more years after retirement, they said.

“Some [adviser] attributes, or service dimensions, like being ‘proactive,’ peak in importance before work stops and remain somewhat high after retirement. Others, like being ‘easily reachable by telephone,’ also peak but increase even more after retirement,” Brown said in a recent press release.

The latest announcement from Hearts & Wallets highlights two of its proprietary studies, “Insight Module 9: Approaching Retirement & the Retirement Learning Curve”and “Insight Module 8: State of Retirement Funding & Household Finances in 2013.” Module 9 is a guide for providers and advisors to understand changes in consumer income, attitudes, and the desired products, services and provider attributes during the pre- to post-retirement transition.

Module 8 includes these topics: Income Sources, Savings, Spending, Debt, Real Estate & Retirement, and Explore: Surprises of Modern Retirement: How Pension Status and Timing is Key to Approaching the Biggest Segment of U.S. Investors as well as the bonus: Retirement Market Income Marketing-Sizing Data, including 2020 Projection.

Module 8 is part of Hearts & Wallets’ annual Quant Panel of more than 5,000 U.S. households, a representative cross-section of the American population, which tracks specific segments and product trends and forms a flexible and inquisitive proprietary database of insights into investor needs and wants as the source for a series of syndicated reports and customized client analyses.

H&W’s research adds some documentation to what advisers may already know from experience. “Advice source consolidation begins three to four years ahead of retirement, heats up during the retirement event and continues the first three to four years of retirement,” according to the firm’s release. “Well before stopping full-time work, most Americans also shift to more conservative portfolios and have a growing risk aversion.”

They’ve identified a window in which they think consumers will be receptive to a pitch from an adviser. “Acquisition opportunity is greatest three to seven years before the retirement event. That’s when households are most likely to try a new provider,” the release said.

Income generation capacity seems to fall two years before people leave the last full-time job, H&W found. Gross household income drops 16% on average ($93,000 to $78,000) during the last two to four years before retirement. To offset the decline, some near-retirees tap into their nest egg prematurely.

Anxiety about finance, especially inflation, mirrors this two-year pre-retirement pattern. Anxiety peaks at 29% within two years of stopping full-time work and declines sharply after retirement. As people become accustomed to their new retirement lifestyle, the share of households with little or no anxiety rises.

Only about half of those within 10 years of stopping full-time work are ages 55 to 64. Many are younger. Seventeen million households believe they are within 10 years of the breadwinner stopping full-time work, although only six million households self-identify as pre-retirees.

American households that are transitioning out of full-time work have about $350,000 of investable assets, on average. Median savings is less than $100,000, however, and 12% of households retire with no savings at all. The study also found, oddly, that 58% of households are still “saving something” even 10 years after retirement.

The Hearts & Wallets study also found that near-retirees start to shift money away from self-service investment firms and toward shift banks and full-service providers during the years directly before and after retirement.

© 2014 RIJ Publishing LLC. All rights reserved.

2014 will be a good year for insurers: Conning

Analysts at Conning Research are bullish on the U.S. and global insurance industry. Their new study, “2014: U.S. and Global Insurance Industry Outlook,” suggests that insurers worldwide should benefit from “improved operating conditions and the initiatives they have been pursuing in response to the challenges of the past few years.”

“Our outlook for the U.S. insurance industry in 2014 is for stable results and some gradual improvement across most segments, but with increasing uncertainty brought on by economic, political or regulatory developments unfolding in the period,” said Stephan Christiansen, a managing director and head of Insurance Research at Conning in a release.

“In 2013, we discussed continuing struggles in the U.S. and global economies, along with capital markets volatility and rising regulatory challenges, and cautioned that insurers needed to take action to improve performance, rather than waiting for a better time. It was prescient. Market performance does appear to be improving, though the economic and market environments do not appear to be the primary cause,” said the introduction to the report.

Steve Webersen, director of research at Conning, said in a statement that “three key factors: economic climate, interest rate environment and regulation” will shape the global insurance industry.

“Fragmented economic growth is creating new pockets of opportunity, while challenging established markets. As in the U.S., growing regulatory convergence and complexity are increasingly commanding insurer attention and resources,” he added.

Conning is an investment management company for the global insurance industry, with more than $83 billion in assets under management as of Dec. 31, 2013 through Conning, Inc.

The new report has three parts:

- The first part includes Conning’s views on likely events and conditions in 2014, in terms of the economy, segment performance, regulatory changes, etc.

- The second level considers what the insurance industry is investing in and committing resources to in 2014, with an analysis of the potential impact of those efforts in subsequent years.

- The third level covers competitive reshaping of the industry, longer-term implications of regulatory trends, and possibilities opening up with technology and marketplace changes.

According to the introduction:

“Our outlook for the U.S. insurance industry in 2014 is for stable results and some gradual improvement across most segments… This broad view is accompanied by increasing uncertainty; improvements may be interrupted or reversed through economic, political, or regulatory developments unfolding in 2014.

“Our outlook for the global insurance industry is focused primarily on Europe (including the U.K.) and Asia. Regulatory and economic changes dominate in both regions. Growing regulatory convergence and complexity are commanding insurer attention and resources. Fragmented economic growth is creating new pockets of growth, while challenging established markets.

“We also discuss some emerging drivers of opportunity, and emerging challenges, in the rest of the world: in Latin America, the Middle East, and Africa.

© 2014 RIJ Publishing LLC. All rights reserved.

U.S. economy faces four headwinds, economist warns

A new paper from a Northwestern University economist posits that the growth rate in the U.S. over the next several decades, at least for most people, will be lower than the 2.0% average per capita GDP growth that the country experienced between 1891 and 2007.

“Future growth will be 1.3% per annum for labor productivity in the total economy, 0.9% for output per capita, 0.4 % for real income per capita of the bottom 99% of the income distribution, and 0.2 % for the real disposable income of that group,” wrote Robert J. Gordon in NBER Working Paper 19895.

- Gordon identified four “widely recognized and uncontroversial” headwinds: Demographic shifts will reduce hours worked per capita, due to the retirement of the Baby Boom generation and an exit from the labor force both of youth and prime-age adults.

- Educational attainment will stagnate at a plateau as the U.S. sinks lower in the world league tables of high school and college completion rates.

- Inequality continues to increase; the bottom 99% of earners will see a rate of real income growth that is fully half a point per year below the average growth of all incomes.

- A projected long-term increase in the ratio of debt to GDP at all levels of government will eventually lead either to higher tax revenues and/or slower growth in transfer payments.

Gordon disagrees with the “techno-optimists” who believe that the U.S. is on the cusp of a surge in technological change. He thinks we’re already well into an innovation slowdown. “In the eight decades before 1972 labor productivity grew at an average rate 0.8% per year faster than in the four decades since 1972,” his paper said.

Historical examples cited in the paper suggest that “the future of technology can be forecast 50 or even 100 years in advance.” The paper assesses innovations anticipated to occur over the next few decades, including medical research, small robots, 3-D printing, big data, driverless vehicles and oil-gas fracking.

© 2014 RIJ Publishing LLC. All rights reserved.

Send in the Robots (Don’t Bother, They’re Here)

The market for financial planning software is huge, and no wonder. The need among financial advisers for productivity-enhancing tools ensures a steady demand. The vast computing power and algorithmic creativity of techno-geeks generates a steady supply.

Advisers in search of the latest planning software could find a lot of it in one place at Joel Bruckenstein’s and David Drucker’s annual T3–Advisor’s Edition conference and trade show, held last week at the Hilton in sunny, palm-studded Anaheim, Calif.

One takeaway from the conference: FAs who still rely on Excel spreadsheets or scratch pads—and many still do, evidently—will find it hard to compete in a world where everybody has an iPhone or ‘Droid. “You’re in danger of falling behind your own clients,” warned one presenter.

Undisputably. But of the dozens of products available, which should an adviser choose? If income distribution is your game, a product with strong distribution capabilities is a must. Unfortunately, distribution wasn’t a strong theme at T3—but it wasn’t absent.

In this article, rather than explore the distribution-related features of products from the better-known exhibitors at T3—MoneyGuidePro, Advisor Software Inc., and Advicent (NaviPlan), for example—in this article I’ll focus on my visits to the booths of three smaller outfits whose products were new to me: RetireUp, AskTRAK, and Riskalyze.

RetireUp. As its name implies, this may have been the only firm at T3 that clearly positions its product as a decumulation tool. Created by LPL Chairman’s Council advisor Jeff Feinendegen and physicist/songwriter Dan Santner, this program aims at replacing time-intensive retirement plans with a process that advisers and their clients can complete “in minutes.”

The demo on the RetireUp website (a 14-day free trial is offered) walks you through a multi-step process that starts with the creation of a client Profile, proceeds to an analysis of “Assets,” “Liabilities,” and Custom Goals, and ends with the creation and presentation of a Retirement Plan.

One of the demos involved a fictional couple named Brian (age 55) and Michelle (age 56). They hoped to generate an after-tax retirement income in about 10 years of $80,000 (with an annual 2.5% inflation adjustment and survivor’s income of $60,000).

One of the demos involved a fictional couple named Brian (age 55) and Michelle (age 56). They hoped to generate an after-tax retirement income in about 10 years of $80,000 (with an annual 2.5% inflation adjustment and survivor’s income of $60,000).

Their assets included Brian’s 401(k) (currently $750,000; projected to be $1.22 million at retirement) and their joint savings ($300,000; $403,000 at retirement). At full retirement age, they’d get about $38,000 from Social Security, and Brian had a $12,000-a-year pension with a 50% spousal benefit.

Probably to keep the example simple, the Brian and Michelle were blessed with no liabilities and their only “Custom Goals” were the anticipated expense of their five-year-old daughter’s wedding ($25,000) and a $5,000 vacation once every three years throughout retirement. Potential college expenses were not listed.

After plugging in these and other numbers, the adviser and client could generate a Retirement Plan page. In the demo, the Plan screen was filled with the inevitable but potentially bewildering rows and columns of numbers, all populated with precise but hypothetical values.

But it wasn’t overwhelming. By toggling back and forth between different spending rates or assumptions about longevity, Brian and Michelle could experiment with various drawdown scenarios that could (or failed to) satisfy their income needs and neutralize their longevity risk exposure.

One of the dashboard indicators on the Plan page was an Income Stability Ratio, which provided a calculation of the percentage of Brian and Michelle’s income that was coming from guaranteed sources such as pensions and Social Security. RetireUp also allows comparisons of variable annuities with living benefits through its “Compare It” function. “We believe our software does a good job of identifying when it is or isn’t appropriate to move into a variable annuity,” said Brian Bossler, RetireUp’s vice president of business development.

AskTRAK. Dallas, Ore.-based Trust Builders, Inc., developed the TRAK planning and education tool (TRAK stands for The Retirement Analysis Kit) largely to help plan sponsor advisers. Defined contribution plan advisors can use it show participants how much to save. In public pensions, it can be used to project future income streams or to coordinate the drawdown of pension and after-tax savings in the most tax-efficient manner. But individual advisers and their clients can evidently use it too.

The AskTRAK toolkit is chock-full of calculators. A Multi-Tiered Split Annuity calculator, for instance, allows advisers to show clients how to split a given lump sum into income from a succession of as many as five tiers of deferred and/or immediate annuities.

In one strategy that’s illustrated on the AskTRAK website, a newly retired 62-year-old with an after-tax $500,000 lump sum decides to build a three-tiered split annuity. The first tier, which uses $118,300 of the $500,000, provides a $2,300 monthly income until age 67.

In one strategy that’s illustrated on the AskTRAK website, a newly retired 62-year-old with an after-tax $500,000 lump sum decides to build a three-tiered split annuity. The first tier, which uses $118,300 of the $500,000, provides a $2,300 monthly income until age 67.

Over those five years, a $102,500 piece of the original asset grows (at an assumed rate of 6%) to a projected $137,200, which provides $2,600 a month until age 72. The remaining $279,200 is allowed to grow (at an assumed 6%) for 10 years, reaching a projected $500,000. That amount can be used to buy more income, if needed, or to fund a legacy.

Like other software, TRAK’s Tax Wise Distribution Strategy can generate the now-familiar Rock of Gibraltar-shaped retirement income chart. But instead of refracting each year’s income into colored bands that correspond to its sources, this chart refracts income into colored bands that correspond to tax brackets.

A client who is drawing down savings from both pre-tax and after-tax accounts, for example, can use this chart as a guide to spending the pre-tax money first (so that it is taxed at the lowest rate) and then relying on after-tax money when income climbs into the higher tax brackets.

For retirees who anticipate using qualified plan assets for legacy purposes, AskTRAK also has a Stretch IRA calculator. It can illustrate the projected annual withdrawals and the declining value of a 401(k) account as it passes from the original account owner to a surviving spouse and then to children or grandchildren.

Riskalyze. This specialty software applies Daniel Kahneman and Amos Tversky’s Nobel Prize-winning “prospect theory” to the task of quantifying a client’s risk tolerance. It aims to replace the traditional risk tolerance questionnaire with a more quantitative and scientific approach.

Every client gets a “Risk Number” from one to 100. Like many risk assessment tools, it’s based on the client’s professed tolerance for loss and desire for gain, along with the his or her “financial devastation” amount—defined by Riskalyze as the amount of paper loss that compels the investor to panic-sell.

The Risk Number is presented to the client in the form of a speed limit sign. The greater the risk tolerance, the higher the Risk Number will be. Portfolios are also assigned risk numbers, enabling the adviser to match clients and portfolios with similar scores.

Using the tool, the adviser can also generate a Risk Number for a new client’s existing portfolio, to see how far it varies from the client’s risk tolerance. The Risk Number is only a starting point in terms of portfolio building. Many different combinations of assets might all generate a score of 45, for instance.

“Heat maps” are popular these days, and Riskalyze offers a “risk/reward heat map” of the investments in a client’s portfolio. It allows the adviser and client to see the projected range of a specific asset’s performance over the subsequent six months.

Aside from showing the possible gain and possible loss, the heat map displays how much of each investment’s downside risk is likely to be buffered by the other investments in the portfolio.

Fans of Kahneman’s 2011 book, “Thinking Fast and Slow,” might be impressed to hear that Riskalyze applies his prospect theory to the task of assessing risk tolerance. A pillar of behavioral finance, this theory has helped describe how people actually weigh and choose between risky alternatives, rather than how a hypothetical “rational investor” might behave.

© 2014 RIJ Publishing LLC. All rights reserved.

The Bucket

ING U.S. announces fourth quarter and full year 2013 results

ING U.S., Inc., which will rebrand as Voya Financial, Inc. in 2014, reported fourth quarter 2013 after-tax operating earningsof $198 million, up from $136 million in 4Q’12, and net income available to common shareholders of $548 million, up from a loss of $23 million in 4Q’12.

Full year 2013 after-tax operating earnings were $825 million, compared with $597 million in 2012. Net income available to common shareholders was $601 million, compared with $473 million in 2012.

Fourth quarter 2013 net income available to common shareholders included:

- Actuarial gains on pension and postretirement benefits, after-tax, of $263 million primarily due to rising interest rates and strong performance of assets in the pension plan.

The Closed Block Variable Annuity (CBVA) segment’s after-tax loss of $147 million, which was driven by an after-tax loss of $177 million related to nonperformance risk. The CBVA segment includes the effect of its hedge program, which focuses on protecting regulatory and rating agency capital from market movements, rather than minimizing GAAP earnings volatility.

Annuities adjusted operating earnings were $56 million, compared with $51 million. The following items primarily accounted for this increase:

- Lower DAC/VOBA and other intangibles amortization ($5 million positive variance) due to a decrease in the amortization rate;

- Higher fee based margin ($3 million positive variance) on increased levels of mutual fund custodial assets; and

- Higher trail commissions ($2 million negative variance) due to increased mutual fund sales and AUM.

Net outflows were $172 million, as lapses on fixed rate annuity policies, especially older products with higher fixed rate crediting levels such as Multi-Year Guarantee Annuities, exceeded new sales.

Retirement business

Retirement adjusted operating earnings were $134 million, compared with $117 million. The following items primarily accounted for this increase:

- Higher fee based margin ($17 million positive variance) on higher variable assets partially offset by reduced recordkeeping revenue;

- Higher investment spread and other investment income ($12 million positive variance) stemming largely from higher limited partnership income and prepayment fee income, as well as reduced crediting rates;

- Higher administrative expenses ($11 million negative variance) partially due to volume-related expenses and ongoing investment in systems infrastructure;

- An increase in other revenue ($8 million positive variance) related to changes in market value adjustments related to surrendered retirement plans;

- Higher DAC/VOBA and other intangibles amortization ($5 million negative variance) as a result of higher gross profits, partially offset by a reduced amortization rate; and

- Higher trail commissions ($4 million negative variance) due to higher AUM.

Retirement net flows were $363 million, compared with $1.8 billion in the fourth quarter of 2012 and $234 million in the third quarter of 2013. (Net flows vary in size and timing, sometimes substantially, from one quarter to the next.) Retirement AUM totaled $105 billion as of December 31, 2013, up from $90 billion as of December 31, 2012 and up from $100 billion as of September 30, 2013.

Annuities segment

AUM for the Annuities segment totaled $27 billion as of December 31, 2013, up slightly from $26 billion as of September 30, 2013 and $26 billion as of December 31, 2012. Included in AUM is the company’s mutual fund custodial product (Select Advantage), which increased to $3.4 billion as of December 31, 2013, up from $3.1 billion as of September 30, 2013 and $2.4 billion as of December 31, 2012.

Closed block variable annuity

Closed Block Variable Annuity had a net loss before income taxes of $226 million, including a loss before income taxes of $272 million due to changes in the fair value of guaranteed benefit derivatives related to nonperformance risk, which the company considers a non-economic factor.

This compares with a fourth quarter 2012 net loss before income taxes of $167 million, which included a loss before income taxes of $401 million related to nonperformance risk.

ING U.S.’s CBVA hedge program is designed primarily to protect regulatory and rating agency capital from equity market movements, rather than minimize GAAP earnings volatility. During the quarter, the hedge program resulted in a net gain to regulatory surplus as a result of the difference between the decline in reserves and the decline in hedge assets related to equity market movements. GAAP earnings were favorably impacted by lower volatility, which offset market appreciation related net hedge program losses.

The retained net amount at risk for CBVA living benefit guarantees improved to $2.2 billion as of December 31, 2013 from $3.0 billion as of September 30, 2013, primarily due to favorable equity and interest market movements.

MassMutual announces new seminar series for plan participants

MassMutual’s Retirement Services Division announced that its RetireSmart interactive participant education series will have a new “lineup” in 2014, its fifth year. The series will include six seminars, each led by an industry expert.

The series opens Feb. 26 with returning guest speaker Dr. Jerry Webman, Ph.D, CFA and Chief Economist for OppenheimerFunds Inc. He will review 2013’s market performance, discuss factors driving the global economy and identify key economic indicators to watch for retirement investors.

The RetireSmart seminar series will continue bi-monthly throughout 2014 as follows:

- April 9: Retirement Planning for the Ages. Presented by Farnoosh Torabi, independent Generation Y money coach, best-selling author and personal finance journalist.

- June 11: Strategies for Pre-Retirees. Presented by Black Rock Investments.

- Aug. 6: The Art of Negotiating a Deal. Presented by Farnoosh Torabi.

- Oct. (exact date to be announced on www.retiresmartseminars.com): Calculating your Social Security Retirement Benefit. Presented by a representative from the U.S Social Security Administration.

- Dec. 3: Maximizing your Workplace Benefits. Presented by Farnoosh Torabi.

Securian individual variable annuity sales up 57% over 2012

According to a release this week from Securian:

“In 2013, many variable annuity providers adjusted their product portfolios to reduce risk.

“Some even exited the market as low interest rates continued to pose significant risk exposure for lifetime withdrawal benefit guarantees which are included in some variable annuity products.

“Meantime, Securian Financial Group’s diligent risk management positioned the company’s retirement unit to step up with new annuity products as demand rose and competitors stepped back. Additionally, Securian responded to distributors’ requests for less complex annuities that meet the financial needs of many clients.

“The result? A 57% surge in individual variable annuity sales, to $900 million.

“‘Our goal has never been to dominate the individual annuity market,’ said Dan Kruse, second vice president, Individual Annuity Actuary, Securian Financial Group. ‘Our goal is to create products that meet the needs of our strategic distribution partners and their clients without exceeding Securian’s risk appetite.’

“Bolstering sales growth is a high customer retention rate of 93% among Securian’s individual annuity owners. Customer satisfaction was 98%. Assets under management rose from $6 billion in 2012 to $7 billion in 2013.”

New York Life reports record sales growth in 4Q 2013

New York Life has announced “very strong” fourth quarter gains in sales of life insurance, annuities and mutual funds. According to a release, sales of recurring premium life insurance through agents were up 5% and total annuity sales were up 14% over 2012, both representing a new record for 12-month growth rates in those products.

The fourth quarter growth of recurring premium life insurance products came from the company’s whole life, universal life and variable universal life products. Of the company’s new life insurance sales, 46% was produced by agents serving the African-American, Chinese, Hispanic, Korean, South Asian, and Vietnamese markets in the U.S.

Agents sold $5.4 billion of annuities of all types in 2013, a 14% increase from 2012. Sales of single premium immediate annuities and the company’s deferred income annuity, Guaranteed Future Income Annuity, increased 6% through the fourth quarter compared with the same period in 2012.

Sales of New York Life’s MainStay family of mutual funds through agents rose 16% over the prior year, to $938 million.

In 2013, New York Life hired 3,460 full-time agents. It seeks to hire 3,600 financial professionals in 2014, with more than half to be women or individuals who represent the cultural markets. New York Life’s operations in Mexico, Seguros Monterrey New York Life, saw 14% sales growth compared with 2012.

MetLife hits 2013 target of $10 – $11 billion in VA sales

MetLife reported operating earnings of $1.6 billion for the fourth quarter of 2013, up 14% over the fourth quarter of 2012. On a per share basis, operating earnings were $1.37, up 10% over the prior year quarter. Operating earnings in the Americas grew 13%. Operating earnings in Asia increased 64% on a reported basis and 74% on a constant currency basis. Operating earnings in Europe, the Middle East and Africa (EMEA) increased 51% on a reported basis and 48% on a constant currency basis. Partially offsetting these gains were larger losses in Corporate & Other.

Fourth quarter 2013 operating earnings included the following items:

- Variable investment income above the company’s 2013 quarterly plan range by $101 million, or $0.09 per share, after tax and the impact of deferred acquisition costs (DAC).

- As previously announced, strengthening of asbestos claim reserves, which reduced operating earnings by $101 million or $0.09 per share, after tax

- An increase in litigation-related reserves, which reduced operating earnings by $46 million or $0.04 per share, after tax.

- Favorable catastrophe experience and prior year loss reserve development of $15 million and an $11 million benefit from tax-related items in EMEA, which increased operating earnings by $26 million or $0.02 per share, after tax.

MetLife reported fourth quarter 2013 net income of $877 million, or $0.77 per share, including $242 million, after tax, in net derivative losses. Increases in interest rates, changes in foreign currencies and the impact of MetLife’s own credit during the quarter contributed to the net derivative losses.

Premiums, fees & other revenues were $13.1 billion, down one percent (up two percent on a constant currency basis) from the fourth quarter of 2012.

Book value, excluding accumulated other comprehensive income (AOCI), was $48.49 per share, up from $46.73 per share in the fourth quarter of 2012.

Full year results

For the full year 2013, MetLife reported operating earnings of $6.3 billion, up 11% over 2012. The increase reflects operating earnings growth of 13% in the Americas, 20% in Asia (27 percent on a constant currency basis) and 21 percent in EMEA (18 percent on a constant currency basis). Partially offsetting these gains were larger losses in Corporate & Other. On a per share basis, 2013 operating earnings were $5.63, up 7% over 2012. Growth on a per share basis was dampened by the increase in the number of outstanding common shares resulting from the conversion of $1.0 billion of the equity units issued in 2010 to fund the Alico acquisition.

MetLife reported full year 2013 net income of $3.2 billion, or $2.91 per share.

The Americas

Total operating earnings for the Americas were $1.4 billion, up 13%. Premiums, fees & other revenues for the Americas were $10.0 billion, up one percent, and excluding pension closeouts, up five percent.

Retail

Operating earnings for Retail were $658 million, up 4%. Premiums, fees & other revenues for Retail were $3.3 billion, up 4% primarily due to an increase in separate account fee income as well as higher income annuity sales. Fourth quarter 2013 variable annuity sales were $1.7 billion, down 49%. For the full year 2013, variable annuity sales were $10.6 billion – in line with the company’s plan of $10 to $11 billion.

© 2014 RIJ Publishing LLC. All rights reserved.

Mutual funds gain 20% in 2013: Cerulli

U.S. mutual funds showed positive flows of $282 billion in 2013, Cerulli Associates said in its January issue of The Cerulli-Edge–U.S. Monthly Product Trends. Equity funds led the mutual fund field last year, capturing $232 billion in flows.

Last year, 10 investment managers garnered total inflows of $10 billion or more. With $74.7 billion, Vanguard added the most of net inflows of any mutual fund manager. Dimensional Fund Advisors followed with $22.5 billion, J.P. Morgan with $21 billion, MFS with $18 billion and and Oppenheimer Funds with $16.1 billion.

Among international funds, Vanguard’s Total International Stock Index Fund took in $17.9 billion, followed by Oakmark International Fund with $12.5 billion and Oppenheimer Developing Markets Fund with $6.7 billion.

Among index funds, the top three were Vanguard funds. Vanguard’s Total International Bond Index Fund took in $18.6 billion, the Total International Stock Index Fund, 17.9 billion and the Total Stock Market Index Fund, $17.5 billion.

Of the ten largest asset managers, PIMCO was the only one to show net outflows in 2013. PIMCO’s Total Return Fund saw outflows of $40.4 billion. Cerulli cited regulatory pressures on the fixed-income industry as the cause. Vanguard’s Inflation-Protected Securities and GNMA Fund experienced net outflows of $14.6 and $11.9 billion last year, respectively.

Among municipal bond funds, Vanguard’s Short Term Tax Exempt Fund had the highest inflows, with $1.2 billion, while its Intermediate-Term Tax-Exempt Fund had the highest outflows, at $3.9 billion.

© 2014 RIJ Publishing LLC. All rights reserved.

Most plan sponsors shun income options: Callan

Annuity options lost considerable ground in the race for retirement income assets in defined contribution plans, as plan sponsors looked elsewhere, according to a new study by Callan Investments Institute.

Indeed, annuity options fell out of favor last year as a form of distribution payment in DC plans, while managed accounts and income drawdown solutions gained territory, Callan said in its new 2014 Defined Contribution Trends report.

The percentage of plan sponsors offering annuities as a distribution option dropped to 9% in 2013 from 22.1% in 2012. But the number of sponsors offering managed accounts and income drawdown services like Financial Engines rose to 6.4% in 2013 from 3.9% in 2012.

Additionally, annuity placement services (like Hueler Income Solutions) were offered by 5.1% of plans last year, a drop from 6.5% a year earlier. Prevalence of in-plan GLWB (guaranteed lifetime withdrawal products) fell to 2.6% of plans from 6.5%.

This trend is expected to persist. When asked if they would offer an annuity as a distribution payment option in 2014, 59.3% of surveyed sponsors said it was “very unlikely.” Currently, 74.4% of plan sponsors do not offer retirement income solutions at all. Nineteen percent of sponsors said they were “somewhat likely” to offer a GLWB option, but only 4.8% said they were “very likely” to do so.

The most common reason among plan sponsors for not offering retirement income options was concern about fiduciary implications. Sponsors also cited the administrative complexity of income options, a lack of need or urgency for them, concerns about insurer solvency and lack of participant demand.

© 2014 RIJ Publishing LLC. All rights reserved.

Prudential launches new version of Highest Daily GLWB

Prudential Annuities has launched a new version of its Highest Daily variable annuity optional living benefit. The new rider represents another de-risking move: the 5% roll-up will be subject to change for new business, 1o% of premium must go into a fixed return account and owners will have to wait until age 85 to get a 6% guaranteed withdrawal rate.

The new rider, HD v3.0, which is available on Prudential Premier Retirement Variable Annuities, replaces the previous v2.1 iteration of the Highest Daily rider. The differentiating feature of the HD rider is that it locks in a new guaranteed benefit base on any day when the account value exceeds the current benefit base and reaches a new high water mark.

Prudential’s VA is also unusual in that it uses a modified version of a risk management strategy called “constant proportion portfolio insurance,” or CPPI, which automatically shifts money to bonds from stocks when equity markets decline, and vice-versa.

The prospectus describes this as “a proprietary mathematical formula that monitors an investor’s account daily and automatically transfers amounts between the chosen variable investment portfolios and the AST Investment Grade Bond Portfolio.”

On this version of the rider, the current annual roll-up of the benefit base is 5% for the first 10 years or until the first withdrawal (whichever comes first). In a release Prudential said it will retain the flexibility to “change the roll-up rate and/or the withdrawal percentages for new contracts in response to market conditions.”

The current withdrawal percentages for sole contract owners range from 3% (for contract owners aged 50 to 54) to 6% (for contract owners ages 85 and older). The withdrawal percentage for those ages 65 to 84 is 5%.

Regarding investment restrictions, contract owners must allocate 10% of each purchase premium to a fixed-rate “secure value” account. Prudential has also added two new asset allocation portfolio options: the AST T. Rowe Price Growth Opportunities Portfolio, an 85/15 (equity/bond) model, and the AST FI Pyramis Quantitative Portfolio, a 65/35 (equity/bond) model. There are now 22 asset allocation portfolios.

The B share of the contract has a seven-year surrender period with an initial surrender charge of 7%, a mortality and expense risk charge of 1.30% and an administrative charge of 0.15%. The minimum initial purchase premium for the B share is just $1,000.

The L share of the contract has a four-year surrender period with an initial surrender charge of 7%, a mortality and expense risk charge of 1.75% and an administrative charge of 0.15%. The minimum initial purchase premium for the L share is $10,000.

The HD v3.0 rider has a current charge of 1.00% a year (1.10% for joint contracts) without the HD death benefit. With the HD death benefit, the charges are 50 basis points greater. Portfolio expenses range from a low of 58 basis points to a high of 177 basis points.

According to the prospectus, the permitted subaccounts for those who choose the HD v3.0 rider include:

AST Academic Strategies Asset Allocation

AST Advanced Strategies

AST Balanced Asset Allocation

AST BlackRock Global Strategies

AST BlackRock iShares ETF

AST Capital Growth Asset Allocation

AST Defensive Asset Allocation

AST FI Pyramis Asset Allocation

AST FI Pyramis Quantitative

AST Franklin Templeton Founding Funds Plus

AST Goldman Sachs Multi-Asset

AST J.P. Morgan Global Thematic

AST J.P. Morgan Strategic Opportunities

AST New Discovery Asset Allocation

AST Preservation Asset Allocation

AST Prudential Growth Allocation

AST RCM World Trends

AST Schroders Global Tactical

AST Schroders Multi-Asset World Strategies

AST T. Rowe Price Asset Allocation

AST T. Rowe Price Growth Opportunities

AST Wellington Management Hedged Equity

In addition, the prospectus said, “There are two types of MVA Options available under each Annuity – the Long-Term MVA Options and the DCA MVA Options. If you elect an optional living benefit, only the DCA MVA Option will be available to you. In brief, under the Long-Term MVA Options, you earn interest over a multi-year time period that you have selected… Currently, the Guarantee Periods we offer are 3 years, 5 years, 7 years, and 10 years… Under the DCA MVA Options, you earn interest over a 6 month or 12 month period while your Account Value in that option is systematically transferred monthly to the Sub-accounts you have designated.”

© 2014 RIJ Publishing LLC. All rights reserved.

Are You Being Served?

“All the heirs hate it,” rued the paralegal at the law firm that represented the company that held the reverse mortgage on my late father’s two-story condo in a development in suburban Philadelphia. They hate getting sued, that is.

I certainly did. As I explained to the paralegal, I answered my doorbell a few weeks ago to find an officer of the law on the stoop—a stone-faced Lehigh County sheriff’s deputy wearing a Stetson and a brush moustache who, after I confirmed my identity, handed me a thin sheaf of papers, stapled in the upper left hand corner.

Underneath a cover sheet that was peppered with opaque words like “prothonotary,” I found a “Complaint in Mortgage Foreclosure.” The plaintiff was an Austin, Texas, bank that I’d never heard of. The defendant was myself, the executor of my dad’s estate.

Leafing through the “complaint,” I was momentarily transfixed when I saw the phrase, “Amount Due: $264,566.57,” but exhaled when I reached paragraph 12, which said: “Plaintiff does not hold the named Defendants personally liable to this cause of action and releases them from any personal liability.” So why was I being sued?

When one or both holders of a reverse mortgage die, the lender can’t simply seize the house. In the Commonwealth of Pennsylvania, where I live, and apparently in other states, lenders must follow the same procedures that they follow when foreclosing on a home whose owner defaulted on a regular mortgage.

That’s a consumer protection measure. In the case of an ordinary mortgage, it protects impecunious owners from summary eviction. It gives them time to seek bankruptcy protection or repair their finances. In the case of a reverse mortgage, it gives the survivors an interval in which to decide whether they want to exercise their right to sell the house and pay off the reverse mortgage. If they’re not interested in keeping the house, it also gives them plenty of time—perhaps too much time—to empty the house of a parent’s possessions.

A widower, my father died unexpectedly during a short trip to Florida in early 2013. Expecting to return home to Pennsylvania within a week, he’d left the house in casual disarray. That’s how we found it. It’s a strange experience, walking through your late parents’ home for the first time. The contour of their lives is still there, as distinct as the impression left by a head on a pillow. I also felt like an intruder—the way I felt when I would arrive home from college, find no one home and the doors locked, and have to break into my own bedroom through a window.

My brother, sister and I needed time to decide what to do with my parents’ belongings. My father had left an entire household frozen in mid-stride. A pipe rack, briar pipes and ashes. Poker chips in an aluminum carrying case. Golf clubs and best-selling books from the 1950s. Cufflinks and a fake Rolex watch. My mother’s decoupaged chairs and tables. Antiques, pictures in ornate frames, small appliances. Drawer after drawer stuffed with old letters, picture post cards, greeting cards and photographs. Sorting out all of this would take some time.

We siblings had never had a conversation with our father about exactly what would happen to the house after he died. (We’d never talked at all about his death, ever. We didn’t know much about his reverse mortgage, except that he’d used his home equity to trade up to a larger condo instead of staying in his old place and taking cash out—which turned out to be a poor idea.) After finding the reverse mortgage documents among his papers, I called the 800-number and told a phone rep that we didn’t want the house. She told me to wait for an update.

Months passed. Property taxes and maintenance fees were accruing, which made us nervous. We called the mortgage company again and were told to have patience during the foreclosure process, which was required by law and might last as long as 600 days from my father’s death.

Then I started receiving letters from bankruptcy lawyers. At first, I didn’t understand why. “Chapter 13 is an effective way to SAVE YOUR PROPERTY and put an end to the torment of debt,” said one letter. “You may be able to stop real estate foreclosure eliminate unsecured debt and keep your property by filing a chapter 13 with only $331 and no upfront legal fees.” Then one day, a few weeks ago, I found out why.

Without warning, a sheriff’s vehicle (large five-pointed gold star on driver’s door) appeared in my driveway, followed by the chime of my doorbell. After the deputy handed me the papers and drove away, I picked up the phone and called the plaintiff’s law firm to ask what this meant and what I should do. The receptionist commiserated; she had heard this story before. Many heirs become frightened when a sheriff’s deputy serves them with papers, she said. Some of them worry that their own credit rating will be in jeopardy, or that they might need to hire a lawyer.

If reverse mortgages are to gain greater respectability and popularity, this tactless procedure will probably need to change. Reverse mortgage brokers are well aware of this ham-handed process, and they don’t like it. They know it’s not helping their industry’s image. “More clients are passing and I’m seeing upset adult children getting put through the wringer afterwards,” Alain Valles, president of Direct Finance Corp. a reverse mortgage writer in Norwell, MA, told RIJ. “I’ve told fellow loan officers that we need to explain all this to borrower at the beginning of the process.

“But many clients don’t want adult children to know what they’re doing. In my own practice, we give the borrowers printed materials to give to the children. I agree 100% that the reverse mortgage industry is doing a terrible job communicating that the children have no obligation to do anything. Let’s tone down the legalized rhetoric. On the other hand, too many people automatically turn the house over to the lender.”

So there you have it. This clunky system is designed to protect the heirs from potentially losing valuable equity in the parents’ homes, and it unquestionably does. But it also leaves many others feeling rattled and blindsided. There should be a more streamlined, and more civil way for reverse mortgage companies to take possession of these leveraged properties after the owners die. Tender feelings aside, the current method, with its long limbo period, must create extra costs for the mortgage company, which they undoubtedly pass along to their borrowers.

© 2014 RIJ Publishing LLC. All rights reserved.

RetiremEntrepreneur: Andrew Rudd

What I do: Advisor Software builds analytical tools to help advisers provide better advice to their clients. We help the adviser get more clients, deliver more relevant advice to the client, and develop stronger and more collaborative relationships with clients. For example, our “goal-based” investing method helps clients identify their goals, prioritize them, and identify the optimal strategy to best fund them. I am very much a proponent of identifying the goals and aspirations clients want to achieve in life and retirement.

Who my clients are: Of the three groups in our client base, one includes the large platforms, asset managers and broker-dealers, such as Charles Schwab, Russell Investments, State Street Global Advisors, and LPL Financial, among others. We provide them with client acquisition, portfolio rebalancing, asset allocation, risk modeling and other analytical tools. The second group of clients consists of advisers, and the third are individual investors.

Who my clients are: Of the three groups in our client base, one includes the large platforms, asset managers and broker-dealers, such as Charles Schwab, Russell Investments, State Street Global Advisors, and LPL Financial, among others. We provide them with client acquisition, portfolio rebalancing, asset allocation, risk modeling and other analytical tools. The second group of clients consists of advisers, and the third are individual investors.

Why people hire me: We tend to be more willing to do custom work than our competitors. We provide customized services for each client—developing specifications, workflow and interface design—which means we spend a lot of time with them. Our product business has a strong reputation and track record. It gives clients confidence that we understand exactly how advisers use their tools. Most recently, we’ve developed a goal-based financial planning tool that significantly improves adviser productivity.

How I get paid:We’re flexible in customizing our fees depending on the client’s considerations. Some clients like to structure fees by the number of seats and type of usage. Others are interested in a flat fee.

Where I came from: I started my working life as an academic. I received a PhD in finance and operations research at UC Berkeley, where I co-founded Barra, Inc. with a colleague, Barr Rosenberg. I taught at the business school at Cornell University for a number of years, then returned to Berkeley to work with Barra. We provided services to the institutional financial community. We delivered indices, portfolio risk, performance analytics and optimization tools. In 2004, we sold Barra to Morgan Stanley. That’s when I moved full time to Advisor Software.

Why a private venture instead of academia: I was always interested in creating products. But I’m still interested in academics. I write occasionally for academic journals and I’m finishing a book with a colleague. I like to keep one leg in each camp. Both lifestyles have their advantages and disadvantages. Both provide challenges that make life interesting and rewarding.

My view on annuities: There are good and bad aspects to annuities. The key disadvantage, for the client, is the loss of control of the assets. The benefit, on the other hand, is the assurance of a lifetime cash flow. There’s clearly a use for annuities, but there’s a trade off. I don’t personally own any annuities, simply because in my present circumstances they don’t fit into my financial plan, but that’s not to say they won’t at some stage in the future.

My retirement philosophy: The success of Barra has enabled me to be aggressive in saving for retirement and investing in various philanthropic ventures. My philosophy is to have enough to last for my doddering years, to support the causes I find important and valuable and, if anything is left over, to leave it to my surviving family. (RIJ has heard through the grapevine that the British-born, squash-playing Rudd, now 66, bought a small vineyard north of San Francisco and will spend at least part of his “doddering years” pursuing a passion for wine and viticulture.)

© 2014 RIJ Publishing LLC. All rights reserved.

Video: RIJ Editor at The American College

The Active Ingredient

In March of 2008, Bear Stearns introduced the first actively managed ETF, the Bear Stearns Current Yield Fund. Later that year, Bear Stearns went belly up, and the first actively managed ETF, after just months from its creation, was put to rest.

Since then, the universe of index-tracking (passive) ETFs has grown exponentially, from several hundred in 2008 to 1,480 today. Purveyors have not only endeavored to track every possible index, but they have also created their own newfangled indexes to track. In search of sales, the industry has been trying to bury the stigma of Bear Stearns and raise interest in actively managed ETFS.

And so, in the past year or two, we’ve seen the introduction of 80 actively managed ETFs. The largest, and most successful, is the PIMCO Total Return ETF (BOND), with current assets of $4 billion. The smallest is… well, the smallest may be out of business by the time this article appears.

Active ETFs have not exactly set the investment world on fire. Why? The memory of Bear Stearns may be a deterrent. ETF investors may simply have a penchant for indexing. Or perhaps ETF providers are hesitant to reveal their secret sauces to investors: ETFs, at least to date, have required much more transparency than mutual funds. (ETF managers must disclose their holdings every day; mutual funds managers disclose theirs every quarter).

But unless ETF providers find another avenue of brand-extension, they will try to sell active ETFs, as well as to lobby regulators to equalize the transparency rules.

Is this good for investors?

As you know, most academics who have studied the issue have concluded, to the chagrin of many on Wall Street, that few actively managed funds beat the indexes over the long run. It’s largely a matter of costs, which matter greatly in determining returns, as Vanguard advertisements attest.

Ah, but the new actively managed ETFs are considerably less costly than actively managed mutual funds. According to Morningstar, the average expense ratio of active ETFs is only 75 basis points, or about 60% of the average cost of actively managed mutual funds (126 basis points). If the academics were to compare passive investing with active ETF investing, indexing might not have such a clear edge.

That said, passive ETFs are similarly less costly than passive mutual funds. Passive ETFs have an average expense ratio of 60 basis points versus an average expense ratio for passive mutual funds of 75 basis points, per Morningstar. (Coincidentally, passive mutual funds and active ETFs have the same average expense ratio.)

So, to the extent that lower costs influence long-term returns, the new active ETFs, collectively, should perform better than active mutual funds, about the same as passive mutual funds, and not as well as passive ETFs.

Of course, costs aren’t the only determinant of long-term returns. The quality of management (of both active and passive funds, but especially of active funds) is also critical.

Bear Stearns’ management wasn’t very good. We’ll just have to wait and see about quality of management of the new active ETFs.

Russell Wild, a fee-only advisor in Allentown, PA, is the author of Exchange Traded Funds for Dummies, 2nd Edition, 2012.

© 2014 RIJ Publishing LLC. All rights reserved.

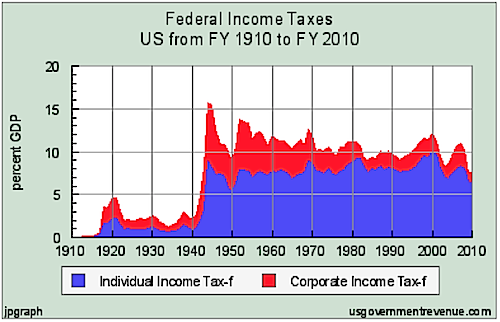

The federal income tax turned 100 this week

The 16th Amendment to the Constitution was ratified on February 3, 1913, authorizing Congress to levy taxes on income and giving the government a replacement for the tax on alcohol—thus paving the way for the passage of the Volstead Act (Prohibition) in 1919.

“In its first two years, the [income] tax was modest, affecting only a very few citizens and provided only a small part of the government’s total revenue,” the U.S. Census Bureau reported this week. “But the need to fund our involvement in World War I moved income taxes to the center of federal finances.”

In 2011, individuals paid around $1.7 trillion in federal income tax, while state and local income taxes amounted to $114 billion in just the second quarter alone of 2013.

© 2014 RIJ Publishing LLC. All rights reserved.

Half of U.S. women fear becoming ‘bag ladies’—Allianz Life

Women are becoming more financially confident, but they still face major obstacles to achieving financial security. And the financial industry doesn’t fully understand their needs or how they prefer to learn about financial planning.

So says the newly released “2013 Women, Money & Power Study” by Allianz Life, a survey sponsored by Allianz Life of more than 2,000 women ages 25-75 with a minimum household income of $30,000 a year.

Despite growing confidence among women, “Irrational fears about losing it all and becoming a bag lady remain,” said Katie Libbe, Allianz Life vice president of Consumer Insights, in a release. “Some women keep a ‘secret stash’ of money that their spouse or partner does not know about, which reflects their need to protect themselves financially.”

CFOs of household. Over half of all women surveyed said they are the chief financial officers of their households and 57% say they have more earning power than their partners. A majority say they primarily handle investment decisions, research retirement ideas, handle tax preparation and teach their children about money. Nearly seven in ten (68%) saying they have increased their financial involvement since the crisis.

Few are involved in investment decisions. One in five fits the profile of women who are actively involved in major investment decisions, understand financial products well and are interested in learning more about financial matters. Such “women of influence” may have a high salary and extensive education, “but [they] are just as likely to be a stay-at-home mom who manages the family’s financial future,” explains Libbe. Seventeen percent admitted to keeping a secret stash of money their spouse or partner doesn’t know about.

‘Bag Lady’ syndrome remains. Nearly half of all women (49%) still fear becoming a “bag lady.” Single (56%) and divorced women (54%) fear it slightly more than do Women of Influence (46%). The thought of running out of money in retirement keeps nearly six in ten women (57%) awake at night. Lack of adequate savings was their top retirement concern.

Non-traditional families. Single mothers, women in blended families or same-sex couples, and women in households with multiple generations under one roof often feel too busy to address financial planning strategies. Ninety-two percent of single mothers and 80% of same-sex female couples say that their nontraditional family structure increases the need for financial awareness.

Underserved. Today’s women still feel underserved by the financial industry. Many believe financial information and materials are geared only toward the wealthy. About 20% say their belief that “financial planning is for people that have more money than me” is a major barrier to getting more involved. Sixty-two percent of women don’t have a financial professional. Of those that do, 69% do not view their financial professional as a go-to source of information on spending, saving or investing.

For more insights from the 2013 Allianz Life Women, Money & Power Study, download a copy of the full 10-page white paper at http://www.allianzlife.com/wmp.

© 2014 RIJ Publishing LLC. All rights reserved.

The QWeMA Group inks deal with The Principal, launches annuity benchmark

A version of the retirement product allocation tool created by The QWeMA Group—the company that Canadian finance professor Moshe Milevsky (left) sold to CANNEX Financial in 2013—has been adopted by The Principal Financial Group for use by its career advisers and its licensed phone counselors, according to a release by The Principal this week.

Principal’s service-marked version of the tool is called the Principal Income Protector. In the past, ManuLife and its subsidiary, John Hancock Financial, as well as Pacific Life have used the software, which shows the retirement income sustainability (RIS) percentage—the likelihood that income will last for life—of various allocations to mutual funds, variable annuities with income benefits, and life-contingent annuities.

The new tool was revealed to financial professionals who attended a Retirement Income Boot Camp sponsored by The Principal, the release said. Milevsky, Ed Slott of Ed Slott and Company; and Laurie Santos, director of Yale University’s Comparative Cognition Laboratory, spoke at the event.

“The tool gives people a retirement income sustainability number. In the process, it shows them that the more sustainability they want, the more they might have to give up in terms of legacies or bequests,” Milevsky told RIJ.

As the percentage of assets that are allocated to mutual funds or deferred variable annuities or income annuities gets dialed up or down, the RIS goes up or down. “Advisers seem to be using it to determine retirement readiness more than to sell certain types of products. It can serve as the back end to whatever front-end the company wants to build,” he added.

Milevsky said he presumed that the companies licensing the QWeMA algorithm had collected data on the cost-effectiveness of using it as an advice or selling tool, but he hasn’t seen any data of that sort.

CANNEX PAY Index

Separately, the CANNEX PAY Index was introduced this week. Milvesky, who retains a financial interest in QWeMA and is research director at CANNEX, said in a release that QWeMA and CANNEX had introduced an unprecedented single-premium immediate annuity payout index.

The benchmark will provide average payouts for single male, single female and joint life annuities against which advisers and investors can compare the payouts of particular products. Along with publicizing future average annuity payouts, Cannex will use some three million separate historical annuity quotes that it has warehoused over the years to show what the index would have been in years past.

In a release, Milevsky said:

“The index is calculated using an extensive dataset of annuity payouts, tracking rates for life annuities at various ages and over time,” the release said. “Note that this isn’t another index based on periodic surveys, historical Monte Carlos or hypothetical affordability numbers. It represents live prices and I am convinced it will become the Dow Jones Industrial Average (DJIA) of life annuities.

“As you can see from the attached, the CANNEX Pay Index yield for a 70 year-old male on Wednesday January 29, 2014 , is 7.73% per year. This means that the typical payout annuity from the top ten insurance companies would provide an income of $7,730 per year for life, on a premium of $100,000. For reference, compare this against the (infamous) 4% sustainable spending rule.”

The CANNEX PAY Index fluctuates (daily) based on market and demographic conditions. CANNEX will be monitor this number and report it each month. In the near future, CANNEX will also make available to all researchers the dataset of historical annuity quotes that went into the creation of the new index.

“We wanted to create a transparent index that the major newspapers could start printing along with the Dow and the S&P 500. It’s a number that will change from week to week and month to month. It’s much more than the annuity quotes that you can get online. We took a lot of care in averaging the prices of the major insurance companies. We weighted them by market penetration. We created filters and threw out outliers. We back-created the index based on past data,” Milevsky said in an interview.

The data that’s used to create the index may also have other uses. “Cannex has a treasure trove of annuity price data that nobody had been leveraging,” he added. “We can invert annuity prices and see how long the market believe that people will live. We can compare the prices to Treasury yields to see whether insurance companies are being more or less generous. It can start a conversation. If prices go up or down, people will have an opportunity to talk about why.”

© 2014 RIJ Publishing LLC. All rights reserved.

Schwab introduces all-ETF 401(k) plan

If index funds are good for 401(k) plan participants, would ETFs be even better? Charles Schwab seems to think so.

Schwab Retirement Plan Services, Inc., which serves 1.3 million 401(k) plan participants, this week announced a new full-service 401(k) program in which exchange-traded funds will serve as core investments. Participants will be able to own the ETFs in a Guided Choice or Morningstar Associates managed account, or in a self-directed brokerage account, if the plan offers one.

Fred Barstein, founder of The Retirement Advisor University (TRAU), told RIJ that Schwab’s move is “Potentially important—though the real question is whether there is a significant price difference between index funds and ETFs, and will it matter in the small and mid-size market? Will the perception that ETFs are cleaner (no trading costs) than index funds be appealing? Will the greater variety be appealing?

“For most people, ETFs are excellent building blocks to capture beta within managed investments like TDFs, custom asset allocation funds and even retirement income—which is the strategy BlackRock seems to be pursuing for the DC market,” he added.

In a release, Schwab claimed to be the first major full-service provider to offer such a plan. Steve Anderson, head of Schwab’s institutional retirement business, described it as “an additional version of Schwab Index Advantage,” a program that Schwab started in 2012 to help participants “use low-cost index mutual funds and personalized advice.”

The new version has a goal of “further driving down investment costs by using low-cost exchange-traded funds,” the release said.

Schwab estimated that a 401(k) plan using index exchange-traded funds could cost 90% less than a 401(k) plan using actively managed mutual funds and 30% less than a 401(k) plan using index mutual funds.

“Several employers have already expressed strong interest in becoming first adopters of the exchange-traded fund version of Schwab Index Advantage. Given the typical 6-12 month sales and implementation cycle in the 401(k) industry, the firm anticipates clients will be offering this new version of Schwab Index Advantage to their employees later this year,” the Schwab release said.

According to the release:

“Using a patent-pending process, Schwab Index Advantage is the first 401(k) program that fully integrates exchange-traded funds as core investments within the plan, including commission-free intraday investing along with the ability to process partial share interests,” Anderson said.

“Many solutions on the market today unitize shares, batch trades, trade only once a day at a single price, or require individuals to open a self-directed brokerage account to access exchange-traded funds. “We believe a truly effective offering requires the ability to invest in and receive allocations of both full and partial shares of exchange-traded funds when the market is open, and that’s what we’ve built. Other 401(k) offerings that we’ve seen take a less comprehensive approach to including exchange-traded funds and also tend to serve smaller plans,” he added.

Assets in exchange-traded funds have grown from $66 billion in 2000 to more than $1.6 trillion at the end of 2013 according to the Investment Company Institute. “The notion by some industry commentators that these benefits should not be available to 401(k) participants reminds me of the proponents of gas lighting who, 100 years ago, argued that electricity was dangerous and unnecessary,” Anderson said in the release. He added:

“Despite the obvious benefits of exchange-traded funds, mutual fund companies that dominate the 401(k) industry have largely ignored them – simply because these companies lack either the capabilities or the will to effectively accommodate exchange-traded funds in the retirement plans they offer. Others in the industry suggest that offering exchange-traded funds to 401(k) participants will lead to over-active trading, an argument not supported by the facts.2 We heard the same false argument 25 years ago when the industry began updating participant 401(k) balances on a daily basis, instead of quarterly,” Anderson noted.

Employers and their retirement plan consultants who use the new Schwab program will be able to build investment lineups from a list of 80 low-cost index exchange-traded funds in more than 25 asset categories. Providers include Charles Schwab Investment Management, ETF Securities, First Trust, Guggenheim Investments, Invesco PowerShares, iShares ETFs, PIMCO, State Street Global Advisors, Van Eck Global, Vanguard and United States Commodity Funds.