Building bond ladders for retirement income is an important but understudied topic. Especially as we are at a point in time when many are worried about future interest rate increases, bond mutual funds will lose value as rates rise, while a bond ladder will still provide the desired income at the bond maturity dates no matter what happens with interest rates. This potentially suggests, to the extent that one is worried about future rate increases, that today’s retirees could be better off by building a bond ladder for their desired bond allocation rather than holding bond mutual funds.

I’m now working on a column for Advisor Perspectives in which I review existing knowledge (preview: the best work I’ve seen comes from the Asset Dedication team of Stephen Huxley and J. Brent Burns) and also investigate how long one might want their bond ladder to be. For that, I will be using Treasury Strips. In that column I will not be getting too much into the details of how to actually construct a bond ladder for retirement income. The purpose of this post is to explain how to build a ladder of TIPS to provide retirement income.

The difference between bond ladders as they are usually discussed and a bond ladder for retirement income, is that with retirement income the idea is to spend the income thrown off by the ladder each year. This means that you set up the bond ladder to generate the amount of planned income you desire. With a traditional bond ladder, you wouldn’t spend the income, but reinvest it to lengthen the bond ladder. With bond ladders for retirement income, you would generally lengthen the bond ladder using other resources, such as stock investments, rather than using the income provided by the bond ladder.

For anyone actually seeking to build a bond ladder with TIPS, I highly recommend Harry Sit’s book, Explore TIPS. He provides all the details needed to actually go out and buy TIPS. My discussion here is more technical in the sense that I’m explaining what you would need to buy, but I’m not getting into the mechanics of how you would actually go about making those purchases (opening a brokerage account, etc.).

I’m getting the raw data for this explanation from the Wall Street Journal‘s Market Data Center. They provide a daily report of wholesale prices from the secondary markets for all of the outstanding TIPS issues. [Note: one of the issues that Harry’s book explores is how household investors will need to pay a mark-up above these prices, so building the bond ladder could cost a couple percentage points more than the prices I’m reporting]. This is the data available for December 18, 2013:

There are a lot of details to note from this data. First, though the Treasury is again issuing 30-year TIPS such that we can find maturities out until 2043, they had stopped that for a period, and there are no TIPS maturing in 2024, 2030-31, and 2033-2039. This actually complicates things a bit. If we try to build a 30-year bond ladder, we need to make assumptions for what to do about the missing years. The common assumption I’ve observed is that one buys more of the TIPS for the later available maturity date and assumes they can be sold off at their accrued value at the earlier date assuming that there are no changes in interest rates until that time. For example, to cover 2024, one buys more of the 2025 issue and then sells it in 2024 to get the income desired for 2024.

This does leave someone exposed to interest rate risk: if rates rise, the income they will receive from selling their TIPS early will be less than otherwise. But it’s the best we can do within the constraint that we are only using TIPS. Strips do provide a work-around for this issue, since one can get stripped coupon payments for years when no bonds mature, but they do not provide inflation protection. The general benefit of building a bond ladder for retirement income is that when you hold the bonds to their maturity dates, you know exactly how much you are going to get.

Next, we need to know what all of these columns are:

Maturity is the maturity date when principal and the final coupon payment is provided.

Coupon is the coupon rate paid by the TIPS. This is one of the most confusing aspects of bonds for people to understand. When the bond is issued, it pays a set coupon rate. For a regular Treasury bond, if the coupon rate is 2% and then face value is $1000, then the bond pays coupons of $20 per year. Usually these are paid semi-annually. Two coupon payments of $10 in this case. Note: the coupon rate NEVER changes. Interest rates can change. But that will affect the yield, not the coupon rate. If interest rates rise, then the price that the bond can be sold at will decrease, raising the underlying yield to maturity to match t he increasing interest rate. But if I buy a $1000 face value bond on the secondary market for only $700 and it has a 2% coupon, it is important to understand that my coupon income will be based on 2% of $1000, not 2% of $700. Though this may seem basic and simple as I explain it, I assure you that this can be a huge source of confusion.

Next are the bid and asked columns. Bid is the price TIPS can be sold for, and Asked is the price they can be purchased for… in the wholesale market. The difference in prices is the spread made by the party helping to conduct the exchanges between buyers and sellers. Again, household investors will experience lower bids and higher asked than reported here as they are not participating directly on the wholesale market. For these prices, they are referenced in terms of face values of $100, though bonds usually have face values of $1000.

The Chg column is just how much change there was in the asked price since the previous day.

Next, the yield is the yield to maturity based on the asked price. This is the return that the investor would get for buying the bond today and holding it to maturity. If the Asked price is 100, then the yield would be the same as the coupon. If the asked price is above 100, then the yield will be less than the coupon, and if the asked price is below 100, then the yield will be higher than the coupon.

Why? This gets back to the point I was stressing before about how the coupon never changes. The bond provides a promise for a fixed set of payments. It pays all of the fixed coupon amounts and it repays the face value at the maturity date. These payments NEVER change. But bonds can be sold and resold on secondary markets prior to the maturity date. If I pay $900 for a bond providing a fixed set of promised payments, then I’m going to get a higher return on my $900 investment than if I paid $1,100 for the same set of promised payments. So lower asking prices imply higher yields, and vice versa. Note that these yields are expressed in real terms for TIPS.

That final point brings us to the final column: Accrued Principal. This is a unique term for TIPS. The accrued principal is the inflation-adjusted principal since the TIPS was issued. The special points about TIPS are that the coupon rate is actually paid on the accrued principal, not the nominal initial $1000 principal. As well, at the maturity date, the investor receives the accrued principal back, not the nominal $1000. This is how the inflation adjustments are incorporated: a real coupon rate is paid on an inflation-adjusted amount and and inflation-adjusted amount is returned at the maturity date.

Another point about this data. If I was constructing it, I would have made one difference. The ask price is in terms of 100, but when you purchase the TIPS, you have to pay in terms of the accrued principal, not in terms of 100. The way I would have presented the asked price in that table is:

“Actual” Asked Price = [Asked] x [Accrued Principal] / 1000

And one final point about this data. Coupon payments are made every 6 months. When you buy the TIPS, you also have to pay any interest that the previous owner would have earned since the last coupon payment up until the data they sold it to you. I believe this is what really throws off the pricing for the TIPS maturing on January 15, 2014. The Yield is artificially high by quite a bit because the purchaser is going to also have to pay about 5/6 of the coupon payment to the previous owner (which, for review, would be 0.5 x 2% x $1265 = $12.65). There is just a month left until maturity.

When I construct my bond ladder below, I will ignore this “accrued interest” problem because it is a rather minor issue, but it does affect that 2014 TIPS a lot. My bond ladder will use the first available TIPS maturing in each year except for 2014. In this case, I use the TIPS maturing in July 2014. Based on what I just wrote, this is the yield curve I have available for constructing the TIPS ladder for retirement income.

Now we are ready to actually construct the bond ladder and determine its cost. To do this, we work backwards. One more simplification I am now going to make to reduce the complexity of the explanations is to assume that coupons are paid only once per year rather than twice per year. I’m also going to assume we can buy fractions of bonds, when in reality we can only get as close as possible to our income goal in increments of $1,000, since fractions of bonds cannot be bought and sold.

Let’s construct a ladder to provide $10,000 of inflation-adjusted income for 30 years between 2014 and 2043. Starting at 2043, we need to buy enough shares of TIPS to give us $10,000 of inflation-adjusted income that year. This involves buying the TIPS maturing in 2043, which has a coupon of 0.625%, an asking price of 77.14, a yield of 1.596%, and accrued principal of $1016. The accrued asking price is this $783.74 out of $1000. In real terms based on today’s accrued principal, and with my simplification that only one coupon payment is made per year instead of 2, on Feb. 15, 2043, this bond will pay 1016 x (1 + 0.00625) = 1,022.35 in interest and principal. We want an income of $10,000. So we need to buy 10000/1022.35 = 9.78 shares.

Given the wholesale accrued asking price, these shares cost us 9.78 x 783.74 = $7,664.98. Actually, these numbers have been rounded. In my computer, the precise cost without rounding is $7,666.09. In other words, paying $7,666.09 today entitles you to $10,000 of REAL income on Feb. 15, 2043. The amount you actually receive on that date in nominal terms will actually be larger to the extent that we experience inflation over the next 30 years.

Now we move to 2042. We want $10,000 of real income for that year too. The trick is that we have to account for the fact that the 2043 maturing TIPS we just purchased is going to give us coupon payments of 9.78 shares x 0.625% coupons x 1,020 accrued value = $62.11 of income in every year for years 1-29 as well. So we can subtract that from what we need to purchase. We need to buy enough 2042 bonds to provide real income of $9937.89 in 2042.

And so this process goes, working backward to 2014. Actually, for 2014, we will have $4280.32 of real income coming from all of the coupons for bonds we purchased which are maturing between 2015-2043. So we only need to purchase enough 2014-maturing bonds to get $5719.68.

That is the logic behind the following table, which shows our menus of purchases to obtain a 30-year TIPS ladder.

Now for some final comments on this table. Note that the cost of building a 30-year TIPS ladder providing $10,000 of annual real income is $247,588.14. This is scalable. If you want $50,000 of real income, the cost is 5 times greater ($1.24 million), etc. Also, this is an approximation due to some simplifying assumptions I’ve listed throughout the post. Note that this cost with regard to the $10,000 income represents a 4.04% withdrawal rate.

With the bond ladder, nothing will be left at the end of the 30th year though. Actually, interest rates have been rising in recent months, and 4.04% is currently the payout rate on an inflation-adjusted SPIA for a 65-year old couple with joint and 100% survival benefits. Also, for what it’s worth, the implied return on the $247k to get these cash payments is 1.29% in real terms. That’s the current “riskless” rate of return for 30 years of retirement income. There is still longevity risk though.

© 2013 Wade Pfau.

We concluded that the retirement income market was overlooked, and I focused on that. In 1997, we launched a syndicated research initiative on attitudes and perceptions about retirement income. We’ve also concluded a number of proprietary research and consulting engagements for clients on the retirement income opportunity. In 2003, we started the Retirement Management Executive Forum, or RMEF.

We concluded that the retirement income market was overlooked, and I focused on that. In 1997, we launched a syndicated research initiative on attitudes and perceptions about retirement income. We’ve also concluded a number of proprietary research and consulting engagements for clients on the retirement income opportunity. In 2003, we started the Retirement Management Executive Forum, or RMEF.

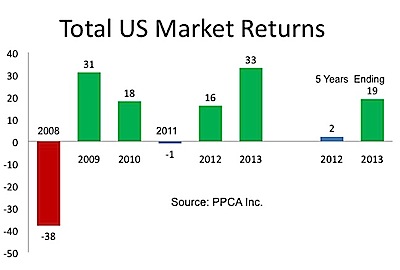

This component is primarily driven by investor behavior, and may well be the cause of future economic results rather than being a leading indicator of the economy.

This component is primarily driven by investor behavior, and may well be the cause of future economic results rather than being a leading indicator of the economy.