American Equity partners with BlackRock and Conning on its AEL 2.0 strategy

American Equity Investment Life Holding Company (NYSE: AEL) (American Equity) announced today it will partner with BlackRock and Conning, for core fixed income and syndicated private placement investments. The transitions to these two managers will be initiated in the fourth quarter of 2021.

American Equity plans to “migrate to a 30-40% allocation to private asset strategies,” said Jim Hamalainen, Chief Investment Officer (CIO) for American Equity, in a release. “In parallel to successfully migrating core fixed income investments to these firms in the coming months, we will continue to transform American Equity’s approach to investment management through nuanced expertise in asset allocation and private assets investment management.”

Last year, the company launched a new business strategy, dubbed as AEL 2.0. This week’s development is part of the continued execution of that strategy. With the eventual migration of its core fixed income management to BlackRock and Conning by early 2022, AEL’s internal investment management capabilities will focus on private assets, cash & derivative trading, unique asset allocation for insured client solutions and asset liability management with team offices located in Des Moines (IA), New York City and Charlotte (NC).

Go big (in alternative assets) or go home, KKR tells insurance CIOs

The CIO) of KKR’s Balance Sheet is urging insurance company CIOs to “dream big” and buy more alternative assets in order to cope with the stress of a low-interest rate environment that he and others predict will last up to ten more years.

“The opportunity to create scale advantages in sourcing, portfolio construction, and risk management can accrue outsized economic ‘rents’ that should offset ongoing spread and rate pressures,” said Henry McVey, the head of Global Macro and Asset Allocation (GMAA) at KKR, which owns Global Atlantic, a big issuer of indexed annuities. “We see a continued migration towards non-traditional products that can offer both enhanced returns and improved diversification.”

McVey has just issued a new white paper, called “Dream Big.” Based on a proprietary survey of 50 CIOs managing some $7 trillion in assets, the report analyzes the extent to which insurance industry CIOs “are optimizing their portfolios in today’s low-yield environment.”

“Thoughtful asset allocation, including bigger thematic investing tilts, will become key differentiators in a world of excess savings amidst lower expected returns,” a KKR release said. It predicted that the low-rate environment “will likely persist over the next five to ten years” and require greater investment in private equity.

Primary findings from the report include:

- Intensifying interest rate pressure will keep pushing average investment yields down. Survey participants saw their average investment yields fall to 3.2% in 2021 from 4.2% in 2017. The GMAA team does not see portfolio yields increasing until 2023.

- The GMAA team is lowering its 10-year interest rate forecast to 1.5% from 1.75% for 2021 and to 1.75% from 2.0% in 2022.

- CIOs have made substantial changes in their asset allocations to offset the negative impact of Quantitative Easing. Non-traditional investments account for 31.8% of survey respondents’ portfolios, up from 20.3% in 2017.

- A net 48% of respondents said they intended to increase their allocations to private equity, a net 60% planned to allocate more to infrastructure and a net 48% planned to allocate more to private credit.

- US monetary policy is the key concern for CIOs. Two-thirds of respondents cited inflation/deflation as their most worrisome macro risk factor.

“Scale players” who “embrace complexity” by capitalizing on “mega themes” like the “global energy transition and digitalization” are most likely to succeed, the release said.

Allianz Investment Management launches new six-month ‘buffered outcome’ ETF

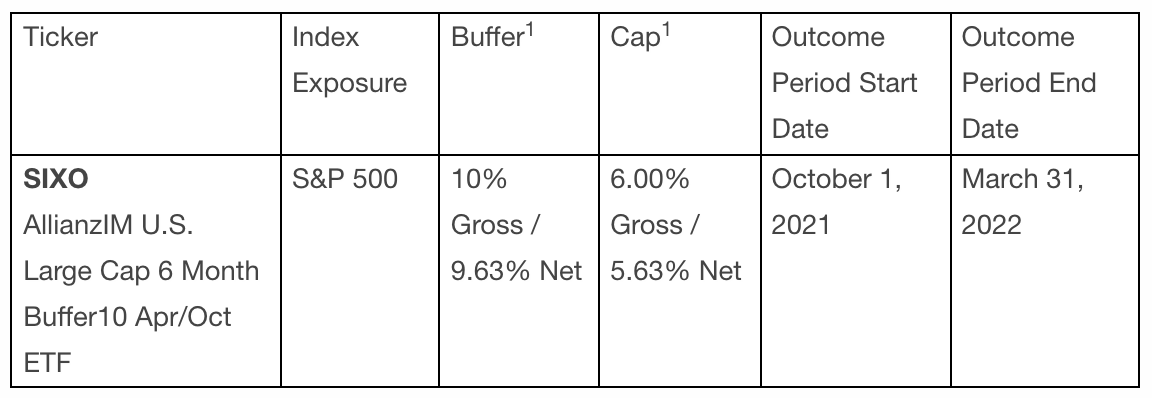

Allianz Investment Management LLC, a wholly owned subsidiary of Allianz Life, today has launched a new buffered outcome ETF with a six-month outcome period: The AllianzIM US Large Cap 6 Month Buffer10 Apr/Oct ETF (NYSE: SIXO).

AllianzIM’s new ETF seeks to match the returns of the S&P 500 Price Return Index up to a stated cap, while providing downside risk mitigation through a buffer against the first 10% of S&P 500 Price Return Index losses for SIXO over a six-month outcome period. SIXO seeks to meet its investment objective using flexible exchange (FLEX) options.

“The buffered outcome ETF market has grown dramatically, increasing from zero to almost $8 billion of assets in just three years,” said Johan Grahn, vice president and head of ETF Strategy at AllianzIM.

SIXO, which has an annual expense ratio of 0.74%, is designed to create more opportunity for investors with two outcome periods per year, as well as provide additional applications within an investment portfolio. SIXO provides the potential for greater downside mitigation with a 10% buffer over a shorter period and can serve as a potential alternative to short-term, low-yielding investment vehicles.

The six-month outcome ETF joins the existing AllianzIM Buffered Outcome ETFs, which offer a 10% and 20% buffer and a one-year outcome period. The AllianzIM U.S. Large Cap Buffer10 Oct ETF. and the AllianzIM U.S. Large Cap Buffer20 Oct ETF began a new one-year outcome period with new upside caps on October 1.

Great American annuities now on the Halo platform

Annuities issued by Great American Life Insurance Co., recently acquired by MassMutual, the giant mutual life insurer, will be carried on the Halo Investing digital annuities platform. Financial advisers will be able access, purchase, and manage Great American Life’s annuities through Halo, Great American announced this week.

“The addition of Great American Life adds to the growing number of leading carriers and annuities offerings on Halo’s platform for financial advisers. In addition to providing an expanded lineup of annuities, Halo has an outsourced insurance desk that can serve as the licensed agent of record for advisors,” a Halo release said.

Halo streamlines the execution and management across the annuity lifecycle for advisers and offers different annuity options and strategies from Great American Life, Allianz Life, AIG Life & Retirement, and others.

“Partnering with Halo demonstrates our commitment to growing within the fee-based annuity space,” said Tony Compton, Great American Life’s Divisional Vice President of Broker/Dealer and RIA Sales.

Halo Investing is a technology platform for protective investment solutions, including annuities and structured products. Headquartered in Chicago, with offices in Abu Dhabi, Zurich, Dubai, and Singapore, Halo was co-founded by Biju Kulathakal and Jason Barsema in 2015.

Through the Halo platform, financial advisers and investors can access structured notes, market-linked CDs, buffered ETFs, and annuities, as well as a suite of tools to educate, analyze, customize, execute, and manage the most suitable protective investment product for their clients’ portfolios.

Vanguard acquires ‘direct indexing’ vendor

Vanguard has completed its acquisition of Just Invest, a provider of tax-managed, tailored wealth management technology. Just Invest’s Kaleidoscope technology adds “direct indexing” or “personalized indexing” to Vanguard’s investment product and service lineup.

For an explanation of direct indexing, click here.

Founded in 2016, Just Invest saw its assets under management surpass $1 billion this year. Just Invest leverages large-scale data analysis, quantitative algorithms, and risk modeling to deliver scalable portfolio and tax management through its direct indexing platform.

Just Invest’s platform uses portfolio management tools traditionally available only to institutional or ultra-high-net-worth investors. The tools allow advisers to tailor portfolios to their values, financial objectives and tax-loss-narvesting needs.

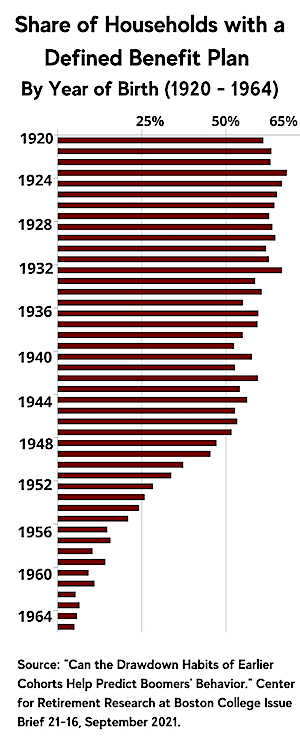

Demand for PRT will persist, MetLife poll shows

New poll results from MetLife, a leader in Pension Risk Transfer (PRT) deals, indicate that PRT activity will remain strong for the foreseeable future, despite COVID-19. The poll showed that 93% of defined pension sponsors with de-risking goals intend to eventually divest all of their company’s DB plan liabilities, up from 76% in 2019.

The MetLife poll found that among those plan sponsors who plan to fully divest their defined benefit plan liabilities at some point in the future, 32% have DB plan assets of $1 billion or more, 35% have assets in the $500-$999 million range, and 33% have assets in the $100-$499 million range.

© 2021 RIJ Publishing LLC. All rights reserved.