Fidelity Investments Life Insurance Company (FILI) and FundQuest, a provider of fee-based managed account services, have agreed that FundQuest will market the Fidelity Personal Retirement Annuity to broker-dealers and about 40 registered investment advisors.

The deal, which helps Fidelity extend its reach into the fee-based advisor and RIA channels, had been under discussion for about 18 months, according to one person familiar with the arrangement. “FILI was looking to get into the RIA and broker-dealer spaces, and this was one of the results of that push,” the source said.

Fidelity Personal Retirement Annuity (FPRA) is a bare-bones variable annuity that provides an opportunity for tax-deferred accumulation in more than 50 funds with an annual annuity charge of only 35 basis points-well below the industry average of 1.37% for nongroup open variable annuities. The contract can be annuitized but does not offer any guaranteed income riders or guaranteed minimum death benefits.

In other words, the transaction is unrelated to the turbulent world of variable annuities with lifetime income guarantees, which has gone through boom and bust in the last three years or so. Interest in products like FPRA and Jefferson National Life’s low-cost variable annuity are pure tax-deferral vehicles for fee-based advisors with clients who want to save far more on a tax-deferred basis than they could in an IRA or a 401(k) plan.

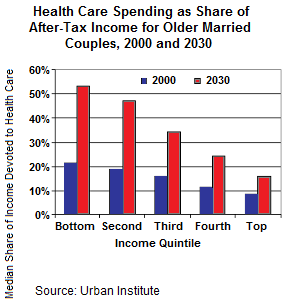

Interest in such products could rise or fall in the future, depending on the future of U.S. tax policy and whether high-income taxpayers expect to pay more or less taxes in retirement than they currently do. On the other hand, a product like FPRA has value for someone who simply wants to save on a tax-deferred basis for several decades and then convert the assets to an income annuity-the purpose for which it was originally intended.

FPRA will be featured on FundQuest’s Wealth Architect, an advisor back-office and investment management platform. Advisory firms use Wealth Architect to outsource the construction and management of fee-based mutual fund models, unified managed accounts (UMAs), income portfolios, specialized portfolios and a variety of services. FundQuest was already a client of the Fidelity Institutional Wealt h Services Group.

“This is about expanded distribution rather than product innovation,” said Joan Bloom, senior vice president in Fidelity’s individual retirement business. “Fee-based advisors are generally under-represented in the annuity space. We believe that annuities can play an important role in adding tax efficiency to a portfolio.”

Some of FundQuest’s broker-dealer clients are owned by insurance companies that in some cases offer their own competing variable annuities. “Some advisors have their own proprietary products, in which case we wouldn’t be offered. Or we might, depending on their views on open architecture,” Bloom added.

The alliance, said to have been initiated by a FundQuest client who wanted access to an additional variable annuity through the FundQuest platform, marks the first time Fidelity’s annuity and insurance business has expanded its distribution through a turnkey asset management firm like FundQuest. Since 2005, Fidelity has marketed the product direct to consumers. Both firms are based in Boston. FundQuest, which has an estimated $40 billion under management in the U.S. and Europe, is a unit of BNP Paribas.

According to a release, FundQuest has integrated FPRA into its asset allocation modeling capabilities for fee-based advisors. Fidelity will provide annuity-related sales support and access to Fidelity’s insurance-licensed sales representatives.

© 2009 RIJ Publishing. All rights reserved.

But the ad spending “doesn’t explain our momentum,” said Jac Herschler, head of marketing at Prudential Annuities. “Our success in the four channels [bank, wirehouse, independent, and captive] has been growing over time. Our differentiation in product design is a big factor. The momentum is also a reflection of producers electing our award-winning product.” The number of independent advisors selling Prudential’s variable annuity reportedly more than doubled in the quarter.

But the ad spending “doesn’t explain our momentum,” said Jac Herschler, head of marketing at Prudential Annuities. “Our success in the four channels [bank, wirehouse, independent, and captive] has been growing over time. Our differentiation in product design is a big factor. The momentum is also a reflection of producers electing our award-winning product.” The number of independent advisors selling Prudential’s variable annuity reportedly more than doubled in the quarter.

If you’ve seen Seibert lately, you may also have heard him announce that the Certified Retirement Counselor designation, which

If you’ve seen Seibert lately, you may also have heard him announce that the Certified Retirement Counselor designation, which

“In the short run, it seems fairly clear that taxes are going up,” said Russell Wild, a fee-only financial planner in Allentown, Pa. “I think the conversion is something everyone should look at. It should be particularly helpful to those already retired, who don’t currently have any money in a Roth.”

“In the short run, it seems fairly clear that taxes are going up,” said Russell Wild, a fee-only financial planner in Allentown, Pa. “I think the conversion is something everyone should look at. It should be particularly helpful to those already retired, who don’t currently have any money in a Roth.”  Unlike many advisors, he also recommends drawing down tax-deferred money before taxable money in retirement. While the money in tax-deferred accounts may be compounding, he said, “The taxes are compounding too. The concept comes from Don Blanton’s Moneytrax.”

Unlike many advisors, he also recommends drawing down tax-deferred money before taxable money in retirement. While the money in tax-deferred accounts may be compounding, he said, “The taxes are compounding too. The concept comes from Don Blanton’s Moneytrax.”