Over the last two decades, China has grown into the world’s second largest economy, generating around 20% of the world’s GDP. It is now the world’s most populous country, its leading manufacturer and purchaser of automobiles, and its largest exporter.

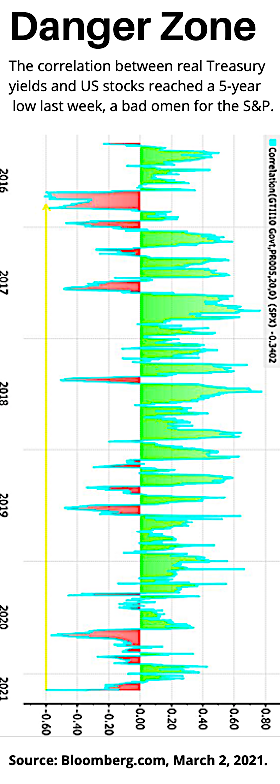

China also hosts the world’s second largest bond market. In the past, restrictions and complications have kept that market off American investors’ radar screens. But with low yields in the US, Europe, and Japan, China’s bonds—government or corporate, denominated either in dollars or yuan—warrant more attention.

Dollar-denominated bonds

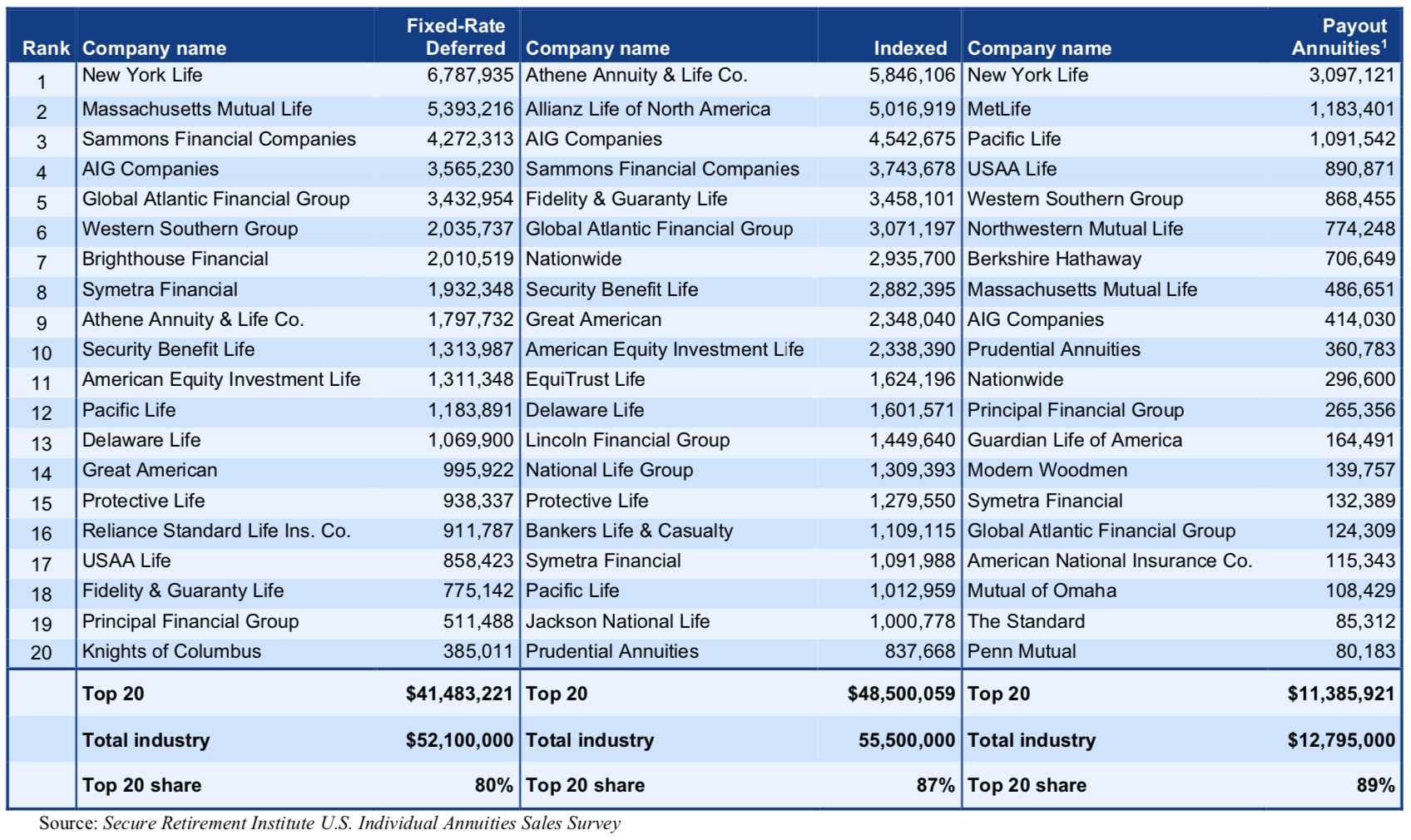

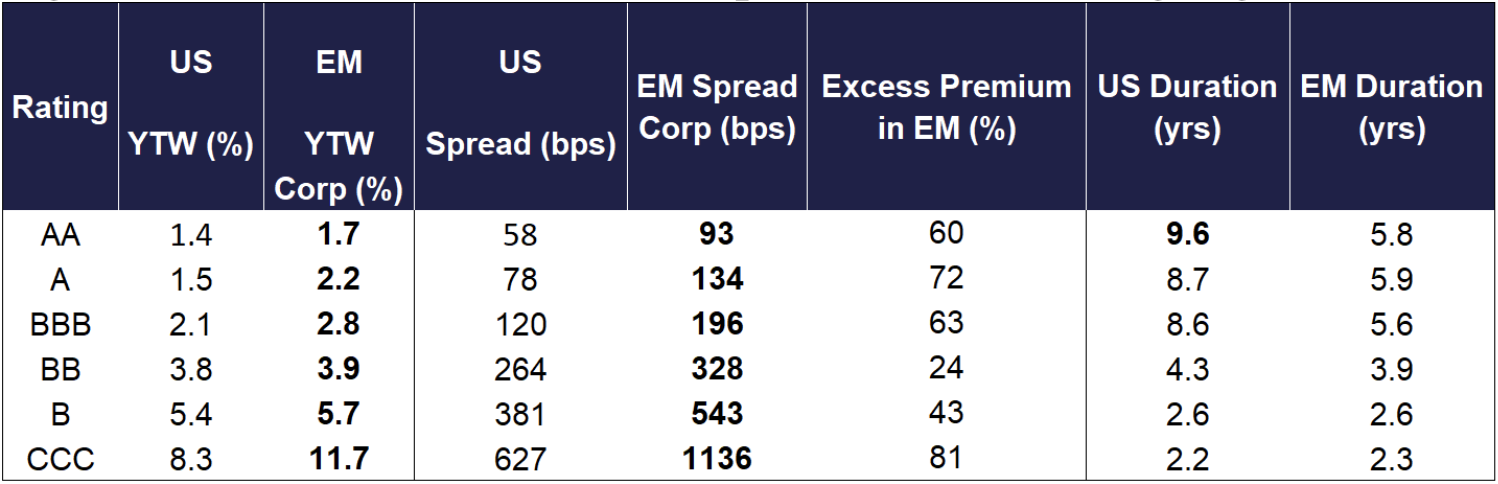

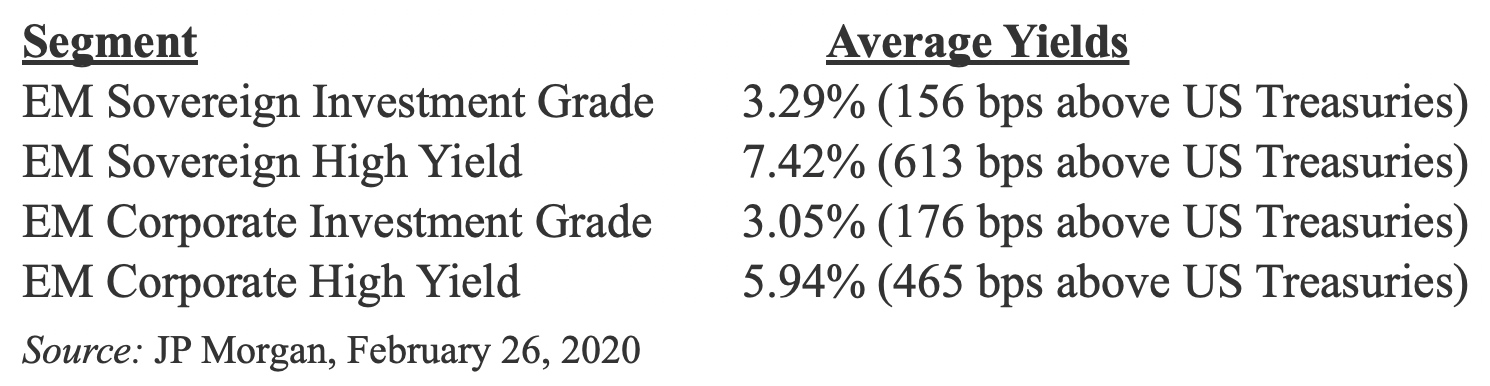

China’s US dollar bonds should be seen as credit investments, not unlike US corporate bonds. The key risk is in repayment: Will coupons and principal be paid back on time. China sovereign debt carries credit ratings of A+ from Standard & Poor’s, similar to Moody’s equivalent rating, and better than many countries in Europe. But not all issuers in China carry such a high rating. China is one of the rare emerging markets (EM) with both an active investment grade market for US bonds and a high-yield market with more than 160 hard currency issuers. Backed by an economy nearly as large as all other EM countries combined, China’s US dollar-denominated corporate issues now comprise 27% of the J.P. Morgan EM corporate debt benchmark.

Large state-linked players dominate China’s high-grade market. That includes global banks, energy companies, and tech players. The 106 Chinese investment grade issuers in the J.P. Morgan Corporate EM Broad Investment Grade Index yield 2.60%, with an average spread of 1.42% over comparable US Treasuries.

The risks of these bonds tend be similar to those of US bonds, and are largely interest rate driven. If rates go up, longer-dated bonds tend to get marked down more than shorter term bonds. Default risk in high-grade bonds is low. Bonds with deteriorating credit typically are downgraded to junk levels but rarely if ever default as an investment grade rated instrument. In the US dollar high-yield sector, China has more than 60 issuers with an average yield of 7.30%. This segment has had the highest year-to-date net issuance of any country in the EM corporate high yield index.

Yuan-denominated bonds

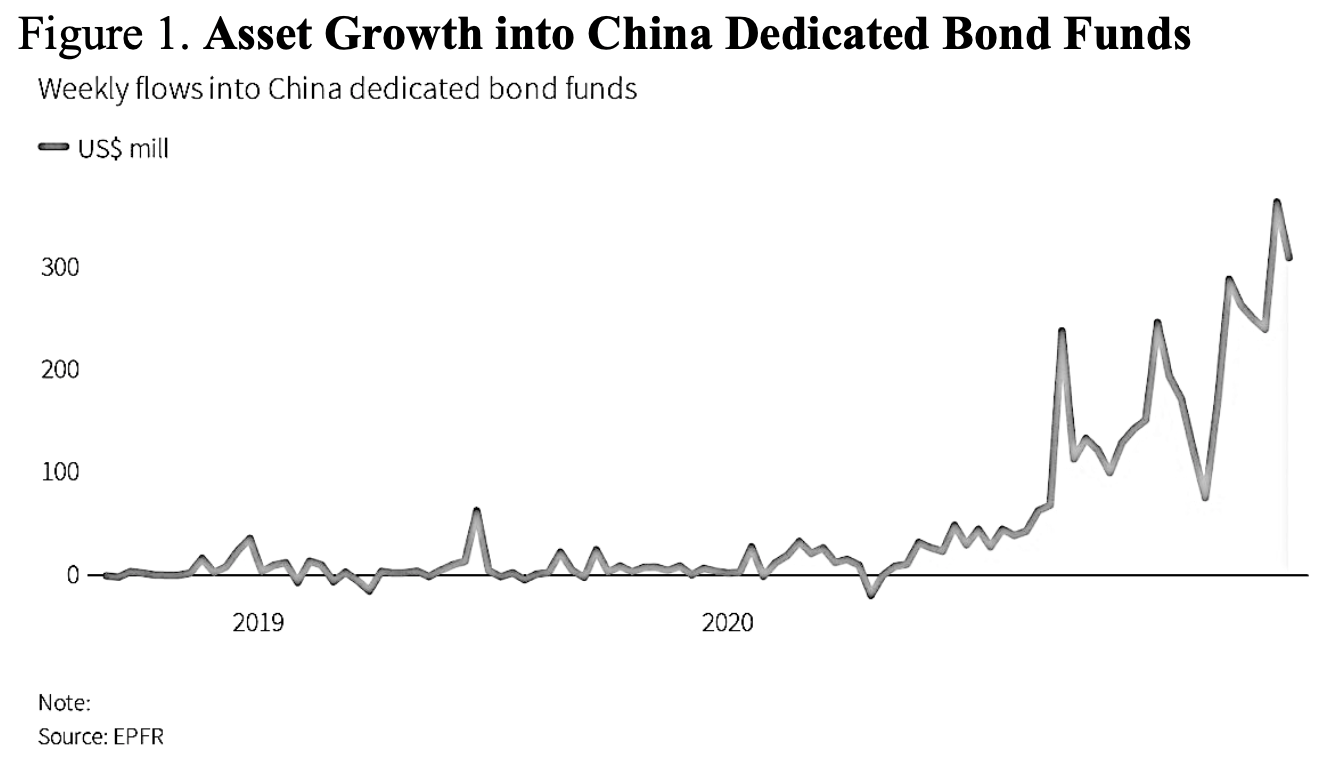

The Chinese have slowly opened their local bond markets to foreigners. Access to these bonds are still highly regulated and not 100% fully accessible, but large mutual fund and exchange traded funds (ETF) companies have been paving the way for retail and institutional investors to gain exposure in recent years. And for good reason: at approximately $16 trillion in value, the Chinese market has become too big to ignore as it grows in bond indices and offers higher yields than in the other large economies.

China’s yuan has slowly grown into a reserve currency, as the country has become the world’s largest trading partner. Local bond investments prices are affected by local interest rate and foreign exchange rates. The Chinese currency has ranged between 6.27 and 7.18 against the U.S. dollar for the last five years according to Bloomberg, and now hovers around 6.50.

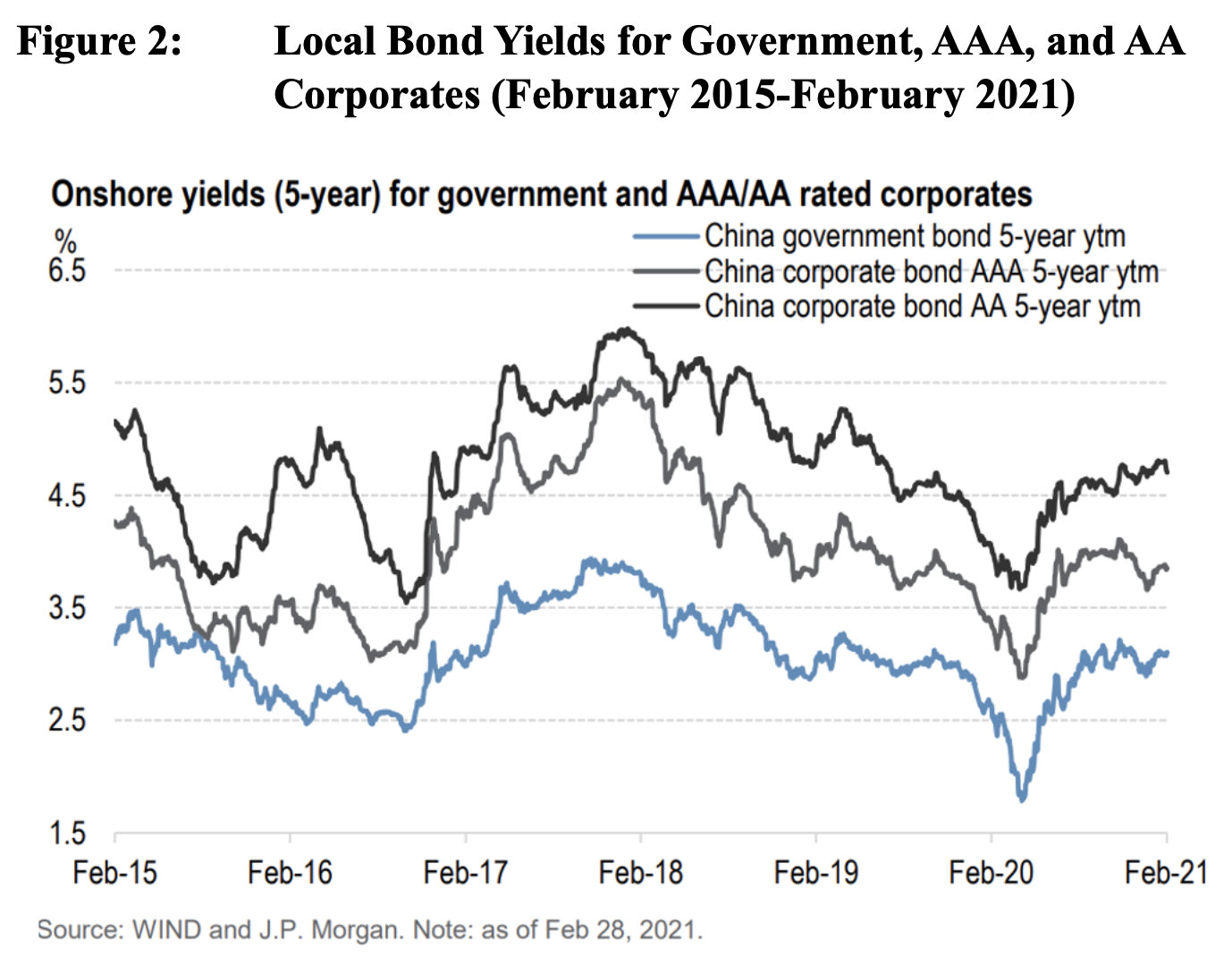

Almost 200 foreign funds held Chinese bonds in late 2020 via the expanding China Interbank Bond Market (CIBM). That was 42% above year-ago levels, according to Reuters. As of mid-March 2021, two-year local government bonds yielded 2.83% vs. only 15 bps in US Treasuries, and comparable 10-year debt paid 3.26% vs. 1.62%. By comparison, Japanese and Germany 10-year yields were at .10bps and -33bps, respectively, as of the same date. Two-year yields both were negative yielding: -14bps. and -68 bps, respectively. Credit issued by Chinese government entities, banks, and corporations pay additional credit spreads above these yields.

The chart below shows how five-year local rates have fluctuated since February 2015.

China is also one of the world’s largest issuers of “green bonds,” floating $37.6 billion worth in 2020, according to S&P. That’s considerably less than the record $55.58 billion in 2019 but still significant given the global pandemic slowdown. President Xi Jinping’s announced in September that China plans to reduce greenhouse gas emissions and become carbon neutral by 2060; that may drive more issuance of green bonds.

Caveat emptor

Investors should exercise more-than-usual care when venturing into Chinese bonds. Local defaults have risen, especially since 2018, according to J.P. Morgan. That said, the default rate was only about 1.10% overall in 2020, but investors need to pay close attention to specific segments. During the 2020 pandemic, the consumer-sector default rate jumped to 4.8%.

China’s disclosure rules differ from those in the US. Some information is lacking by American standards. US sanctions against several Chinese companies in recent years add an element of political risk that American investors seldom encounter. Individual – and even institutional – investors might prefer an exchange traded fund (ETF) or mutual fund, with professionals managing the credit and political risks. Funds also help diversify and minimize issuer-concentration risk.

US investors took decades to globalize their equity portfolios, and they’ve taken even longer with bonds. It’s time to look at China. The country contained COVID-19 quickly, and its economy actually expanded by 2% in 2020. The growth rate may top 6% in 2021, and the economy is on track to surpass America’s in a decade or two. Once small and protected, the country’s local bonds markets—like its stock market and overall economy—can’t be ignored.

Peter Marber, PhD, is a 30-year Wall Street veteran, heads emerging markets at Aperture Investors, LLC and lectures at Harvard and Johns Hopkins. He would like to thank Yardley Peresman of Aperture Investors, LLC for her contributions to the article.

The views expressed are those of Peter Marber but may not be the views of Aperture Investors, LLC.

DISCLOSURES

This whitepaper was prepared by Peter Marber. The examples cited herein are based on public information and we make no representations regarding their accuracy or usefulness as precedent. The author’s views are subject to change at any time based on market and other conditions. The information in this report represents the opinions of the author as of the date hereof and is not intended to be a forecast of future events, a guarantee of future results, or investments advice. The views expressed may differ from other investment professionals or from the firm as a whole.

This whitepaper is not an offer to sell any security nor is it a solicitation of an offer to buy any security. For more information, visit our website: www.apertureinvestors.com