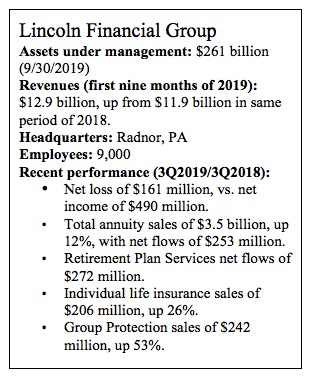

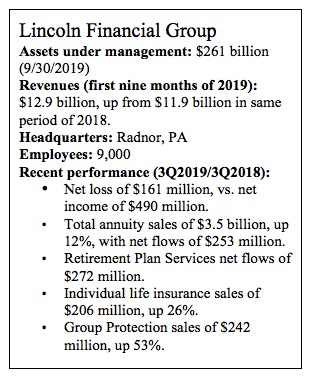

In the slugfest known as the annuity market, Lincoln Financial Group punches above its weight-class. While Lincoln was the third biggest seller of retail annuities in the U.S. in the first nine months of 2019, according to LIMRA Secure Retirement Institute, it is smaller than its rivals.

Lincoln ranks only 187th in the Fortune 500, with $16.4 billion in revenues. Its close competitors—Prudential, AIG, New York Life, TIAA—either rank much higher or have big overseas parents (Jackson National, Allianz Life of North America and, until recently, AXA).

Executive vice president Wilford H. “Will” Fuller has figured prominently in Lincoln’s success. Arriving from Merrill Lynch in 2009, he now runs Lincoln’s wholesale operations, its broker-dealer and its annuity business. At 48, he’s the youngest and third-highest paid executive at Lincoln, according to wallmine.com, with responsibility for units that produce a majority of Lincoln’s revenues.

Fuller talked with RIJ late last fall at Lincoln’s Radnor, PA, headquarters. The past year has been busy: Lincoln added indexed variable annuities (IVAs) to offset softening sales of traditional variable annuities and built new bridges to registered investment advisers. Last September, the Insured Retirement Institute named Fuller its 2019 Industry Champion of Retirement Security.

Just this week, Lincoln announced its latest partnership with Capital Group, which manages American Funds, to issue a new variable annuity with Lincoln’s lifetime income rider attached to a target date fund series created by Capital Group.

RIJ: You joined Lincoln just as the financial crisis bottomed out, in early 2009. The company had recently bought Jefferson Pilot and established its headquarters in the Philadelphia suburbs. How has Lincoln’s product mix evolved over the years?

Fuller: Jefferson Pilot and Lincoln merged 13 years ago. I joined Lincoln Financial 10 years ago. When I joined we had two core product lines. Nearly 80% of our life insurance business consisted of sales of universal life. Ninety percent of our variable annuity sales were VAs with guaranteed living benefits.

After the financial crisis, we decided to become more diversified. So now you see that, within our life insurance business, we have variable, indexed, term and hybrid life, and long-term care solutions. And we sell lots of kinds of annuities. We have a fundamentally different company today. We’ve built out a more resilient and diversified franchise that relies on an all-weather product portfolio. Lincoln Financial is a far more flexible company because of that decision. It’s better than being married to one product design.

RIJ: Diversification is the first rule of risk mitigation, I imagine. For companies and individuals.

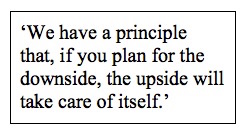

Fuller: We have a principle that, if you plan for the downside, the upside will take care of itself. We plan for down environments, as do our customers. Preferences and markets can change. So we expanded our product offerings. We went for an all-weather product portfolio.”

RIJ: When did you decide to diversify out of variable annuities?

Fuller: In 2016, we decided to participate in more segments of the annuity market. Before then, as I mentioned, we were focused on the variable annuity with guaranteed living benefits. As rates began to recover after the 2016 election, we responded with the same strategies we’d used before: We strengthened the VA benefits, and we benefited from rising sales.

Since then, we’ve brought out indexed annuities and increased our focus on traditional fixed annuities. Those products led to the expansion of shelf space with bank partners. It also led to our January 2019 partnership with Allstate, which is the first property and casualty insurer to distribute our annuities. We have also started building out customized products for new distributors. For instance, we began partnering with Market Synergy Group and Impact Partnership to distribute custom fixed index annuities.

RIJ: How’s that working out?

Fuller: Because of these new products and new channels, we’ll see more overall sales of annuities in 2019 than we did in 2016—even though we expect to sell only about as much of the traditional VA as we did then. Sales of the traditional VA have in fact been off by over $1 billion, but we more than made it up with IVA (indexed variable annuity) sales.

RIJ: The IVA, which is also called the registered indexed linked annuity (RILA) or the structured variable annuity, has been a game-changer for the annuity industry since AXA introduced the first one in 2011. [Like a fixed indexed annuity, or FIA, the IVA uses options to deliver gains or losses within a spread on the performance of a market index or a combination of market indices. An IVA typically offers more upside potential than an FIA because it doesn’t offer absolute prevention from loss.]

Fuller: Our overall variable sales got back into positive territory because of the success of the IVA. We made a commitment to return to net positive flows of variable annuities in 2018, and we achieved that goal a quarter early. But it took some time to be positive in both fixed and variable annuities. We’re positive for the VA market because we’re positive for indexed variable annuities.

RIJ: There’s a relatively new structured products sales platform called SIMON Markets. It offers a tool that helps advisers select the combination of indices in an IVA product that is most likely to maximize the product’s performance. Does Lincoln have anything like that on its IVA platform?

Fuller: With the IVA, we saw the importance of a tool that optimizes the indices. But we decided to focus our marketing on the longer-term indexed variable annuity (IVA) contracts instead. Roughly three-quarters of our IVA sales are in the six-year duration term, [where the initial cap on credited interest is valid for the entire duration of the contract, rather than subject to change every year or every three years]. We also built a calculator that allows advisers to run different scenarios comparing a portfolio with or without an IVA.

RIJ: That product seems to be built mainly for risk-reduced accumulation, not for retirement income generation. But it does seem to be resonating with a lot of people. It’s the annuity world’s version of a structured note.

Fuller: It’s extraordinary how the market for IVAs has grown. At Lincoln, nearly two-thirds of the advisers who sell our indexed variable annuity have sold more than one. We can leverage our broad access to over 90,000 advisers through Lincoln Financial Distributors. On average, they sell about twice as many indexed variable annuities as they do any other annuity category. That product is still in its early days. We launched our IVA, Lincoln Level Advantage, in May 2018 and we have a 15% market share. We launched a commission-based and a fee-based version of that product, but our distribution partners are selling mostly the commission-based product.

RIJ: Does Lincoln offer a buffer version or a floor version of the IVA? [A “floor” means the client can’t lose more than, say, 5%, 10% or 15% in a year. A “buffer” means the client is protected from the first 5%, 10% or 15% loss in a year.]

Fuller: We sell only a buffer design on the IVA. We are researching a floor design as well as additional crediting strategies. We currently sell only a one-year and a six-year term product, but we plan to offer a three-year term product in 2020.

RIJ: That product should be even more attractive with interest rates moving back down.

Fuller: The IVA holds up pretty well in a low volatility, low-interest-rate environment. It was created to withstand the pressures of low interest rates. It’s more capital-efficient and less affected by rates than the VA with a living benefit. At the same time, the IVA takes a lot of work. You must register it with the Securities and Exchange Commission. You must register the insurance subsidiary as an SEC entity. You need an augmented hedging program. And you need shelf space.

RIJ: Comparing the IVA with the fixed indexed annuity, a person might wonder why the FIA focused on zero-losses… as if it were fatal to cross into negative territory in a calendar year. I suppose the no-loss guarantee made a strong marketing story.

Fuller: The no-loss guarantee in FIAs came about because, by definition, a general account product is a principal-protected product. A separate account product can “break a buck,” but a general account product can’t. The original target market for the FIA, if you remember, was the CD [certificate of deposit] buyer. We’ve been in a declining rate environment for almost 40 years. The FIA was born in an era when CD rates were coming down. People wanted safety but they also wanted a rate greater than they could get from a CD.

RIJ: Let’s pivot to the distribution side of the annuity business, if we can. How does Lincoln approach the Registered Investment Advisor (RIA) market, which may or may not represent a growth opportunity for annuity sales?

Fuller: We divide the RIA market between pure Investment Advisor Representatives (IARs), who are associated only with an RIA, and the dually registered or hybrid RIAs, who are also registered with a broker-dealer. These hybrid advisers have their RIA business and their broker-dealer business; they can use either side. They’re a much bigger opportunity than the pure RIA market.

RIJ: What are some of the nuances of marketing to this split group?

Fuller: We approach the two markets in different ways. We can reach the hybrid advisers through their broker-dealer platforms. We call on that market through our broker-dealer wholesalers. But, since the fee-only RIAs are not registered with broker-dealers, we have a dedicated team of wholesalers and relationship managers that works directly with those advisers. We’ve also made technology integrations with Orion, eMoney, Envestnet/Tamarac and Redtail to better support the needs of RIAs. We’re making it easier for them to incorporate annuities into their clients’ planning strategies.

RIJ: Where do you see the most sales potential?

Fuller: I see our products being sold in both places—the broker-dealer and the fee-only RIA platform. The hybrid RIAs have a history of greater appreciation for and use of insurance products. The fee-only RIA platform, on the other hand, is a true frontier for new annuity and life insurance sales. Those advisers haven’t traditionally used insurance products. In fact, fee-only RIAs are skeptical of insurance products. It will require education, new product development and new technology to develop that channel. The RIA market is still small. But it’s the fastest growing adviser market, and it serves people who need annuities. The question is, can we bring those concepts together?

RIJ: Nothing stands still for very long. The brokerage side is changing too, isn’t it?

Fuller: Trying to get shelf space in an era where broker-dealers have curated their product shelf isn’t easy. It’s not like it was before the 2016 Department of Labor’s fiduciary rule, when broker-dealers felt that it was more compliant to have open-architecture for products. Now a curated shelf is considered more compliant.

RIJ: Shifting to the “macro” view, we’re all still feeling whiplash from the Fed’s recent rate reductions.

Fuller: There’s no industry more impacted by low interest rates than the insurance industry. The rates determine the expense of providing the guarantees. Our sales pulled back after the financial crisis because of the impact of rates.

RIJ: Do falling rates affect both the in-force business and new business?

Fuller: Low rates don’t necessarily affect the in-force business. They affect the business going onto the books today. The annuity business we’re selling today is under pricing pressure. In the VA with guaranteed living benefits, low rates increase the cost of the hedging strategy. You can respond to that either by pulling back on benefits or pushing up on cost. Our competitors appear to be pulling back on benefits.

RIJ: Back on July 31, what was your personal reaction the first of the three rate cuts?

Fuller: What was my personal reaction? It was, “Damn it!” We were disappointed at how swiftly the Fed pulled back. It’s hard to see how the monetary policies of the last ten years—of quantitative easing and fiscal stimulus—haven’t resulted in more inflationary pressure. That’s what should have happened, according to current economic theory. I’m disappointed. Obviously, our value proposition is higher, and demand for our products is higher, when interest rates are higher.

RIJ: What can we expect to see from Lincoln in the coming year?

Fuller: We’re moving into 2020 with a game plan on how to manage the low rate environment for a longer period, and we’re implementing that plan.

RIJ: What will that entail?

Fuller: We’ll provide choice. Commission-based products will always be a presence in the annuity marketplace. [Regarding the cost of a one-time annuity sales commission of 3% to 7% relative to an annual asset-based fee of 1%], I’ve always said, ‘Why is this not an easy math concept?’ People need to consider the length of the holding period when they compare the cost of the commission to the cost of the fees [which may be higher in the long-run].

RIJ: And on the product front?

Fuller: Our priority for 2020 is to put product development effort into Lincoln Level Advantage. We’re looking at the duration of the product and at the participation rates. We’re also focused on building out more shelf space for it. Beyond that, our next focus will be to develop guaranteed living benefits that are less sensitive to interest rate fluctuations.

RIJ: With the passage of the SECURE Act in December, will Lincoln try to take advantage of the safe harbor for plan sponsors choosing in-plan annuities?

Fuller: We’ve had a product available: Secured Retirement Income, which is available as either as a standalone investment, or included in the glide path of custom target-date portfolios. We’ve given it a compelling guarantee. We made sure that it’s portable. The take-up rate today is minuscule, but the SECURE Act would mean a completely new frontier for the annuity industry.

RIJ: Thank you, Will. We appreciate this opportunity.

© 2020 RIJ Publishing LLC. All rights reserved.