Sullivan to succeed Pelletier at Prudential

Prudential Financial announced this week that Andrew Sullivan will succeed Stephen Pelletier as executive vice president and head of U.S. Businesses, reporting to chairman and CEO Charles Lowrey, effective December 1.

Pelletier, 66, will retire after a 27-year career with the company, in which he led Group Insurance and Prudential Annuities, and founded Prudential’s international asset management businesses, now PGIM Global Partners. He will remain in an advisory role until April 1, 2020.

Kent Sluyter, current president of Prudential Annuities, will retire, following a 38-year career at Prudential, during which he has held various leadership positions, including president and CEO of Individual Life Insurance and Prudential Advisors.

The company also announced today three new appointments, effective December 1, to its U.S. Businesses executive team:

- Phil Waldeck, current president of Prudential Retirement and pioneer of Prudential’s Pension Risk Transfer business, will succeed Andy Sullivan as head of the Workplace Solutions Group.

- Yanela Frias, current head of Investment and Pension Solutions within the Retirement business, which surpassed $100 billion in pension and longevity risk transfer sales under her leadership, will be elevated to president of Prudential Retirement.

- Scott Gaul, current senior vice president, Sales and Strategic Relationships, Prudential Retirement, will succeed Frias as head of Investment and Pension Solutions.

- Dylan Tyson, current CEO of Prudential of Taiwan who, in a prior role, led the General Motors pension risk buyout transaction for Prudential, will become president of Prudential Annuities. His successor will be named upon receiving regulatory approval.

Continuing in their current roles will be:

- David Hunt, president and CEO of PGIM

- Caroline Feeney, CEO of Individual Solutions Group

- Jamie Kalamarides, president, Prudential Group Insurance

- Salene Hitchcock-Gear, president, Individual Life Insurance and Prudential Advisors

- Naveen Agarwal, senior vice president and chief marketing officer

- Caroline Faulkner, senior vice president, Enabling Solutions

Three Jackson fee-based annuities join RetireOne platform

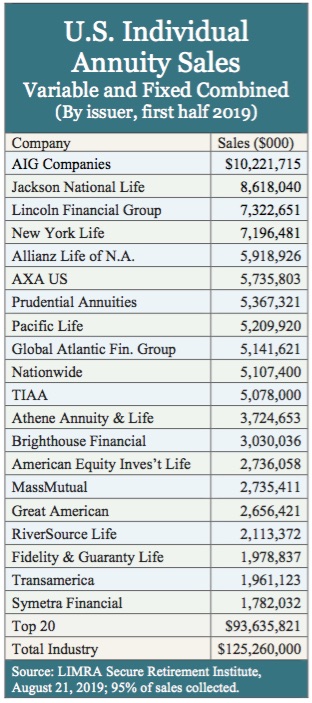

RetireOne, the web platform where Registered Investment Advisors (RIAs) who don’t take commissions or have insurance licenses can purchase annuities and life insurance, said this week that three of Jackson National Life’s fee-based annuities are now available on the platform.

The Jackson products are the Perspective Advisory II and Elite Access Advisory II variable annuities (VA) and the MarketProtector Advisory fixed index annuity (FIA). Elite Access Advisor is a flat-fee investment-only variable annuity and MarketProtector Advisory has no surrender penalties.

Perspective Advisory II, a no-commission version of the top-selling variable annuity contract in the US, offers a popular selection of lifetime income riders that have few restrictions on the advisor’s investment options, relative to other variable annuities with guaranteed lifetime withdrawal benefits.

Jackson’s operations team will support RetireOne’s advisors and their clients, complementing RetireOne’s Advisor Solutions Team.

Ascensus publishes ‘Inside America’s Savings Plans’

Ascensus, the large independent recordkeeper that partners with Vanguard to manage thousands of small and medium-sized 401(k) plans, health savings plans and college savings plans, has released a new report on how Americans are saving.

The report is available at the Inside America’s Savings Plans microsite.

Ascensus analyzed data from over 88,000 retirement plans, 4.6 million 529 college savings accounts, more than 280,000 consumer-directed healthcare accounts, and 20 ABLE (Achieving a Better Life Experience) plans for which it provided recordkeeping and administrative services as of 2018 year-end.

The firm also highlighted health savings account (HSA) industry data from Devenir, a provider of customized investment solutions for HSAs and the consumer-directed healthcare market. The report identifies the following patterns in tax-advantaged saving behavior:

Plan sponsors and savers see the value in automatic savings models:

401(k) plans with automatic enrollment and automatic escalation features saw an average plan-weighted participation rate of 81%, which was 10 percentage points higher than that in plans without automatic enrollment.

In 2018, 35% of 529 account owners had scheduled recurring bank contributions and 20% of ABLE accounts leveraged automatic savings methods. Approximately 6% of 529 account owners use payroll direct deposit.

According to Devenir, 26% of all HSA contributions came directly from an employer and 56% came from an employee through their workplace in 2018.

Digital tools have a positive influence:

Ascensus’ Retirement Outlook Tool allows savers to refine retirement savings goals. In 2018, 26% of first-time tool users were saving at an average rate of 8% within a few weeks of engaging with it. According to Ascensus’ partner Financial Finesse, people must save at the rate of 9% or more to be financial prepared for retirement.

The firm’s Ugift platform allows secure gifting to beneficiaries’ 529 accounts. The Ugift website allows users to establish gift-giver profiles and schedule recurring gifts to streamline the process. As of 2018 year-end, gift givers had established 26,284 online profiles and 10,438 recurring gifts. Overall, the Ugift program saw a 345% year-over-year increase in dollars gifted to 529 accounts.

Changing financial and market landscapes are influencing individuals’ savings strategies:

Ascensus’ 401(k) platform data highlights that individuals under 25 years old are saving at lower savings rates than those in older age groups. Of all retirement savers on our platform who are “on track” to meet their goals, 20% of them are between 25 and 34 (versus 3% for the under-25 age group).

The market downturn in 2018 had a minor impact on overall 529 account balances across all demographics, but this average balance still reached nearly $23,000 as of 2018 year-end. Account owners ages 55 to 64 and over 65, with average beneficiary ages of 17 and 13 respectively, had the second- and third-largest average balances of all age groups, both exceeding $22,000.

Healthcare expenses continue to increase exponentially, with the Employee Benefit Research Institute (EBRI) reporting that the average couple will now cumulatively need $399,000 for a 90% chance to cover their healthcare expenses in retirement. There are currently over 25 million HSAs held by savers across the U.S. with a combined $53 billion in assets.

Fidelity publishes 10th annual plan sponsor survey

Many plan sponsors believe their employees are falling short in their retirement savings, according to the 10th edition of Fidelity Investments’ Plan Sponsor Attitudes Study, whose results were announced this week.

While 62% of sponsors said their employees expect the plan to meet all of their funding needs in retirement, only 55% said they believe their plan participants are actually saving enough in the plan to retire. The study, which began in 2008, surveyed employers who offer retirement plans that use a wide variety of recordkeepers.

Nine in 10 plan sponsors reported that they have had employees work past their desired retirement date, according to the study, and 73% of sponsors acknowledged costs associated with those delays, including increased benefit costs (37%), reduced mobility for younger employees (33%), obstacles to strategic workforce planning (31%), and lower productivity (27%).

The top two reasons plan sponsors gave for hiring plan advisors were (1) to understand how well the plan is working for employees and how to improve it (27%), and (2) for help with the increasingly complicated process of managing a retirement plan (26%).

This year, the report said, three-fourths of sponsors reported making a change to their plan design or investment menu in the past two years. The top plan design changes were to increase the match (26%) or add a match (24%). The top menu change was to increase the number of investment options, consistent with last year’s study.

Sponsors appear to be reviewing plan performance more often, with a shift away from annual reviews (14% in 2019 versus 27% in 2018) to quarterly reviews (45% in 2019 versus 38% in 2018).

Fidelity research found that 36% of employees have less than three months of income saved in case of emergency and that absenteeism is 29% higher among employees who do not have enough emergency savings.

This year’s Plan Sponsor Attitudes Study found that more than half (56%) of sponsors said they offer financial wellness programs, and 59% saw them as very impactful for employees. Two-thirds of sponsors said that advisors discussed financial wellness programs with them, and plans with advisors were more likely to have them in place than those without advisors (57% versus 43% respectively).

Vanguard releases fund voting records

Vanguard has released its global 2019 Investment Stewardship Annual Report, which details company engagements and voting records of its mutual funds for the 12 months ended June 30, 2019.

In the report, Vanguard calls for greater diversity among boards of directors at public companies. Vanguard believes that diverse boards make better decisions, which can lead to better results over the long term.

Vanguard is asking boards of directors to publish their views on board diversity, disclose their board diversity measures, broaden their search for director candidates, and report progress against those outcomes. The report also addresses sustainability’s role in long-term investing and the importance of standardized risk disclosure frameworks.

Over the last year, Vanguard’s investment stewardship team voted on nearly 170,000 matters at 13,225 companies. The team also held discussions, known as engagements, with the boards and management teams of almost 900 companies representing 59% of Vanguard funds’ equity assets under management.

While all portfolio companies have the opportunity to engage with Vanguard, similar to previous years, the team primarily held engagements with companies that represent Vanguard funds’ largest holdings, as well as corporations facing governance issues. A full list of all of the companies Vanguard engaged with during the 2018-2019 proxy year is available on page 36 of the report.

Fleming moves to Lincoln Financial

Christopher Fleming has joined Lincoln Financial Group as senior vice president and head of Life & Annuity Operations, with a focus on enhancing the customer experience and improving internal operating efficiency. He will report to Jamie Ohl, executive vice president, president Retirement Plan Services, head of Life & Annuity Operations.

Fleming has more than 25 years’ industry experience. He joins Lincoln Financial from Fidelity & Guaranty Life, where he served as senior vice president, Operations and IT since 2011. Prior to that role, he was with ING for seven years, at AIG and at GE. Fleming earned a Bachelor of Science in Business Administration from the Ohio State University and is based in Greensboro, NC.

© 2019 RIJ Publishing LLC. All rights reserved.