Indexed annuities used to be a joke in the loftier precincts of the life insurance industry, but not any more. Once scorned by big insurers in favor of variable annuities (VAs) ignored by academics in favor of income annuities, and assaulted by state and federal regulators, they’ve emerged from a turbulent decade with the last laugh.

“I am not surprised to see yet another record-setting quarter for indexed annuities,” said a press release from Sheryl J. Moore, president and CEO two annuity data tracking firms and a tireless advocate for fixed indexed annuities (FIAs). “I want to prepare everyone, and just say that you can count on another go-round for fourth quarter, 2018; we are going to make it a three-peat!”

The Trump victory in 2016 helped. No longer in danger of violating the Obama administration’s tough fiduciary standard of conduct, advisors, reps and agents can safely go back to selling them on a buyer-beware basis. The sales figures reflect a return to the old regulatory normal.

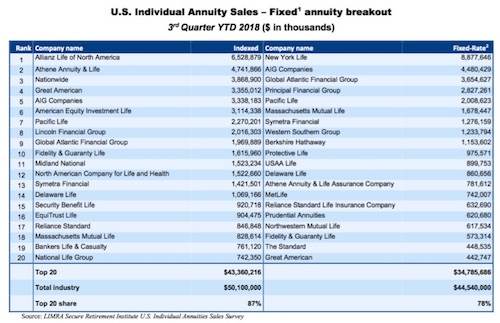

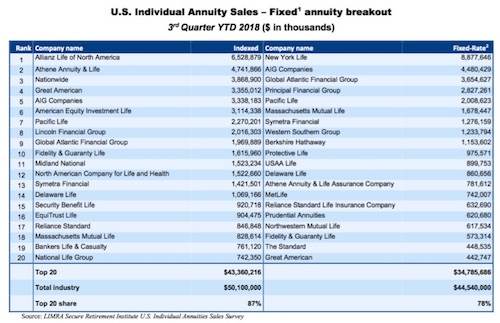

In the third quarter of 2018, FIA sales were $18.0 billion, up 38% from third quarter 2017, according to the LIMRA Secure Retirement Institute (LIMRA SRI) Third Quarter 2018 Sales Survey (representing 95% of the market). Year-to-date, FIA sales were $50.1 billion, 22% higher than the first three quarters of 2017.

Rising interest rates have not hurt. “Over the past year, the 10-year Treasury rate has increased nearly 60 basis points and ended the third quarter above the 3% mark,” said Todd Giesing, annuity research director, LIMRA SRI.

Manufacturers and distributors can both find something to like about FIAs. These bond-based products offer a more stable chassis (relative to variable annuities) on which life insurers can build the living benefit riders that offer Boomers a flexible source of guaranteed income.

“FIA products with guaranteed lifetime benefit riders showed the most growth [among annuities] in the third quarter,” said Giesing. “In a higher-interest rate environment, companies are able to increase their guaranteed lifetime withdrawal rates.” VAs are also more capital intensive than FIAs, and bull markets can hurt as well as help them. Ohio National’s recent decision to leave the annuity business after selling too much of a rich VA product is a recent example of that.

Insurance agents once sold virtually all FIAs; now fee-based advisors and even registered investment advisors (RIAs) can sell them. FIAs’ combination of attributes—a guarantee against downside loss, high commissions for agents and brokers, better lifetime income than deferred income annuities, and a bit of exposure to the equity markets—add up to a viable sales proposition. Unlike VAs, a securities license isn’t required to sell them.

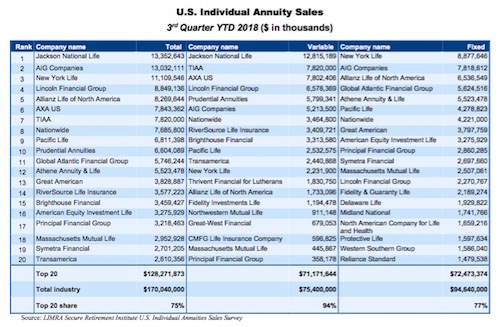

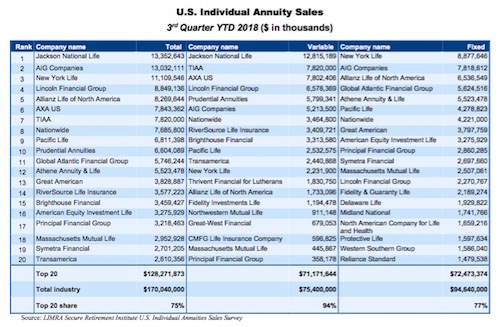

VAs still outsold FIAs through the third quarter of 2018, by $75.4 billion to $50.1 billion. VAs will likely continue to benefit from their status as the best way for high net worth investors to accumulate and trade equities on a tax-deferred basis. If you combine FIAs with other fixed deferred annuities, fixed annuities outsold VAs in the first nine months of this year by $94.6 billion to $75.4 billion.

LIMRA SRI expects total fixed annuity sales to hit record levels in 2018, with fixed annuities expected to end this year at around $130 billion, the fourth consecutive year exceeding $100 billion. This has never occurred in the more than 40 years LIMRA SRI has tracked annuity sales, LIMRA said. LIMRA SRI forecasts total 2018 FIA sales to reach about $70 billion. Slower growth is expected in 2019 and 2020.

The manufacturers

With their growing respectability—although some broker-dealers still haven’t embraced them—FIAs have found more life insurers wanting to offer them. Allianz Life of North America still rules the FIA world (as it has since buying Bob MacDonald’s Life USA in 1999 for $540 million) with a 13% market share (15.4%, according to Moore’s LooktoWink.com, which uses a slightly different survey base). Allianz Life’s Allianz 222 Annuity was the top-selling indexed annuity, for all channels combined, for the seventeenth consecutive quarter, according to LooktoWink.com.

But many new players have piled in, shuffling the sales leaderboard. The top 10 sellers of FIAs now include three FIA veterans (Allianz Life, Great American, and American Equity Investment Life), three offsprings of equity-backed firms (Athene, Global Atlantic and Fidelity Guaranty & Life) and four big insurers that have embraced FIAs in recent years (AIG, Nationwide, Pacific Life, and Lincoln Financial).

Rising competition from new entrants has been tough on American Equity Investment Life. Over the past three years, its third-quarter year-to-date sales have dropped from $4.75 billion in 2015 to $3.11 billion in 2018.

“There has not been any change in our ratings or reorganization since that time but the competitive environment has changed quite a bit over the last three years. The LIMRA reports for the 2015–2018 periods should show substantial increases in fixed index annuity sales for Athene, Nationwide and AIG Companies,” Giesing said.

Jackson National continues to sell the most VAs, with its Perspective II contract a perennial sales leader. But even Jackson is selling fewer VAs than it used to. Jackson National sold $12.8 billion worth of VAs in the first nine months of 2018, down about 30% from $17.8 billion for the same period three years ago.

VA sales were $75.4 billion in the first nine months of 2018, up 4% compared with the same period in 2017. Variable annuity sales increased 25% in the third quarter to $25.0 billion, compared with prior year results, but LIMRA SRI expects VA sales to increase less than 5% in 2018. That would, however, represent the first annual growth for VA sales in six years. VA sales are expected to slightly dip in 2019 in anticipation of equity market declines, according to LIMRA.

While fee-based VAs increased 43% over prior year to $800 million, this is down 6%, compared with second quarter results. “There continues to be operational hurdles in the fee-based VA market, which challenge adoption of these products by certain distribution channels. We expect companies will work to resolve these in the next few years,” Giesing said.

The VA product with the most sizzle is a hybrid of an indexed annuity and a variable annuity: the so-called registered index-linked annuity or RILA. “One of the factors driving VA sales growth is the increase in RILA sales, which were nearly $3 billion in the third quarter,” said Giesing.

“With more companies signaling their intention to enter the market, LIMRA SRI expects this market to top $10 billion by the end of 2018. Greater volatility in equity markets and better pricing due to rising interest rates are attracting consumers looking for a blend of growth and downside protection.”

Third quarter RILA sales grew 27% to $2.98 billion, representing 12% of the VA market. Year-to-date, RILA were $7.68 billion, 13% higher compared with prior year.

Total annuity sales were $58.8 billion, 25% above the third quarter 2017 results. For the first three quarters of 2018, total annuity sales were $170 billion, 11% higher than prior year. LIMRA SRI expects 2018 individual annuity sales to surpass $230 billion.

Fixed annuities

Fixed annuity sales drove most of this quarter’s growth. Fixed annuity sales have outperformed variable annuity (VA) sales in nine of the last 11 quarters. Total fixed annuity sales were $33.8 billion in the third quarter, a 39% increase compared with third quarter 2017 results. Year-to-date, total fixed annuity sales were $94.6 billion, up 18% from prior year.

Fixed-rate deferred (FRD) annuity sales jumped 51% in the third quarter to $11.2 billion. Year-to-date, FRD sales were $31.3 billion, 17% higher than prior year.

LIMRA SRI expects FRD sales growth to continue into the fourth quarter. Many FRD contracts are out of their surrender charge period, which could find more attractive rates in the rising interest rate environment. LIMRA SRI expects 2018 FRD sales to grow as much as 20% and as much as 25% in 2019.

Fixed immediate annuity sales were up 20% in the third quarter to $2.4 billion. Year-to-date, fixed immediate annuity sales were $7.0 billion, 13% higher than prior year. Deferred income annuity (DIA) sales rose 6% in the quarter, to $550 million. Year-to-date, DIA sales were $1.64 billion, down 2% from the same period in 2017. LIMRA SRI expects income annuity growth of 5-10% in 2018 and as much as 5% in 2019.

© 2018 RIJ Publishing LLC. All rights reserved.