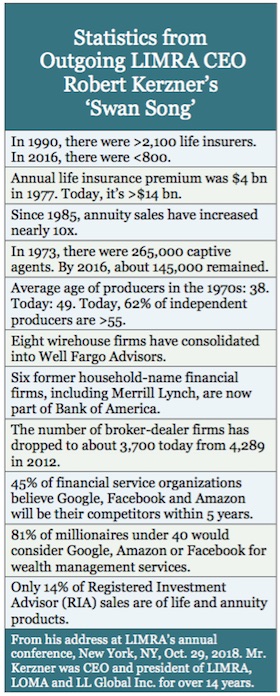

Bob Kerzner, in his final address to the LIMRA membership after 14 popular years as their CEO, posed a perennial question: why hasn’t the life insurance industry capitalized on the Boomer retirement opportunity to the degree that it hoped, expected and, in its mind, deserved to?

A complete answer to that question (which may stem in part from a post-demutualization misalignment of interests with the public) will fill a book someday (see note at end of story).

Bob Kerzner

Kerzner spoke at the annual LIMRA conference, which was held this year at the Marriott Marquis Hotel in New York. As the polyglot mass of tourists posed for snaps with the “Naked Cowboy” et al in Times Square below, a thousand or so dark-suited executives gathered soberly in the hotel ballrooms above.

The conference was ornamented by the appearances of a celebrity guest speaker, former FBI director James Comey, and an inspirational TED talker, Simon Sinek (pronounced “cynic”). Both spoke of one’s duty to callings higher than achieving sales goals; both were also promoting new books.

The most productive breakout session at the conference, for annuity issuers at least, may have been a discussion about potential synergies between various annuity industry stakeholders. Robert DeChellis, CEO of Allianz Life Financial Services, moderated a panel consisting of Gumer Alvero of Ameriprise, Zach Bevevino of BlackRock and George Riedel of T. Rowe Price.

Robert DeChellis

Their conversation shed as much light on the differences between the interests of assets managers, retail advisors, and institutional providers as it did on their similarities. The panelists explained, as panels of distributors have explained during nearly identical discussions at past conferences, that they face their own challenges, which are not necessarily related to annuities.

BlackRock’s income fund

Bevevino, product strategist for BlackRock’s Multi-Asset Group, explained that while BlackRock manages about $300 billion for variable annuity issuers, and while its CEO, Larry Fink, declared that retirement is the big asset manager’s top priority, the company is more focused on satisfying demand for safe income with a non-insurance product.

Zach Bevevino

That product is the Multi-Asset Income Fund, and BlackRock is struggling with it. The fund is designed to yield a steady 5% a year, Bevevino said, but “hasn’t sold well in retail channels. Why do retirees not understand what they need? We have a whole working group with a research component looking at this.”

[But that product is expensive. It is actively managed and has lagged its benchmark after accounting for fee drag. The A-share assesses a 5.25% front-end load. The C-share charges 1% upfront and 1.59% per year. The institutional class charges a mere 0.57% per year but requires a $2 million investment.]

Regarding annuities, BlackRock has a web portal, iRetire, where advisors can access “retirement income planning technology… for use alongside clients.” It solves income plans using one of five BlackRock model portfolios: Tax Aware, Target Allocation, ESG (environmental, social and governance), Smart Beta, and Income.

“iRetire helps us sell annuities,” Bevevino said. “The interface lets advisors include essential spendings in their plans and choose the right model portfolio. But the through-put has been very slow with advisors and clients. We’re trying to lubricate that a little.”

The fact remains, he said, that in BlackRock’s world, where investors can find funds that charge for five to eight basis points, the cost and complexity of annuities loom large.

The Naked Cowboy of Times Square

Ameriprise ‘adaptive withdrawal’

Gumer Alvero, executive vice president for annuities at Ameriprise, said that his advisors are more focused on encouraging “adaptive withdrawal” from investment portfolios as an income strategy for retirees and that “the consumer isn’t looking” for things like variable annuities with guaranteed lifetime withdrawal benefits, given the fees and complexities.

“We’ve had a variety of GLWBs [guaranteed lifetime withdrawal benefits], but we’re seeing only about a 20% take-rate on contracts with the richer benefits,” he said. “The industry is going for another arms races in the opposite direction” as the public.

Gumer Alvero

“I’m surprised to see the recent sales increase, because I think they’re missing the boat.” Alvero told RIJ that high payout rates on living benefits don’t appeal to retirees “because they don’t want to spend their money that fast.”

In general, Ameriprise practices the “floor and upside” approach to retirement income planning, where the retiree meets essential expenses with guaranteed or safe income. The balance of savings can be invested in risky assets. The withdrawal rate will vary, depending on market conditions. “Four percent is only the most conservative withdrawal rate over 30 years,” he said. “You could have withdrawn 15% a year from savings if you happened to retire at the right time.”

T. Rowe Price: Enough balance sheet?

George Riedel of T. Rowe Price, one of the big-three providers (with Fidelity and Vanguard) of target date funds to 401(k) participants, said that his firm has “hundreds of people looking at what embedding annuities in 401(k) plans might mean.” He sees a mismatch between the costs of annuities and the current priorities of large plan sponsors, who are focused on minimizing the costs of their plans.

George Riedel

If millions of 401(k) participants decided to annuitize part of their savings, he noted, life insurers wouldn’t be able to handle all the longevity risk. “Is there enough balance sheet in America?” he asked. (That helps explain Social Security; it takes a national government to handle a nation’s collective longevity risk.)

T. Rowe Price, which specializes in actively managed funds, faces the challenge faced by all asset managers who distribute mutual funds through 401(k) plans: How to deal with the ongoing flood of dollars from plan accounts to rollover IRAs. The only solution is to get their products on the shelves of the broker-dealers who manage IRA money.

James Comey: ‘You have to interrupt him’

The former FBI director, who says he was fired in 2017 for refusing to pledge his loyalty to Donald Trump, compared him unfavorably with former Presidents Obama and George W. Bush and with candidates John McCain and Mitt Romney. A leader needs to be able to listen, especially to dissenting opinions, “but to speak to [Trump] you have to interrupt him,” Comey said.

Obama, he continued, once asked him into the Oval Office and, after shooing everyone else from the room, asked for Comey’s views on the spike in police shootings of black men in U.S. cities.

“He didn’t speak for 10 minutes. He just drank it in, and then he asked questions. It was one of the most impressive things I’ve ever seen. Actual listening happens very rarely in Washington. Instead, one person will say what they want to say, and then the other person will ignore it and say what they want to say.”

Note: At the top of this story, a link was drawn between demutualization and the industry’s current troubles. In the 1990s, many large members of the life insurance industry chose to become public companies and to shed their captive sales forces.

It’s arguable that, at that point, the policyholders began to take a backseat to the shareholder and to the third-party distributors on whom the industry began relying for sales. Since then, the resulting conflicts keep bubbling up, like rust through a thin coat of paint. The ghost of demutualization and its consequences, including a loss of public trust, haunt much of the annuity industry today.

© 2018 RIJ Publishing LLC. All rights returned.