The right-wing populism that has emerged in many Western democracies in recent years could turn out to be much more than a blip on the political landscape. Beyond the Great Recession and the migration crisis, both of which created fertile ground for populist parties, the aging of the West’s population will continue to alter political power dynamics in populists’ favor.

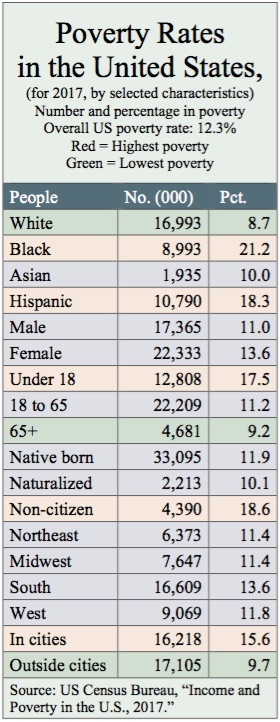

It turns out that older voters are rather sympathetic to nationalist movements. Older Britons voted disproportionately in favor of leaving the European Union, and older Americans delivered the US presidency to Donald Trump. Neither the Law and Justice (PiS) party in Poland nor Fidesz in Hungary would be in power without the enthusiastic support of the elderly. And in Italy, the League has succeeded in large part by exploiting the discontent of Northern Italy’s seniors. Among today’s populists, only Marine Le Pen of France’s National Rally (formerly the National Front) – and possibly Jair Bolsonaro in Brazil – relies on younger voters.

Next spring, this age-driven voting pattern could drive the outcome of the European Parliament election. According to recent studies, older Europeans – especially those with less education – are more suspicious of the European project and less trusting of the European Parliament than younger Europeans are. This is surprising, given that memories of World War II and its legacy should be fresher for older generations. Nevertheless, their skepticism toward democratic EU institutions may explain their receptiveness to authoritarian leaders.

Most likely, a growing sense of insecurity is pushing the elderly into the populists’ arms. Leaving aside country-specific peculiarities, nationalist parties all promise to stem global forces that will affect older people disproportionately.

For example, immigration tends to instill more fear in older voters, because they are usually more attached to traditional values and self-contained communities. Likewise, globalization and technological progress often disrupt traditional or legacy industries, where older workers are more likely to be employed. The rise of the digital economy, dominated by people in their twenties and thirties, is also pushing older workers to the margins. But, unlike in the past, crumbling pension systems can no longer absorb such labor-market shocks. The result is that older workers who lose their job are condemned to long-term unemployment.

Moreover, pensioners now have reason to worry about threats to their retirement benefits from their own children. Young people, frustrated with socioeconomic systems that are clearly tilted in favor of retirees, are increasingly calling for fairer intergenerational redistribution of scarce resources. For example, Italy’s Five Star Movement, which governs in a coalition with the League, recently called for a “citizen’s income” that would be available to all unemployed people regardless of age. So, while right-wing populists have attracted older voters, left-wing populist have gained a following among younger generations.

By backing right-wing populists, older voters hope to return to a time when domestic affairs were insulated from global forces and national borders were less porous. At the heart of today’s nationalist politics is a promise to preserve the status quo – or even to restore a mythical past.

Hence, nationalist politicians often resort to nostalgic rhetoric to mobilize their older supporters. For his part, Trump has pledged to bring back jobs in the American Rust Belt, once the center of US manufacturing. Likewise, there could be no clearer symbol of resistance to change than his proposed wall on the US-Mexico border. And his crackdown on illegal immigration and ban on travelers from predominantly Muslim countries signals his commitment to a “pure” American nation.

Similarly, in continental Europe, right-wing populists want to return to a time before the adoption of the euro and the Schengen system of passport-free travel within most of the EU. And they often appeal directly to older voters by promising to lower the retirement age and expand pension benefits (both are flagship policies of the League).

In the United Kingdom, the “Leave” campaign promised vindication for those who have been left behind in the age of globalization. Never mind that it also touted the idea of a free and independent “Global Britain.” The Brexiteers are not known for their consistency.

At any rate, to the extent that today’s populist wave is driven by demographics, it is not likely to crest anytime soon. In graying societies, the political clout of the elderly will steadily grow; and in rapidly changing economies, their ability to adapt will decline. As a result, older voters will demand more and more socioeconomic security, and irresponsible populists will be waiting in the wings to accommodate them.

Can anything be done? To stem the nationalist tide, mainstream parties urgently need to devise a new social compact that addresses the mounting sense of insecurity among older voters. They will need to strike a better balance between openness and protection, innovation and regulation; and they will need to do so without falling into a regressive populist trap.

The answer is not to suffocate global forces, but to render them more tolerable. Citizens of all ages need to be equipped to face current and future disruptions. In this sense, it is better to empower the elderly than simply to protect them. Most advanced economies simply cannot afford massive new benefits for an oversized interest group. And besides, a policy that makes people reliant on some form of external support is morally questionable, at best.

Instead, governments should focus on upgrading older workers’ skills, creating more opportunities for older and younger generations to work together, and holding disruptors accountable for the socioeconomic consequences they generate. Subsidies to the most vulnerable should remain a last resort.

In many ways, older voters’ infatuation with populists is a cry for help. It is up to enlightened politicians to respond to it constructively.

Edoardo Campanella is a Future of the World Fellow at the Center for the Governance of Change of IE University in Madrid.