At the LIMRA-SoA Retirement Conference in Chicago last week, actuary Doug French of Ernst & Young revealed the secret sadness of the affluent retired professional who doesn’t have sleep-easy annuity income or longevity insurance to bolster his or her Social Security and pension.

“They spend all their time looking for pockets of income to spend,” he said. If they can’t find gains to harvest, they’re miserable. They’ve joined the ranks of the worried wealthy. “That results in a not-so-fun retirement,” French told a not-so-numerous general session audience at LIMRA’s signature retirement event.

Doug French (left) and Todd Giesing

The small crowd was no surprise, given the dismal state of domestic income annuity sales. French joined LIMRA research director Todd Giesing on stage for a tag-team slide presentation entitled, “Annuities: Are We Swinging and Missing on Guaranteed Lifetime Income?” The answer was yes.

While sales of accumulation-oriented annuity products had grown to $101.2 billion in 2017 from $59.0 billion in 2011, combined sales of “income later” products (variable and fixed indexed with living benefits and deferred income annuities) fell 45%, to $65.9 billion in 2017 from $120 billion in 2011. (Immediate annuities saw a modest increase, to $8.3 billion in 2017 from $7.6 billion in 2011.)

The next question was: Why did such a steep drop in sales occur, especially when Boomers are entering retirement at the rate of more than 10,000 people a day? As in an Agatha Christie play, there are plenty of plausible suspects, along with a few suspicious-looking maids, butlers and gardeners.

“If you look at the headwinds,” said French, you’ll see a nine-year bull market in equities (which has lulled people into a state of risk-acceptance), the long low interest rate period (which feeds the bull market), and the declining richness of living benefit riders in variable annuities, which no longer offer the 10%-of-premium payouts after a 10-year deferral period that they once did.

The enforced use of target-volatility funds in income-oriented VAs has undermined the living benefit, he said (which was surprising, since de-risking the funds should have allowed better living benefits). “The advisors say, ‘Give us back unlimited investment options, but the actuaries will say no to that,” he added. The Obama Department of Labor’s fiduciary rule was also cited as a headwind, since (as currently written) it allows only fiduciaries or those who accept fiduciary status to sell FIAs or VAs to IRA clients.

It was noted that financial advisors, who are the bouncers at the gate of the exclusive high net worth club, are rarely annuity lovers. When clients have $2 million or more, their advisors tell them to self-insure, French said.

At the other end of the affluent spectrum, clients with $250,000 to $500,000 “need an annuity or an advisor but not both,” he added. French also noted that advisor think annuities are hard to process; they complain that “annuities don’t fit on my work station” or integrate with their other software.

Advisors are also still angry that VA issuers de-risked in-force contracts after the financial crisis, sometimes by hiking fees as their own hedging and reserve costs went up. “Many advisors feel betrayed by the issuers and they will never forget that betrayal,” French said.

The declining supply of VAs is also to blame for falling sales, as Nick Carbo of Oliver Wyman pointed out in one of the conference break-out sessions. Four companies that dominated VA production and sales in 2008–MetLife, John Hancock, Hartford and ING–are out of the VA business. Meanwhile, Prudential has purposely reduced VA sales by more than 40% over the past 10 years, AXA has switched its focus to selling accumulation-oriented “buffered” indexed annuities.

The 2017 VA sales leader, Jackson National, still sells a lot of Perspective II contracts with income riders, but it has introduced investment-only VAs and, recently, a new FIA. VAs with GLWBs, which have equity-linked risk as well as equity-linked returns, simply demand too much capital that could be applied to other business lines.

What’s the solution to the sales drought?

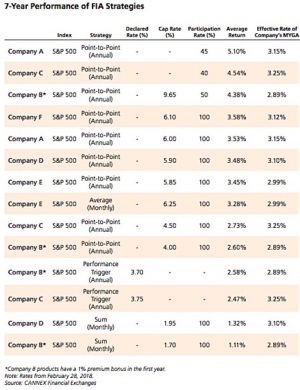

Like French, Carbo blamed the drop in client election of living benefits on VAs to “less attractive” riders. He attributed the drop in the election of living benefits on FIAs to the increase in FIA sales in the bank channel, where the FIA is sold as an alternative to low-yielding certificates of deposit rather than as a source of guaranteed income. He noted, however, that the GLWB on a typical FIA after a 10-year deferral period now pays out more per year than life-only DIA with a 10-year deferral.

How do we not strike out with guaranteed income? French suggested, to no small surprise, that annuity product design should be standardized to reduce client and advisor confusion, that more advisor “toolkits” should include annuities, and advisors should be taught to use annuities for “risk rearrangement” in client portfolios.

“We can stick with business as usual, which means staying complicated and kicking the can down the road for another five years,” he said. “Or, we can work with regulators to remove some of the hurdles to selling annuities, with common licensing, standardized products and streamlined compliance. We should also embrace the principle of ‘Know Your Customer.’ Advisors need to understand their clients’ health and likely longevity.”

A close follower of the annuity industry might observe a few structural reasons why income annuities aren’t selling well.

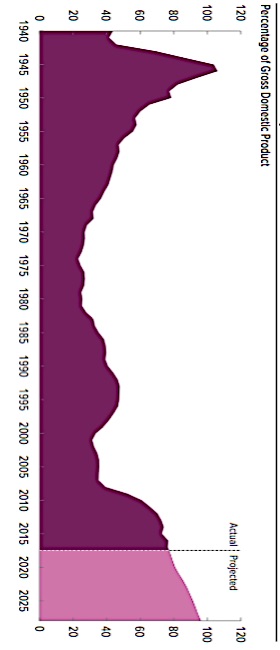

First, every American already has an inflation-protected life annuity with a 100% spousal survivor benefit called Social Security. For all but the wealthiest Americans, Social Security represents half or more of their retirement income. A retired boomer couple with two strong earnings histories might receive a combined $60,000 at age 70.

Second, everyone who has a sizeable 401(k) or IRA balance needs to take required minimum distributions at age 70½. RMDs are a form of forced annuitization; they are a reminder from the government that tax deferred savings is supposed to provide lifetime income, not bequests. Third, tens of millions of boomers are likely to regard their home equity (and perhaps a reverse mortgage) as a substitute for longevity insurance or long-term care, if they need it.

Indeed, selling income annuities may be difficult for a somewhat obvious reason: Americans have no history, tradition or memory of buying annuities near retirement with large lump sums of their own money. They do have a history of accumulating pensions incrementally over their lifetimes through their places of employment. Defined contribution/defined benefit hybrids are gaining traction abroad, and they may eventually emerge as the best avenue of progress for those who want to spark more interest in lifetime income products in the US.

© 2018 RIJ Publishing LLC. All rights reserved.

One fresh proposal—among seven winning responses to a 2016 “AARP Policy Innovation Challenge”—calls for the creation of new savings accounts that would give Americans enough money to delay Social Security claiming until age 70 and thereby reap higher annual benefits for life.

One fresh proposal—among seven winning responses to a 2016 “AARP Policy Innovation Challenge”—calls for the creation of new savings accounts that would give Americans enough money to delay Social Security claiming until age 70 and thereby reap higher annual benefits for life. developed with assistance of Jason Fichtner, a former Social Security official now at the conservative Mercatus Center at George Mason University, and William Gale of the liberal Brookings Institution.

developed with assistance of Jason Fichtner, a former Social Security official now at the conservative Mercatus Center at George Mason University, and William Gale of the liberal Brookings Institution.

Romine returns to JNLD after serving as the president and chief executive officer of National Planning Holdings, Inc., Jackson’s affiliated independent broker-dealer network that was sold to LPL Financial (LPL) in August 2017.

Romine returns to JNLD after serving as the president and chief executive officer of National Planning Holdings, Inc., Jackson’s affiliated independent broker-dealer network that was sold to LPL Financial (LPL) in August 2017.

A relevant deadline is looming. Minimum contributions to NEST will rise to 5% this month and to 8% in April 2019, effectively locking more consumer earnings into a pension fund. If participants think these increases are unaffordable or don’t want to tie up their money in this way, they might drop out of NEST (National Employment Savings Trust).

A relevant deadline is looming. Minimum contributions to NEST will rise to 5% this month and to 8% in April 2019, effectively locking more consumer earnings into a pension fund. If participants think these increases are unaffordable or don’t want to tie up their money in this way, they might drop out of NEST (National Employment Savings Trust).