Financial un-wellness haunts the American workplace. On concrete factory floors and carpeted office hallways across our land, debt-anxiety and a lack of adequate savings distracts young workers from their jobs and prevents older workers from retiring. The result: declining productivity.

Or so we’re told. A snow-capped mountain of white papers from think tanks (Aspen Institute), government agencies (CFPB) and consulting firms (Deloitte, Aon, Mercer, Pricewaterhouse Coopers) has accumulated in recent years. All agree that about a quarter of U.S. workers are so stressed about their finances that it hurts their on-the-job performance and employers’ bottom lines.

“Financial wellness” programs (or, for brevity, FW) are said to be the solution. These are web-based or in-person training programs, delivered during the workday or off-hours, either as part of traditional 401(k) “participant education” or separately. They can be free (i.e., part of the recordkeeping services bundle), or be expensed separately.

Often, they consist of interactive videos that ask employees a series of assessment-type questions and then direct them to the tutorials on retirement, or debt consolidation, or health care savings accounts. The goal is to train employees to use their existing salary and benefits more efficiently.

Retirement plan providers have jumped all over this trend. Full-service and advisor-sold firms like MassMutual, Voya, Vanguard, Fidelity, Principal, and Empower have all created FW programs, either homegrown or subcontracted to a myriad of new vendors. Providers at first saw FW capability as a competitive edge; in the past two year it has become a necessity.

But proving that FW programs pay for themselves is a big challenge. The devil as usual, is in the metrics. To get funding for FW, HR executives need to convince often skeptical CFOs that FW will result in bigger 401(k) contributions, less leakage from 401(k) plans, greater usage of health savings accounts, less absenteeism, higher average productivity, and less “deadwood,” as superannuated employees were once uncharitably called. For that ROI data, HR folks turn to the providers and consultants.

Cost-benefit studies

The biggest source of savings may be a reduction in absenteeism. That factoid comes from Financial Finesse, an El Segundo, Calif.-based FW firm founded in 1999 by former investment banker Liz Davidson (below right). The 50-employee firm, Davidson told RIJ recently, serves about 52 large companies directly and about 600 companies indirectly by contracting with plan advisors or providers.

Interestingly, Financial Finesse works with current and former NFL players. “We help them find advisors. We show them how to make their 17-week paychecks last a whole year and how much to save for the long-term,” Davidson told RIJ. The agents are often the ones who call us first. It’s not unusual for us to have an agent, a rookie player, and the player’s mom on the phone at the same time.”

Depending on the specific program, plan sponsors pay Financial Finesse annual fees for ongoing assessment, daily fees for workshop presentations and per capita fees for personal financial coaching. The services come with a performance guarantee that ties the expense to measurable improvements. “We’re on the line for results,” Davidson said. “For our relationships to grow, and for HR departments to increase budgets for FW, it comes down to the quality of our analysis.”

In 2016, Financial Finesse’s in-house think tank published a white paper on the return-on-investments in FW programs. It described the FW interventions at an unnamed Fortune 100 company over the five-year period from 2009 to 2014. Financial Fitness assessed all of the workers and assigned each to one of five categories according to their “Financial Wellness Scores.”

Employees went through a variety of training programs, depending on their specific level or type of financial distress. For the most afflicted, the priority may have been to eliminate wage garnishment or credit card debt. For the healthiest, the first step might be to increase deferral rates to retirement plans. Periodic re-assessments showed whether the employees’ scores have improved.

Financial Finesse assigned the employees to one of five quintiles of financial wellness, ranked from lowest to highest. In this company, 13% of workers were in the lowest quintile, while 35%, 34%, 15% and 3% were in the second, third, fourth and highest quintiles, and their estimated annual cost to the employer averaged $198, $94, $0, -$82 and -$143, respectively. Almost half the workforce (48%) was defined as either “suffering” (the lowest quintile) or “struggling” (the second lowest).

Based on those metrics, Financial Finesse estimated that raising the company’s average financial wellness to a score of 5 from a score of 4 would save the firm about $50 per employee. An increase to 6 from 4 would result in an estimated annual savings of about $100 per employee, the study showed, or about $1 million for a 10,000-person company. About 80% of the savings came from reduced absenteeism.

MassMutual’s ‘Viability’ software

MassMutual has a patent-pending software program called Viability that it claims can quantify the impact of FW programs. The mutual life insurer and provider of advisor-sold retirement plans bought Viability Advisory Group two years ago. Its creator, former MassMutual executive Hugh O’Toole, rejoined the insurer to run its FW business.

Since MassMutual’s 30,000 plans (many of them under $15 million, thanks to its 2012 acquisition of the Hartford’s retirement business) are initially sold to plan sponsors by advisors, MassMutual markets Viability to plan advisors. Viability works in conjunction with two of MassMutual’s FW interventions: Mapmybenefits and Beneclick! (from Maxwell Health).

MassMutual declined to explain exactly how Viability works. The Viability website tells advisors: “Now you can show them—really show them, with actual numbers” about the savings from FW programs. “If an employer will give us their data, we can run the numbers to show them the liability they create for themselves by not helping their employees retire at their normal retirement age.”

MassMutual declined to explain exactly how Viability works. The Viability website tells advisors: “Now you can show them—really show them, with actual numbers” about the savings from FW programs. “If an employer will give us their data, we can run the numbers to show them the liability they create for themselves by not helping their employees retire at their normal retirement age.”

O’Toole (left) believes that FW might divert 401(k) contributions into rainy-day accounts, health insurance accounts and debt-reduction programs, but he thinks that each employee has different priorities, depending on their age and circumstances.

“It’s heresy in the retirement industry to say this, but making sure an employee can afford the deductible on a high-deductible health saving account, or making sure they have some basic life insurance is probably a better utilization of their limited benefit dollar than recommending that that employee puts 10% of their pay into their 401(k) plan,” he told RIJ in an interview.

Garman’s estimates

More than 20 years ago, a personal financial planning specialist at Virginia Tech University, E. Thomas Garman, produced hard estimates of the costs of financial stress in the workplace. In this graphic, for instance, he maps out the elements of financial un-wellness that cost employers money and estimates a $3 return for every $1 invested in “workplace financial education and assistance programs.”

Garman, who founded the Personal Finance Employee Education Foundation in 2006, has also cited the following rules of thumb for estimating the savings from FW programs:

“Take the 10% of the workforce which is currently experiencing financial problems and multiply that by a 10% average annual wage loss in employee productivity; that equals the cost of an employer doing nothing. For example, consider an employer of 1,000 employees with an average wage of $30,000 who has 100 workers experiencing financial problems to the extent that their productivity is reduced by 10%.

“That calculates to $300,000 in annual lost productivity ($30,000 [annual employee wage] X .10) = $3,000 per financially troubled employee] times 100 [current number of financially troubled employees]). This $300,000 annual productivity loss for an employer with 1,000 employees is a conservative estimate.”

Prevalence and skepticism

Are CFOs heeding the call to FW? At a recent SPARK conference for recordkeepers, Michael Kozemchak, a managing director at Institutional Investment Consulting, said that the push for FW is still coming from the human resources department, without necessarily a lot of pull from CFOs.

“The interest is coming from the HR department. They meet with benefits consultants who are talking about it and showing them data. If the data looks compelling then the matter percolates up to the senior managers. If it looks compelling to senior managers then they might do something about it,” Kozemchak told RIJ.

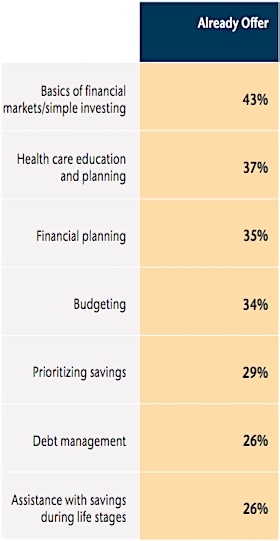

AonHewitt, in a 2017 report called “Hot Topics in Retirement and Financial Well-Being,” estimated that “60% of employers feel [FW’s] importance has increased at their organization over the last 24 months,” with 59% of employers “very likely” and 33% “moderately likely” to “focus on the financial wellbeing of workers in ways that extend beyond retirement decisions.”

The same report said that 49% of companies “are still in the process of creating their financial well-being strategy, but that is not stopping them from offering tools, services, and educational campaigns on various financial matters to their workforces. As of the beginning of [2016], 58% of employers have a tool available to workers covering at least one aspect of financial wellbeing. By the end of the year, the percentage is expected to climb to 84%.”

Some plan sponsors are said to worry that FW programs might open the door to unwanted sales overtures to employees. There are also skeptics who believe that 401(k) plans themselves are flexible enough to provide employees with all the remedies they might seek from an FW plan.

That’s a view held by Jack Towarnicky (right), an attorney and former benefits executive who is currently the president of the Plan Sponsor Council of America (formerly the Profit-Sharing Council of America).

Towarnicky sees little need to create a new benefits overlay at the worksite. “My financial wellness solution is the 401(k),” he told RIJ. “The better answer is to educate folks within the 401(k) plan, and how it can be used to meet short, medium and long-term financial objectives.” If people learn leveraging the tax advantages of retirement plans and health savings accounts, he believes, financial wellness will follow.

A cynic might say that FW programs are at best superficial or palliative remedies for a deeper problem: the decades-long shrinkage in total compensation for all but the upper quintile of the income spectrum, and the “great risk shift” of financial responsibilities from employers to workers.

But at least one observer believed that it’s worthwhile to improve employee morale, reduce stress and raise efficiency here and there, even if you don’t save the world. “The whole thing is about efficiency,” said Betsy Dill, the head of financial wellness at Mercer.

“We’ve done analyses at dozens of employers and seen time and time again that employees are spending money on benefits in non-advantageous ways. About 25% are making the right decisions, but maybe 75% don’t. When you show someone how to use benefits the right way, it can put real money back into their pockets or into their retirement plan.” And make the workplace a bit less haunted by financial un-wellness.

© 2018 RIJ Publishing LLC. All rights reserved.

As the savings grow, the investor gradually reduces his purchases of term life insurance. After 23 years, at age 53, the investor reaches a tipping point. His savings are steadily compounding toward the goal of $500,000. No longer worried about mortality risk, his or her thoughts turn to longevity risk—the risk of outliving his life expectancy (age 86) and savings.

As the savings grow, the investor gradually reduces his purchases of term life insurance. After 23 years, at age 53, the investor reaches a tipping point. His savings are steadily compounding toward the goal of $500,000. No longer worried about mortality risk, his or her thoughts turn to longevity risk—the risk of outliving his life expectancy (age 86) and savings.

MassMutual declined to explain exactly how Viability works. The Viability website tells advisors: “Now you can show them—really show them, with actual numbers” about the savings from FW programs. “If an employer will give us their data, we can run the numbers to show them the liability they create for themselves by not helping their employees retire at their normal retirement age.”

MassMutual declined to explain exactly how Viability works. The Viability website tells advisors: “Now you can show them—really show them, with actual numbers” about the savings from FW programs. “If an employer will give us their data, we can run the numbers to show them the liability they create for themselves by not helping their employees retire at their normal retirement age.”