TIAA, as you probably know, was recently the subject of a couple of major man-bites-dog stories in the New York Times. TIAA is the hundred-year-old provider of 403(b) plans to universities, colleges and other non-profit institutions of higher learning. It hasn’t been a non-profit entity itself since 1998. But it still has a cooperative, not a corporate, structure that it touts as non-conflictive with the professors and administrators who participate in its plans.

Unlike 401(k) firms, it serves multiple plan sponsors, so that teachers can switch colleges without leaving the plan. It is also primarily an annuity provider. Participants can invest in mutual funds through a deferred variable or fixed annuity during the accumulation period. When they retire, they can take income via systematic withdrawals or through a fixed life annuity that offers bonuses when investment returns are good.

Despite TIAA’s carefully tended reputation for absolute probity, two Times reporters asserted, the company isn’t as free of conflicts-of-interest as it presents itself. In possible violation of the Department of Labor’s best interest rule, the Times said, TIAA has begun incentivizing its financial advisors to steer clients into relatively expensive products.

After the Times stories appeared, RIJ reached out to former TIAA executives about the story. Two were willing to comment on the condition of anonymity. Both thought the Times October 22 story was unfair to TIAA. But they also confirmed many of the points that were made. Their portrait of TIAA differs mainly in its emphasis. They focus on the organizational and financial stresses that TIAA has come under as a result of the maturity of the higher-ed market, the stress of acquiring an asset management firm and a bank, and the heat of competition from giant 401(k) plan providers like Vanguard and Fidelity.

Their answers to our questions can be found below. One is identified as a “former executive,” and another as “the second executive.” They depict a company under pressure on several fronts. A formal response to RIJ from a TIAA spokesperson can be found at the end of the article. (Full disclosure: TIAA is a group subscriber to Retirement Income Journal. My spouse is a TIAA plan participant, and we’ve received financial advice from a TIAA advisor.)

What about the allegations of conflicted sales practices?

“If what they’re questioning are the sales practices—I was involved in discussions about advisor compensation,” said one former executive. “We agreed: You don’t get paid more money for recommending TIAA products. There’s nothing in the compensation scheme that rewards people for that. We make fund recommendations using a third-party provider. Ibbotson runs the model. There are lots of safeguards. There may have been differential compensation based on the complexity of the transaction, and that [compensation] might have been correlated with certain products. But [we did that] so [the advisors] would be willing to take the time to sell those products.

“If a client says, ‘I want to learn more about managed accounts,’ we will show them. But within those transactions there’s no bias toward TIAA. These are allegations. The Times ignored certain things. [Gregtchen Morgenstern] ot certain facts wrong. She said we opposed the fiduciary rule. We didn’t. There was no lawsuit; there was a whistleblower filing with the SEC. I don’t know what her motivation was. We welcome the regulators coming in. If they find stuff we’ll clean it up. They won’t find a lot. The reporter had a story she wanted to write. I believe TIAA is wearing the white hat here. It might have some dust on it. It has 15,000 employees. We’re not just another profit mongering financial services company. That’s not the company I know.”

“TIAA makes the most money on its annuitization outcome,” a second executive said. “There’s no mystery there. But obviously as they ramped up their individual financial planning enterprise, which now has 850 or 900 planners, there was a question of how those people were compensated. Absolutely, there was a degree of incentive to open managed accounts. But was there as much incentive as you’d see at a wirehouse? No.

“It’s funny that the Times article took that approach—‘TIAA is incentivizing planners to open managed accounts.’ A managed account is actually a good outcome for investors with money. It was a reasoned approach. But that’s not even where TIAA makes the most money. What’s best for TIAA—and for the investor, in my opinion—is their annuitization outcome. They have a strong annuity product. It’s the TIAA equivalent of a defined benefit outcome.”

“TIAA has three silos. There’s asset management, which includes the old TIAA funds plus the Nuveen funds. Then there’s the individual side, which means Everbank, which was another challenging acquisition. That’s a different culture. That’s where the individual planners are. They’re the only people who could put someone in a managed account. The planners see people who have $500,000 or more. People with $50,000 will not get a call from a planner. The third division is the traditional TIAA 403(b) business, which includes hundreds of relationship managers. That group struggles with questions like, ‘What do our fees need to be if Fidelity comes in with much lower fees and TIAA’s costs are higher?’”

Was there a link between the layoffs and the whistle-blower complaint?

“Before 2003, TIAA had never had a layoff,” the second executive said. “They had their first layoff that year and have had them regularly since then. That’s an indicator of how they think about business. [Previous layoffs have had a mix of people from different levels of the company], but one layoff last fall didn’t focus on low-level people. It focused on high-level people. This is pure speculation, but one could make the interpretation that when you lay off high-level people who have incredible knowledge and have made big contributions to the organization, a small percentage of them might be unhappy.

“There’s been a lot of turnover among the advisors in the wealth management business—probably more there than anywhere else in the company. They have had a lot of goals and quotas. TIAA’s core business was trying to retain assets and gather more share of the wallet of participants, but how long can that last? Once you’ve combed through current customers, at some point you have to look elsewhere.

“The layoffs started in earnest in June of 2016. That’s when they really got under way. They ramped up toward the end of last year and have continued. From my vantage point, the layoffs of high-level people peaked toward the early part of this year, and they are still continuing. There were two reasons. TIAA had a substantial amount of right-sizing to do. They recognized it. I don’t think they’re quite there yet. They have more to do. But they’re doing it in a very quiet manner. You won’t read a press release about it.

“Do I see a link between layoffs and whistle-blowing? Yes. That’s the short answer. I put that in the ‘human nature’ category. Anytime you are terminating people, even if you are trying to do it fairly and congenially, you will eventually awaken a sleeping giant or poke the wrong bear. But when it comes time to react you have to react on a bigger scale.

“The company was not the right size to move forward in the interest rate environment that we’re in. Think of it in these terms: Before the election—and by the way there weren’t too many people, especially in Manhattan, who thought Trump was going to win—there were lots of very credible forecasts saying that the 10-year Treasury would be at 2.5% going forward. At the time, TIAA was considering whether they were or weren’t right-sized. But then the ten-year rate keeps going down, and down. Say that you’re an insurer thinking that the 10-year will be 2.5% or even 3%, and you’re considering whether you’re right-sized or not. If it goes down to 1.5% or lower, you know that you’re not even close to being right-sized. A little panic sets in. TIAA may have to lay off a thousand more people. It’s an economic issue.”

“Are there disgruntled people at TIAA?” the first executive said. “Find me a company with 15,000 employees, with five to ten percent turnover every year, that doesn’t have them.”

What’s the larger context for these accusations?

“There’s a big picture and a little picture,” he added. “The little picture is that employees have leaked internal presentations and talked about pressure to sell and put people into higher-profit products. The big picture is that TIAA used to be a co-op. As a co-op, TIAA traditionally charged every client, regardless of the size, the same amount, with only slight differences. Since everyone got charged the same, it meant that people with high account balances paid more than it cost to maintain those accounts.

“Their cost per dollar invested was higher. It was the same with the institutions. The University of Michigan, with 60,000 employees, is cheaper to serve per person than a small liberal arts college. So you had cross-subsidies. That was so participants could move from one institution to another and still pay the same fees. It was for the good of the whole.

“And for a long time, that was OK. But with the advent of competition from firms like Fidelity and Vanguard, there was pressure to add more products and services. Not too long ago, we didn’t even have a money market account. There started to be pressure to cut deals with big institutions. Fidelity and Vanguard were going after the biggest accounts, and offering to charge them lower prices. Those bigger institutions then came to TIAA and said, ‘We want a better deal.’”

“TIAA struggles with the average cost of servicing a plan,” the second executive said. “They tried to better match the fees with the amount of work that had to be done. In the case of the bigger institutions, which were large enough to have their own CFOs and a team of sophisticated assistants, TIAA didn’t have to work as hard. So they tried to reduce the prices to the large institutions and raise the fees of the smaller ones. At smaller institutions, TIAA was their retirement office, so they involved more work. But there wasn’t as much price-raising as you might expect. The idea was to get more competitive and you don’t get more competitive by raising prices.

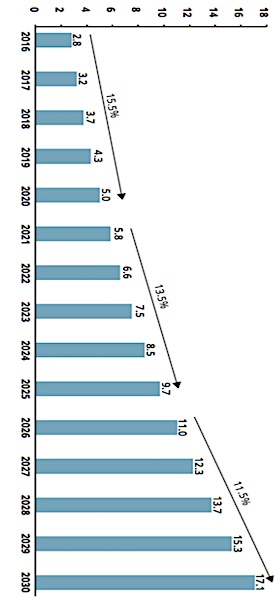

“What had also happened was that the higher education business became mature,” the first executive said. “TIAA grew tremendously in the 1980s and 1990s because of changes in the pension law. The real competition in the old days came from the public retirement plans in higher education. For instance, North Carolina might have a state retirement plan for university workers. We competed. A lot of those state plans [closed] and TIAA got a lot of new business. We were an option everywhere outside of California.

“But then that business became mature. TIAA faced a situation where the core pension business was flat to declining. At the same time, we had a big group of participants who had come into the plan in the 1960s. They were retiring and taking their money out. In the late 1990s we were facing changes in the cooperative structure and a shift in demographics. So TIAA went into new businesses.

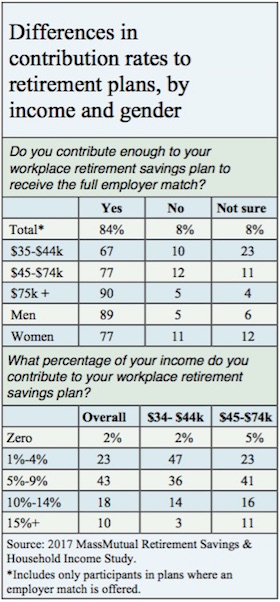

“TIAA also wanted to hang onto the business that they have. Our participants typically contributed a total of 10% to 15% of their pay to their 403(b) retirement accounts, if you include employer contributions. The all-in contribution rate to 401(k)s is typically only 7.5%. So there are some high account balances, and competitors looked at them as potential rollovers. So TIAA started a wealth management group to give those [high account-balance participants] more services. It was a defensive move. TIAA doesn’t want money moving to Wall Street. So, combined with these other pressures—the nature of being a co-op and the flattening growth—that’s the big picture.

“We wanted to start the wealth management business to retain assets and to get more of the [non-TIAA] assets of the people we already served. That’s where you saw the pressure. The core retirement business isn’t growing. They have to cut deals with the big university plans. There was intense competition there. They lost Notre Dame and Stanford. Fidelity took over Stanford. It’s no longer this one-happy-family co-op that it used to be, though there are still vestiges of that.

“As you stop being so much of a co-op, you have to cut prices to your biggest customers and raise prices on smaller customers. They did some of that, but then you need new revenue streams. That would come from managed accounts, the institutional asset management business, and from Nuveen.”

When did the culture at TIAA start to change?

“It started with Herb Allison. He came in from Merrill Lynch in 2001 or 2002. Starting with the top leadership, he brought in a new head of sales, a new head of marketing, new public relations people. There were more outsiders, and that continued under [current CEO] Roger Ferguson [who had been vice chair of the Federal Reserve and was a McKinsey veteran],” the first executive said.

“Now only one of the top senior leadership team is homegrown. They noticed all of the problems I’ve been talking about, and they knew they needed to do something different. You have to understand that TIAA didn’t get big enough to break even until the 1950s. Until then it got infusions from the Carnegie Foundation, which was always there to write another check.

“Unequivocally, the culture has changed. When you’re running a mutual or a not-for-profit for decades and along comes Herb Allison from Merrill Lynch, the culture will definitely change. And they needed some of that change. It had gotten too sleepy. So a lot of that [cultural change] needed to happen. The cultural changes continued under Roger Ferguson, but he’s not like Allison. He’s a McKinsey guy, not a Wall Street guy. The Nuveen acquisition definitely changed the culture, and I don’t think that was all positive. Nuveen had a really different culture. TIAA is still trying to wrap their arms around that.”

“TIAA is a different company than it was four years ago,” the second executive said. “A lot of the cultural change came from the Nuveen acquisition. That absolutely changed the culture of the asset management side at TIAA, and not all for the better. TIAA made those acquisitions because they wanted a bigger asset base. They wanted a cushion against the annuitization business, which was in trouble.”

“We bought Nuveen and Everbank because we thought they were good investments that would generate higher returns on the general account,” the first executive said. “In the case of Everbank, we wanted to be able to serve our clients’ needs up to and through retirement. Part of the reason was to make TIAA relevant to a younger generation and part was to provide in-house services to retirees. On the Nuveen side, we wanted to get assets under management up to scale, to be more profitable, and to provide more investment options. The subsidiaries are for-profit and they will continue to act like for-profit entities. But their profits still get dividend-ed up to the general account.”

TIAA’s response

TIAA’s vice president for media relations, Chad Peterson, sent RIJ the following prepared statement in response to our inquiries:

“Because TIAA does not have public shareholders, all of our earnings are returned to participants or are invested in our business. TIAA focuses exclusively on meeting our clients’ long-term financial needs. We always put our clients first and operate in a highly transparent and ethical way.

“Our financial advisor compensation practices are designed to put our clients first. They are paid a salary plus an annual variable bonus that is not based on the profit any product may deliver. Our advisors do not have product-specific targets.

“Financial advisors rely on a Centralized Advice Group to develop tailored client financial plans. Unlike many other firms, our advisors are not responsible for choosing the underlying funds in managed accounts or any other investment solution. In addition, all recommendations are reviewed by a separate review team to ensure they are appropriate and in the client’s interest. We are transparent about how we compensate our financial advisors.

“Ninety-five percent of participants responding to surveys agreed/strongly agreed that TIAA’s Wealth Management Advisors considered their interests first, based on our Customer Insights Scorecard as of December 31, 2016.

“[Regarding] our managed account offer: We believe our managed account offer is strong and competitively priced. A team of skilled investment management professionals manages the asset allocation, investment selection, daily portfolio review and rebalancing, as needed. Additionally, all managed account clients have a dedicated advisor who assists with professional oversight. Our offers also take into account tax sensitivities, where appropriate.”

© 2017 RIJ Publishing LLC. All rights reserved.