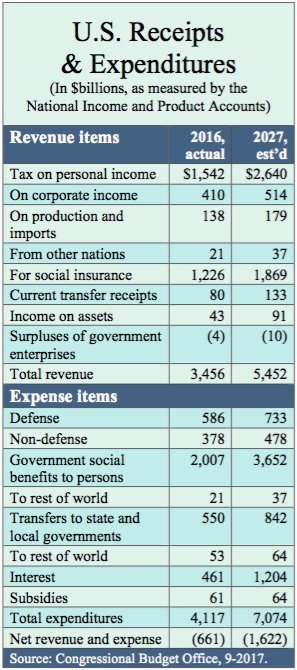

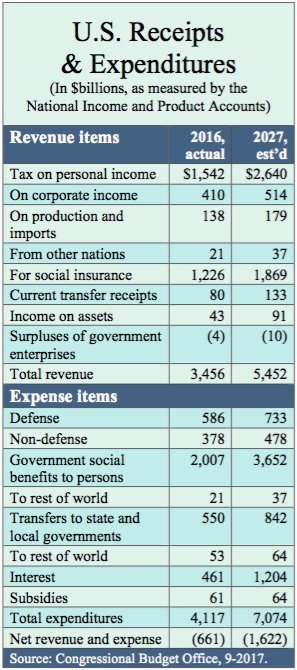

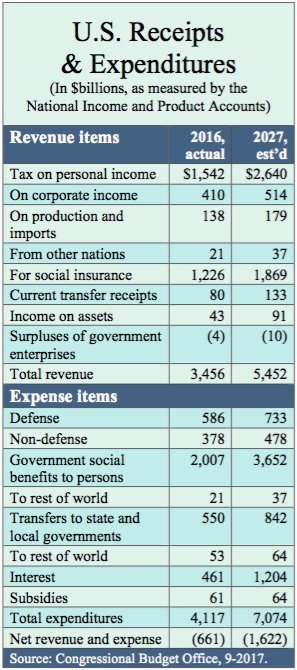

U.S. Gov’t Receipts and Expenditures

IssueM Articles

The €10bn pension fund of Dutch telecom giant KPN disclosed this week that it would allow its plan participants to choose a new kind of distribution option for their defined contributions to the plan: Payouts that fluctuate with the performance of the underlying investments.

That’s a relatively new development in the Netherland’s retirement system. It was only a year ago that the Dutch parliament passed legislation enabling defined contribution (DC) pension fund participants to opt for variable benefits after retirement—also known as drawdown plans—instead of a fixed annuity.

As IPE.com reported, most Dutch plans have not introduced a variable benefit option. Only a handful of retirees has opted for them. The fund for the postal workers (Pensioenfonds PostNL) and the fund for construction workers (BpfBouw), have said they won’t. Participants in such plans must turn to insurers like Aegon, Nationale Nederlanden, Delta Lloyd and Allianz if they want variable payout arrangements instead of fixed annuities at retirement.

The four providers have designed products that differ considerably, with Aegon offering the highest risk profile, investing 66% of the available pension capital in risky assets during retirement. For Aegon, the high equity allocation is deliberate. “Participants often have additional DB pension entitlements of at least as much as their DC capital,” said Frits Bart, director of policy.

“We consider these to be a risk-free investment. In addition, people have benefits from the state pension, which often represents an equivalent value and can also be seen as risk-free. In our opinion, people need the 66% risk assets in their investment mix as part of their variable payment plan in order to benefit from continued investing.”

The three other providers choose to emphasize the security aspect of their plans. At Delta Lloyd, the risky asset allocation is linked to a participant’s risk tolerance and can be 15%, 30% or 45%. The variation in benefits solely depends on the risk asset holdings. Participants purchase fixed annuities with the remainder of their pension assets.

Delta Lloyd says it will calibrate the risk profile once every five years, and subsequently adjust benefits if necessary. Participants can also indicate if they want their risk profile reviewed, but the provider will adjust the ratio between fixed and variable payments only once a year.

Nationale Nederlanden’s variable benefit product invests 35% in a multi-asset fund with an allocation of almost 20% to fixed income and other liquid assets.

Participants bear longevity risk in some plans but not others. The variable benefits of the Aegon and Allianz products will decrease if life expectancy continues to rise, but the Delta Lloyd and Nationale Nederlanden plans insure against this.

Allianz offers a combination of fixed (75%) and variable (25%) benefits, with a risk assets allocation of 7.7%. Allianz’s riskiest investment variant has purely variable payments and the maximum risky asset allocation is 31%. After 20 years of variable benefits, Allianz customers will no longer be exposed to investment risk.

“At that time, the assets available for variable payments would have shrunk so far that investing no longer adds value for them,” says Bram Overbeek, head of products and markets for life and income at Allianz Benelux. “That’s why we will set the benefits at a fixed level by then. We want the man in the street with DC benefits to relax after he has retired. We don’t want people running unacceptable risks and therefore we have aimed at shock-proof and gradual changes without too much risk.”

Nationale Nederlanden customers will receive fixed benefits from age 85. Delta Lloyd says it will gradually reduce the investable part of the assets to zero over a nine-year period after age 85. Delta Lloyd is the only provider that will smooth both positive and negative income shocks over a standardized period of five years.

Jeroen Koopmans, managing director at the consultancy LCP Netherlands, said variable benefits could be attractive for many. “A comparison of quotes for fixed and variable benefits shows that the variable benefits will be considerably higher in the first year. The difference could be 20%, or even 35%,” he said.

“If you start at 35% plus, you could afford negative returns for some years. But it could also turn seriously wrong, with benefits ending up lower than fixed payments. If equity markets were to drop 25%, a participant with Aegon would lose more than 16% of their pension assets,” he said. Aegon said it discloses the risks of its product in its literature.

One hurdle for wider practice of the new variable option in the Netherlands is that existing DC funds are geared towards de-risking ahead of retirement, thus reducing the level of risky assets on the assumption that retirees will buy an annuity. This is set to change, however. Aegon, for example, says it will come up with a solution for that inconsistency later this year.

The insurer ASR says the lifecycle options in its DC plans will be adapted for continued investing from 2018, and is developing a product for this purpose.

Allianz has recorded the greatest interest for variable drawdown products, with a take-up rate of one in five. At €300,000 against €95,000, the average purchase price for variable benefits is much higher than for fixed annuities. Similarly, Aegon reported a purchase price of twice as much on average. However, its take-up for variable benefits is lower at just 10%. For Nationale Nederlanden the figure is 5-10%. Delta Lloyd declined to provide details.

Overbeek noted that the variable option could lose its attraction if interest rates and annuity payout rates rose in the future. “Taking risks must pay off. If interest rates rose to 7% or 8%, few would opt for continued investing,” he said.

The KPN plan said it decided to offer the variable option because 8,000 of its participants accrued pension rights under defined contribution arrangements when they worked for Getronics, an information and communications technology firm whose pension KPN acquired in 2007.

© 2017 IPE.com.

Yeah, we know about rollovers. But what about IRA asset transfers?

With some $8 trillion in IRAs, there’s plenty of interest among brokers in attracting IRA assets from other custodians. But how volatile is the IRA transfer market? What is IRA owner behavior with respect to transfers? What does it take to put their assets into play?

It turns out that IRA owners aren’t very fickle. New research from LIMRA Secure Retirement Institute suggests that only about 9% of IRA owners have moved their accounts from one broker or custodian to another in the past two years. And retirees, who have the biggest accounts, are least likely to change horses.

Indeed, the IRA custodial relationship gets stickier with age. Far fewer retirees than workers (18% vs. 82%) executed IRA transfers in the past two years. People ages 45 and older were significantly less likely than people ages 40 to 44 (29% vs. 11%) to move their IRAs recently. Gender-wise, men were much more likely than women to do so (63% vs. 37%).

Of those who moved their accounts, people with the largest IRAs—as common sense might suggest—were the most likely to seek lower fees when changing custodians. For IRA owners in general, however other factors mattered more, indicating that fees aren’t everything. “IRA companies that focus heavily on their low-cost offerings may be missing a substantial portion of the IRA-to-IRA transfer market,” an SRI release said.

By the same token, companies that do not (or cannot) compete on fees alone should highlight their brand and overall customer services, SRI advised. They should emphasize the prestige of their brand or mind their customer service manners more astutely.

Predictably, people who moved their IRAs to companies where they already did business cited “relationships” as their top reason for choosing their new custodians. People who moved their IRAs to firms where they had no prior relationship listed “recommendations” as the determining factor in their selection.

Referrals evidently matter, especially with men. Sixteen percent of IRA owners said they changed to a firm recommended by a family member or friend. Nearly a third of men (32%) said a recommendation played a role in their decisions to move their assets compared with about one in four women (24%).

In other findings by LIMRA SRI:

“Companies should ensure that their representatives are well-versed on the features offered by their company and are able to share these with clients when they call,” the release said.

LIMRA members can read the full report by visiting: Money in Motion: Understanding the Dynamics of Rollovers, Roll-ins, and IRA Transfers (2017).

© 2017 RIJ Publishing LLC. All rights reserved.

To help beef up its share of the shrinking U.S. defined benefit (DB) pension market, MassMutual has introduced a new diagnostic tool to help DB plan advisors, consultants and sponsors assess DB plan health and, ideally, find ways to raise assets and reduce liabilities.

PensionSmart Analysis, as the new tool is called, is available to DB plan sponsors through financial advisors and consultants who serve the pension recordkeeping, investments and actuarial marketplaces, MassMutual said in a release this week.

“The tool… creates a ‘persona’ that details the plan’s current status, funding level or health, service structure, and a comparison to pension plans sponsored by other employers in the same industry.” It can also help advisors and consultants identify local plans that could use a checkup, the release said.

Private and public DB pension plans in the U.S. had $8.6 trillion in assets and $4.2 trillion in unfunded liabilities as of March 31, 2017, according to the Investment Company Institute.

According to the release, the PensionSmart Analysis tool can:

© 2017 RIJ Publishing LLC. All rights reserved.

So far in 2017, $136 billion in assets changed hands among independent broker-dealers (IBDs) as a result of five merger/acquisition deals, while $80 billion was spread across 82 deals between RIAs (Registered Investment Advisors) during the same time period, according to a new report from Fidelity Clearing & Custody Solutions, a unit of Fidelity Investments.

The report, “Insights from Independent Broker Dealers,” the latest in the Fidelity Wealth Management M&A Series, reveals that fewer, but bigger M&A transactions are changing the IBD channel. A press release about the report didn’t name the firms involved.

Large IBD acquirers (firms with $10 billion+ in assets) drove the five IBD deals to-date and are helping to shape the IBD channel into a concentration of a small number of large firms. The top ten IBD firms now manage 65% of all broker-dealer assets and 48% of all broker-dealer advisors, the report said.

What’s driving M&A in the brokerage and RIA worlds? Costs are rising as broker-dealers invest in technology, advisor education and oversight to comply with regulations. Lower advisor productivity is straining bottom lines: Average assets per IBD advisor are $32.9 million, whereas advisors at independent RIAs manage $66.6 million.

Drawing upon interviews with executives at Large IBD Acquirers, the report shows how M&A enables IBDs to:

1. Refine their growth strategies. The report found that two models are emerging in today’s IBD landscape – large firms with scale and focused firms with a distinct value proposition to serve a niche.

2. Balance size and culture. Post-acquisition, large IBD Acquirers are standardizing practices and procedures to improve efficiencies, while also maintaining advisor independence and choice. The report found that the large firms are focused on advisor engagement, management continuity and productivity improvements.

3. Strengthen value propositions. Large IBD Acquirers are creating additional value to appeal to firms looking to sell and to retain advisors post-acquisition through four key strategies:

4. Mitigate operating and regulatory risk. Reducing risk is top-of-mind for Large IBD Acquirers as they evaluate acquisition targets and the advisors affiliated with them. The report found that many Large IBD Acquirers are experienced buyers with well-defined strategies and thorough vetting processes, and they will decline deals that pose potential risks to their culture, sales record and firm value.

For more information, read Insights from Independent Broker-Dealers, the latest report from the Fidelity Wealth Management M&A series.

© 2017 RIJ Publishing LLC. All rights reserved.

Overall closed-end fund (CEF) usage has increased significantly since 2013, according to a study focused on financial advisors and their use of CEFs released today by Nuveen, the investment management arm of TIAA. When looking for new sources of income, more than half (57%) of all advisors recommend CEFs as an investment option.

Nuveen’s study monitors trends in the CEF space, specifically tracking usage among the financial advisor community, which has increased since the inaugural study in 2013, and remained steady from 2016. Nearly two-thirds of advisors (62%) currently use CEFs in client portfolios – up from roughly half (51%) in 2013. Closed-end funds remain an attractive investment option as financial advisors are reportedly recommending the funds to clients seeking income and diversification opportunities for income portfolios.

Of those advisors who reported increasing CEF usage over the past year, the top two reasons include the attractive yield and return on investment as well as helping clients generate more income in their portfolios. Nine out of 10 advisors (91%) say clients ask about income producing investments – such as CEFs and other fund types. Increasing income remains the top reason for using CEFs in investment portfolios, according to 62% of the financial advisors surveyed who use CEFs.

Dubick & Associates conducted the latest version of the study of financial advisors’ closed-end fund usage on behalf of Nuveen using a sample drawn from the Discovery Database.

The study, also conducted in 2013 and 2016 by Dubick & Associates, included a weighted statistically valid sample of 326 financial advisors from wirehouses, regional broker/dealers, independent broker/dealers, registered investment advisors, bank and insurance companies. The 2017 study was fielded from April 27–May 11.

For the 11th consecutive year, Ubiquity Retirement + Savings, a flat-fee 401(k) provider for small businesses and individuals founded in 1999, has been named in the Inc. 5000 list of the nation’s fastest-growing private companies.

The 2017 Inc. 5000, unveiled online at Inc.com and with the top 500 companies featured in the September issue of Inc. (available on newsstands), is the most competitively successful group in the list’s history. The average company achieved a three-year average growth of 481%.

“Our placement on the Inc. 5000 for so many years represents our commitment to supporting small businesses and educating the market on the importance of personal savings,” said Chad Parks, CEO and founder of Ubiquity Retirement + Savings, in a release. “Since 1999, Ubiquity has strived to reach unserved markets, which makes up more than 40% of our nation’s workforce.”

A new Conning study, “Individual Life-Annuity Growth and Profit Leaders: Preparing to Change Tack” analyzes individual life-annuity insurer performance, identifies the most successful firms based on Conning’s multi-year leadership criteria, and identifies shared characteristics among the successful firms.

“Companies that met our criteria to be considered growth and profit leaders did so by successfully managing through operating and market complexity,” said Steve Webersen, Head of Insurance Research at Conning.

“Leading companies of all sizes consistently exhibited faster capital growth than their peers and had bond portfolios of longer maturity than the remaining companies. Overall, annuity products performed better in the period than life insurance, which explains the predominance of annuity specialists among the leading companies,” he added.

© 2017 RIJ Publishing LLC. All rights reserved.

There is a psychological bias to believe that exceptional events eventually give way to a return to “normal times.” Many economic commentators now focus on prospects for “exit” from nearly a decade of ultra-loose monetary policy, with central banks reducing their balance sheets to “normal” levels and gradually raising interest rates.

But we are far from a return to pre-crisis normality.

After years of falling global growth forecasts, 2017 has witnessed a significant uptick, and there is a good case for slight interest-rate increases. But the advanced economies still face too-low inflation and only moderate growth, and recovery will continue to rely on fiscal stimulus, underpinned if necessary by debt monetization.

Since 2007, per capita GDP in the eurozone, Japan, and the United States are up just 0.3%, 4.4%, and 5%, respectively. Part of the slowdown from pre-crisis norms of 1.5- 2% annual growth may reflect supply-side factors; productivity growth may face structural headwinds.

But part of the problem is deficient nominal demand. Despite central banks’ massive stimulus efforts, nominal GDP from 2007-16 grew 2.8% per year in the US, 1.5% in the eurozone, and just 0.2% in Japan, making it impossible to achieve moderate growth plus annual inflation in line with 2% targets. US inflation has now undershot the Federal Reserve’s target for five years, and has trended down over the last five months.

Faced with this abnormality, some economists search for one-off factors, such as “free” minutes for US cellphones, that are temporarily depressing US inflation measures. But mobile-phone pricing in the US cannot explain why Japan’s core inflation is stuck around zero. Common long-term factors must explain this global phenomenon.

Labor-market developments are key, with wage growth remaining stubbornly low even as unemployment falls to “normal” pre-crisis levels. Japan is the most extreme case: with a shrinking labor force, minimal immigration, and a 2.8% unemployment rate, all standard models predict accelerating wage growth.

But however much Prime Minister Shinzo Abe urges employers to give Japanese workers a raise, growth in compensation remains sluggish: in June, total wages grew just 0.4%. In the US, too, each new batch of monthly data indicates strong employment growth and surprisingly low wage growth.

Three factors may explain this trend. For 30 years, labor markets have become more flexible, with trade union power dramatically weakened. At the same time, globalization has exposed workers in the tradable sector to global wage competition. But, most important, information technology delivers ever-expanding opportunities to automate all economic activities. In a fully flexible market labor with, as it were, a reserve army of robots, the potential for pervasive automation can depress real wage growth even with full employment.

Nominal demand, meanwhile, is still being held back by an overhang of unresolved debt. Between 1950 and 2007, advanced economies’ private debt grew from 50% to 170% of GDP. Since 2008, debt has shifted from private to public sectors, with large fiscal deficits both an inevitable consequence of post-crisis recession and essential to maintain adequate demand.

In addition, the global economy has been kept going by China’s enormous leverage increase, with the debt-to-GDP ratio up from around 140% in 2008 to 250% today. Worldwide, total public and private debt has reached a record high, up from 180% of global GDP in 2007 to 220% in March 2017. As a result, interest rates cannot return to pre-crisis levels without risking a new recession.

Facing this debt overhang, loose monetary policy alone was bound to be ineffective and, beyond some point, potentially harmful and counterproductive. Neither investment nor consumption responds strongly to ever-lower interest rates when debt burdens are high. Very low interest rates, meanwhile, generate asset-price increases, which benefit the already wealthy and reduce the income of less wealthy bank depositors, who in some circumstances might cut consumption more than deeply indebted borrowers increase it.

In this context, as Princeton University economist Christopher Sims argued in 2016, loose monetary policy cannot work through normal transmission channels, and is effective if, and only if, it facilitates fiscal expansion by keeping government borrowing costs low.

Nominal GDP in the US has grown faster than in the eurozone since 2007 because the US ran deficits averaging 7.2% of GDP versus the eurozone’s 3.5%. Global growth today is crucially underpinned by China’s 3.7%-of-GDP fiscal deficit, up from 0.9% in 2014. Japan’s continued growth is assured only by large fiscal deficits stretching well into the 2020s; the Bank of Japan, which now holds government bonds equivalent to about 75% of GDP, will hold some of them forever, permanently monetizing accumulated fiscal debts.

The partial recovery this year thus reflects neither a return to pre-crisis normality nor the success of monetary policy alone. But, even if inflation rates remain below target, there is still a good case for some interest-rate increases. Because ever-looser monetary policy alone is decreasingly effective beyond some point, it can be partly reversed with little danger to nominal demand; and slightly higher interest rates would temper, even if only mildly, the in-egalitarian impact of the current policy mix.

But the rate increases will and should be very small. I doubt that the US federal funds rate will exceed 2.5% in 2020, while Japanese and eurozone rates will rise only marginally, probably remaining well below 1%. Inflation is more likely to undershoot than to exceed 2% targets. Moderate growth at best will be insufficient to offset the impact of the lost decade of 2007-17.

The psychological bias to expect a return to “normality” will remain strong. But the drivers of post-crisis economic performance are so deep that no return to normality is likely any time soon.

Adair Turner, a former chairman of the United Kingdom’s Financial Services Authority and former member of the UK’s Financial Policy Committee, is chairman of the Institute for New Economic Thinking. His latest book is Between Debt and the Devil.

© 2017 Project-Syndicate.

Bryan Anderson and Nathaniel Pulsifer are two expert fly-fishermen in northwestern Montana who also sell annuities to investors all over the country via the web. Anderson leads AnnuityStraightTalk, their indexed annuity (FIA) business. Pulsifer heads up DCF Exchange, their secondary market annuity (SMA) business.

An SMA and an FIA are central to the retirement income plan they’ve submitted for Andrew, 64, and Laura, 63, the real-life near-retirement empty-nesters who have $1.25 million in a balanced portfolio, most of it tax-deferred, about $1 million in home equity. RIJ asked its readers to submit income solutions for them, and this is the fifth plan that we’ve published. (For more about Andrew and Laura, click here.)

SMAs, if you’re new to them, are the “used” contracts referenced in our headline. These are income streams or lump sum payouts that were originally awarded to individuals as monetary awards in wrongful injury suits. The recipients of these annuities have the option of keeping them or selling them to investors for lump sums.

Asset securitization firms like J.G. Wentworth are able, with court approval, to buy billions of dollars of such “structured settlements” at steep discounts. Smaller factoring firms, like DCF Exchange, also buy the income streams. They restructure and resell them to individuals for up to 25% less than the price of a comparable retail annuity.

Indexed annuities also figure in the income plan that Anderson and Pulsifer (right) created, but in a counterintuitive way. Instead of recommending that the couple buy an FIA and use a lifetime income benefit rider, they suggest purchasing an accumulation-only FIA and using the 10% annual no-penalty withdrawal option as a source of emergency income.

Quick takeaway

Anderson and Pulsifer noticed that most of Andrew and Laura’s $1.24 million in savings is in SEP IRAs. The couple can therefore expect to take required minimum distributions of at least $40,000 a year starting at age 70½. They advise the couple to spend about half of their qualified savings on two contracts: A fixed period-certain SMA to provide income roughly equal to their RMD for the first 15 years of retirement and an FIA for growth or contingent income.

The annuities, pension and Social Security will provide the couple with income that’s immune to market volatility. Since the couple won’t need to sell other assets for income, they can afford to invest most of the rest of their savings in equities. The anticipated growth from equities, plus home equity and long-term care insurance, can finance their lifestyle and medical expenses later in life. In the meantime, equity upside can help protect them from inflation risk.

AnnuityStraightTalk assumptions

Advice point

Laura and Andrew need to be wary of sequence of returns risk. With about $1 million in tax-deferred accounts, including traditional and SEP IRAs, they will begin taking substantial required minimum distributions at age 70½. They also have a high equity allocation. “This can be a significant issue in volatile market years, with Uncle Sam forcing you to sell securities in down markets to satisfy RMDs,” Pulsifer and Anderson said. Their recommended solution provides guaranteed income to cover these RMDs and neutralize sequence of returns risk.

Advice point

With bond yields so low, the couple also faces interest rate risk. If they decided to rely on bonds or bond funds for income in retirement, they’d be exposed to the risk that rates might rise and reduce the value of their principal. If rates don’t rise, the low returns would stunt their portfolio growth. Anderson and Pulsifer’s solution, using the index annuity as an alternative allocation to their bond holdings, reduces this interest rate risk, and provides a safe protected growth vehicle.

Advice point

The two advisors considered and ultimately rejected single premium immediate annuities (SPIA), variable annuities (VA) and FIAs with living benefits, as well as the 4% withdrawal rule, as income solutions for Andrew and Laura. They chose a period-certain SMA instead of a retail SPIA because of its higher internal rate of return (IRR) and because the couple can buffer longevity risk with other assets. As for the guaranteed lifetime withdrawal benefits associated with VAs and FIAs, they found that an SMA cost less and offered higher monthly payouts. The SMA income was also more predictable than income from the VA. Regarding the 4% withdrawal rule (with annual inflation adjustments), they thought it carried little or no protection from sequence risk, market risk or longevity risk.

Advice point

Anderson and Pulsifer’s plan assumes a reallocation at age 85, rather than at the higher ages that other advisors have begun to use. “The surplus in their equity portfolio and in their two homes will be the couple’s longevity protection,” they told RIJ. “In our planning practice, very few people who have assets like Laura and Andrew need to annuitize or buy lifetime income. Longevity risk simply isn’t a concern for them. Their assets and other sources of income will be more than adequate.”

AnnuityStraightTalk/DCF Solutions recommendations

The optimal solution will allocate 40% of their combined qualified funds into two different annuity products. For guaranteed income, we use a period-certain guaranteed payment stream provided by a secondary market annuity from the DCF Exchange.

Bottom line

Adding $42,000 in guaranteed income from an SMA to Laura and Andrew’s other safe sources of income (Social Security, pension and rent on their second home) will provide enough income to meet their income and RMD needs. This will maximize their peace of mind even as they devote the rest of their portfolio, almost $750,000 to equities or other growth-oriented investments.

Adding $42,000 in guaranteed income from an SMA to Laura and Andrew’s other safe sources of income (Social Security, pension and rent on their second home) will provide enough income to meet their income and RMD needs. This will maximize their peace of mind even as they devote the rest of their portfolio, almost $750,000 to equities or other growth-oriented investments.

“Rather than pay too much and lock themselves into a rigid paycheck for life, or let the markets rule their fate, Andrew and Laura should allocate a portion of their assets to two smart, safe-money assets that will protect their principal and create multiple sources of guaranteed income insulated from volatility. This relieves pressure on other investments, provides security, and allows for growth that will reduce their longevity risk and secure their inheritance goals,” Pulsifer and Anderson (at left) said.

SMAs, it should be said, are in relatively short supply and require careful due diligence before purchase. The supply of secondary market annuities is only $800 million to $1 billion per year, according to Pulsifer. Large asset securitization firms buy an estimated 80% of that amount, leaving the rest for smaller factoring firms. Because the market is so small, investors need to be careful, and to work only with reputable agents who can document each link in an SMA’s chain of ownership.

© 2017 RIJ Publishing LLC. All rights reserved.

With tax reform soon to dominate our disquiet national discourse, I propose a modest change in the tax code with respect to qualified longevity annuity contracts, or QLACs. Income tax on withdrawals from QLACs should be eliminated. If so, QLACs would be the new Kardashians, in terms of media attention.

Most Americans don’t know a QLAC from an Aflac. But retirement income mavens know that QLACs are deferred income annuities, purchased with up to 25% of a person’s qualified savings (or $125,000, if less) to generate income starting after age 70½ but not later than age 85.

QLACs haven’t had time to build much familiarity. The Treasury Department, in an effort led by deputy secretary Mark Iwry, introduced them in the second half of 2014. QLACs act as insurance against outliving your savings. Until you take income from a QLAC, you can exclude its value from your required minimum distribution (RMD) calculations.

For example, a person with $500,000 in a rollover IRA at age 65 could buy a QLAC with as much as $125,000. At age 70½, he or she would calculate their RMD on the basis of $375,000 instead of $500,000. The QLAC exclusion reduces the RMD and the income tax bill by 25%. When QLAC withdrawals begin, they’re taxable as ordinary income.

QLACs are available if you know where to look. Vanguard investors can buy them at IncomeSolutions.com. Fidelity investors can buy them on Fidelity’s annuity platform. You can buy them through immediateannuities.com. New York Life and Northwestern Mutual Life agents sell them.

So far, sales are low. But nothing would jump-start the deferred income annuity (DIA) market or make longevity risk a top-of-mind concern better than eliminating future income tax on QLACs. Perhaps only those payouts that begin at age 80 or later would be tax-free. That would encourage the intended use of DIAs: to provide income during the years when you are least likely to be alive (and when longevity insurance is cheapest).

Uncle Sam won’t miss the tax revenue. The IRS, I’ve been told, doesn’t even bother to count taxes paid on RMDs separately from other income taxes.

Deficit hawks are thinking: Whoa. Republicans and Democrats can’t afford to play the Two-Santa game any longer, with Republicans handing out new tax cuts to wealthy voters and Democrats handing out new spending programs to struggling voters.

Perhaps we can find the money. Maybe 401(k) participants could check a box that says they’ll take only 75% of the tax break on their contributions. They would pay for their untaxed QLAC withdrawals in advance. New research shows that, even in our instant-gratification culture, many people still like paying it forward.

Or perhaps we could assume that QLACs would pay for themselves by reducing the likelihood that people over age 80 will run out of money and need public assistance. (Alternately, QLACs might meet the conditions of a “Medicaid-friendly” annuity and be excludable from available assets. It may depend on which spouse wants to qualify for Medicaid. I’ll check into that.)

Some might say that such a tax benefit would wasted on the many older Americans who aren’t likely to pay much tax on their QLAC income anyway. In that case, it wouldn’t cost much. But it would still raise awareness of QLACs.

Other countries have combined tax benefits with longevity risk protection. In Britain, before the annuitization mandates were repealed, the government sweetened annuity purchases by letting retirees spend 25% of their tax-deferred savings tax-free. Singapore, I believe, has experimented with a two-period retirement system, involving a period of systematic withdrawals followed by a period of annuitized income.

Longevity risk pooling—either with life insurance products or low-cost tontines (as Moshe Milevsky recommends)—is the most efficient societal response to the problem of financing unknown life expectancies. A tax break for QLACs would rivet the public’s attention on longevity risk. Now’s the time to ask for it.

© 2017 RIJ Publishing LLC. All rights reserved.

For RIJ readers with an academic or commercial interest in tontine annuities, a South African company by the name of NOBUNTU —loosely translated from Zulu into female spirit of the community—has just launched a novel savings scheme for low income South Africans.

You can think of this as a micro-pension plan for domestic and other workers who have little in the way of savings for retirement. Right now their only source of retirement income is ad hoc support from their prior employer (a gift when they retire) plus a meager sustenance-level pension (Social Grant) from the government; hoping that president Zuma keeps his pension promises.

The way the new scheme works is that every month individuals or employers will contribute a handful of ZARs (South African Rand) to a savings fund, using a text message or WhatsApp. The technology is quite clever, if I may say so myself.

Half the invested or contributed funds are allocated for paying out funeral costs—which is a really big deal in South African culture—and the other half is allocated to what we would call a long-term pension plan. With that part of the pot, if-and-when a participant dies, the money in the pension half of their account is redistributed to survivors in their community in the spirit of solidarity, hence the name of the company Nobuntu. Upon death, the family or beneficiaries only receive the funeral pot. The other half of the pot is forfeited to the group. The participant’s pension investment return, then, is a blended mix of capital, interest and perfectly transparent mortality credits. In essence, this is a modern day (21st century) tontine scheme.

Now, before you say to yourself: “tontines in the South African townships?” and laugh hysterically, please note the following. The company is targeting women in the 50 to 80 age range, many of whom are forced to support two or even three generations of family members in their household. They aren’t selling this on the streets. Note that the unemployment rate in these areas is a staggering 40%. So, this isn’t intended as a lottery, gamble or some perverse pyramid scheme. It is designed to squeeze the highest amount of return from the lowest amount of capital, while respecting their (cultural) need for funeral funds, etc. In other words, every ZAR is made to count using the tontine element.

Now, before you say to yourself: “tontines in the South African townships?” and laugh hysterically, please note the following. The company is targeting women in the 50 to 80 age range, many of whom are forced to support two or even three generations of family members in their household. They aren’t selling this on the streets. Note that the unemployment rate in these areas is a staggering 40%. So, this isn’t intended as a lottery, gamble or some perverse pyramid scheme. It is designed to squeeze the highest amount of return from the lowest amount of capital, while respecting their (cultural) need for funeral funds, etc. In other words, every ZAR is made to count using the tontine element.

Now to my part in all of this. When the promoters (Tyron, Ross and Reka) contacted me a few months ago and informed me about their plans, I was intrigued enough to swing by Johannesburg on my way from (lecturing in) Sydney to London. In fact, I spent 72 hours in and around Soweto, which was my first time in South Africa. (I’ll get to the safaris next time around.)

It was an opportunity to observe the modern-day incarnations of the entrepreneurial Lorenzo de Tonti, pitching their novel scheme to potential participants and their employers. While many of the presentations took place in neighborhoods I would never dare to enter alone—and in the Zulu language which I don’t speak—I did pick up some great pointers on how to position annuities and longevity insurance almost anywhere in the word. It was a crash course in (African) behavioral finance and insurance. In fact, almost everyone spoke some rudimentary English and I was able to conduct real research in a place quite different from Monte Carlo.

If you are wondering, nobody in the audience asked about Internal Rates of Return (IRRs), yields to maturity or actuarial tables on which the dividends would be paid. But the audience did ask some really sharp questions about long-term security, fairness, trust and even—what we quants might call—credit default risk.

On a personal note, I developed a newfound and heart-wrenching appreciation for the personal financial challenges one faces with three generations to support and only one breadwinner in the household. Or, think about the technical challenge of pricing and valuing longevity-contingent claims when a large swath of the population has AIDS. It’s one thing to read about these things in academic papers or in books (such as Portfolios of the Poor, Princeton U.P. 2009, or the U.S. focused The Financial Diaries, Princeton U.P. 2017.) It’s quite another matter to be there in person.

Ok, so during the first meeting I was amused by the novelty of it all and readily admit my biggest concern was getting good pictures on my iPhone—much to the chagrin of my hosts. But by the second tontine enrollment meeting I started paying attention to the finer details, the audience dynamics and listening to (translations of) many of the audience’s questions. Trust me, this was no client appreciation event at Maggiano’s. Audience members were promised a can of coke and a half-donut, buy only if they stayed until the very end.

Eventually though, as the day progressed the big picture finally did sink in. It shook me. Even if these kind folks do sign-up (and start saving for their retirement) and eventually receive some tontine dividends, how will they ever manage? I was told by one of the ministers that every second person in the audience had a relative in their household who had died of AIDS.

So, Nobuntu isn’t selling souped-up variable annuities to American baby-boomers or planning on using Blockchain, Bitcoin or Etherium to help shelter your nest egg from income taxes and prying eyes. Etherium, you ask? Well, write a book about the history of tontines in the 17th century and I promise you too will be inundated with similar pitches. This plan is very different.

One of the reasons Nobuntu is such a fascinating experiment—and this young company is able to “move fast and break things”—is that they operate in a (very) loose regulatory environment, known as the Stockvel regime in South Africa. Traditionally Stockvels—well known to South Africans—have consisted of small community-based savings schemes in which friends and acquaintances help each other by pooling financial resources. Many have been plagued by fraud and other shenanigans.

This post isn’t the place or time to get into the regulations pertaining to Stockvels or how the company can innovate without bumping into multiple legal barriers. But the bottom line is that Nobuntu can get away with things that would land them in a heap of regulatory manure anywhere else in the developed world. I can only imagine what a regulator like FINRA or the SEC—let alone the state insurance commissioner—would have to say about such a scheme and the way in which it was presented.

To be clear, I don’t think there was any mis-selling taking place. The warm, kind and very welcoming people—I was invited into many of their homes, although the kosher thing got awkward—understood the risks involved. They live with constant risk. Yes, many of them might be classified as having a very low level of financial literacy, but I think they really do get what’s at stake, albeit in a non-numerical way.

So, I’m now back in North America for the fall teaching semester but I’ll be watching (what I call) the Sowe-ton-tines experiment quite closely over the next 6-18 months. The company’s success in the narrower world (i.e. “regulatory sandbox”) could be leveraged beyond the townships into a broader swath of South Africa. More importantly it could serve as a template in other developing parts of the world that lack suitable pensions or annuities. It’s a form of micro-insurance or micro-pensions with a very unique twist, the tontine element.

The founding partners of Nobuntu will soon be releasing a technical document (a.k.a. “White Paper”), to be posted on their website (http://www.nobuntu.co.za/). In it they have promised to explain exactly how they plan to manage the myriads of technical — actuarial, financial and even legal — issues that will undoubtedly arise in such a unique scheme. How will the funds be managed and invested? How will the tontine dividends be calculated? How will individuals of different ages be pooled? How will all of this be explained to participants in a way they can understand?

As you may suspect, I might even lend a hand with some of the mathematical and statistical problems, which are quite interesting in their own right. Perhaps good for a PhD thesis or even two. Stay tuned.

#TontinesForGood

To reduce dispersion of client returns and mitigate legal risks, more wirehouses and brokerages have begun encouraging their advisors to outsource portfolio construction and become relationship-builders, according to new research from Cerulli Associates, the global consulting firm.

“Going forward, if you want to be an advisor, you have to place your value-add on goal-based planning, and other higher-order planning activities. If your value prop is creating asset allocation models, then you have to rethink it,” Tom O’Shea, associate director at Cerulli, told RIJ in an interview.

The trend comes mainly from the Obama Labor Department’s fiduciary rule, which will have a big effect on brokerages regardless of how much the Trump administration weakens it, O’Shea said: “The people we talk to use a lot of metaphors like, ‘The horse is out of the barn’ and ‘the toothpaste is out of the tube.”

Wirehouses and brokers have seen the dispersion of returns created by independent-minded “reps-as-portfolio-managers” using discretionary managed accounts, and see legal or regulatory liability there. That risk exposure would largely vanish if a single, centralized investment team laid down investment guidelines.

More to the point, individual advisors too often deliver lower investment returns than the centralized team. “Many advisors pride themselves on their portfolio management skills,” said Cerulli, in a release. “But Cerulli finds that home-office portfolios outperform open portfolios managed by advisors.”

“As regulatory risk increases, firms look more closely at fees and pricing schedules, product choice, and advisor discretion. Home offices will require even the most sophisticated advisors to document each action to protect themselves from future inquiries,” the release said.

“Increasing due diligence may be cumbersome and expensive to many advisors. As a result, advisors will gravitate toward offloading this responsibility to their home office or a third-party strategist,” the release added.

“While advisors prefer managed account products such as rep-as-portfolio-manager (RPM) or rep-as-advisor, centrally researched, packaged offerings may be the future. Advisors enjoy the flexibility that RPM allows them, but more sponsors and advisors have started to realize that advisor discretion may not be optimal.”

Whether advisors would still be able to claim their own “book of business,” in terms of assets under personal management, or evolve into soft-skilled planners, or make as much money, O’Shea couldn’t say. But he agreed that advisors may not be compensated as much for delivering packaged products as for managing risky assets where they can attribute upside performance to their own skills.

Regarding a product like no-commission indexed annuities, first introduced in 2016, O’Shea doubted that advisors could justify charging a full one percent management fee on the assets devoted to those products, which are guaranteed and relatively static. He likened them to bond-ladders, on whose underlying value firms might charge only “25 to 30 basis points.”

Of the managed account providers that Cerulli recently surveyed, 79% said they expected managed account fees to decline, with an expected reduction of about 10%, O’Shea told RIJ. “You’ll see advisory fees coming down. The industry understands that.”

The rise of computer-driven advice is also driving the trend. Digital advice appeared two decades ago with Financial Engines’s algorithms and Monte Carlo simulations for individual retirement plan participants. The arrival of Envestnet and other turnkey asset management programs (TAMPs), which now manage about $250 billion, added momentum. In the last three years, with cheap computing and API plug-ins, robo-advisors have piled in.

“Digital advice is part of this trend, in the sense that it’s a long term trend traceable to the beginning of online trading,” O’Shea told RIJ. “Stockbrokering went away as a value ad. Digital advisors have already shown that creating asset allocation and rebalancing and security selection is analogous to what happened to stock trading in the 1990s. Its not a value add for the advisor. Financial Engines invented this in 1999, so its been going on for a long time.”

Outsourcing of portfolio construction favors unified managed accounts (UMAs), which have grown 23.3% during the past year. Most advisors expect to increase UMA assets by 2018. At present, more than half (55%) of UMA assets are housed at wirehouses and 14.9% at direct firms, Cerulli said.

The third quarter 2017 issue of The Cerulli Edge – U.S. Managed Accounts Edition discusses in-sourcing versus outsourcing, and how age, designations, and channels are contributing factors, and how regulatory changes prompt review of packaged versus open or hybrid portfolios.

© 2017 RIJ Publishing LLC. All rights reserved.

Matt Fellowes, who founded HelloWallet in 2009 and sold it to Morningstar in 2014 for $52.5 million, has launched a new, web-based, hybrid digital money management solution “for people near or in retirement.” The new firm, United Income, raised $5.8 million in capital in 2016 and gathered $200 million in assets during a private beta launch, according to release this week.

An SEC-registered investment adviser open to clients in all 50 states, United Income offers a free financial plan, including advice on retirement age and Social Security claiming.

Membership starts at 0.50% annual fee on assets under management for self-service financial planning, investment management, and the retirement paycheck and goes up to 0.80% for unlimited access to a personal financial advisor and concierge service.

“United Income offers holistic financial planning and investment management aimed at extending the life and potential of money,” the release said. “It examines millions of potential future market and life outcomes, creating personalized projections of future changes in spending on health and other items.”

Fellowes claimed that United Income’s financial planning methodology and investment recommendations can increase the average 64 year-old’s chance of having enough money in retirement to 65.1% from 9.4%, compared to other low-cost retirement income solutions.

United Income has been advised by the former Commissioner of the Bureau of Labor Statistics, Director of Policy Research at the Social Security Administration, Deputy Assistant Secretary of Treasury in charge of tax policy, Deputy Chief of Staff at the Centers for Medicare and Medicaid, and Senior Advisor to the Secretary of the Treasury, among others, the release said.

Services on the United Income platform include:

Budgeting and Spending. These services are designed to help members determine how much they can spend annually, recognizing that household spending can fluctuate by as much as 50% year-to-year in retirement. United Income uses custom models to provide personalized projections to members for essential expenses, health expenses, lifestyle expenses, and charitable giving or inheritance planning.

Investment Management. These services are designed to help members make investment decisions to better enable them to reach their goals, even creating a custom investment strategy for each spending need. United Income’s investment management approach also integrates automatic rebalancing and tax optimization.

Financial Planning. These services consider millions of potential life and market outcomes to build personalized plans that aim to maximize the probability of achieving as many of an individual’s retirement needs and goals as possible. This includes recommendations on retirement age, Social Security claiming age and strategy, and more.

Account Sequencing. This service is designed to help retired members lower their taxes and improve investment returns by helping to determine which account to withdraw money from and when.

Retirement Paycheck. This service aggregates different retirement income streams to provide members with a monthly paycheck, so they know how much they have to spend and can budget to that amount – just as they did during their working lives.

In addition, “Concierge Services” will enroll members in Social Security and Medicare benefits. “United Income will also curate opportunities for users to pursue their hobbies, passions and dreams, including volunteering opportunities and obscure adventure trips,” the release said.

© 2017 RIJ Publishing LLC. All rights reserved.

Industry-wide annuity sales totaled $50.4 billion in the second quarter of 2017, up 2.4% from $49.2 billion in the first quarter but down 9.8% from $55.9 billion in the second quarter a year ago, according to the Insured Retirement Institute, Beacon Research, and Morningstar, Inc.

Variable annuity total sales were $23.7 billion in the second quarter of 2017, up 1.7% from $23.3 billion in the prior quarter and down 10.2% from $26.4 billion in the second quarter of 2016, according to Morningstar.

Fixed annuity sales during the second quarter of 2017 rose to $26.7 billion, up 3.1% from $25.9 billion during the first quarter and down 9.5% from $29.5 billion during the second quarter of 2016, according to Beacon Research.

The increase in total fixed annuity sales was led by sales of fixed indexed products (FIA) and income annuities. FIA sales rose 10% to $14.9 billion from $13.6 billion in the first quarter of 2017. Sales were down 7.1% from $16.1 billion in the second quarter of 2016, however. Sales of income annuities rose to $2.8 billion, up 11% from $2.5 billion in the first quarter.

Combined sales of book value and market value adjusted (MVA) annuities were $9.0 billion, down 7.7% from $9.8 billion in the first quarter and down 8.9% from $9.9 billion in the second quarter 2016. For the entire fixed annuity market, there were approximately $15.1 billion in qualified sales and $11.6 billion in non-qualified sales during the second quarter of 2017.

Variable annuity net assets rose 1.8% to $1.98 trillion during the second quarter of 2017, according to Morningstar. On a year-over-year basis, assets increased 5.1%, from $1.88 trillion at the end of the second quarter of 2016, as positive market performance offset lower sales and negative net flows.

Net flows in variable annuities were negative $14.8 billion in the second quarter. Within the variable annuity market, there were $15.3 billion in qualified sales and $8.4 billion in non-qualified sales during the second quarter of 2017. Qualified sales fell 1.8% from first quarter sales of $15.6 billion, while sales of non-qualified variable annuities rose 8.6% from first quarter sales of $7.7 billion.

“While total variable annuity sales rose slightly,” said John McCarthy, Senior Product Manager at Morningstar, “the largest increases were in non-qualified sales. We are also seeing growth in newer investment-oriented products such as structured annuities. These products offer tax deferral, growth potential and downside protection, and the ability to selectively convert account value to guaranteed lifetime income.

“Sales of structured variable annuities are on the rise, climbing to $1.6 billion in the second quarter of 2017, or 6.7% of total variable annuity sales, as compared to $1.2 billion, or 4.5% of sales, in the second quarter of 2016.” AXA, Brighthouse and Allianz Life are prominent sellers of structured variable annuities.

© 2017 RIJ Publishing LLC. All rights reserved.

The Boston-based Wagner Law Group issued the following alert this week:

The DOL recently proposed to extend the transition period by 18 months (i.e., from January 1, 2018 to July 1, 2019) for the full implementation of the Best Interest Contract Exemption (“BICE”), the Principal Transactions Exemption, and PTE 84-24 (relating to sales of annuities and other transactions involving insurance companies and agents) (collectively, the “Exemptions”). The proposal, published in the Federal Register on August 31, 2017, is subject to a 15-day comment period.

We think it is highly likely that the DOL will finalize the proposal (although changes to the proposal are possible). The DOL stated that the Impartial Conduct Standards that are currently in effect will continue to be the sole conditions for the Exemptions during the extended Transition Period (i.e., the period in which the exemption is available but compliance with the full conditions of the exemption is not necessary).

Briefly, the Impartial Conduct Standards require that the financial institution and its advisors:

(1) Act prudently and in the best interest of the retirement investor without regard to the financial institution’s or advisor’s interests,

(2) Charge no more than reasonable compensation, and

(3) Do not make misleading statements.

If you are in compliance with those standards now, the proposed extension does not otherwise increase or extend your liability.

However, we note that it is unclear if the DOL will extend its current temporary enforcement policy on the Exemptions. The DOL previously stated that it would not take action against financial service providers for failing to comply with the Exemptions as long as they were “working diligently and in good faith to comply with the fiduciary duty rule and exemptions” during the Transition Period, which was then scheduled to end on January 1, 2018.

In its recent proposal, the DOL asked for comments on whether to continue with this approach, suggesting that the DOL has not yet decided how to handle enforcement of the Impartial Conduct Standards.

What Do I Do Now? In this environment, a critical and bottom-line question for financial advisers and financial institutions is “What do I do during the Transition Period?”

For all its many faults, the Exemptions, especially the full BICE, provided compliance professionals with a long checklist of specific compliance items. The Impartial Conduct Standards are somewhat more vague and do not necessarily lend themselves to easy compliance checklists.

Below is a non-exhaustive list of steps that financial institutions and financial advisors can take to protect themselves and demonstrate compliance with the Impartial Conduct Standards during the extended Transition Period, or at least until it becomes more clear what the compliance landscape will look like after the Transition Period is over. Although no single step listed below is required by law or regulation, we think it is important for financial advisers and institutions to take some steps to implement and enforce the Impartial Conduct Standards.

Best Effort Compliance. The DOL, IRS and SEC will continue to share audit information and make cross-referrals under existent inter-Departmental protocols. Regardless of the stated enforcement position of any of these regulatory bodies, a demonstrated effort to meet the Impartial Conduct Standards during this Transition Period (whether it ends in 2017 or extends to a later date as currently proposed) will be a powerful factor in a finding of compliance for the financial institution. The presence of well-documented client files, formally adopted processes and procedures, evidence of attempts to adhere to such processes and procedures, and internal compliance training will be among the most impactful factors to demonstrate efforts to comply with the Impartial Conduct Standards.

© 2017 Wagner Law Group.

Three-quarters of Americans want guaranteed lifetime income, but less than half (46%) know that annuities can provide this feature, according to a new report from Jackson National Life and the Insured Retirement Institute.

The report, The Language of Retirement 2017: Advisor and Consumer Attitudes Toward Securing Income in Retirement, is based on a March 2017 survey of 1,000 consumers age 25 or older with at least $10,000 in retirement savings, along with several hundred annuity owners and financial professionals.

More than 80% of advisors say that guaranteed lifetime income product features have had a positive impact for their clients, and one-third say it is the most impactful feature of annuities. Further, a 90% of all consumers who responded, and 95% of those 35 to 44 years old, are very or somewhat interested in receiving lifetime income.

While 63% of advisors recommend annuities to their clients, only one in four respondents age 45 and up plan to purchase an annuity.

More than half of the financial professionals surveyed believe at least some of their clients who do not own annuities will run out of money during retirement. More than half of advisors said they have had clients who exhausted their financial resources, mainly because of overspending and/or health care costs.

Of advisors who responded, 61% believe negative client perceptions of annuities present a barrier. Almost half of advisors say their clients believe annuities are too expensive.

Additional key highlights of the study include:

BitcoinIRA.com, a firm that allows investors to purchase Bitcoins and other crypto-currencies for their IRA or 401(k) retirement accounts, announced this week that it has begun offering Litecoin (LTC), Ethereum Classic (ETC), and Bitcoin Cash (BCH) for investment.

The service includes setting up a qualified cryptocurrency account, rolling over funds from an existing IRA custodian, executing a live trade on a leading exchange and then moving funds into BitGo, a secured multi-signature digital wallet. Individuals can roll over retirement funds into whole coins or into a percentage of each.

BitcoinIRA.com now offers six coins for investment: Bitcoin, Ethereum, Ethereum Classic, XRP, Litecoin and Bitcoin Cash. BitcoinIRA.com first offered altcoin Ethereum (ETH) in April of 2017 and released XRP (Ripple) in August.

“We’re excited to offer our customers the chance to capitalize on this technology and build a retirement portfolio with Bitcoin and altcoins,” said Chris Kline, chief operations officer at BitcoinIRA.com. Based in Los Angeles, Bitcoin IRA is privately funded.

The U.S. digital advice market is growing fast, with the number of robo-advice clients projected to reach 17 million by 2021, up from 1.8 million in 2016, according to “U.S. Digital Advice: Consolidation, Fee Disruption, and the Battle of the Brands,” a new report from Aite.

The report measures consolidation in the U.S. digital advice sector and describes the battle between major financial brands over new subscription models for pricing wealth management services. The report tries to answer some basic questions that impact the global trend:

Based on research conducted from August 2016 to July 2017, the report includes a series of structured and unstructured interviews with executives at leading firms in the digital advice industry as well as the analysis of public filings.

Firms mentioned include Acorns, Ally Invest, Alpha Architect, AssetBuilder, Bank of America, BATS, Betterment, BlackRock, blooom, Charles Schwab, Covestor, Edelman, Ellevest, E-Trade, eSavant, Global Trading Systems, Fidelity Investments, Future Advisor, Hedgeable, Invesco, Merrill Edge, Morgan Stanley, Nasdaq, New York Stock Exchange Arca, Personal Capital, Pimco, Raymond James, Rebalance IRA, Ritholz Wealth Management, Scalable, State Street Global Advisors, Sigfig, SoFi, TD Ameritrade, T. Rowe Price, The U.S. Securities and Exchange Commission, UBS, VanEck, Vanguard, Wealthfront, Wela Strategies, Wells Fargo, Wise Banyan, and WorthFM.

AXA will collaborate with gerontologist Sandra Timmermann, Ed.D., to deliver training around aging issues, including offering client seminars and creating training materials for financial professionals and informational packets for clients, the insurer announced this week.

Dr. Timmermann’s areas of expertise include retirement life stage issues and connecting the dots between aging at home and long-term care protection. She covers subjects ranging from retirement finances, family needs and intergenerational relationships, housing and aging in place, long-term care and other transitional topics.

Timmermann founded the MetLife Mature Market Institute and has held senior staff positions with several aging organizations including the American Society on Aging, AARP and SeniorNet. She is currently a visiting professor of gerontology at the American College of Financial Services and writes the financial gerontology column for the Journal of Financial Service Professionals.

While Middle American men and women share similar feelings of financial security, women are more likely to worry about their personal finances and with good reason: they are three times more likely to say they cannot afford to save for retirement, according to a new study from Massachusetts Mutual Life Insurance Co. (MassMutual).

Four in 10 women (39%) and 35% of men with annual household incomes of between $35,000 and $150,000 report feeling “not very” or “not at all” financially secure, according to the 2017 MassMutual Middle America Men & Women Finances Study (Men & Women Finances Study). The internet-based study polled 1,010 middle-income Americans and finds men and women have different saving habits, especially when it comes to retirement. The study is being released to mark 401(k) Day on Sept. 8.

One in two women (51%) say they worry at least once a week about money compared to 45% of men, according to MassMutual’s Men & Women Finances Study. Women are also more likely to bring those worries to work while men are twice as likely to say they never worry about money, the study finds.

He saves, she saves

Men and women differ in their approaches to saving money, especially when it comes to retirement. Both genders overwhelmingly agree they are not saving enough for retirement (74% women; 71% men) but men tend to be more confident when it comes to being financially secure when they eventually retire. Nearly half of Middle American women (47%) say they are “not very” or “not at all” confident about being financially secure in retirement compared to 39% of men, the study shows.

Women worry with good reason. Forty-four% of women in Middle America report they cannot afford to save for retirement compared to 14% of men, according to the study. One in four women says they don’t save because their employer either doesn’t match retirement plan contributions or doesn’t offer a compelling match. Twenty-one% of men say the same, the study finds.

Only two in 10 women report having $10,000 or more in savings for financial emergencies compared to three in 10 men, the study reports. Seventy-three% of women who are not saving for anything other than retirement say all of their income goes towards monthly expenses and bills; 62% of men say the same. Women are also less likely than men to use any extra money to pay off debt (38% to 47%, respectively).

When they do save, men and women typically take different approaches. Women are more likely than men to save “whatever is left after expenses” (47% women; 34% men) while men are more likely to save a set amount each month (33% women; 44% men).

The American Association of University Women (AAUW) reported that women typically are paid 80% of what their male colleagues earn for the same job.

He worries, she worries

Women tend to worry more than men about several different aspects of life, especially politics, money and family.

|

From day to day, how worried are you about each of the following? |

Men Very or somewhat worried |

Women Very or somewhat worried |

|

Politics/direction of the country |

59% |

74% |

|

Your household’s financial situation |

51 |

57 |

|

Health and well-being of parents or in-laws |

50 |

52 |

|

Personal health |

43 |

38 |

|

Health and well-being of children |

30 |

40 |

|

Marriage/love life |

22 |

21 |

|

Housing situation |

25 |

27 |

|

|

|

|

Those who worry about money at least once a week report negative implications for their health and well-being, especially women. Women are more likely to blame financial concerns for stress (59% women; 54% men), hurting their social life (43% women; 37% men), affecting the frequency or quality of their family’s medical or dental care (27% women; 17% men) and negatively impacting their marriage or romantic relationship (30% women; 25% men).

© 2017 RIJ Publishing LLC. All rights reserved.

Four years ago, the Nobel Prize-winning economist Bill Sharpe started writing a blog to chronicle a pet project. “This is a new blog,” he wrote at the time, “on which I plan to post material on creating and analyzing ranges of scenarios for retirement income using different strategies for investing, spending and annuitizing retirement savings.”

That blog is now an e-book, called “Retirement Income Scenario Matrices” or RISMAT. The 21 free, download-able chapters comprise two books braided into one: a manual for writing retirement income planning software and a more accessible, and often amiable, explanation of the philosophy behind the code.

As you might expect from Sharpe, one of the giants of Modern Portfolio Theory, the co-creator of the Capital Asset Pricing Model and the originator of the eponymous Sharpe ratio, this retirement how-to can rely on market history for its assumptions (or not, according to each user’s preference) and uses Monte Carlo simulations for its probabilistic recommendations.

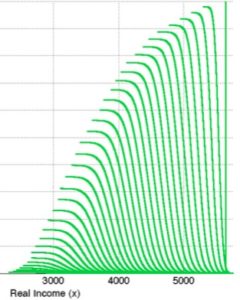

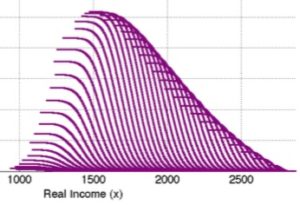

Illustration from RISMAT

But, surprisingly perhaps, this disciple of Harry Markowitz also takes a deep dive into annuities. The big tail risk in retirement, his approach implies, is not market risk but longevity risk. “Annuities are a potent and sensible instrument,” he told RIJ in a recent interview from his home in Carmel, Calif.

Many others have written software for retirement income planning. Sharpe himself has written papers on this topic before. So have the quants at Financial Engines, the 401(k) robo-advice firm he co-founded in 1996. This lengthy e-book, is written in a voice both technical and personal. It sums up the 83-year-old economist’s vision for the future of retirement income planning. Along the way, he brainstorms new ideas for life insurers, financial mathematicians, coders, broker-dealers, advisors and even individual retirees.

Notional “lockboxes”

The algorithms (written in MathWorks’ MatLab software) that Sharpe describes in this book may be rocket science, but anybody familiar with time-segmented income planning, aka “bucketing,” should feel at home with what he calls a lockbox approach, one of several that he prefers to the 4% “safe withdrawal” rule.

In one chapter, Sharpe divides retirement into two periods. During the first period, starting at the retirement date, a retired couple takes withdrawals from an investment portfolio. In one of his examples, the first period lasts 19 years and consumes 64% of savings. In the second period, if the retirees are still living, they buy an income annuity with the remaining 36%.

Each year of the systematic withdrawal period is represented by a “lockbox.” Each lockbox contains a certain portion of Treasury Inflation-Protected Securities and a share in an investment portfolio consisting of ultra-low-cost total market stock and bond index funds.

“The idea is to provide the discipline to say to yourself, ‘I will only cash the number of shares in this year’s lockbox,’ he said in an interview. “Obviously, the lockboxes aren’t really locked. If you have an emergency, you can take money out. You still have the key.”

The asset allocation depends on the client’s risk appetite or capacity. “For implementation, you’d buy a certain number of TIPS, and a certain number of mutual fund shares,” Sharpe told RIJ. “You build a spreadsheet with one column for the initial amount in TIPS and another column for the amount in a risky portfolio. Then you would multiply the number of TIPS and shares for each lockbox by their current values and figure out what they’re worth in each period. Once a year, you would sell off that year’s portions of the two at their current price. It’s an accounting/spreadsheet task.”

In the 20th year of retirement—which in this example roughly corresponds to the average American’s life expectancy—the couple, if living, buys a joint-and-survivor fixed life annuity. For the sake of liquidity, flexibility, and cost-reduction, they might prefer to make the annuity purchase an option, rather than buying an immediate or deferred annuity at retirement.

That’s a layperson’s description of Sharpe’s approach. Underneath the hood, the software relies on programmed assumptions about growth and inflation, incorporates variables about life expectancies and volatility, estimates present values, and uses Monte Carlo simulations to help identify the strategies that are most likely to bring a desired outcome.

[His software includes a valuation model so one can find present values of possible future payments to retirees and their estate. It also can compute costs of taking sequence-of-returns risk.]

Sharpe believes in this technique, but he admits its limitations. “Overall, the results of our exercise are depressing. Even if we were able to obtain a substantial history for the true market portfolio and if its returns had all been drawn from the same probability distribution every year and if future returns will be drawn from the same distribution, we could still make major errors when estimating parameters for the future distribution.

“And the reality is likely to be even worse. Political affairs, technology, communications, financial markets and financial economics have all changed radically over the last several decades. And they will undoubtedly change substantially in the future. When estimating future return distributions, humility is very much in order.”

“And the reality is likely to be even worse. Political affairs, technology, communications, financial markets and financial economics have all changed radically over the last several decades. And they will undoubtedly change substantially in the future. When estimating future return distributions, humility is very much in order.”

A retirement ‘family doctor’

In this book, Sharpe anticipates a future when life insurers, RIAs (registered investment advisors), advisors and retirees might use Sharpe’s software or something like it to create new products and processes and even to overcome some of the behavioral barriers to retirement income planning.

“I would love to see a product called lockbox annuities,” Sharpe told RIJ. “This would be an annuity in which the insurer would hold the lockboxes. The customer would tell the insurer, for example, ‘Here’s what I want in my year 2020 lockbox. Here’s the amount of TIPS I want and here’s the amount of market portfolio.’” The client would bear the market risk and reap mortality credits. “It wouldn’t cost much for the distant lockboxes. You might only pay 10% of what you would need.”

RIAs are already using homemade or licensed retirement planning software, and Sharpe hopes to see more of that. “In a small firm, there could be one or more technology specialists with detailed knowledge of the software’s functions and the ability to adapt or augment them to include additional income sources…

“The person or persons working directly with clients could focus more on communicating possible outcomes, helping the clients understand the options, then implementing some or all of the chosen approaches. Such a ‘family retirement doctor’ could help each client or pair of clients understand relevant graphs, discuss alternatives, then make informed choices.

The book also contains something for individuals. Sharpe recognizes that many retirees avoid talking about annuities or income because it forces them to contemplate their own mortality. “That’s the first hurdle: Talking about death,” he said. He thinks that his software could help retirees “think about what nobody thinks about.”

“I like the idea of sitting down and saying, ‘If I’m alive 20 years from now, and if I’ll need x amount of dollars in order to live reasonably well, what strategy should I have for that year? And if I don’t make it, do I leave my money to a charity or my children? Or do I buy an annuity, have more money and leave nothing? Or some combination of the two” he said.

“The hardest thing to think about is the issue of mortality. The lock box concept helps you think about that and can give you a cost-efficient strategy for each year. Behaviorally, it makes you think seriously about the future.”

© 2017 RIJ Publishing LLC. All rights reserved.

Investors, like George Costanza on ‘Opposite Day,’ should never trust their own instincts. In 1975, when they should have stocked up on cheap stocks (as a guy named Buffett did), they wouldn’t touch equities. In 1999, when people should have dumped tech stocks, the dot.com mystique held them transfixed.

So it is today. Boomers should be buying guaranteed income products and treating equities like (excuse the near-anachronism) overdue library books. They should take the profits that the Fed has showered on them since 2009 and lock the gains into personal pensions.

But they aren’t. As LIMRA’s Secure Retirement Institute reported two weeks ago, annuity sales at mid-2017 were at the lowest level for a half-year since 2001. For this year, the SRI predicts that variable annuity sales will drop below $100 billion for the first time since 1998, when stocks were up and the 10-year Treasury rate was as high as 5.7%.

The variable annuity market, which is more accurately a subset of the mutual fund market, should do well when stocks are up, but it isn’t. Indexed annuities, which are supposed to do well when bond yields are down, have seen their fantastic run stalled. Fixed income annuity sales are down too. The annuity marketplace feels strangely quiet, one booth shy of a trade show.

The government is of course partly to blame. The Obama DOL, keen on QLACs but suspicious of VAs and FIAs, put a big chill on those two products. The Trump DOL pushed back the deadline for compliance with the fiduciary rule but didn’t bring annuities in from the cold. (Have you noticed that firings, cancellations, delays and postponements are this administration’s primary policy tools?)

And, of course, annuities themselves are to blame. Sex them up as much as we’d like, insurance is an expense, not an investment. But why do people believe that equities are safer?

There’s a more fundamental obstacle to making annuities more available to their logical buyers: American retirees who have at least a few hundred thousand dollars in savings, who guzzle kombucha and snack on flaxseed to maximize their lifespans, and who lack corporate or public pensions.

Advisors are both the problem and the solution. The problem is the strong tendency for most financial intermediaries to specialize either in investments or insurance, not both. Once an advisor settles into a product category (risky or guaranteed), regulatory regime (state or federal), theoretical foundation (MPT or the law of large numbers) and revenue model (commission or AUM-based), he or she tends to stick with it.

Quants and actuaries just don’t hang out much.

To be sure, many advisors have become “ambidextrous.” You can find them among the graduates of RIIA’s Retirement Management Analyst program or The American College’s Retirement Income Certified Professional course. You can meet them here in the virtual pages of Retirement Income Journal. But they’re still a tiny minority. Investors don’t know about them, and don’t know where to look.