Taking advantage of provisions in the SECURE Act of 2019, Principal Financial Group will roll out a new Pooled Employer Plan (PEP) in 2021, marketing the Principal EASE multiple employer 401(k) plan to a range of employers, from start-ups with as few as 10 workers and to companies with as much as $10 million in existing plans.

Principal EASE will be a packaged 401(k) plan that combines integrated retirement plan administration, customer service and investment management services. Principal will serve as the Pooled Plan Provider (PPP), or oversee of the PEP, while National Benefit Services will be the third-party administrator (TPA) and Wilshire will handle the investments as a 3(38) fiduciary. (The numbers refer to B of the Employee Retirement Income Security Act of 1974, or ERISA.)

Congress created the SECURE Act in part to close the so-called retirement plan “coverage gap,” which refers to the fact that 40% or more of full-time workers in the US are at any given time without a tax-deferred payroll savings plan at work. The gap is especially prominent among small employers without the administration resources needed to sponsor a single-company 401(k) plan.

PEPs are intended to invite dozens or hundreds of small firms into a single turnkey plan that relieves the employer of all but a minor responsibility for selecting a legitimate provider. Principal, which operates 49,000 retirement plans in the US, would presumably fill the bill.

The SECURE Act does not require PEP providers to market only to firms without existing plans or to offer annuity options to participants. Principal plans to offer EASE to existing and prospective clients, and Wilshire will offer Principal’s Pension Builder deferred income annuity as an in-plan investment option.

Joni Tibbetts

“We will make the PEP available to our existing clients,” Joni Tibbetts, vice president of project management at Principal, told RIJ. “But EASE is focused on simplifying the choices for participants, and our existing clients won’t necessarily want to make that kind of change. Principal is indifferent to whether [a current plan client] joins the PEP or not.” In 2019, Principal acquired Wells Fargo’s Institutional Retirement and Trust business, becoming one of the largest retirement plan providers in the US.

Another goal of the SECURE Act was to help small companies enjoy the same high level of services and economies of scale that large companies typically enjoy when obtaining 401(k) services. In the past, small company plan participants often paid higher fees than large company plan participants.

That’s important, because a 1% fee difference over 30 years of saving can reduce a participant’s retirement plan balance by 30%, as behavioral economist Shlomo Benartzi of UCLA has pointed out. Principal is looking to serve firms with prospective annual 401(k) contributions of as little as $50,000. Before the SECURE Act, such firms could find boutique turnkey 401(k) providers or use SIMPLE 401(k)s, but demand for those options has not closed the coverage gap.

Principal declined to say what the EASE fees would be. “While we are unable to share fees for Principal EASE, they will be competitive for the value of the service package that’s being provided,” a Principal spokesperson said.

Principal’s in-plan deferred income annuity (DIA) for 401(k) plans, Pension Builder, will be one of the investment options approved and offered by Wilshire to PEP participants, Tibbetts told RIJ. Each company in the PEP will decide for itself whether to offer Pension Builder to participants or not. The DIA would have “institutional pricing,” she said.

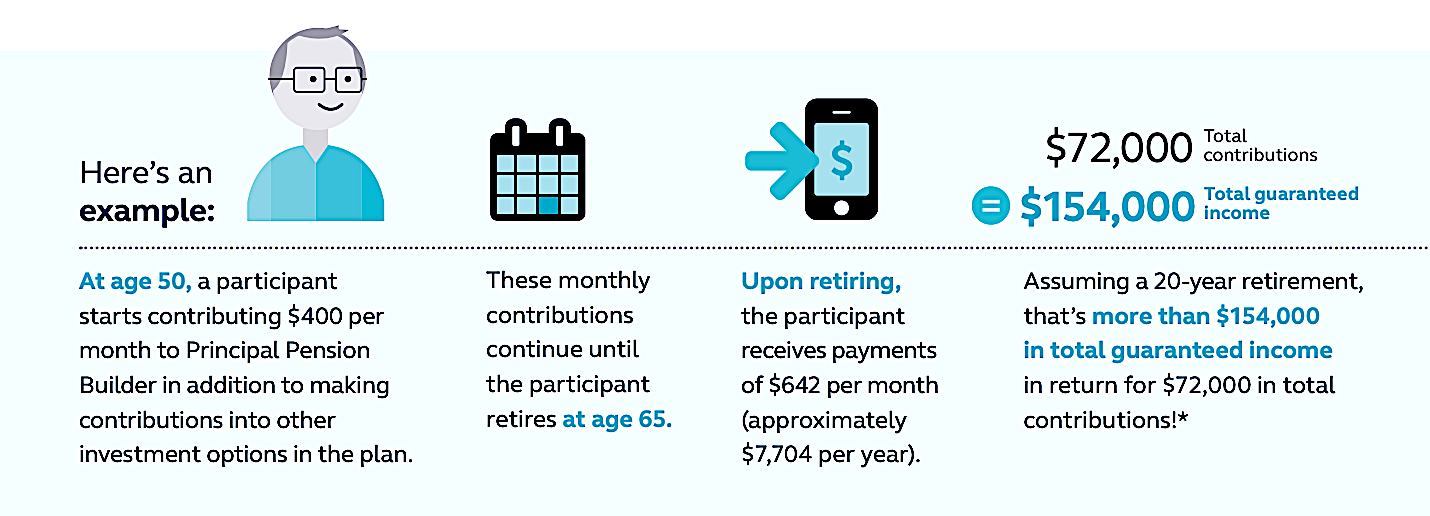

A hypothetical illustration of Pension Builder, from a Principal brochure.

Principal launched Pension Builder five years ago. It is a flexible-premium, unisex-priced, individual deferred income annuity (DIA) contract offered as a stand-alone investment option for plan participants. Contributions to the DIA go into the general account of the life insurance company, in this case Principal Life. Each contribution purchases a discrete amount of guaranteed income for life.

Participants who own Pension Builder contracts can roll them over penalty-free and tax-free if they change jobs, as stipulated by the SECURE Act, and retirees can choose to take lump sums instead of accepting the annuity. There may be surrender charges or value adjustments on lapsed policies, however, according to a PEP brochure.

The fact that Principal is the PPP and that its PEP offers a bundled Principal annuity product doesn’t present a conflict of interest, Tibbetts said. That’s because Principal doesn’t select itself as the annuity provider; Wilshire does. The employer can fulfill its fiduciary burden by following the requirements of the optional “safe harbor” procedure for annuity selection outlined in the SECURE Act. The employer also relies on the recommendations of the 3(38) fiduciary, Wilshire.

Principal offers this disclosure in its press release: “Wilshire and National Benefits Service are not an affiliate of any member of the Principal Financial Group. The decision to delegate to and ongoing monitoring of the Pooled Plan Provider (PPP) and 3(38) investment manager is the fiduciary responsibility of the adopting employer.”

Tibbetts has a clear mental image of the ideal small-business candidate for the Principal PEP: Her cousin the woodworker. “My cousin is a cabinetmaker,” she told RIJ. “He has a group of about 20 employees. I brought up the subject of PEPs with him and his wife at a family function. And when I testified about RESA [an early version of the SECURE Act] on the Hill I used them as an example of our target client.”

© 2020 RIJ Publishing LLC. All rights reserved.