The Advisor Network will provide participants with access to a pre-screened network of qualified investment advisors who provide participant-level advice at "an investment advisory fiduciary standard of care."

Jackson National closes five equity funds to VA separate account investors

With a May 31 SEC filing, the company has apparently made good on its parent company's promise to de-risk the equity exposure of its top-selling variable annuity. The changes...

Let’s Not Panic Over the Deficit

“The current weak state of many economies argues against implementing budget cuts in the next couple of years,” says a new pamphlet from the Peterson Institute for International...

In Italy, annuity demand correlates with wealth and education

Italians were asked: ‘Imagine you are 65-years old and will receive an inflation-adjusted pension of €1,000 a month. Would you give up that half of that pension in exchange...

Russell LifePoints TDFs Tops $1 billion AUM

The series’ 2055 fund, for instance, has a 10% bond allocation, while the In Retirement Fund maintains a 68% bond allocation throughout retirement.

Putnam’s iPhone “app” puts point-of-purchase savings into 401(k)

First, find a bargain. Then calculate its value 30 years from now. Then contribute to retirement plan.

Beams to help merge ING retirement units in advance of IPO

Maliz Beams previously served as president and CEO of TIAA-CREF’s Individual and Institutional Services, where she founded the Wealth Management business and re-launched IRAs, Insurance Products and Private Asset...

BNP Paribas and Tennis: Love Match

The French bank has sponsored the French Open for 38 years and in March launched a website called "We Are Tennis."

Fed governor details rationale for higher capital standards for “SIFIs”

Regulations should limit the creation or growth of giant financial institutions unless the “benefits to society are clearly significant,” said Daniel Tarullo.

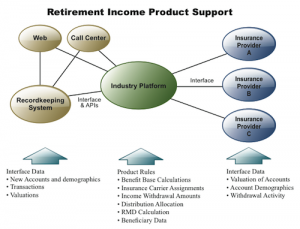

A Hub Named RICC

DST Systems’ Larry Kiefer says his firm’s new “middleware” simplifies the distribution of lifetime income products to plan participants, IRA owners and others.

Heritage Foundation Suggests Means-Testing for Social Security, Medicare

Under the conservative think-tank's proposal, a new optional, auto-enrolled savings plan would start in 2014. Under this plan, 6% of each worker’s income would go in a retirement savings...

SPARK accepting requests to change lifetime income product data standards

The SPARK Institute's Data Layouts for Retirement Income Solutions provides the standards for DST Systems' RICC hub featured in today's issue of RIJ.

Structured product from AXA Equitable blends upside potential, downside protection

Called Structured Capital Strategies ADV, the product will be distributed at first to fee-based advisors in the Commonwealth Financial Network.

Public doesn’t trust Wall Street, Prudential survey shows

People need financial help, but avoid financial services providers. Is it possible that they blame the industry itself for their financial woes?

New York Life launches GPA (It doesn’t mean grade point average)

Smaller defined benefit pension plans are adopting a liability-driven investment model that resembles the three-bucket system used by retirees to provide income. New York Life has designed a fixed...

Unbundle advice and product sales, older investors say

Chris Brown and Laura Varas (left) of Hearts & Wallets, a Boston-area research firm, find that many pre-retirees and retirees want financial advice that's not simply the prelude to...

Taxes deferred aren’t taxes denied: ASPPA

In their attacks on retirement savings incentives, 'budget hawks' don't appear to realize that 401(k) participants and others pay the deferred taxes after they retire, albeit sometimes at a...

Reading the Minds of the Affluent

Cogent Research has tapped into the attitudes of wealthy retirees and pre-retirees toward retirement income products.

Anxiety and distrust are common among Boomer participants: Financial Engines

A new white papers shows that plan participants want flexibility, safety, advice, sponsor oversight and fee transparency from financial products and service providers.

A quarter of Americans couldn’t find $2,000 in 30 days, study shows

Generally, low levels of ability to access $2,000 on short notice correlated with low income. But the researchers were also surprised to see so many high-income households without $2,000...