'Even though there is not a clear conflict among the Circuits, this case will likely be heard by the Supreme Court,' said ERISA attorney Marcia Wagner after judges in...

Roger Ibbotson embraces indexed annuities over bonds

'Conventional wisdom has most investors de-risking their portfolios by allocating more heavily to bonds as they approach retirement," Ibbotson said. 'Investors should consider other alternatives such as FIAs.'

Conning reports on 2017 insurer M&A activity

'Insurers actively exited underperforming lines and entered specialty segments offering healthier growth and margin prospects,' said a Conning analyst.

Jackson National reports record pre-tax operating income during 2017

An indirect wholly owned subsidiary of Britain’s Prudential plc, Jackson recorded sales and deposits of $21.4 billion in 2017. The insurer recently announced that it would close its Denver...

Convert deferred annuities into long-term care coverage: OneAmerica

People who don’t plan to use their deferred annuities for lifetime income should consider using exchanging their contracts for a hybrid annuity with a long-term care rider, an issuer...

Patterson promoted at Principal Financial

Jerry Patterson will succeed the retiring Greg Burrows as head of the Principal's full service retirement and individual investor businesses.

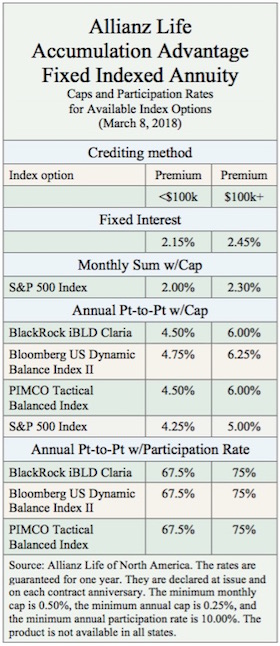

Allianz Life Accumulation Advantage Fixed Indexed Annuity

Caps and Participation Rates for Available Index Options

Behavior risk is rising for FIA living benefit issuers: Ruark

The amount of client assets protected by a GLIB outside the surrender charge period—a measure of the rising behavioral risk exposure for FIA issuers—increased 82% from 2017 to 2018,...

Babybust? Only 11.7% of financial advisors are under 35: Cerulli

'The industry has been scrambling to find a proactive solution to this demographics problem,' said Marina Shtyrkov, a Cerulli research analyst in a release.

Ireland to adopt auto-enrollment, follow ‘roadmap’ to pension reform

In the next 40 years the ratio of working age people to pensioners in Ireland is expected to fall from 4.5 to one to 2.3 to one, said Taoiseach...

Two providers enter Germany’s new market for hybrid DB/DC plans

Starting in January, Germany has entered into a new workplace retirement plan era, with greater opportunity for hybrid DB/DC plans that feature defined contributions and variable payouts in retirement....

Honorable Mention

Marlene Debel to lead MetLife's institutional retirement business; Funded status of S&P 1500 pension plans rose 1% in January; TrimTabs reports that global equities outdrew U.S. equities after the...

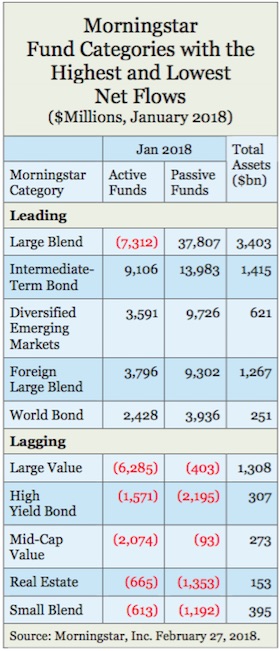

Investment Fund Strategies with Highest Net Flows in January

Large cap blend funds, intermediate bonds, and emerging market strategies are among the leaders.

Flight to passive funds continued in January: Morningstar

State Street enjoyed a second month of double-digit billion-dollar flows and almost caught up with Vanguard in terms of passive flows. Their flagship ETF, SPDR S&P 500 SPY, attracted...

Ameriprise settles SEC claims that it over-charged retirement clients by $1.78 million

Approximately 1,791 customer accounts paid a total of $1,778,592.31 in unnecessary up-front sales charges, contingent deferred sales charges, and higher ongoing fees and expenses as a result of Ameriprise’s...

Stock buybacks reach $113.4 billion in February: TrimTabs

Despite the $1,000 one-time bonuses reportedly paid to employees at large employers after the passage of the new tax law, the buyback spurt indicates that the corporate tax cut...

U.S. ETF assets top $3.6 trillion: Cerulli

In response to the steady migration to index funds and ETFs, “many asset managers are looking to multi-asset-class investments as a way to reestablish their competitive position,” Cerulli said...

If jobs were more flexible, seniors would work longer: NBER

About 40% of retirees would work at a job that had the same wages and total hours as their last job, but a higher percentage--60%-- would be willing to...

Annuity Industry Sales Estimates

In 2017, total annuity sales decreased 8% to $203.5 billion compared with 2016, according to LIMRA Secure Retirement Institute’s Fourth Quarter 2017 U.S. Individual Annuity Sales Survey.

Annuity Sales Declined in 2017: LIMRA

Structured annuity sales increased 25% in 2017, to $9.2 billion, but indexed annuity sales fell year-over-year for the first time since 2009, according to the LIMRA Secure Retirement Institute.