Dementia, preventative care, ageing workforces, technologies and accessibility are just some of the areas of standardization that the committee proposes to work on, said ISO/TC 314 Secretary Nele Zgavc...

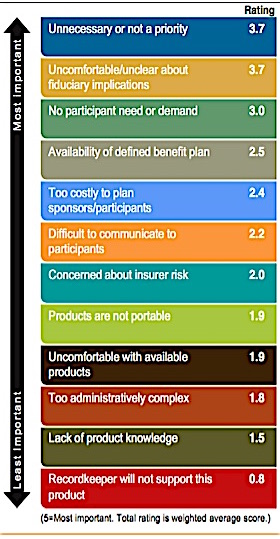

Why DC Plan Sponsors Don’t Offer In-Plan Annuities

As reported in Callan's 2018 Defined Contribution Trends Survey, many sponsors either believe they're unnecessary or are uncertain on the fiduciary implications.

What’s in the latest issue of Journal of Retirement?

The Winter 2018 issue features a mix of articles by familiar authors, including Mark Warshawsky, David Blanchette, John Turner, Michael Kitces, and others.

2017 was another big year for Vanguard funds: Cerulli

Vanguard’s total flows for year were over $207 billion (DFA was second with $31 billion).

Blooom surpasses $2 billion in advised assets

The company, which helps 401(k) participants manage their accounts more effectively, claims that its median client will save $41,456 in investment fees over his or her working career.

Book on mandatory ‘Guaranteed Retirement Accounts’ is reissued

The book is 'Rescuing Retirement,' by economist Teresa Ghilarducci of the New School and Hamilton James of BlackRock. Rush Limbaugh once called Ghilarducci 'the most dangerous woman in America'...

New Security Benefit deferred annuity offers floating interest rate and income rider

At purchase, Security Benefit assigns an interest rate to the contract and guarantees that rate for five years. The contract owner receives that rate plus a floating rate, the...

IRAs now account for 25% of retirement savings: EBRI

The average balance for all IRAs grew by about 50% during the 2010-2015 time frame, to about $146,000. People 70 years old and older had the highest average ($229,000)...

Quote of the Week

'Anything can make or break a market,' Tighe explained in his delicate brogue, 'from the failure of a bank to the rumor that your second cousin's grandmother has a...

New DIY decumulation software from team of Meyer and Reichenstein

'Incorporating the latest tax code and social security calculations, Income Strategy goes far beyond currently available retirement calculators,' claims William Meyer (pictured) about his new income planning software.

German workers adjust to retirement plans without guarantees

Germany, like the U.S., has a retirement plan coverage problem. A new law, for the first time, allows employers and workers to set up U.S.-style defined contribution plans. But...

Former New York Life executive Chris Blunt joins Blackstone

Mr. Blunt joins Blackstone after 13 years at New York Life, where he most recently served as president of the Investments Group.

Honorable Mention

RetireUp acquires RepPro, Northwestern Mutual hires Lori Brissette from USAA and invests in ClientWise; Eversheds Sutherland starts a catastrophe relief fund for its employees; Robert P. Regnery and Kenneth...

“Fiduciary” share of advised retail assets up 68% since 2005: Cerulli

'Fee-based relationships better align with the goals of firms, advisors, and investors by tying revenue growth to client portfolio performance,' Cerulli commented.

Is Northwestern Mutual’s new ad campaign a bellwether?

'Through focus group research, Northwestern Mutual found that the tension between living for now and saving for later was universal for people regardless of demographics,' a press release said.

Voya’s strength ratings are under review

In late December, Voya announced that it would sell its closed block variable annuity (CBVA) and individual fixed indexed annuity (FIA) segments to a consortium of investors led by...

Honorable Mention

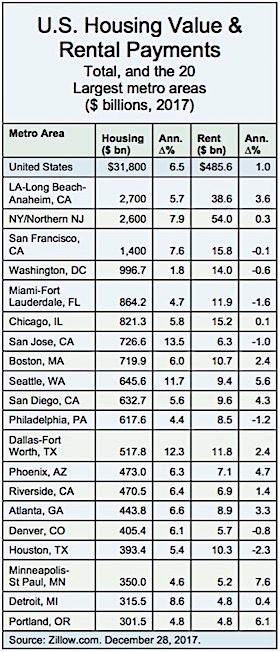

Envestnet, AdvisorEngine and The Segal Group all make acquisitions, and Zillow estimates the total value of U.S. homes at $31.8 trillion. Lincoln Financial appoints Joe Mrozek to head of...