The life insurance industry is sensitive to changes in interest rates and in regulations, and President Trump appears bent on lowering rates and removing regulations that he doesn't...

Dutch Pensions Go Collective

Today’s financial Goldilocks moment—with strong equity returns and robust fixed income yields—creates favorable conditions for the Netherlands to complete its long-planned switch from traditional private defined benefit plans to...

The Private Credit Instability Hypothesis

Private credit might be healthy in moderation. But 'moderation' isn't Wall Street's modus operandi. We shouldn't expect that to change.

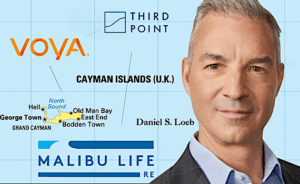

Third Point Joins the Triangle, Cayman-Style

Another asset manager goes subtropical. Third Point Investors Ltd. established Malibu Re in the Cayman Islands, bought a Texas life insurer from Mutual of America, acquired a private credit...

How Life Insurers Changed Alt-Asset Managers

A new research paper from Harvard Business School and State Street documents how publicly-traded alternative asset managers have channeled hundreds of billions of dollars from annuity issuers into their...

A Look at Nine RILA Income Riders

We examine the lifetime income riders on registered index-linked annuity contracts from the six largest RILA sellers (Equitable, Allianz Life, Prudential, Brighthouse, Lincoln, and Jackson) plus those from Principal,...

Gold, Not Tariffs, Saved the 1890s

President Trump said his "Liberation Day" tariffs would boost the U.S. economy the way President William McKinley's tariffs did in the 1890s. But the boom of the 1890s came...

401(k)s don’t need private assets or ‘crypto’

Alternative investments, crypto, private assets—these are bread for the money management industry. For most Americans, these exotic assets are not bread, or even cake; let alone icing.

A Menu of Income Options for DC Plans?

If no two 401(k) participants have the same levels of retirement savings and the same retirement spending needs, shouldn't their plans offer more than one process for decumulating their...

Equitable Joins the ‘Bermuda Triangle’ Club

Equitable Holdings' recent reinsurance deals were the topic of critical articles in three financial publications this summer. Underneath the controversy, the leader of the RILA industry was catching up...

Powell Should Resist Pressure to Lower Interest Rates

Today, interest rates in the U.S. are close to long-term averages. As a result, equity and fixed income investors are both rewarded. Lower rates aren't needed now, and may...

A Fixed Index Annuity with a Dash of Risk

The Momentum Growth contract from Delaware Life introduces a bit of gambling to the FIA product category—but within guardrails, and only with what contract owners might call 'house money.'

Social Security Needs a More Positive Spin

Our conceptual logjam over the future of Social Security comes partly from mistaking "stocks" for "flows," as the economist Michal Kalecki once warned.

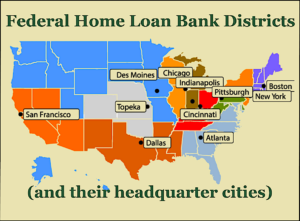

F-H-L-B Spells Cheap Cash for Big Annuity Issuers

The largest borrower from the Federal Home Loan Bank (FHLB) system in 2024 was Athene Annuity and Life, at more than $15 billion. For at least 16 other top...

What a Mighty Joy That Would Be

More than a million Americans receive artificial hip, knee or shoulder joints every year. This month, after years of procrastination, I became one of them. Joint surgery is now routine, friends told...

Crypto-Blitz: A Timeline of Presidential Emolument

As president, Donald Trump is in a unique position to connect the public purse to his own purse, and so far he's shown no resistance to temptation. The Wall...

RIJ and ChatGPT Discuss ‘Funding Short’

Life insurers used to be known as champions of 'asset-liability matching,' or ALM. Today, many of them are doing the opposite by 'funding short.' Here's a transcript of RIJ's...

The NAIC, the FIO and the ‘Bermuda Triangle’

The Federal Insurance Office has issued warnings about the ties of private equity-led life insurers to 'shadow banking' and 'shadow insurance.' Why do state insurance commissioners want to shoot...

CLOs: The 4th Leg of the ‘Bermuda Triangle’

Ownership of life/annuity companies has given PE companies a tool for tapping the virtually bottomless pool of tax-deferred U.S. retirement savings for their high-profit, lightly-regulated private credit businesses.

Warring Watchdogs: NAIC and FIO

'The Federal Insurance Office conflicts with the states’ role as primary regulators, complicates their engagement with fellow insurance regulators globally, duplicates data collection from our industry,' said state...