There are clear similarities between the business scheme that brought down Executive Life Insurance Co. in 1991 and the 'Bermuda Triangle' strategy that many US life/annuity companies use.

An In-Plan Annuity with Three Life Insurers

Asset manager AllianceBernstein and three life insurers—Jackson National, Lincoln National, and Nationwide—are offering their Secure Income Portfolio deferred variable annuity (with income rider) to plan sponsors as a retirement...

A Plan Sponsor’s Guide to In-Plan Annuities

Broadridge, Cannex, The Index Standard, Micruity, and ERISA attorney Fred Reish have co-produced a 39-page guide designed to help 401(k) plan sponsors choose a retirement income tool for their...

Double Trouble in the Bermuda Triangle

What can go wrong with the Bermuda Triangle strategy, with its closely affiliated annuity issuers, reinsurers and asset managers? PHL Variable Insurance, a former unit of Nassau Financial, is...

BlackRock relaunches its “LifePath Paycheck” retirement income tool

'DCIO' asset managers like BlackRock must find ways to retain participant assets post-retirement and enrich the value of their target date funds. They must also make themselves relevant to...

The DOL Should Challenge the Fifth Circuit’s Opinion

When insurance agents encourage IRA owners or rollover candidates to buy fixed indexed annuities, are they like EMTs, who save lives without having to be MDs or carry malpractice...

For Ibexis Life, Cayman Outshines Bermuda

This Missouri-domiciled life insurer epitomizes the asset-manager-driven life/annuity companies that have been disrupting the U.S. life/annuity business since 2010 or so. In its first year selling fixed indexed annuities,...

A ‘Nesting Doll’ of an In-Plan Annuity

ARS, State Street Global Advisors, Nationwide, Athene, Transamerica and Global Trust Company have brought to market the State Street GTC Retirement Income Builder, a target date fund with a...

Here Come the Suits

Close observers of the 'Bermuda Triangle' strategy weren't surprised when class action lawsuits were filed against AT&T, State Street Global Advisors and Lockheed Market for their choice of Athene...

Life Insurers as LEGO Monsters

Michael Gordon, CEO of Axonic Insurance, part of Axonic Capital, sees the future of the life/annuity/asset-management business as an increasingly a la carte affair, where the components of the...

Meet the Newest Platform in the 401(k) Annuity Space

'We’re a product design firm,' ALEXIncome co-founder E. Graham Clark told RIJ. 'We feel we’ve built the best process for integrating annuities into retirement accounts.'

Two retirement experts launch a planning start-up

“By clarifying how investment volatility and an unknown lifespan impact spending, IncomePath allows a client to select the right combination of investment risk, portfolio withdrawals, and annuity income,” Michael...

This Year’s Legal Battles

The life/annuity industry faces three big legal issues this year. All stem from, or are complicated by, the patchwork regulation of financial products in the US, our out-of-date pension...

NAIC Urged to Limit ‘Bermuda Triangle’ Strategy

'The ability of insurers to significantly lower the total asset requirement for long-duration blocks of business that rely heavily on asset returns appears to be one of the drivers...

Fidelity’s Plan Sponsors Can Now Offer Annuities

Income products issued by MetLife, Pacific Life, Prudential Financial and Western & Southern Financial Group are available on the Fidelity platform, with additional insurers to be added in the future, Fidelity said in its...

‘Sticking to the Plan’ While Taking Income

Pension Plus is a recent entry in the race to sell decumulation tools to 401(k) plan sponsors. Shlomo Benartzi, the behavioral finance expert, conceived it. Retirement industry veteran Mike...

We’re Baaaaaaaaack

Too much is happening in the retirement industry to ignore. So I'm planning to publish RIJ once a month, nine times a year, while spending the rest of my...

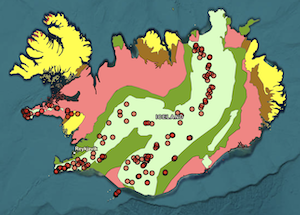

Iceland’s Tiny But Great Collective DC Plan

I visited Iceland in mid-2022 to interview pension experts in Reykjavik, the capital city and to fish for brown trout in the rivers near Akureyri, a harbor town on...

Of Athene, Pension Risk Transfers, and Fiduciaries

The ERISA Advisory Council recently heard comments on changing the criteria that fiduciaries use when vetting annuity providers in pension risk transfer deals. Athene's vice chairman defended his company's...

RIJ’s Next Phase

In the near future, I plan to turn the RIJ website into a free library of information on retirement income planning. Before then, I hope to revise 'Annuities for...