The famed Canadian adviser-of-advisers and author, now retired, has released his latest and last book, 'Advanced Retirement Income Planning.' It's a concise version of his magnum opus, 'Unveiling the...

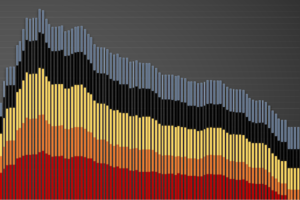

A Closer Look at CLOs (and Other U.S. Credit)

Bond mavens, check this out. A new SEC report describes how most of the $54-trillion dollar U.S. credit market survived last spring's financial crisis. It covers securitized 'leveraged loans,'...

Why American Equity’s Share Price Spiked Today

With new management and a new business model, American Equity Investment Life hopes to climb back onto the FIA sales leaderboard. It's using the strategy that RIJ dubbed 'The...

She’s Got Advice for Life Insurers

'Insurers can't remain wedded to product sales, which are becoming commoditized in a future that trends toward financial advice,' says industry veteran Michelle Richter, who just launched Fiduciary Insurance...

Searching for Yield? Here’s Where to Look

Bond gurus Anne Mathias of Vanguard and Rick Rieder of BlackRock spoke at the Morningstar Investment Conference last week. Emerging markets, real estate debt, and asset-backed securities are...

Long Guns as Leading Indicators

In past election periods, when I’ve canvassed door-to-door, some people have told me they won’t bother to vote because politicians are all alike. But they aren’t.

The Sacrificial Payroll Tax

Idle talk about suspending the payroll tax is making 'blue' Senators blue. We get answers from Social Security expert Eugene Steuerle of the Urban Institute.

An Income-Generating ‘Collar’

Using a 'protective net-credit collar,' the Nationwide Risk-Managed Income ETF has distributed monthly income at an annual rate of 7.88% in 2020, while appreciating 10%. Is there a catch?

Two Cheers for DOL’s Lifetime Income Disclosure

The Department of Labor's 'interim final rule' on disclosure of estimated lifetime income from 401(k) balances is welcome, but it lacks a critical feature. Public comments might improve it.

Life Insurers’ Bermuda Triangle, Part II

The humble fixed indexed annuity is at the center of the restructuring hurricane that has swept through the life insurance industry in recent years. We bring you the second...

Why Life Insurers Fly into the ‘Bermuda Triangle’

Private equity firms have steadily acquired U.S. life insurers and blocks of fixed annuity business and moved the blocks offshore to free up capital. This worries some people.

Is a P.E.P. Rally About to Start?

Willis Towers Watson and Aon both suggested in letters to the Labor Department that they may create defined contribution plans (Pooled Employer Plans, or PEPs) that many employers and...

The Key to Turning On 401(k) Annuities

Micruity, a tech startup with a 30-year-old CEO, says it has the "middleware" that can integrate 401(k) plans and annuity issuers. Will the retirement industry listen?

Wells Fargo’s New Annuity Wagon

Wells Fargo Asset Management's new target-date series of CITs comes with a built-in, optional retirement income strategy: systematic withdrawals plus an annuity starting at age 85.

‘Capital Arbitrage’ Helped PE-Led Insurers: Study

From 2009 to 2014, when private-equity firms bought life insurers, they exploited a capital-saving regulatory ruling to lucrative advantage.

How MMT Became Clear To Me

In colonial Virginia, the law required the burgesses to set the incoming tax receipts on fire. That taught me a key lesson about how our money works today. ...

Where Does the Fed Get Its Trillions? Ask MMT

In her new book, 'The Deficit Myth,' Stephanie Kelton explains Modern Monetary Theory--and how we can afford a lot more as a nation than we think we can. ...

DOL’s Perplexing ‘Best Interest’ Proposal

Why is the Trump Labor Dept so determined to align its Best Interest standard with the SEC's 'Reg BI'? It claims that such an alignment will be more efficient....

Romancing the Fixed Annuity: KKR Buys Global Atlantic

The deal, part of a trend in private-equity acquisitions of life/annuity properties that began a decade ago, makes KKR about one-third larger. The trend tailwind: low rates.

Why Is Income Planning So Hard?

Everyone says retirement income planning is harder than 'accumulation' planning--for advisers as well as their clients. If so, what makes it that way?