Can you use unneeded annuity assets or annuitized income to buy life insurance and create a tax-free bequest? Sure. Does it make sense for the client? Only under certain...

A New NEST for British Nest-Eggs

This is the first part of a two-part article on Britain’s ambitious national defined contribution fund for undersavers, a "public option" called the National Employment Savings Trust, or NEST.

Weighing the Value of a Variable Annuity

A VA lifetime withdrawal benefit—especially one with a 'ratchet'—can provide the upside potential and downside protection that many Boomers want in retirement, say researchers Petra Steinorth and Olivia Mitchell....

Webinar: Retirement Income with Dividends and Interest

In this 52-minute webinar, Mitchell Keil of Integrity Financial Advisory demonstrates the use of Manish Malhotra's (pictured) Income Discovery software to model the creation of a retirement income stream...

New York Life Remixes the Variable Annuity

You've heard of New York Life's Guaranteed Future Income, where clients pay today for lifetime income several years from now. A new NYL product, Income Plus, also locks in...

Float Through Retirement on a CDA

Contingent deferred annuities (CDAs) are income guarantees for managed accounts. Their biggest regulatory hurdle may have been cleared last February, when an NAIC committee agreed that CDAs are annuities...

How to Become a ‘Doctor’ of Retirement Income

Several certification programs—some new, some well-established—can show you how to become an expert in retirement income planning. We looked closely at the following certification programs and feel confident in...

The Black Box of 401(k) Expenses

The experts--Louis Harvey of Dalbar, Mike Alfred of Brightscope, David Witz of PlanTools, Phil Chiricotti of CFDD, Jonathan Leidy, CFP, and Tussey v. ABB attorney Jerry Schlichter--talk about what...

How Retirement Advisors Get Paid

Are yesterday’s compensation practices preventing you from becoming the retirement income advisor of tomorrow? Here’s how some advisors have adapted to a brave new world.

Searching for an Oasis

This roundup of investment flow reports from Beacon Research, Strategic Insight, Morningstar and the Insured Retirement Institute suggests that investors are looking for shelter from an economic sandstorm in...

What’s Good for General Motors…

A month after Ford’s pension buyout offer, GM is offering some salaried retirees a choice of a lump sum buyout or lifetime income from Prudential. Both automakers took advantage...

No Fluke: Income Annuity Sales are for Real

Sales of income annuities may soon breach the $10 billion-a-year barrier. We talked to the Numbers 2 through 5 SPIA sellers in the U.S.: MetLife, MassMutual, Pacific Life (whose...

Annuicide Prevention Tool

By establishing a standard for valuing in-force income annuities, an industry task force hopes to reduce fear of "annuicide" and stimulate SPIA sales. "We're taking a thorn out of...

Talking DIAs with Matt Grove of NY Life

New York Life launched its Guaranteed Future Income Annuity, a deferred income product, in mid-2011 and has found traction among pre-retirees who want income about 10 years later. We...

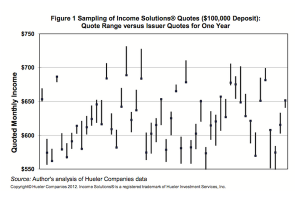

Is This Any Way to Sell SPIAs? You Bet.

Kelli Hueler, creator of the Income Solutions online income annuity sales platform, delivered an academic paper at the Pension Research Council's annual conference at the Wharton School last week,...

Lounging by the (Mortality) Pool

The climate was ideal, but annuities upstaged sunbathing at the 2012 Retirement Industry Conference at Walt Disney World Resort in Orlando last week.

The Bucketing Brigade

Pershing LLC, Sovereign Bank, and Securities America have all made Income for Life Model (IFLM) software available to advisors. That represents growth for IFLM, and progress for the income...

The “Stacking” Strategy

Are bond yields awful? Are investors terrified of equities? Then it’s perfect weather for indexed annuities, the unpredictable but often effective knuckleballs of the annuity world. Check out these...

The Bucket

Brief or late-breaking items regarding Mary Fay, Curian Capital, RIIA, New York Life, Milliman, and Albridge Solutions.

St. Louis Fed president questions U.S. monetary policy

"Monetary policy is a blunt instrument which affects the decision-making of everyone in the economy,” said James Ballard, pointing out that low interest rates hurt savers. Better to address...