Vanguard analysts put the chance of a double-dip recession at about 20%. The bond yield curve suggests only a 6% risk, but the yield curve isn't as reliably predictive...

How Many VA Owners Will Bail Out?

Issuers of variable annuities with income benefits could face lower-than-expected lapse rates and higher reserve requirements over the next 18 months, says Oliver Wyman.

Plugging Leaks in VA Guarantees

VA issuers can’t keep bearing so many of the contract risks. Milliman's Ken Mungan (above) and Deep Patel suggest three ways to make VA manufacturing more sustainable.

For VAs, Roll-Ups Rule

Perhaps unintentionally, "roll-ups," aka deferral bonuses, have arguably become the key feature of variable annuities with GLWBs. But can they save VAs from becoming a niche business?

The ‘Senior’ Senator from Wisconsin

The soft-spoken Herb Kohl (D-WI) fights for retirees as chairman of the Senate Special Committee on Aging, which will hold hearings on retirement income June 16.

You May Live in Interesting Times

Interest rate risk keeps us all in suspense. Here’s how executives at Vanguard, New York Life, Delta Global Advisors, Prudential Annuities, and Loomis, Sayles cope with the uncertainty.

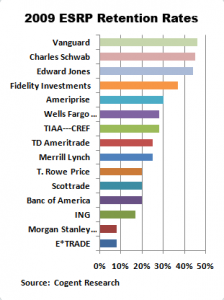

Who’s Winning the Rollover War?

IRAs now hold more money than employer-sponsored retirement plans, and the big beneficiaries are Fidelity, Vanguard and Charles Schwab, says a report from Cogent Research.

From an IVA, New Blood for Insurers

Life insurers, advisors and consumers should embrace his immediate variable annuity (IVA) with a refund option and a death benefit, says Achaean Financial CEO Lorry Stensrud.

Mad About 401(k) Annuities

Part I: ‘Keep Your Hands Off My 401(k).’ Based on their recent e-mails to the Labor Department's RFI, some Americans think Uncle Sam wants to confiscate private savings.

The Savings Sweepstakes

Lottery-like savings programs aren’t widely legal in the U.S., but a Harvard Business School professor believes they could inspire more low and middle-income Americans to save.

Volcker’s Minsky Moment

“The banks shouldn’t be running casinos on the side,” said former Fed chairman Paul Volcker at the Hyman P. Minsky Conference in New York last week.

Annuity Products That Will Sell

At LIMRA's 2010 Retirement Industry Conference, consultant Timothy Pfeifer identified the deferred and immediate products that he thinks are ideal for insurers, distributors and investors today.

Eating the Competition’s Lunch

MetLife’s Retirewise program offers hundreds of brown-bag seminars, like the one depicted in this ad, for 401(k) participants at firms where MetLife isn’t the provider.

Spock-o-nomics at the RIIA Meeting

At the spring meeting of the Retirement Income Industry Association, held at Morningstar Inc. in Chicago, concepts like "stocks for the long run" and "safe withdrawal rate" were out...

The Empire Strikes Back

Lest they be drowned out by 401(k) critics, major DC plan providers have formed a new trade group, the DCIIA, chaired by PIMCO's Stacy Schaus. The group supports target-date...

Black Swan or Black Turkey?

The Great Recession is just the latest financial ‘black turkey,’ said the CFA Institute's Laurence B. Siegel at the Morningstar/Ibbotson conference in Orlando.

“Face-Off” at the IRI Marketing Conference

Annuity manufacturers and distributors went eyeball-to-eyeball at the Insured Retirement Institute's marketing conference in New York this week, where medical economist J.D. Kleinke (pictured here) was a featured speaker....

In League with the Angel of Death

Lawsuits filed in Rhode Island, New York and Illinois shed light on the sinister, multi-million-dollar strategy of using the dying as fronts to exploit variable annuity loopholes.

Easing a Widow’s Hardship

What's the best way for a 62-year-old man to say “I love you” to his wife? By waiting to claim Social Security benefits until he reaches full retirement...

In Search of Plan C

“We have a crisis of confidence regarding retirement,” said assistant Secretary of Labor Phyllis C. Borzi at the NIRS conference in Washington, D.C. Tuesday.