Lottery-like savings programs aren’t widely legal in the U.S., but a Harvard Business School professor believes they could inspire more low and middle-income Americans to save.

Volcker’s Minsky Moment

“The banks shouldn’t be running casinos on the side,” said former Fed chairman Paul Volcker at the Hyman P. Minsky Conference in New York last week.

Annuity Products That Will Sell

At LIMRA's 2010 Retirement Industry Conference, consultant Timothy Pfeifer identified the deferred and immediate products that he thinks are ideal for insurers, distributors and investors today.

Eating the Competition’s Lunch

MetLife’s Retirewise program offers hundreds of brown-bag seminars, like the one depicted in this ad, for 401(k) participants at firms where MetLife isn’t the provider.

Spock-o-nomics at the RIIA Meeting

At the spring meeting of the Retirement Income Industry Association, held at Morningstar Inc. in Chicago, concepts like "stocks for the long run" and "safe withdrawal rate" were out...

The Empire Strikes Back

Lest they be drowned out by 401(k) critics, major DC plan providers have formed a new trade group, the DCIIA, chaired by PIMCO's Stacy Schaus. The group supports target-date...

Black Swan or Black Turkey?

The Great Recession is just the latest financial ‘black turkey,’ said the CFA Institute's Laurence B. Siegel at the Morningstar/Ibbotson conference in Orlando.

“Face-Off” at the IRI Marketing Conference

Annuity manufacturers and distributors went eyeball-to-eyeball at the Insured Retirement Institute's marketing conference in New York this week, where medical economist J.D. Kleinke (pictured here) was a featured speaker....

In League with the Angel of Death

Lawsuits filed in Rhode Island, New York and Illinois shed light on the sinister, multi-million-dollar strategy of using the dying as fronts to exploit variable annuity loopholes.

Easing a Widow’s Hardship

What's the best way for a 62-year-old man to say “I love you” to his wife? By waiting to claim Social Security benefits until he reaches full retirement...

In Search of Plan C

“We have a crisis of confidence regarding retirement,” said assistant Secretary of Labor Phyllis C. Borzi at the NIRS conference in Washington, D.C. Tuesday.

The Strongest Financial Brands Are…

In Cogent Research's Investor Brandscape 2010 survey, Vanguard, Charles Schwab and TIAA-CREF earned top honors for brand strength. But many affluent investors are mistrustful of the financial industry and...

Heard On The Grapevine

An all-star group of RIIA members engaged in a spontaneous online debate about 'time-segmentation' bucket methods. Here’s what they said.

New York Life Introduces ‘Lifetime Wealth Strategies’

The big mutual insurer plans to offer its managed account program, incubated last year among career agents, to third-party registered reps, says Michael Gordon, first vice president in the...

The Trouble with Calculators

A new critical survey of twelve retirement planning calculators shows why they're so frustrating to use.

AXA Trumpets a Treasury-Linked VA Rider

AXA Equitable Life (and its trademark gorilla) have bounced back from the financial crisis with a novel variable annuity rider that pegs guaranteed accumulation and withdrawal rates to the...

Can’t Do The Math

You knew it all along, but now there's evidence. Most Americans are financially illiterate. Experts wonder how the millions who don't understand compound interest can possibly fashion successful retirements.

Bridge to Somewhere

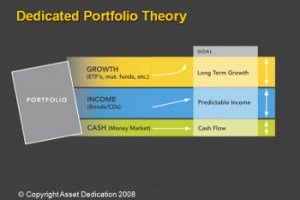

"Liability-driven investing for individuals" is how J. Brent Burns, MBA, (left), and Stephen J. Huxley, Ph.D., describe Asset

Dedication, which is the name of their bond-laddering methodology, their book...

Luck of the Draw

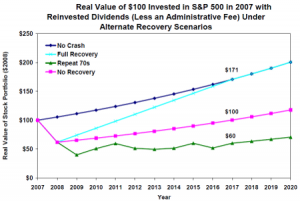

In this second installment of our series on retirement risks, we examine sequence-of-returns risk: what it is, what it can cost, and how best to deal with it.

Holiday Cheer

Forget doom-and-gloom. Recent research suggests that the Crash of 2008 will not prevent most Boomers from retiring as planned.