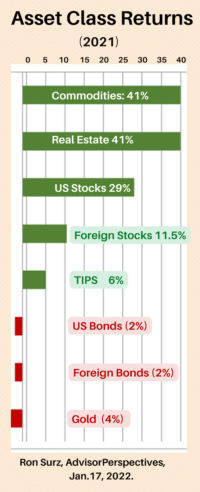

A 5-Year Cushion against Market Risk

'Prudent Asset Allocation' gives you the confidence of knowing that over the next five years, you don’t have to worry about market conditions,” says Louis S. Harvey of Dalbar, the financial services research firm. 'You can put more money into growth assets.'