One size rarely fits all. That’s especially true for retirement income planning.

No two retirees have the same levels of savings, debt, risk-tolerance, anticipated retirement living expenses, marital status, tax liabilities, health status, or “bequest motives.” Nor do they have the same education, financial literacy or familiarity with investments and insurance.

Which raises a question about annuities and 401(k) plans: If plan sponsors embrace the spirit of Congress’ 2019 and 2022 SECURE Acts and offer annuities to participants, should they give participants a menu of “decumulation” options to choose from instead of just one?

There are potential benefits to that. Participants might like to see a wide range of choices. Plan sponsors may not feel as much pressure to pick “the safest available annuity,” as required by the U.S. Department of Labor’s IB 95-1 bulletin.

But there are also potential drawbacks. Participants might fall victim to choice-overload. And, each income solution provider will naturally prefer to be a Qualified Default Investment Alternative (QDIA) to which participants who don’t choose their own investments can be assigned.

To gauge prevailing opinion on this issue, RIJ called on several experts on defined contribution plans and retirement income:

- Spencer Look, associate director of Retirement Studies, Morningstar

- Jack Towarnicky, former executive director of the Plan Sponsors Council of America

- David Richardson, director and head of research, TIAA Institute

- Ramsey Smith, co-founder of AlexIncome, a fintech in the 401(k)/annuity space

- Sherrie Grabot, CEO of GuidedChoice, an online education tool for plan sponsors and participants

- Olivia Mitchell, Raimond Maurer and Vanya Horneff, as authors of a recent paper, “Defaulting 401(k) Assets into Payout Annuities For “Pretty Good” Lifetime Incomes.”

Here are some of their comments.

‘If it’s done the right way’

“Participants’ needs and wants are all over the place, and there’s no consensus among academics on a single solution,” Spencer Look, an actuary and Associate Director of Retirement Studies Morningstar Center for Retirement and Policy Studies in Morningstar’s Retirement Center, told RIJ in an interview. “So I think it makes sense to have multiple options—if it’s done the right way.”

Look contributed to a March 2025 report from the American Academy of Actuaries, “Decumulation Strategies: Creating Lifetime Income from Defined Contribution Plans,” that said:

“There is no single option that will meet all plan participant needs due to differing participant demographics, household needs, other income, other retirement plans, etc. Plan sponsors may find that a choice from among a combination of two or more options may better meet the needs of most plan participants.”

If annuities are offered in 401(k)s, “There should also be at least one investment based, non-insurance option,” Look told RIJ. The AAA report suggested that RMDs [required minimum distributions starting at age 73] might be enough of a tool. It also suggested guiding participants to spread their savings evenly over a fixed number of years, or withdrawing a fixed percentage of savings per year, or payouts that expand or contract with market fluctuations.

But if the menu required choices on the part of participants, that would fly in the face of the spirit of having default strategies in the first place—as a solution to individual inertia. And it might take only a couple of choices to paralyze auto-enrolled participants. “If you offer only two or three options, they’re already overwhelmed,” Look said.

In addition to behavioral issues, there are structural obstacles to the widespread acceptance of annuities in 401(k) plans. “The reason behind slower take-up is related to people who have low balances. You’ll need scale to make this happen, but the median balances are way lower than average balances,” he added.

While the average 401(k) savings at retirement is a healthy $250,000—enough to finance an annuity—the median is only about $80,000, according to Vanguard’s annual review of the industry.

Look was one of several 401(k) specialists who pointed out that annuity issuers and target date fund (TDF) providers prefer that their product be the QDIA; they don’t want competitors to dilute their opportunity. “There would be some push back from providers [to a multi-option platform],” Look said. “A menu would solve one problem but it would create new problems.”

Towarnicky: An out-of-plan purchasing platform

We also asked Jack Towarnicky whether 401(k) participants should have multiple payout options. “Yes,” he wrote in an email, “however, not limited to the options ‘endorsed’ (selected) by the plan fiduciary and added as in-plan options.”

Jack Towarnicky

What options should be included in a hypothetical in-plan menu? “None,” he said. The needs of participants (and their households) are so diverse that no set of in-plan options could ever be sufficient. A menu of options is just as likely to mislead as to inform.”

Also, QDIA payout strategies don’t have long shelf-lives, he wrote. He singled out default solutions where participants automatically begin transferring some of their plan contributions to a so-called “in-plan” deferred annuity with a guaranteed lifetime income rider at age 50—which might be a generation before they stop working.

“Assuming that an in-plan option targets age 50 [as the age when participants make their first contribution to a deferred annuity]…, it will likely be out of date by the time most workers reach their retirement age. If you were a plan fiduciary and made a decision 15 years ago, what would you have offered? Go out 15 years to 2040, what will be new options available then?” he said.

Towarnicky prefers an “individual marketplace” or “purchasing platform” for payout solutions. (The Hueler Income Solutions platform, though not named by Towarnicky, fits that description.) This strategy would have the advantage of removing the legal burden that plan sponsors assume when adding a specific annuity-based payout solution to their plan. Fear of assuming this burden currently makes many plan sponsors hesitant to bring annuities into their plans.

“All options but one would be off MY table if I were a plan sponsor,” Towarnicky told RIJ. The only guaranteed income feature I would offer would not involve a fiduciary decision, and as a result, it would generally not increase fiduciary risks, nor increase the potential for litigation.”

Echoing an idea also favored by the Center for Retirement Research (CRR) at Boston College, Towarnicky thinks the best payout strategy retirees would be one that helps 401(k) participants maximize the value of their Social Security benefits.

“I favor a plan design default, for workers who commence payout between ages 62 and 70, that would use DC (defined contribution) plan assets as an income bridge to defer Social Security to age 70,” he told RIJ.

An eight-year postponement can raise Social Security benefits by 70% (for instance, a monthly $1,400 benefit at age 62 would grow to $2,400 if delayed until age 70). “Commencement of the remainder of the assets would dovetail with RMDs starting at age 73” he added. Starting in 2033, RMD age will be 75.

Like Look, Towarnicky believes the income-product providers will prefer exclusive access to plan participants, rather than competition. (“Duh!,” he wrote.) He seconded Look’s belief that “most participants will not have significant asset accruals, unless they avoid leakage when changing employers.” He also believes that “the perceived endorsement by the plan sponsor and plan fiduciary” of “one or five or ten in-plan choices would increase the existing [legal] burden” on the plan sponsor, not reduce it.

Richardson: What about haircuts?

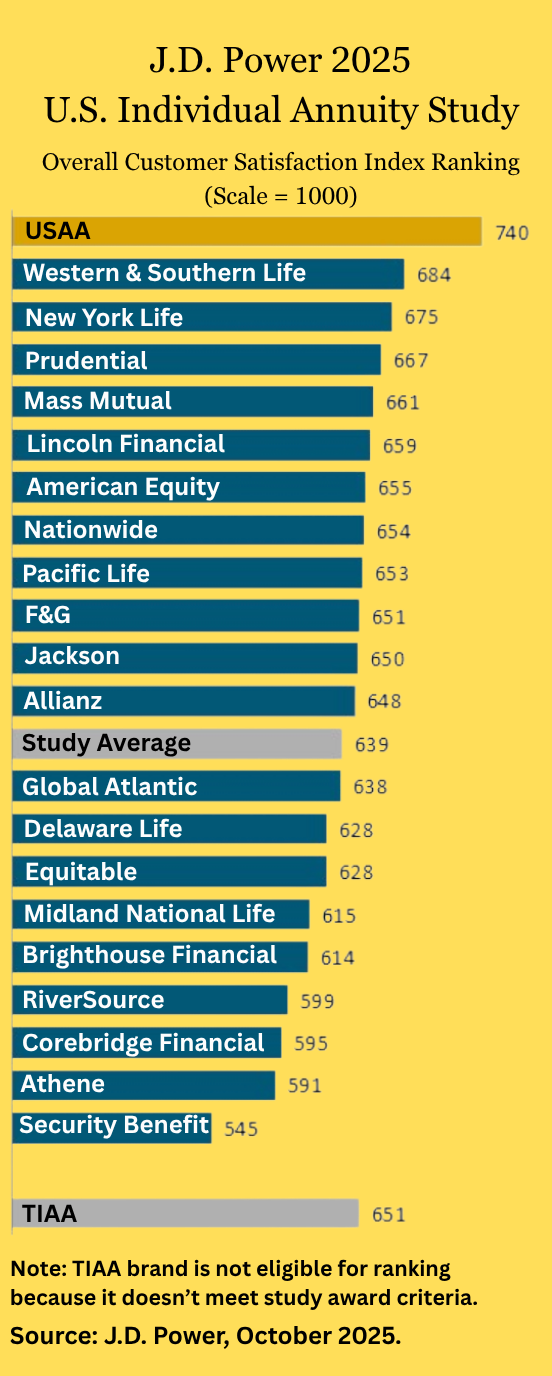

His 18 years at TIAA has given David P. Richardson, the director and head of research at the TIAA Institute, a front-row seat on the pros and cons of offering plan participants a menu of retirement payout options. TIAA is a long-time provider of 403(b) plans at educational institutions, and now offers a 401(k) version of those plans.

David Richardson

“It’s a simple insight: Why don’t 401(k)s have income menus as well as investment ideas,” Richardson told RIJ in a phone interview. When they created the 401(k), you had to offer an equity fund, a bond fund, and a money market fund, and the investment menus have grown from that. But there’s no corollary to that in the income space. That represents a big hole in the 401(k) structure—that there’s not some income menu.”

TIAA’s 403(b) plans always gave participants several ways to save and, at retirement, to convert savings to income. Participants can allocate their contributions to a semi-liquid deferred annuity or to a liquid portfolio of mutual funds, in whatever ratio they wish. At retirement, participants can spend down their annuity assets and/or mutual fund savings in a couple of different ways.

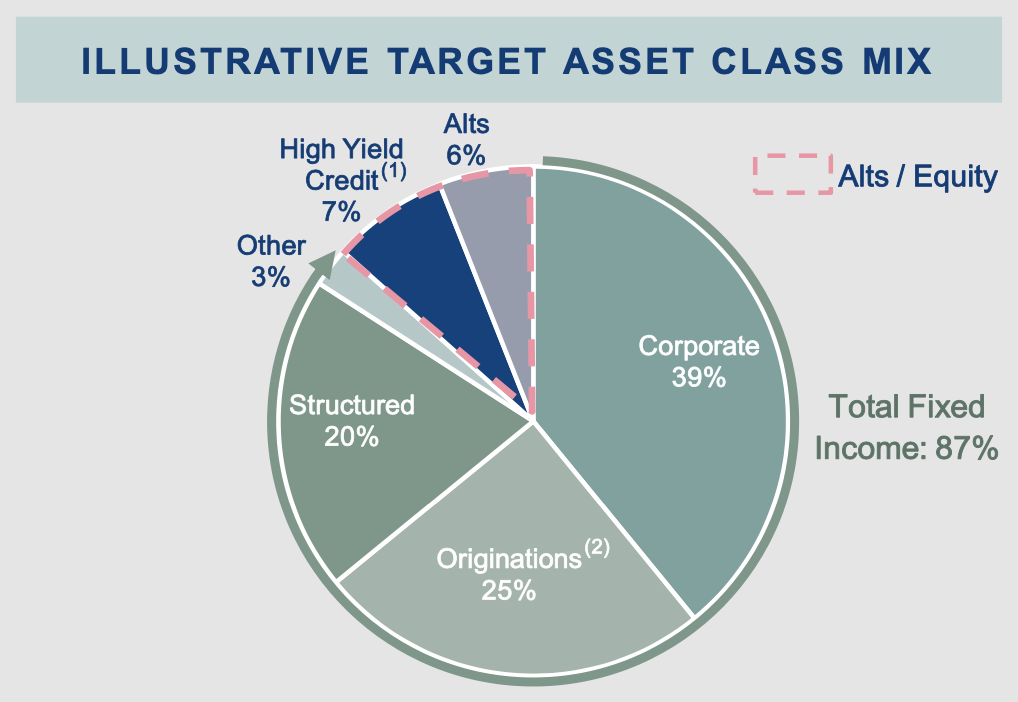

Under the SECURE 2.0 legislation of 2022, new participants in all 401(k) or 403(b) plans can be defaulted into a target date fund with a deferred annuity embedded in it. Richardson expressed concerns about the potential consequences of defaulting 401(k) participants into an illiquid annuity while still promising them unrestricted access to their savings.

“It always bothered me that people kept talking about default, default. There are a ton of problems with that. Labor won’t go along with that or insurance companies won’t. An annuity default means you have to surrender assets to people [annuity providers]. Once I give them [insurers] assets, you’ll [participants] get [pay] a big haircut if you want them back.”

Richardson was touching on the liquidity/illiquidity conflict that complicates the introduction of annuities into 401(k) plans as part of TDFs. If the participants’ pre-retirement contributions to the annuity are transferred to the annuity issuer’s general account—to reap a higher yield—withdrawals can produce a loss that the participant or the plan has to pay for.

While income menus may make sense, Richardson said, plan sponsors shouldn’t regard them as a way to shed their fiduciary responsibilities—even if they’d like to. “My experience over years is that no one wants to be a plan fiduciary,” he told RIJ. “The sponsors, the consultants, everyone wants to guard themselves from risk. But you can’t push it all onto participants.”

Smith: Go with the flow

Ramsey Smith, co-founder with Graham Clark of AlexIncome, a platform that helps life/annuity companies or asset managers design and build income solutions for 401(k) plans, believes that, since TDFs are already the most popular QDIA, they’re the obvious vehicle for introducing annuities into a plan.

Ramsey Smith

“Sixty percent of the new money coming into 401(k) plans goes into TDFs,” Smith said in an interview. “It’s approaching half of existing money. It’s so hard to establish a new standard. So you go with what serves participants reasonably well. You go with the flow.”

“The deviations from that pattern are not as great as you might think,” he said. “Even wealthy investors might be using the set-it-and-forget-it approach in their 401(k) plans. They make their more sophisticated plans elsewhere. If you create additional complexity, do people ultimately come to better solutions, or do you have ‘analysis paralysis?’

“Our business and most of the current defined contribution income businesses are targeting the QDIA. That’s where the action is now and will be for the foreseeable future. In the future, AI agents might be giving us perfect information on all sides. But today the primary goal is to solve the retirement income opportunity, and do that in the world we currently live in. That’s why we’re focused on TDF solutions.

“AlexIncome has always been an in-plan solution. In a perfect world, we’ll be part of a TDF solution. It might be a TDF that we co-develop with a partner. [Our prototype] is a fixed deferred annuity that starts gathering a participant’s contributions as early as age 40, with optional annuitization. Funds are transferred to the carrier before retirement,” he said.

As for the “haircut” issue that David Richardson raised, Smith said, the participant doesn’t suffer a loss when re-allocating money out of an in-plan deferred annuity. But either the 401(k) plan itself or the annuity issuer might incur a loss. The plan itself might keep the insurer whole by paying a “market value adjustment.” The insurer might require that withdrawals be spread out over several years.

Grabot: ‘Self-annuitizing’ works well

“I cannot imagine a participant being able to discern the variance in the value proposition of multiple products on their own,” said Sherrie Grabot, CEO of GuidedChoice Retirement Income Solution, a digital adviser used by some 65,000 plans and three million participants.

Assuming that participants have access to an advice engine like GuidedChoice, “we would prefer more than one solution,” she said. “The challenge for the average plan participant is determining the cost-benefit trade-off of these products. Evaluating even one of these products becomes challenging.”

Her service provides, in effect, an alternative to an annuity default. It leads participants to retirement spending plans that she calls “self-annuitizing,” which in the companies she serves “provides better outcomes” than annuities, she told RIJ.

“When we run the numbers for [our Retirement Income tool] at a close to 90% probability and add 10 years to the mortality table, in most scenarios people will come out with more income throughout retirement than if they purchase an annuity.”

By “90% probability” and “add 10 years,” she means that her service creates plans that will almost certainly prevent retired participants from running out of money, even if they live 10 years longer than average.

Showing partiality to her company’s approach, Grabot emphasizes that it’s not the decumulation product in the plan but the educational component that has the biggest impact on participants’ success in generating lifelong income from their savings.

Mitchell, Maurer and Horneff:

In a recent research paper, published by the Pension Research Council at The Wharton School of Business, co-authors Olivia Mitchell (director of the Pension Research Council at Penn) and Raimond Maurer and Vanya Horneff (of Goethe University, Frankfurt) make the case that “plan sponsors could default a portion of retirees’ DC plan assets into [annuities], as long as their savings exceeded a reasonable threshold.”

More than one default annuity might be necessary, they point out, because different segments of a participant population will have not just different levels of education, different levels of savings and, importantly different life expectancies, but also different levels of risk tolerance and bequest motives.

“Retirees are always better off if they use a portion of their retirement assets to buy a payout annuity… [But] this varies across the annuity start ages and demographic subgroups. … No single type of annuity dominates in terms of providing the highest welfare gains for every single demographic group.” Their study shows how much more a person would have to save in a defined contribution plan to match the income they’d receive if they bought an annuity with part of their plan savings.

Among their findings: People with only high school educations would benefit the most from being defaulted into an immediate annuity (income starting at age 67) because of their shorter life expectancies. People with college degrees would benefit most from a deferred income annuities or QLACs (income starting at age 80).

Editor’s note

While the “safe harbor” provisions of the two SECURE Acts lowered one of the structural hurdles to incorporating annuities into 401(k) plans, other obstacles remain. Wide diversity in the savings levels and life expectancies mean that there’s no universally-appropriate “default” annuity.

Observers say that defaulting participants into an annuity is the only way to ensure sufficient “take-up” of an annuity option. But annuity providers are expected to object to there being several payout options in a plan, since competition could dilute their opportunity.

Other structural hurdles remain:

A large part of annuities’ value comes from making assets illiquid, and 401(k) plans require liquidity.

- Defaulted participants may be least likely accumulate enough savings to finance a meaningfully large annuity payment stream.

- Inadequate savings and shortfalls in retirement plan coverage, two huge barriers to retirement security for millions of Americans, wouldn’t be resolved by putting annuities in 401(k) plans.

- Annuities (tax-deferred growth) and 401(k) plans (tax-deferred contributions and growth) offer redundant tax benefits.

- Annuities are regulated by the states, while 401(k) plans are regulated by the federal government’s Department of Labor.

- The RMD provision in qualified plans, by forcing participants to take annual distributions from their tax-deferred accounts starting at age 73, already serves part of the purpose of an annuity.

- Plan sponsors are responsible for choosing an implementing a successful in-plan annuity but they don’t get any direct benefit from bringing annuities into their plans.

- It’s not clear yet who will pay for the education that participants will need in order to get the most benefit from having annuities in their plans.

- American workers already have annuities in the form of Social Security benefits. It will make sense for many Americans to regard Social Security as their “annuity” and to keep their defined contribution savings liquid and readily available for emergencies.

© 2025 RIJ Publishing LLC. All rights reserved.