401(k)/IRA

TIAA's RetirePlus gives 403(b) plan participants access to a customized target date fund with an investment sleeve that can be turned into lifetime income.

It’s Back: The Norcross-Walberg Bill to Make Annuities a 401(k) Default

Under the bill, participants who are defaulted into an annuity must have 180 days before their premium becomes illiquid, and the participant must receive 30 days notice before the...

RIAs, 401(k)s, and Annuities: Is This the Future?

Managed accounts are one way to build annuities into 401(k) plans. Morningstar is bundling Hueler Income Solutions into its managed accounts, giving participants an easy path to an income...

Pensionizing the 401(k) with Annuities

Historically, workers couldn’t set up guaranteed retirement income streams directly through their 401(k) accounts. But that’s changing, and the annuity industry sees it as a big opportunity, according to...

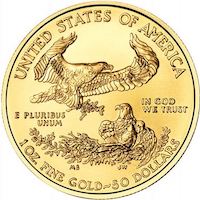

‘Eagle’ gold coins in a self-directed IRA? That bird won’t fly.

Ms. McNulty bought American Eagle gold coins for her IRA but stored them in a safe in her home. That's not legal, the tax court ruled. Attorney Barry Salkin...

TIAA Expands into 401(k) Plan Market

Many firms are trying to add retirement income options to defined contribution plans at for-profit companies. TIAA, which invented the in-plan annuity for the non-profit world, intends to cross-over...

LGIM America launches ‘Retirement Income Fund’ and four other funds for DC plans

In early 2022, LGIM said it will be 'completing a long-life strategy, which is the longevity piece of our solution and designed to support individuals into their later years...

‘Smart,’ from UK, Enters the US PEP Market

'Smart' is the recently-launched American branch of a British fintech with expertise in a kind of retirement savings plan that's called a 'master trust' in the UK and a...

Consortium to promote income options in 401(k) plans is formed

So far, Nationwide and Alliance Bernstein have joined the “Lifetime Income consortium,” which was created by Cannex, Broadridge FI360 Solutions, and Fiduciary Insurance Services.

Progress for retirement provision in ‘Build Back Better’ bill

'Among other things, the legislation would require employers without employer-sponsored retirement plans to automatically enroll their employees in IRAs or 401(k)-type plans,' according to a report today in the...

Ubiquity and Sallus partner on new Pooled Employer Plan

Sallus Retirement is backed by Magis Capital Partners and its CEO is former Jackson National president James Sopha. Chad Parks founded Ubiquity as "The Online 401(k)" more than 20...

Allianz Life offers in-plan indexed annuity with living benefit

'Allianz Lifetime Income+ Annuity' comes with two annual bonuses to participants who maintain the contract through retirement. Whether plan sponsors will embrace this type of in-plan income solution remains...

More Plan Sponsors Want to Keep Retiree Accounts: Cerulli

For years, people have been rolling their DC plan assets over to brokerage IRAs at retirement. Many plan providers hated to lose the managed money, but plan sponsors were...

Vanguard publishes 2021 ‘How America Saves’

In this 20th annual survey of its own 1,700 retirement plans and 4.7 million participants, the full-service plan provider and fund giant offers a detailed snapshot of plan design...

Cryptocurrencies available in ForUsAll retirement plans

'By introducing the Alt 401(k), we are democratizing access to what drives wealth for the wealthy - alternative investment options, combined with our original core offering of low-cost index...

A close look at ‘collective defined contribution’ plans

A timely new white paper from the Center for Retirement Initiatives at Georgetown University makes a case for these retirement plans, which try to blend elements of defined benefit...

Not Yet Legal in the US: CRITs

Collective Retirement Income Trusts resemble variable income annuities, but without explicit guarantees. These group arrangements could help retirees turn part of their 401(k) or IRA savings into rising income...

If the DOL Investigates You…

Here are five FAQs about Department of Labor investigations of retirement plan advisers, and answers from attorneys at the prominent ERISA law firm Faegre Drinker. (Photo: Labor Secretary Marty...

Secure 2.0: A Booster Shot for Qualified Savings Industry

The proposed bill would allow ETFs in variable annuities and remove the 25% limit on the share of IRA money that can be used to buy a Qualified Longevity...

Boola-Boola, Retirement Moolah

Yale's $7 billion 403(b) plan offers TIAA's RetirePlus Pro target-date solution to its 27,000 active and retired participants. The portfolios use Vanguard and TIAA CREF funds, and a liquid...