_Position: Cover

Listen to an actuary who put $50k into a five-year indexed variable annuity four years ago as an alternative to CDs. We explain how IVAs are priced, and we...

Does Your Suffering Need Buffering?

Buffered or structured variable annuities 'are the new shining star of the annuity market,' said Sheryl Moore, CEO of Wink, Inc., which tracks annuity sales. 'This is where life...

BlackRock Makes a Bundle (with Annuities)

BlackRock, the giant asset manager, is adding a lifetime income dimension to its LifePath target date funds by partnering with Brighthouse, Equitable and Voya on a service that will...

Research Roundup

For weeks, interesting studies have been gushing from the National Bureau of Economic Research and elsewhere on the economic implications of COVID-19. We've selected and summarized seven of them...

With BluePrint Income, AARP Ups its Ante on Annuity Sales

AARP's 38 million members can now buy income annuities and fixed-rate annuities on a platform powered by fintech firm Blueprint Income. Buyers get a complimentary annual 'retirement income check-up'...

We Could Use Some Inflation

The Treasury said this week that it will borrow (and spend) about $3 trillion this quarter, to cover its stimulus promises. Where does that money come from and where...

Look Homeward, Seeker of Liquidity

During a market crisis, a reverse mortgage home equity line of credit (ReLOC) can be a lifeline of ready cash for homeowners ages 62 and older. Don Graves of...

Portfolio Rebound: How Long Should It Take?

Using his proprietary 'aftcasting' technique instead of Monte Carlo simulations, the author shows how long it will probably take different portfolios to recover after a negative market shock.

The CARES Act Isn’t Careful Enough

If this agonizing period leads to genuine reform, our 'blood, sweat and tears' (to borrow Winston Churchill’s famous words) won't have been in vain, writes our contributor.

Stormy Weather for Life Insurers

Life insurers are buffeted by a perfect storm of falling interest rates, falling share prices and falling sales of annuities. But, according to David Paul of ALIRT Insurance Research,...

The Big Sick Leave: How Bad Will The Economy Get?

Economists don't expect the crisis to resolve before the summer. Assuming that no effective vaccine or treatment appears suddenly, we’re probably in for a long campaign.

‘Dull’ Investments Shine in a Crisis

Three retirement experts talk about boring products that you might wish you owned right now: I-Bonds, cash value life insurance and annuities.

Turn 401(k)s into Bond Ladders

Franklin Templeton SVP Drew Carrington says his firm's Defined Maturity Funds, which work like bond ladders, could provide retirement income for 401(k) participants, and could be paired with qualified...

An Actuary Assesses COVID-19

A mortality and longevity expert at Willis Towers Watson writes that 'the variability of the mortality impact by age makes the impact highly variable by type...

At These Rates, Why Bother to Save?

Negative real interest rates have become a disincentive to personal savings, especially among lower-income Americans who will rely heavily on Social Security and Medicaid anyway, this team of economists...

Project LIMA Aims to Solve the Annuity Puzzle

Milliman, the actuarial consulting firm, envisions putting a multi-premium deferred income annuity inside a 401(k) managed account as a way to turn tax-deferred savings into lifetime income. It seeks...

Ask the Wizard: Can I Retire?

We tested online retirement readiness calculators at Vanguard, Fidelity, Schwab, New York Life, Pacific Life and the Alliance for Lifetime Income to look for best practices that might inform...

Research Roundup

These five research papers explain why many institutional investors still work with 'high-touch' brokers, why the economy may slow as populations shrink, why parents might save more than they...

A New Kind of Old Folks’ Home

For retirees who want a bundled (but not too restrictive) solution to their future housing and medical needs, a Type-C Continuing Care Retirement Community is an option. RIJ looked...

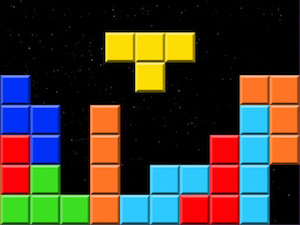

Tetris, Taxes and Retirement

The tradition of withdrawing taxable, tax-deferred and finally tax-free assets in retirement may be obsolete. Matching retirees' tax brackets with the right account types may be better. It's like...