Research

"Even if the fund says ‘value,’ there’s no likelihood that it’s a value fund,” said Martin Lettau of UC-Berkeley, co-author of a study showing that Dimensional's value funds may...

Aging boomers drive flows into fixed income

Advisors are focused on downside risk protection and they commonly use taxable fixed income (83%) and municipal fixed income (74%) to achieve the objective for clients, said Cerulli Associates.

Notable Retirement Research of 2018

Our selection of ten outstanding retirement-related research papers from 2018 starts off with a summary of Joe Tomlinson's proposal for three new annuity products that have never been issued...

‘No Sign of Recession on the Horizon’

Citing growth in the US labor force and in productivity, our guest columnist sees no likelihood of a recession in the near future despite volatility in the equity markets....

Conning assesses life and annuity businesses

The new study focuses on 'the inorganic strategies that insurers have used over the last decade' and on how insurers 'are creating value by strategically repositioning their companies.'

Money Myths, Legal Realities

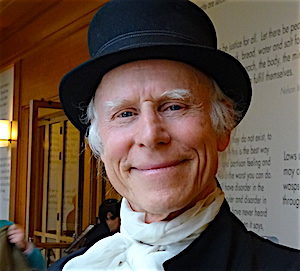

At a conference at Harvard Law School called "Money as a Democratic Medium," law professors debated the origins, purposes, and rightful ownership of money in the modern era. (Photo:...

Numbernomics’ Forecast for 2019

'The stock market will climb to a record high level during 2019. But for this to happen, investment spending must continue to grow rapidly, and productivity must sustain a...

Prudential surveys ethnic, gender finances

'The average annual income for women in our sample was $52,521, compared with $84,006 for men—a difference of 37%,' according to Prudential's new survey.

Survey shows how advisors generate income for clients

A survey by bond dealer Incapital LLC showed that 51% of financial advisors generate income for clients from dividend-paying stocks, 43% from equity income mutual funds, and 43% from...

VA income deferral incentives are working: Ruark

Income commencement rates on guaranteed lifetime withdrawal benefits with 10-year deferral bonuses are highest in year 1 and in years 11+, with low commencement rates in between, according to...

Which Annuities Pay Out the Most?

The answer depends on whether your clients want income to start now or in five years or 10 years. Indexed annuities offer the highest minimum income guarantees, if you...

Flight from active to passive funds and ETFs slowed in September: Morningstar

Among all U.S. open-end mutual funds and ETFs, Fidelity Advisor Growth & Income saw the most inflows of all active strategies at $1.8 billion, the fund's highest inflows in a...

Some investors ‘bet the farm’

Most respondents overestimate the probability of rare events, and underestimate the likelihood of more certain, but lower-value, payouts, according to a new paper from the National Bureau of Economic...

Are fewer people seeking financial advice?

'After an extended period of good economic news—and right before recessions—people tend to believe that they do not need financial advice,' according to this brief from MacroMonitor, a publication...

Society of Actuaries posts resources for actuaries, retirement planners

More highlights and research sessions from the Aging and Retirement Strategic Research Program will be introduced at the SoA Annual Meeting in Nashville, October 14-17, 2018.

Guess What: America Is Rich

Warning: Ingestion of the contents of this column may cause symptoms of apoplexy and dyspepsia among disciples of classical macroeconomics, neo-liberalism, or 'deficit hawks' in the US Congress. ...

Transparency, low-cost will guarantee a market for clean-shares: Cerulli

Despite the death of the DoL Conflict of Interest Rule and lack of clarity around the inclusion of sub-transfer agent (sub-TA) fees, clean-share mutual funds will likely have a...

People who think annuities are ‘fair’ are more likely to buy one

People who worry about becoming a burden on family and people who are relatively less loss-averse are also more open to the idea of buying annuities, a study by...

CFP quarterly debuts with article on managing longevity risk

"The Financial Planning Review will publish research that builds the financial planning body of knowledge," said Marilyn Mohrman-Gillis, executive director, CFP Board Center for Financial Planning.

Public Reactions to SEC ‘Best Interest’ Proposal

A survey sponsored by AARP, the Consumer Federation of America, and the Financial Planning Coalition shows that most people are at best confused by the language of the SEC's...