Taxes

The Penn Wharton Budget Model, a group that assesses new spending programs, calculates that, if the US Treasury eliminated the tax deduction for contributions to retirement plans, it could...

How inflation impacts 2022 tax provisions: Wolters Kluwer

Taxpayers with the same income in 2022 as in 2021 will tend to experience a lower tax rate in 2022 than in 2021 due to automatic inflation adjustments, according...

Tax hike looms for top earners

The House Ways & Means Committee's budget reconciliation recommendations include, among other measures, increases in income taxes on individuals earning over $400,000.

A Surprise from IRS about Inherited IRA Distributions

IRS Pub 590-B presents a conundrum. It appears to deprive owners of inherited IRAs (already deprived by SECURE Act of the 'stretch IRA') to take distributors annually, rather than...

Raising Revenue–and Consciousness

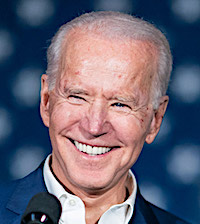

With his Made in America Tax Plan, announced Wednesday, President Biden would raise corporate tax rates and try to stop transfer pricing worldwide. He wants to raise revenue and...

Research Roundup

Here's new research on tax avoidance among the very rich, the logic that millionaires use when buying equities, considerations for plan sponsors when estimating income from 401(k) balances, and...

Will Biden tinker with tax deferral?

'Biden will equalize benefits across the income scale, so working families also receive substantial tax benefits' when they save, a former official told the Financial Services Institute.

Does the Pandemic Limit Biden’s Fiscal Options?

Our guest columnists, from the Urban Institute, examine the impact of the pandemic on the Congressional Budget Office's projections for the state of US government finances in 2030. ...

A List of Joe Biden’s Tax-related Campaign Proposals: Crowe

'Even if major tax legislation is unlikely, the executive branch has regulatory tools at its disposal to impact tax policies,' said Gary Fox, managing partner of tax services at Crowe....

What Trump’s Tax Returns Reveal

Everyone loves a tax cut, and low interest rates appear to boost the economy, but they don't necessarily represent the tide that lifts all boats. Our guest columnist suggests...

‘A Payroll Tax Holiday Will Put the U.S. Back to Work’

A temporary payroll tax holiday could be offset by raising the retirement age for those who choose to participate. The full retirement age for Social Security, now 67, could...

What the Debate over ‘Wealth Taxes’ Misses

Why not create greater parity between households with IRAs and more wealthy households who accrue untaxed capital income outside of retirement accounts? asks our guest columnist, an economist.

Unsure how much to commit to Roth or traditional accounts? This rule might help.

'Higher-income investors have greater exposures to tax-schedule uncertainty, which can be managed using post-tax Roth options,' says a new paper from the Journal of Financial Economics.

A Tax Break That Could Raise Retiree Income and Reduce the Deficit

Our guest columnist, who has spent decades in the annuity industry as an executive, entrepreneur and advisor, suggests a new win-win tax break for annuitized income.

New tax law reveals imbalance in homeownership benefits

'The TCJA has left the nation with an upside-down tax incentive for homeownership that applies to only about one-tenth of all households—nearly all of them with high incomes,' writes our guest columnist.

Total revenue for public life insurers rises in 2017

The industry garnered a year-over-year $9.5 billion tax benefit in 2017 due to the impact of tax reform. Nearly three-quarters of that went to Prudential, MetLife and Aflac.

How Demand-Siders See the New Tax Law

'The [new tax law] will likely stimulate investment and encourage domestic and foreign companies to do business in the United States,' write Tyson (above) and Mendonca. 'But the increase...

Trump Tax Plan Revealed

'The framework retains tax benefits that encourage work, higher education and retirement security,' said the report issued by the White House Wednesday. It was entitled, Unified Framework for Fixing...

How to decumulate without getting fleeced by the tax man

Investors are often advised to exhaust one retirement account at a time, starting with tax-deferred accounts and moving to tax-exempt accounts. That's not a good strategy, according to decumulation...

Retirement trade groups gird to protect ‘tax deferral’

The 'SOS Coalition' encompasses the $25.3 trillion retirement industry, which plans to defend the $100 billion-a-year tax expenditure on long-term savings if and when Congress attempts to overhaul the...