Variable annuities

Americans own almost $900 billion worth of variable annuities with lifetime income guarantees. Uncertainty over the way policyholders and their advisers might use the contracts can keep life insurer...

AM Best assesses variable annuity regulatory reforms

The NAIC's VA reforms 'will serve to diminish the noneconomic volatility..., but ongoing developments related to the pandemic will likely lead to more uncertainty, with potential increases in equity...

These Hedges (Probably) Won’t Clip You

Listen to an actuary who put $50k into a five-year indexed variable annuity four years ago as an alternative to CDs. We explain how IVAs are priced, and we...

The SECURE Act Set To Pass (Finally)

'This is an early Christmas present,' said Melissa Kahn, managing director of the Defined Contribution team at State Street Global Advisors (SSgA), in an interview yesterday.

At the RIA Dance, Annuities Look for Partners

Nationwide Advisory Services and Great American announced moves this week aimed at making their fee-based annuities attractive and accessible to Registered Investment Advisors.

Pacific Life’s new 5-year VA/GMAB rider sets -10% floor

'Unlike a structured variable annuity, there’s no cap on investment returns, so contract owners' earning potential is unlimited,” said Pacific Life senior vice president Brian Woolfolk.

Tell Us What You Really Think

At the LIMRA-Society of Actuaries Retirement Industry Conference in Baltimore last week, Scott Stolz from Raymond James, Greg Jaeck from Edward Jones and Jarrod Fisher from Simplicity Financial Distributors...

Jackson issues fee-based version of popular Elite Access VA

Elite Access as a B-share VA was first issued in 2012, when advisors were hungry for access to so-called liquid alternative assets. Its sales through the first three quarters...

Who Will Sell Transamerica’s New No-Commission VA?

“The sales outlook for 2017 is too soon to tell, given . We are confident that there is a market need for this structure in...

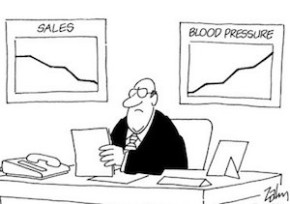

VA Sales are Down, But AUM Is Up: Morningstar

'Eight of the top-ten issuers saw their sales decline in the third quarter compared to the first quarter, where all 10 had negative sales growth,' writes Morningstar's annuity product...

Income benefits attract older variable annuity buyers: LIMRA

People who purchased a variable annuity contract without the guaranteed living benefit are more than five years younger (57.3 years versus 62.5 years) on average than buyers who purchase...

On New Lincoln VA, the Income Benefit Is Mandatory

Available in 2017, the new product is called Lincoln Core Income. Its three underlying investments are all BlackRock iShares. The income benefit comes as part of the product, not...

Transamerica’s new living benefit offers 1% more payout for 5-year deferral

The payout bands for single-life contracts are 4% until age 65 and 5% until age 80, with payouts for joint-life contracts a half percentage point lower. For investors who...

Jackson offers no-load VA for fiduciary era

'In today’s heightened regulatory environment, many of our distribution partners are choosing this type of product to serve their clients who are seeking strategies for retirement planning, a Jackson...

Lincoln Financial enhances VA income rider

'The 5% rollup starts at purchase and runs for 10 years. It applies only in years when there’s no withdrawal and there’s a hard stop at 10 years from...

A.M. Best report defines VA issuers’ dilemma

Qualified VA’s will be affected by the DOL fiduciary rule, which includes more fee disclosures and level compensation structures, said a new report from the ratings agency. About 58%...

Great Hopes Ride on Great-West’s New Annuity

Great-West Financial's new Smart Track II variable annuity contract has four different income riders. Will it help Bob Reynolds achieve his goal of making Great-West a top-five retirement company...

A Quiet Winter for Variable Annuities: Morningstar

'A quiet quarter is not a bad thing,' writes Morningstar's Senior Product Manager in his quarterly report on VA product updates. 'It gives advisors a chance to focus their...

Expect Sharp Drop in VA Sales: LIMRA

'We are seeing a significant shift in the annuity market,” said Todd Giesing, assistant research director at LIMRA's Secure Retirement Institute. 'We have to go back 20 years—to 1995—to...

“In the moneyness” drives VA policyholder behavior: Ruark

'A bit less than half of annual withdrawals are at the maximum amount,' a Ruark study found. Maximum withdrawals are most efficient for...